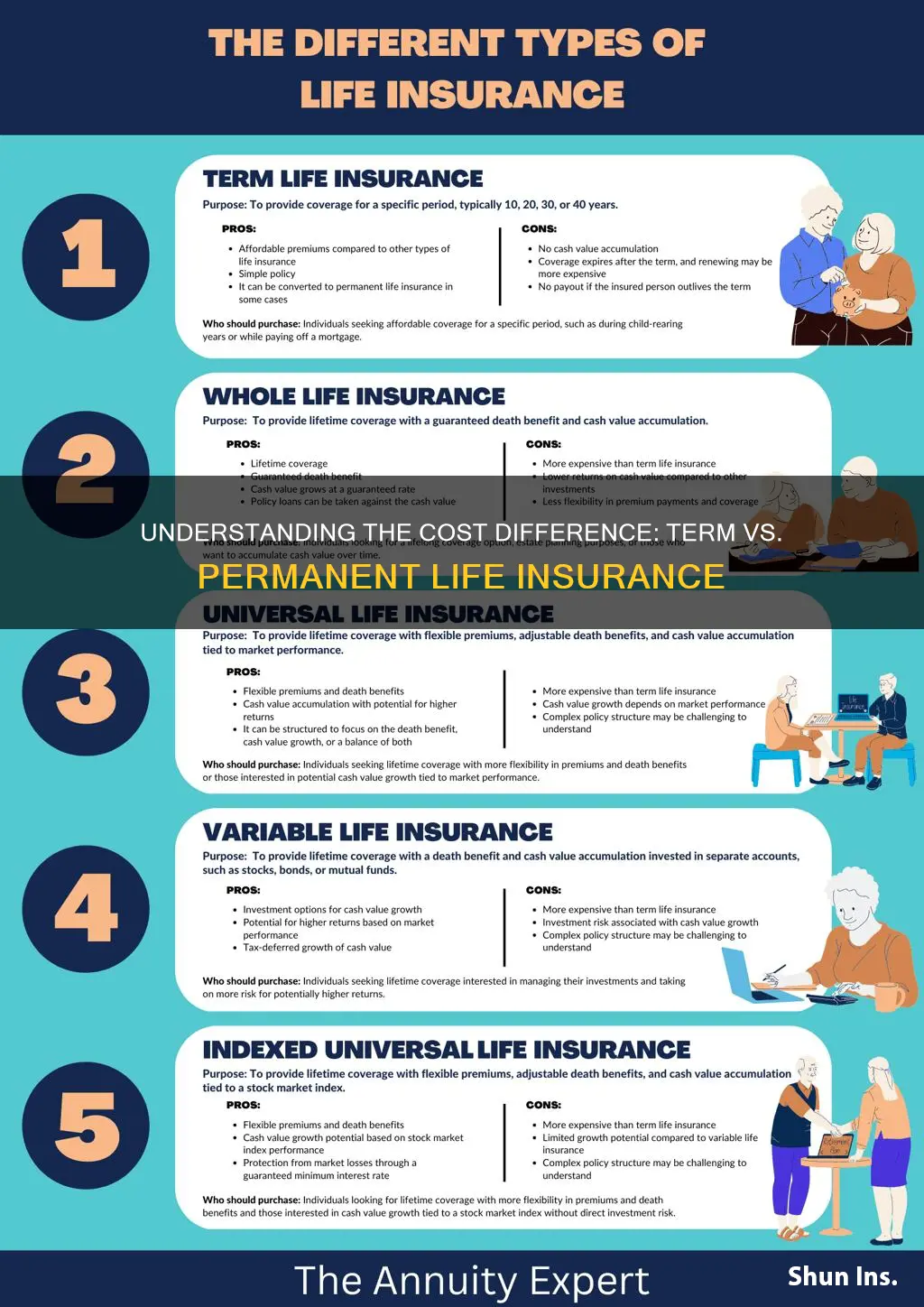

Permanent life insurance, also known as whole life insurance, is a long-term financial commitment that provides coverage for the entire life of the insured individual. Unlike term life insurance, which is designed to cover a specific period, permanent life insurance offers lifelong protection and additional benefits. One of the primary reasons permanent life insurance is more expensive than term life insurance is that it provides a guaranteed death benefit for the entire duration of the policy. This means that the insurance company is committed to paying out a predetermined amount to the policyholder's beneficiaries, regardless of when the insured person passes away. Additionally, permanent life insurance policies often include a cash value component, which allows the policyholder to build up a cash reserve over time. This feature enables policyholders to borrow against the policy or withdraw funds, providing financial flexibility and a potential investment opportunity. The higher cost of permanent life insurance can be attributed to the extended coverage period, the guaranteed death benefit, and the additional features that provide long-term financial security.

What You'll Learn

- Long-Term Coverage: Permanent insurance provides lifelong protection, which is more complex and costly to administer

- Cash Value Accumulation: It builds cash value, a feature not present in term insurance

- Guaranteed Death Benefit: Permanent policies offer a fixed payout, ensuring financial security for beneficiaries

- Flexibility: Policyholders can borrow or withdraw funds from the cash value, adding to costs

- Medical and Financial Factors: Underwriters consider health and financial history, impacting premium rates

Long-Term Coverage: Permanent insurance provides lifelong protection, which is more complex and costly to administer

The concept of permanent life insurance, also known as whole life insurance, is fundamentally different from term life insurance, and this difference contributes to its higher cost. Permanent insurance is designed to offer coverage for the entire lifetime of the insured individual, providing a sense of security and long-term financial protection. This lifelong commitment to coverage is a significant factor in its pricing.

The complexity of permanent insurance lies in its structure and the guarantees it provides. Unlike term life, which is a pure insurance product with a defined period of coverage, permanent insurance includes a savings component. This savings element is designed to accumulate cash value over time, which can be borrowed against or withdrawn. The presence of this savings aspect adds layers of complexity to the policy's administration and management. Insurers must ensure that the policy's investment returns are sufficient to cover the policyholder's premiums and the guaranteed death benefit, which is a fixed amount paid to the beneficiary upon the insured's passing.

Administering permanent insurance policies requires a more intricate process. The insurer must carefully manage the investment portion of the policy to ensure it grows adequately to meet the policy's obligations. This includes regular monitoring of investment performance, managing risks, and ensuring compliance with regulatory requirements. The complexity increases when considering the potential for policyholders to access their cash value, which can impact the insurer's ability to meet long-term commitments.

The cost of permanent insurance reflects the higher level of expertise and resources required to manage these policies. Insurers need to employ skilled professionals to handle the investment management, policy administration, and customer service aspects. Additionally, the guarantees associated with permanent insurance, such as the fixed death benefit and the accumulation of cash value, contribute to the overall expense. These guarantees provide policyholders with a sense of security and predictability, but they also require insurers to maintain a robust financial foundation to fulfill their commitments.

In summary, the lifelong coverage aspect of permanent life insurance is a key differentiator that influences its higher cost. The complexity of managing the savings component, the guarantees provided, and the administrative requirements all contribute to the expense. While permanent insurance offers long-term financial protection, the intricacies involved in its administration and the insurer's commitment to lifelong coverage result in a more costly product compared to term life insurance.

Contacting MetLife: Insurance Claims and Queries

You may want to see also

Cash Value Accumulation: It builds cash value, a feature not present in term insurance

When comparing permanent life insurance to term life insurance, one of the key differences lies in the concept of cash value accumulation. Permanent life insurance, also known as whole life insurance, offers a unique feature that sets it apart from term insurance: the ability to build cash value. This is a significant advantage for those seeking long-term financial security and flexibility.

Cash value accumulation is a process where a portion of the premium payments made for permanent life insurance goes towards building a cash reserve. This reserve grows over time, providing a valuable asset for the policyholder. Unlike term insurance, which focuses solely on providing coverage for a specified period, permanent insurance combines insurance protection with a savings component. As the policyholder pays premiums, a small amount is allocated to create this cash value, which can be borrowed against or withdrawn, providing financial flexibility.

The cash value in permanent life insurance grows at an interest rate set by the insurance company. This rate is typically guaranteed, ensuring that the policyholder's investment has a solid foundation. Over time, the cash value can accumulate significantly, allowing the policyholder to build a substantial savings pot. This feature is particularly beneficial for those who want to secure their financial future, plan for retirement, or even fund their children's education. With permanent insurance, the cash value can be utilized in various ways, providing financial security and control.

One of the advantages of cash value accumulation is the ability to access funds without canceling the policy or incurring penalties. Policyholders can borrow against the cash value, taking out loans with interest, which can be repaid over time. This provides a source of funds for various purposes, such as home improvements, business ventures, or major purchases. Additionally, the cash value can be withdrawn as needed, offering financial flexibility and the ability to adapt to changing circumstances.

In contrast, term life insurance does not offer this cash value accumulation feature. Term insurance is designed to provide coverage for a specific period, typically 10, 20, or 30 years. Once the term ends, the policy expires, and any premiums paid do not accumulate value. This makes term insurance a more straightforward and cost-effective option for temporary coverage needs, such as protecting a family during a specific life stage or until a certain financial goal is achieved.

Reporting Life Insurance: Tax Implications and Guidelines

You may want to see also

Guaranteed Death Benefit: Permanent policies offer a fixed payout, ensuring financial security for beneficiaries

When considering life insurance, one of the key differences between permanent and term policies is the guaranteed death benefit. Permanent life insurance, also known as whole life insurance, provides a fixed payout upon the insured individual's death, regardless of the time of passing. This feature is a significant advantage for those seeking long-term financial security and peace of mind.

The guaranteed death benefit is a cornerstone of permanent life insurance. It means that the insurance company has a commitment to pay out a specific amount to the policy's beneficiaries when the insured person dies. This fixed payout ensures that the financial obligations of the deceased are met, providing a safety net for loved ones. For example, if a policyholder purchases a permanent life insurance policy with a guaranteed death benefit of $500,000, the insurance company will honor this promise, providing the full amount to the designated beneficiaries, even if the policy has been in force for decades.

This feature is particularly valuable for individuals who want to provide long-term financial support to their families. It offers a sense of security, knowing that a specific financial commitment will be honored, even if the insured person's health or financial situation changes over time. For instance, a parent might purchase a permanent life insurance policy to ensure their children's education fund is secured, regardless of any future health issues or economic fluctuations.

The guaranteed death benefit also provides flexibility in policy ownership. Policyholders can choose to pass on the death benefit to beneficiaries, such as a spouse or children, ensuring their financial needs are met. Alternatively, the policy can be structured to provide income to the policyholder during their lifetime, with the death benefit remaining intact for beneficiaries. This flexibility allows individuals to tailor the policy to their specific needs and goals.

In contrast, term life insurance offers a temporary death benefit, which only pays out if the insured person dies within a specified term, typically 10, 20, or 30 years. While term life insurance is generally more affordable, it lacks the long-term security and flexibility of permanent policies. Understanding the guaranteed death benefit is crucial when comparing these two types of life insurance, as it highlights the financial security and peace of mind that permanent life insurance provides.

Life Insurance: Dave Ramsey's Long-Term Financial Wisdom

You may want to see also

Flexibility: Policyholders can borrow or withdraw funds from the cash value, adding to costs

The concept of permanent life insurance, often referred to as whole life insurance, offers a unique feature that sets it apart from term life insurance: flexibility. This flexibility is primarily derived from the cash value component of permanent life insurance policies. When you purchase a permanent life insurance policy, a portion of your premium goes into building a cash value, which grows over time through interest and investment returns. This cash value can be a valuable asset for policyholders, providing them with a sense of financial security and control.

One of the key advantages of this flexibility is the ability to borrow funds from the cash value. Policyholders can take out loans against the cash value, allowing them to access a portion of the funds they've accumulated without having to surrender the policy or pay a surrender charge. These loans are typically interest-free, as they are considered a form of policy borrowing. This feature can be particularly useful for individuals who need immediate access to funds for various purposes, such as starting a business, funding education, or covering unexpected expenses.

Additionally, policyholders can also withdraw funds from the cash value, although this option may come with certain considerations. Withdrawing cash value means taking money out of the policy, which can reduce the overall value of the policy and the death benefit. This action can also impact the policy's ability to accumulate cash value over time. Policyholders should carefully evaluate their financial needs and understand the potential consequences before deciding to withdraw funds.

The flexibility provided by the cash value in permanent life insurance policies does come with additional costs. Borrowing and withdrawing funds from the cash value can lead to higher overall policy costs. When a policyholder borrows money, they are essentially using the policy's cash value as collateral, and the insurance company may charge a fee for this service. Similarly, when funds are withdrawn, the policy's investment-based growth may be impacted, and the policyholder might incur fees or penalties. These costs contribute to the higher overall price of permanent life insurance compared to term life insurance, which typically does not offer the same level of flexibility.

In summary, the flexibility offered by permanent life insurance, through the ability to borrow or withdraw funds from the cash value, is a valuable feature for policyholders. However, it is essential to understand the associated costs and implications. While this flexibility provides financial security and control, it also adds to the overall expense of permanent life insurance, making it a more complex and potentially more expensive option compared to term life insurance.

Understanding STR: Unlocking Life Insurance Benefits

You may want to see also

Medical and Financial Factors: Underwriters consider health and financial history, impacting premium rates

When it comes to life insurance, the cost of permanent (also known as whole life) insurance is often significantly higher compared to term life insurance. This disparity in pricing can be attributed to several key factors, and understanding these factors is essential for anyone considering life insurance options. One of the primary reasons for the higher cost of permanent life insurance is the long-term coverage it provides. Unlike term life insurance, which is designed to cover a specific period, permanent life insurance offers lifelong coverage, ensuring financial security for the insured's beneficiaries even after the insured's passing. This extended coverage comes with a higher price tag.

Underwriters play a crucial role in determining the premium rates for life insurance policies. They carefully evaluate various aspects of an individual's health and financial situation to assess the risk associated with insuring that person. One of the most critical factors in this evaluation is the insured's medical history and current health status. Underwriters consider a range of medical factors, including age, gender, family medical history, current health conditions, and lifestyle choices. For instance, individuals with pre-existing health conditions such as heart disease, diabetes, or cancer may face higher premium rates due to the increased likelihood of making a claim. Similarly, lifestyle factors like smoking, excessive alcohol consumption, or a sedentary lifestyle can also impact premium rates, as these behaviors can significantly affect an individual's health and longevity.

In addition to health considerations, underwriters also delve into an individual's financial history and circumstances. Financial factors such as income, employment status, debt obligations, and credit history are taken into account. A stable financial situation with a steady income and a good credit score can result in lower premium rates, as the insured is considered less risky. Conversely, individuals with significant debt, a history of financial instability, or those who are self-employed may face higher premiums due to the perceived higher risk associated with their financial profile.

The impact of medical and financial factors on premium rates is significant. Underwriters use complex algorithms and statistical models to calculate these rates, ensuring that the insurance company can cover the potential costs of claims. For permanent life insurance, the higher premium rates are justified by the long-term commitment and the promise of lifelong coverage. This type of insurance provides a cash value component, which grows over time and can be borrowed against or withdrawn, offering financial flexibility. However, this flexibility comes at a cost, and underwriters must ensure that the premiums charged reflect the potential risks and benefits of the policy.

In summary, the higher cost of permanent life insurance compared to term life insurance can be attributed to the extended coverage period and the underwriters' careful consideration of medical and financial factors. These factors influence the risk assessment, and ultimately, the premium rates are set to ensure the insurance company's financial stability and the insured's long-term protection. Understanding these considerations can help individuals make informed decisions when choosing the right life insurance policy for their needs.

Understanding Life Insurance: Cash Surrender Value Explained

You may want to see also

Frequently asked questions

Permanent life insurance, also known as whole life insurance, offers lifelong coverage and a cash value component, which is a key reason for its higher cost. This type of policy builds up a cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. The guaranteed death benefit and the accumulation of assets within the policy contribute to the increased premium.

Permanent life insurance policies invest a portion of the premiums in various investment options, such as stocks, bonds, and mutual funds. This investment strategy allows the policy to grow its cash value, providing a financial benefit to the policyholder. However, investing also comes with risks, and the performance of these investments can impact the overall cost of the policy.

The guaranteed death benefit is a fixed amount that the insurance company promises to pay out upon the insured's death. This guarantee ensures that the beneficiaries receive the full death benefit, regardless of the insured's age or health at the time of passing. Term life insurance also provides a guaranteed death benefit but for a specific period, whereas permanent life insurance offers coverage for the entire life of the insured, hence the higher cost.

Yes, several factors contribute to the higher price of permanent life insurance. These include the longer coverage period, the potential for policy loans and withdrawals, and the inclusion of a savings component. Additionally, the insurance company's commitment to providing lifelong coverage and the associated administrative costs also play a role in determining the premium rates.