Valuation in life insurance is a critical process that determines the financial worth of an individual's life. It involves assessing the economic value of a person's life based on various factors, such as age, health, lifestyle, and financial circumstances. This valuation is essential for insurance companies to set appropriate premiums and ensure that the policyholders and their beneficiaries receive the necessary financial protection in the event of the insured's death or a specified life event. Understanding the principles of valuation is crucial for both insurance providers and policyholders to make informed decisions regarding life insurance coverage.

What You'll Learn

- Definition: Valuation in life insurance is the process of determining the financial worth of a life policy

- Purpose: It helps insurers set premiums and assess risk

- Methods: Valuation uses statistical models and data to estimate policy value

- Factors: Age, health, lifestyle, and mortality rates influence valuation

- Impact: Accurate valuation ensures fair pricing and protects policyholders

Definition: Valuation in life insurance is the process of determining the financial worth of a life policy

Valuation in life insurance is a critical process that assesses the monetary value of a life insurance policy. It involves a comprehensive analysis to determine the financial worth of the policy, taking into account various factors and considerations. This process is essential for insurance companies, policyholders, and financial institutions to understand the true value of a life insurance contract.

When it comes to life insurance, valuation is not merely about the initial premium paid by the policyholder. It encompasses a broader scope, considering the policy's cash value, future benefits, and the overall financial impact it has on the insured individual and their beneficiaries. The primary goal is to provide an accurate financial assessment, ensuring that the policy's value aligns with the expectations and needs of all parties involved.

The process of valuation typically involves several key steps. Firstly, it requires an in-depth understanding of the policy's terms and conditions, including the coverage amount, premium payments, and any additional benefits or riders attached to the policy. Secondly, actuarial science plays a significant role, as it involves statistical analysis and mathematical models to predict future cash flows and estimate the policy's worth over time. This includes considering factors such as the insured individual's age, health, and lifestyle, as these elements can significantly impact the policy's value.

Additionally, valuation takes into account the time value of money, which is a fundamental concept in finance. It recognizes that a dollar received today is worth more than the same amount in the future due to its potential earning capacity. By applying this principle, the valuation process determines the present value of future benefits, ensuring a fair and accurate representation of the policy's financial worth.

In summary, valuation in life insurance is a meticulous process that evaluates the financial value of a life policy. It requires a comprehensive understanding of the policy's features, the application of actuarial science, and the consideration of time-based financial principles. This process ensures that the policy's worth is accurately assessed, providing clarity for policyholders, insurance companies, and other stakeholders in the life insurance industry.

Life Insurance Beneficiary Options in North Carolina

You may want to see also

Purpose: It helps insurers set premiums and assess risk

Valuation in life insurance is a critical process that underpins the entire insurance industry. It is a comprehensive assessment of an individual's or group's financial worth and risk profile, which is essential for insurers to make informed decisions about premium pricing and risk management. This process involves a meticulous examination of various factors that could influence the likelihood and impact of a life insurance event, such as death or critical illness. By understanding these factors, insurers can accurately determine the potential financial burden they may face and, consequently, set appropriate premiums to ensure the sustainability of their business.

The primary purpose of valuation is to help insurers set premiums that are fair and reflective of the risks they are taking. When an individual applies for life insurance, the insurer must evaluate the potential risks associated with insuring that specific person. This includes considering factors like age, health, lifestyle, family medical history, and occupation. For instance, an older individual with a history of smoking and high blood pressure may be considered a higher-risk candidate, requiring a higher premium to offset the potential financial loss the insurer might incur if the insured person were to pass away or suffer a critical illness.

In the context of assessing risk, valuation takes into account a wide range of data points and statistical models. Insurers use sophisticated algorithms and historical data to predict the likelihood of various life events. For example, they might analyze mortality rates for individuals of similar demographics, lifestyle choices, and health conditions. By doing so, they can make more accurate predictions about the potential claims they may have to pay out in the future. This risk assessment is crucial for insurers to ensure that their premium rates are sufficient to cover expected claims and maintain the financial stability of the insurance company.

Moreover, valuation also plays a vital role in identifying and managing group risks. When insuring a group of individuals, such as employees of a company, valuation helps insurers understand the collective risk profile of the group. This is particularly important for group life insurance policies, where the insurer is exposed to a larger number of potential claims. By evaluating the group's characteristics, insurers can tailor their policies to manage risks effectively and offer competitive premiums that are sustainable for both the insurer and the group members.

In summary, valuation in life insurance is a complex and essential process that enables insurers to set premiums and manage risks effectively. It involves a detailed analysis of individual and group characteristics, historical data, and statistical models to predict potential financial burdens. Through accurate valuation, insurers can ensure that their premium rates are fair, reflective of the risks, and sufficient to cover expected claims, thereby maintaining the long-term viability of the life insurance business. This process is a cornerstone of the insurance industry, providing a solid foundation for the financial security of both insurers and their policyholders.

Life Insurance: Age-Related Expiry and What You Need to Know

You may want to see also

Methods: Valuation uses statistical models and data to estimate policy value

Valuation in life insurance is a critical process that determines the worth or value of a life insurance policy. It is an essential aspect of the insurance industry, ensuring that policies are priced fairly and accurately reflect the risks associated with each individual's life. One of the primary methods used in this valuation process is the application of statistical models and data analysis.

Statistical models play a vital role in assessing the risk associated with insuring an individual's life. These models utilize various factors such as age, health, lifestyle, and family medical history to predict the likelihood of certain events, such as death or critical illness. By analyzing large datasets and historical trends, insurers can develop sophisticated models that provide a comprehensive understanding of the risks they are undertaking. For instance, a statistical model might consider a person's smoking status, occupation, and medical conditions to estimate the probability of a premature death or a serious health issue.

The data used in these models is extensive and diverse. It includes demographic information, medical records, financial details, and even behavioral patterns. For example, insurers might analyze data on smoking rates, obesity trends, or the prevalence of certain diseases in specific populations to make more accurate predictions. This data-driven approach allows insurers to make informed decisions about policy pricing and coverage.

Through the use of statistical models and data, insurers can estimate the expected future costs associated with a policyholder's life. This estimation involves calculating the potential payouts over the policy's duration, considering factors like mortality rates, interest rates, and investment returns. By doing so, insurers can set appropriate premiums that will cover these expected costs and generate a profit. This method ensures that the insurance company can fulfill its financial obligations to the policyholder and maintain the stability of the insurance pool.

In summary, the valuation of life insurance policies heavily relies on statistical models and data analysis. These tools enable insurers to assess risks, predict future costs, and set fair premiums. By employing these methods, the insurance industry can provide accurate coverage, manage risks effectively, and offer financial security to policyholders. This detailed and scientific approach to valuation is essential for the long-term success and sustainability of life insurance companies.

Green Card Life Insurance: What's the Deal?

You may want to see also

Factors: Age, health, lifestyle, and mortality rates influence valuation

The concept of valuation in life insurance is a critical aspect of determining the financial worth or value of an individual's life. It involves assessing the potential financial impact of an individual's death or the likelihood of their survival over a specific period. Several key factors come into play when evaluating this value, and understanding these factors is essential for both insurance companies and policyholders.

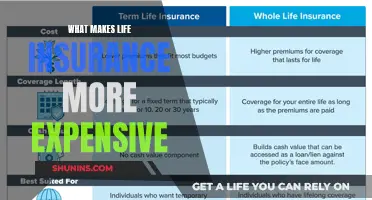

Age is a fundamental consideration in life insurance valuation. As individuals age, the risk of mortality increases, and this is reflected in the insurance premium. Younger individuals are generally considered lower-risk candidates for life insurance as they have a higher life expectancy. Insurance companies often offer lower premiums to younger policyholders because they are statistically less likely to make a claim. Conversely, older individuals may face higher insurance costs due to the higher risk associated with their age.

Health status plays a significant role in this process. An individual's health can be assessed through medical examinations, health history, and lifestyle factors. Good health indicates a lower risk of early death, which can result in more favorable insurance terms and lower premiums. Conversely, individuals with pre-existing medical conditions or those who engage in unhealthy behaviors (such as smoking, excessive drinking, or drug use) may be considered higher-risk and could face higher insurance costs or even be declined coverage.

Lifestyle choices also have a direct impact on valuation. Insurance companies consider factors such as occupation, hobbies, and daily routines. For example, high-risk occupations like construction or emergency services may result in higher insurance premiums due to the increased likelihood of accidents or injuries. Similarly, extreme sports enthusiasts might pay more for life insurance as their activities pose a greater risk.

Mortality rates are another critical factor. These rates provide statistical data on the expected number of deaths in a given population over a specific period. Insurance companies use these rates to calculate the likelihood of an individual's death and, consequently, the potential payout. Regions with higher mortality rates may influence insurance valuations, as the risk of an individual's death is directly related to the local statistics.

Who Can Receive a Life Insurance Check?

You may want to see also

Impact: Accurate valuation ensures fair pricing and protects policyholders

Accurate valuation in life insurance is a critical process that directly impacts the fairness and protection offered to policyholders. When an insurance company values a life insurance policy accurately, it ensures that the policy's worth is appropriately assessed, leading to fair pricing for both the insurer and the insured. This process involves a comprehensive analysis of various factors, including the insured individual's age, health, lifestyle, and financial situation. By considering these elements, the insurance company can determine the likelihood of the insured's death or the occurrence of a specified event, which is essential for setting the policy's premium.

The impact of accurate valuation is twofold. Firstly, it ensures that policyholders are not overcharged. Insurance companies use the valuation to calculate premiums, and if the assessment is precise, it results in fair pricing. This fairness is crucial as it prevents policyholders from paying more than necessary, especially when the policy's value is accurately reflected. Secondly, accurate valuation protects policyholders by providing them with appropriate coverage. When the policy is priced fairly, it ensures that the insurance company has sufficient funds to pay out the death benefit or other specified amounts when the event occurs. This protection is vital for the financial security of the policyholder's beneficiaries.

Inaccurate valuation can lead to significant issues. If an insurance company undervalues a policy, it may result in lower premiums, but this could also mean that the policyholder receives less coverage than expected. Conversely, overvaluation can lead to higher premiums, causing financial strain for policyholders. Therefore, a precise and thorough valuation is essential to maintain a healthy relationship between the insurer and the insured, ensuring both parties' interests are protected.

Moreover, accurate valuation allows insurance companies to offer a wide range of policy options. By assessing the insured's profile accurately, insurers can provide tailored policies with specific benefits and coverage levels. This customization ensures that policyholders can choose plans that best suit their needs and financial capabilities, further enhancing the protection and value they receive.

In summary, accurate valuation in life insurance is a vital process that ensures fair pricing and safeguards the interests of policyholders. It enables insurance companies to provide appropriate coverage, protect policyholders from financial strain, and offer customized policy options. By valuing policies correctly, the insurance industry maintains integrity and trust, ultimately benefiting both the insurer and the insured.

Understanding Universal Life Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

Valuation in life insurance is a critical process that determines the financial worth or value of a life insurance policy. It is an essential step to ensure that the policyholder, the insurance company, and all stakeholders are aware of the policy's current value, which is crucial for various reasons. These include policy lending, assignment, or surrender, as well as for tax and estate planning purposes.

The valuation process involves assessing the policy's cash value, which is the total amount of money that has accumulated in the policy over time. This includes the initial premium payments, interest earned, and any additional benefits or riders attached to the policy. The calculation takes into account factors such as the policy's term, the insured individual's age and health, and the investment performance of the policy's underlying assets.

Knowing the valuation of your life insurance policy is essential for several reasons. Firstly, it allows you to make informed decisions about your policy, such as taking out a loan against it or assigning the policy's value to a third party. Secondly, it helps you understand the financial security provided by your policy and how it can be utilized for various financial goals. Additionally, being aware of the valuation can assist in tax planning and estate distribution, ensuring that your life insurance benefits are utilized efficiently according to your wishes.