The insurance industry is a vast and complex market, and a significant portion of life insurance sales are facilitated by agents. It is estimated that a substantial percentage of life insurance policies are sold through the efforts of insurance agents, who play a crucial role in helping individuals and families secure their financial future. This paragraph aims to explore the extent of this involvement and the impact it has on the insurance sector.

| Characteristics | Values |

|---|---|

| Percentage Sold by Agents | According to various sources, approximately 70-80% of life insurance policies are sold through agents and brokers. This percentage varies by country and region. |

| Trends | The percentage of life insurance sold by agents has been relatively stable over the years, with a slight decline in recent times due to the rise of digital sales channels. |

| Geographical Variations | The sales distribution can differ significantly across regions. For instance, in the United States, independent agents and brokers dominate the market, while in some European countries, direct sales and online platforms are more prevalent. |

| Demographic Factors | Age, income, and education level can influence the preference for agents. Younger individuals might prefer digital platforms, while higher-income earners often seek personalized advice from agents. |

| Regulatory Impact | Insurance regulations and policies can affect the sales landscape. Some regions have stricter rules regarding agent commissions and disclosure requirements, which may impact sales strategies. |

| Technological Influence | Technology has transformed the industry, allowing for online comparisons, digital applications, and automated advice. This shift might gradually reduce the reliance on traditional agents. |

| Customer Preferences | Personalized service, trust in agents' expertise, and the ability to tailor policies are key reasons why many customers prefer agents over direct sales. |

| Market Competition | The presence of multiple insurance providers and a competitive market can drive agents to offer better services and products to attract and retain clients. |

What You'll Learn

- Distribution Channels: Agents dominate sales, but online and direct-to-consumer options are growing

- Commission Structure: High commissions motivate agents, but may influence product recommendations

- Customer Engagement: Agents provide personalized advice, building trust and long-term relationships

- Regulatory Oversight: Insurance regulators monitor agent practices to ensure fair and ethical sales

- Technological Impact: Digital tools enhance agent productivity, but may reduce personal interaction

Distribution Channels: Agents dominate sales, but online and direct-to-consumer options are growing

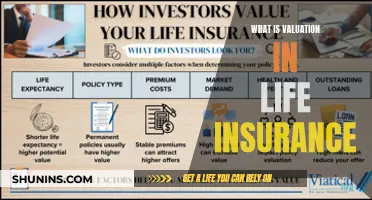

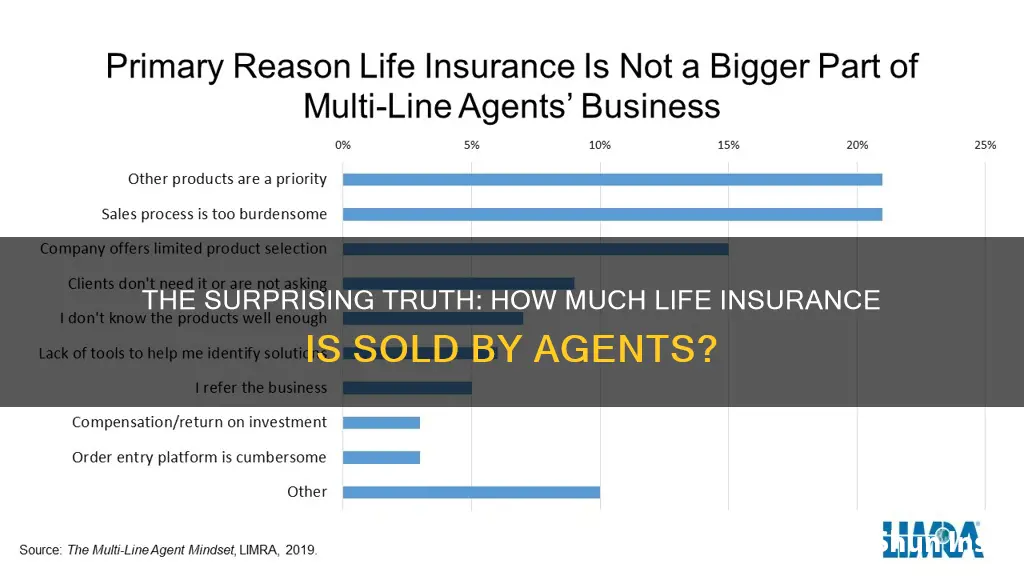

The life insurance industry has traditionally relied on a network of agents as its primary distribution channel, and this trend continues to dominate the market. Agents have been the go-to intermediaries for consumers seeking life insurance policies, and their role in the sales process is well-established. According to recent studies, a significant portion of life insurance sales, approximately 70-80%, are indeed facilitated by these agents. This high percentage highlights the importance of this distribution channel and the influence agents have on consumer choices.

The success of agents in selling life insurance can be attributed to several factors. Firstly, they provide personalized advice and guidance, helping customers navigate the complex world of insurance products. Agents build relationships with clients over time, understanding their specific needs and offering tailored solutions. This human connection is a powerful motivator for many consumers, who appreciate the trust and expertise associated with these professionals. Moreover, agents often have access to a wide range of insurance providers, allowing them to compare policies and find the best fit for their clients.

However, the life insurance industry is not static, and there is a noticeable shift towards alternative distribution channels. The rise of online platforms and direct-to-consumer models has disrupted the traditional agent-dominated landscape. Consumers now have more options to explore and purchase life insurance policies without necessarily relying on intermediaries. Online insurance marketplaces and comparison websites have gained popularity, offering convenience and transparency in the buying process.

Direct-to-consumer (D2C) life insurance companies are also emerging, challenging the dominance of agents. These companies utilize digital technologies to streamline the insurance application process, making it more accessible and efficient. By cutting out the middleman, D2C insurers can offer competitive pricing and a more personalized experience. As a result, consumers are increasingly turning to these online platforms for their insurance needs, especially for simpler, term-life policies.

Despite the growth of online and D2C channels, agents remain a crucial component of the life insurance distribution ecosystem. Many consumers still prefer the traditional approach of working with agents, who can provide valuable advice and support throughout the policy lifecycle. The industry is likely to see a continued collaboration between agents and online/D2C insurers, creating a hybrid distribution model that caters to diverse consumer preferences. This evolution in distribution channels will shape the future of the life insurance industry, offering consumers more choices and flexibility in securing their financial well-being.

Kaizen in Life Insurance: Small Changes, Big Results

You may want to see also

Commission Structure: High commissions motivate agents, but may influence product recommendations

The life insurance industry relies heavily on agents and brokers to sell policies, and the commission structure plays a significant role in motivating these professionals. When agents are offered high commissions, it can indeed be a powerful incentive for them to promote specific products or services. This compensation model is a standard practice in the industry, but it has raised concerns about potential biases in product recommendations.

High commission rates can create a strong motivation for agents to sell certain policies, especially those with higher profit margins. These commissions are often structured as a percentage of the policy's premium, and in some cases, can reach up to 50% or more. While this system encourages agents to drive sales, it may also lead to a conflict of interest. Agents might be more inclined to recommend products that offer higher commissions, even if they are not the best fit for the customer's needs. For instance, a complex policy with numerous features and benefits might yield a higher commission, but it may not be the most suitable option for an elderly client or someone with pre-existing health conditions.

The influence of commission structure on product recommendations is a critical aspect of the life insurance sales process. When agents are heavily compensated for sales, they might prioritize their earnings over providing tailored advice. This could result in customers being sold policies that are more profitable for the agent rather than those that align with their specific requirements. As a result, clients might end up with coverage that is either over- or under-insured, leading to potential financial losses or a lack of adequate protection.

To address this issue, regulatory bodies and industry associations have implemented guidelines and codes of conduct. These standards aim to ensure that agents act in the best interest of their clients. For instance, some organizations require agents to disclose their commission structure to potential customers, allowing clients to make informed decisions. Additionally, ongoing training and education programs can help agents understand the ethical implications of their commission-driven approach and encourage them to provide unbiased advice.

In summary, while high commissions are an effective way to motivate life insurance agents, they can also impact the integrity of product recommendations. Striking a balance between sales incentives and ethical practices is essential to ensure that customers receive suitable coverage. By implementing transparent commission structures and providing comprehensive training, the industry can work towards maintaining trust and delivering quality service.

Understanding Indemnity Health Insurance: Philadelphia Life Coverage Explained

You may want to see also

Customer Engagement: Agents provide personalized advice, building trust and long-term relationships

The role of agents in the life insurance industry is often underestimated, but they play a crucial part in customer engagement and sales. Agents are the face of the company and act as trusted advisors to their clients, which is why they are essential in building long-term relationships and ensuring customer satisfaction. When it comes to selling life insurance, agents have a unique advantage due to their personalized approach.

One of the key strengths of agents is their ability to provide tailored advice. They take the time to understand each customer's unique needs, financial situation, and goals. This personalized approach allows agents to offer suitable life insurance products that align with the customer's requirements. By offering customized solutions, agents build trust and establish themselves as reliable experts. For instance, an agent might recommend a term life insurance policy for a young family to ensure financial security during the children's upbringing or suggest a whole life policy for an elderly client to provide lifelong coverage and a guaranteed death benefit. This level of personalization sets agents apart and creates a strong bond with their clients.

Building trust is an integral part of the agent-client relationship. Life insurance is a complex product, and customers often have numerous questions and concerns. Agents act as intermediaries, simplifying the process and providing clear explanations. They ensure that clients fully understand the policy, its benefits, and any potential risks. Through regular communication and follow-ups, agents can address any emerging issues and provide reassurance, fostering a sense of security and confidence in their clients. This trust-building process encourages customers to return to their agents for future insurance needs and recommendations.

Long-term relationships are a significant outcome of the personalized advice provided by agents. By understanding their clients' evolving needs over time, agents can offer appropriate adjustments to their insurance policies. For example, a client's life circumstances might change, requiring an increase in coverage or a switch to a different policy type. Agents can proactively suggest these changes, ensuring that the customer's insurance remains relevant and effective. This level of proactive service keeps the agent at the forefront of the customer's mind and strengthens the relationship.

In summary, agents play a vital role in customer engagement by providing personalized advice, which is a key differentiator in the life insurance industry. Their ability to build trust and establish long-term relationships ensures that customers receive the best possible guidance and support. Through their expertise and dedication, agents can help clients make informed decisions, leading to successful and satisfying insurance outcomes. This personalized approach is a powerful tool for agents to stand out and create a loyal customer base.

Life Insurance for Dependents: Who and What is Covered?

You may want to see also

Regulatory Oversight: Insurance regulators monitor agent practices to ensure fair and ethical sales

Insurance regulators play a crucial role in maintaining the integrity of the life insurance industry, especially when it comes to the sales practices of agents. These regulators are tasked with overseeing and monitoring the activities of insurance agents to ensure that they adhere to ethical standards and act in the best interest of their clients. The primary goal is to protect consumers from fraudulent or misleading practices and to promote fair competition within the market.

One of the key responsibilities of regulatory bodies is to establish and enforce rules and guidelines for insurance agents. These regulations often include requirements for licensing, training, and ongoing education. Agents must meet specific criteria to obtain and maintain their licenses, ensuring they possess the necessary knowledge and skills to provide accurate advice and sell insurance products appropriately. Regular training sessions and continuing education programs are mandated to keep agents updated on industry changes and best practices.

Regulatory oversight also involves monitoring the sales practices of insurance agents. This includes reviewing their interactions with customers, assessing the accuracy of information provided, and ensuring that agents do not engage in deceptive or manipulative tactics. Regulators may conduct audits, inspections, or even surprise visits to insurance agencies to verify compliance with the established standards. By doing so, they can identify and address any potential issues, such as misrepresenting policy benefits, hiding important details, or engaging in high-pressure sales tactics.

In addition to monitoring individual agents, regulators also focus on the overall market dynamics. They analyze sales data, consumer complaints, and industry trends to identify any emerging issues or patterns of misconduct. This proactive approach allows regulators to take timely action, such as issuing warnings, implementing stricter regulations, or even penalizing non-compliant agents. By doing so, they aim to maintain a level playing field and protect consumers from unfair practices.

The presence of regulatory oversight provides consumers with a sense of security and trust in the life insurance market. It ensures that agents are held accountable for their actions and that the sales process is transparent and fair. Through regular monitoring and enforcement, regulators contribute to a healthy insurance industry, fostering a relationship of trust between agents, consumers, and the regulatory authorities. This, in turn, promotes the long-term sustainability and growth of the life insurance sector.

Understanding Blended Term Life Insurance: Pros and Cons

You may want to see also

Technological Impact: Digital tools enhance agent productivity, but may reduce personal interaction

The insurance industry has witnessed a significant transformation with the integration of digital tools, which has had a profound impact on the way life insurance agents operate and interact with their clients. One of the most notable effects is the enhancement of agent productivity through technology. Digital platforms and software have streamlined various processes, making it easier for agents to manage their daily tasks. For instance, customer relationship management (CRM) systems enable agents to efficiently organize and track client interactions, ensuring no lead is left unattended. Automated data entry and processing reduce the time spent on paperwork, allowing agents to focus more on sales and client engagement. Additionally, digital tools facilitate quick access to relevant information, such as policy details, claim histories, and market trends, empowering agents to provide more informed advice to their clients.

However, the increased reliance on technology in the insurance sector has sparked debates about the potential reduction in personal interaction between agents and clients. As digital tools become more sophisticated, there is a growing concern that face-to-face meetings and traditional sales techniques might become less prevalent. Online platforms and video conferencing have already proven to be effective in initial client engagement, but they may not fully replace the value of in-person meetings. The art of building trust and rapport, which is crucial in insurance sales, often requires a human touch. Personal interactions allow agents to understand their clients' unique needs and concerns, tailor their advice accordingly, and provide a more empathetic approach.

The shift towards digital sales processes could potentially lead to a more standardized and less personalized experience for clients. While efficiency and convenience are undoubtedly benefits, some argue that the human element in insurance sales is irreplaceable. The insurance industry has always relied on strong relationships and trust, and the current technological advancements might inadvertently diminish these essential aspects. As a result, there is a growing emphasis on finding a balance between leveraging digital tools for productivity and maintaining the human connection that is integral to the insurance business.

To address this challenge, insurance companies are now investing in ways to integrate technology while preserving the personal touch. This includes implementing video conferencing for face-to-face interactions, utilizing AI chatbots for initial client engagement, and providing agents with tools to personalize the digital experience. By combining the efficiency of technology with the warmth of human interaction, the industry aims to create a more comprehensive and satisfying customer journey.

In conclusion, while technological advancements have undoubtedly enhanced the productivity of life insurance agents, the industry must also recognize the importance of personal interaction. Striking a balance between digital tools and human connection is key to ensuring that the insurance sales process remains effective, efficient, and client-centric. This approach will not only benefit the agents but also contribute to a more positive and lasting impression of the insurance industry in the eyes of the consumers they serve.

Supplemental Insurance: Colonial Life and Medicare – Compatible Coverage?

You may want to see also

Frequently asked questions

The majority of life insurance policies are sold by independent agents and brokers. According to various industry reports, agents and brokers account for approximately 70-80% of the total life insurance sales in the United States. This high percentage is attributed to their extensive network of clients, personalized services, and ability to offer a wide range of products.

Yes, numerous studies have been conducted to analyze the effectiveness of different sales channels. Research suggests that life insurance agents and brokers have a higher success rate in selling policies compared to direct-to-consumer advertising or online sales. On average, agents can convert around 30-40% of their leads into actual policy sales, while online sales may only convert about 1-2% of visitors.

Several factors contribute to the success of life insurance agents:

- Personalized Service: Agents provide tailored advice and guidance, helping clients understand their insurance needs and offering suitable products.

- Trust and Relationships: Building trust with clients is essential. Agents often develop long-term relationships, which can lead to repeat business and referrals.

- Comprehensive Product Knowledge: They are well-informed about various insurance products, allowing them to recommend the best options based on individual circumstances.

- Network and Leads: Agents have access to a vast network of potential clients, and their ability to generate leads through referrals and networking is significant.

The digital revolution has brought about some changes in the industry. While online sales and direct-to-consumer platforms have gained popularity, they still account for a relatively small portion of the market. However, technology has enhanced the capabilities of agents by providing digital tools for lead generation, customer relationship management, and policy administration. This integration of technology and human expertise allows agents to offer a more efficient and personalized service, maintaining their position as a dominant sales channel in the life insurance industry.