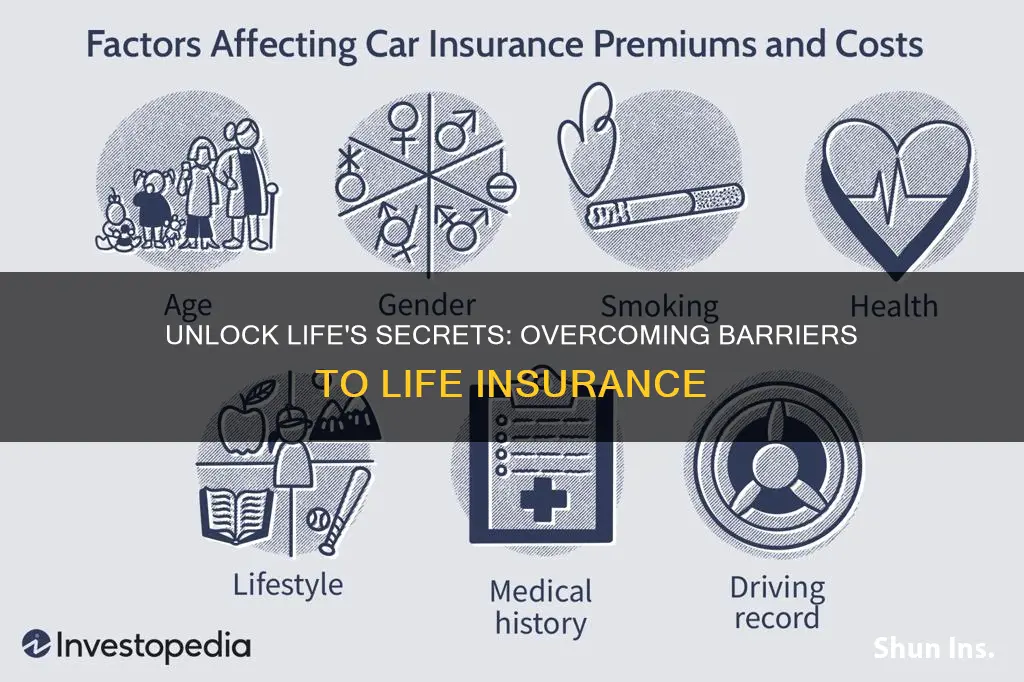

Many factors can prevent individuals from obtaining life insurance, which is a crucial financial protection tool. Common obstacles include age, health conditions, lifestyle choices, and pre-existing medical issues. For instance, individuals with severe health problems or chronic illnesses may face higher premiums or even be deemed uninsurable. Additionally, lifestyle factors such as smoking, excessive alcohol consumption, or dangerous hobbies can significantly impact insurance eligibility and rates. Understanding these barriers is essential for individuals to assess their options and explore alternative solutions to ensure they have adequate coverage for their loved ones.

What You'll Learn

- Health Conditions: Pre-existing medical issues can impact eligibility and rates

- Age: Younger individuals may face higher premiums due to longer coverage needs

- Lifestyle Factors: Smoking, excessive drinking, and risky hobbies can increase risk

- Income and Debt: High debt or low income might make it difficult to afford premiums

- Occupation and Hobbies: Certain high-risk jobs or extreme sports can affect insurance availability

Health Conditions: Pre-existing medical issues can impact eligibility and rates

Pre-existing medical conditions can significantly affect an individual's ability to secure life insurance, often leading to higher premiums or even denial of coverage. Insurers are particularly cautious when assessing applicants with health issues, as these conditions may pose a higher risk for the company. The impact of pre-existing health problems on life insurance eligibility and rates can vary widely, depending on the severity and nature of the condition.

For instance, chronic illnesses such as diabetes, heart disease, or cancer can be major red flags for insurance providers. These conditions often require ongoing medical management and can significantly reduce life expectancy. As a result, individuals with such health issues may face challenges in obtaining competitive life insurance rates or may be deemed uninsurable by some companies. In some cases, insurers might require a medical examination and may even ask for detailed medical records to assess the risk accurately.

Additionally, mental health disorders, such as depression or anxiety, can also impact life insurance eligibility. Insurers may view these conditions as a potential long-term risk, especially if they are not well-managed. Similarly, a history of substance abuse or addiction can lead to higher insurance premiums or even exclusion from coverage, as these issues can significantly impact an individual's overall health and longevity.

It's important to note that the impact of pre-existing health conditions on life insurance is not uniform across all providers. Some insurers may offer specialized policies or rates for individuals with specific health issues, while others may be more stringent in their requirements. Therefore, it is crucial for applicants to shop around and compare quotes from multiple insurers to find the best coverage options.

In summary, pre-existing medical issues can indeed prevent or complicate the process of obtaining life insurance. However, with proper research and understanding of the market, individuals with health concerns can still find suitable coverage. Consulting with independent insurance advisors or brokers can be beneficial in navigating the complexities of the insurance market and finding the right policy to meet one's needs.

Aflac Life Insurance Loan: Online Application Process

You may want to see also

Age: Younger individuals may face higher premiums due to longer coverage needs

Younger individuals often encounter higher life insurance premiums, and this can be attributed to several factors. Firstly, younger people typically have longer life expectancies, which means insurance companies may perceive them as higher-risk policyholders. The longer the coverage period, the more financially exposed the insurer is, and this can result in increased premium costs. Additionally, younger adults might not have established a comprehensive financial history, including a consistent income and credit score, which are crucial factors in determining insurance rates. Insurance providers often use these factors to assess the likelihood of a claim and the potential financial impact on the company.

Another reason for higher premiums among the young is the assumption that they are less likely to require immediate financial support. Life insurance is designed to provide financial security to beneficiaries in the event of the insured's death. Younger individuals might not yet have a family or dependents who rely on their income, reducing the perceived need for immediate financial assistance. As a result, insurance companies may charge higher premiums to account for the extended period during which the policy might not be utilized.

Furthermore, younger people might also face challenges in obtaining comprehensive life insurance coverage. Standard life insurance policies often have a maximum age limit, and younger individuals may not qualify for the most favorable rates or terms. This can be a significant obstacle for those who want to secure financial protection for their loved ones early in life. However, it's important to note that there are alternative options, such as term life insurance, which can provide coverage for a specific period at a potentially lower cost.

To navigate this challenge, younger individuals can explore various strategies. One approach is to consider term life insurance, which offers coverage for a defined period, typically 10, 20, or 30 years. This type of policy can be more affordable and may be suitable for those who want temporary coverage until they reach a certain age or achieve specific financial milestones. Additionally, building a strong financial profile by maintaining a good credit score, saving consistently, and having a stable income can help reduce insurance premiums over time.

In summary, younger individuals may face higher life insurance premiums due to longer coverage needs, higher risk assessments, and the potential lack of immediate financial dependents. However, by understanding these factors and exploring alternative insurance options, they can make informed decisions to secure the financial protection they need. It is essential to consult with insurance professionals who can provide tailored advice based on individual circumstances.

CMFG Life Insurance: Is It Worth the Hype?

You may want to see also

Lifestyle Factors: Smoking, excessive drinking, and risky hobbies can increase risk

Lifestyle choices play a significant role in determining your eligibility for life insurance and can greatly impact the cost and terms of your policy. Three key lifestyle factors that can influence your insurability are smoking, excessive alcohol consumption, and engaging in risky hobbies or activities.

Smoking is a well-known health hazard and is strongly associated with numerous life-threatening conditions. Insurers consider smokers to be high-risk individuals due to the increased likelihood of developing smoking-related diseases, such as lung cancer, heart disease, and chronic obstructive pulmonary disease (COPD). The harmful chemicals in cigarettes can damage your lungs and cardiovascular system, leading to a higher risk of death and health complications. As a result, smokers often face higher premiums and may even be denied coverage altogether. Quitting smoking is one of the best decisions you can make to improve your health and increase your chances of securing life insurance at a favorable rate.

Excessive drinking, similar to smoking, can have detrimental effects on your health and insurability. Heavy alcohol consumption is linked to liver damage, cardiovascular issues, and an increased risk of accidents and injuries. Insurers may view frequent and excessive drinking as a warning sign of potential health problems and higher mortality rates. This behavior can lead to higher insurance premiums or even exclusion from coverage. It is essential to practice moderation and be mindful of your alcohol intake to ensure you remain eligible for life insurance benefits.

Engaging in risky hobbies or activities can also impact your insurability. These activities often involve a higher likelihood of injury or death, which can raise concerns for insurance providers. Hobbies like skydiving, scuba diving, rock climbing, or racing motorcycles are considered high-risk pursuits. If you participate in such activities, insurers may view you as a higher-risk candidate, potentially resulting in higher premiums or difficulty obtaining coverage. It is advisable to assess the risks associated with your hobbies and consider safer alternatives to ensure a smoother insurance application process.

In summary, lifestyle factors, including smoking, excessive drinking, and risky hobbies, can significantly influence your ability to obtain life insurance and the terms of your policy. Insurers assess these factors to determine your overall health and risk profile. By making positive lifestyle changes, such as quitting smoking, moderating alcohol consumption, and engaging in safer hobbies, you can improve your insurability and secure more favorable coverage. It is always beneficial to consult with insurance professionals who can provide personalized advice based on your specific circumstances.

Selling Sister Life Insurance: Conflict or Care?

You may want to see also

Income and Debt: High debt or low income might make it difficult to afford premiums

High debt and low income can significantly impact your ability to secure life insurance. When considering life insurance, insurers often look at your financial health and stability. One of the primary factors they assess is your ability to afford the premiums. If you have substantial debt obligations, such as student loans, mortgages, or credit card debt, it can be challenging to meet the financial requirements for life insurance. This is because a large portion of your income may be dedicated to servicing these debts, leaving limited funds for insurance premiums.

For instance, if you have a substantial mortgage payment, car loan, or student loan, the monthly outgoings can be substantial. This leaves you with a smaller disposable income, making it harder to afford the regular payments required for life insurance. Similarly, if you have multiple credit card debts with high interest rates, the monthly payments can eat into your overall financial resources. As a result, you may find it difficult to allocate the necessary funds for insurance premiums, which can be a significant monthly expense.

On the other hand, low income can also present challenges. Life insurance companies typically require a certain level of income to ensure that policyholders can afford the premiums over the long term. If your income is insufficient to cover the basic necessities of life, let alone insurance premiums, it may be challenging to secure coverage. Insurers often have minimum income requirements to ensure that policyholders can maintain their payments, especially for long-term policies.

In such cases, it is essential to explore options that can help manage debt and increase income. This might include negotiating lower interest rates on loans, creating a budget to reduce unnecessary expenses, or seeking additional employment or side hustles to boost your income. By improving your financial situation, you can make yourself a more attractive candidate for life insurance and increase your chances of obtaining the necessary coverage.

In summary, high debt and low income can make it challenging to afford life insurance premiums. It is crucial to address these financial factors to ensure you can meet the insurer's requirements. Managing debt, increasing income, and creating a sustainable financial plan can help overcome these obstacles and provide the necessary foundation for securing life insurance coverage.

Life Insurance After Retirement: Keeping Your Policy Post-Job

You may want to see also

Occupation and Hobbies: Certain high-risk jobs or extreme sports can affect insurance availability

Occupation and hobbies play a significant role in determining one's insurability and the terms of life insurance coverage. Certain professions and recreational activities can be considered high-risk factors by insurance providers, which may impact the availability and cost of life insurance.

For instance, individuals employed in high-risk industries such as construction, mining, or emergency services (e.g., police officers, firefighters) are often classified as having a higher risk profile. These jobs typically involve hazardous working conditions, dangerous machinery, or exposure to extreme environments, all of which can lead to increased likelihood of injuries or fatalities. As a result, insurance companies may charge higher premiums or even deny coverage to individuals in these occupations. The reasoning behind this is straightforward: the higher the risk associated with the job, the more likely it is that the insured individual may require financial compensation.

Extreme sports enthusiasts also face potential challenges when seeking life insurance. Activities like skydiving, bungee jumping, rock climbing, or white-water rafting are inherently dangerous and can lead to severe injuries or accidental deaths. Insurance providers often view these hobbies as a red flag, as they may indicate a tendency towards risky behavior or a higher likelihood of accidents. Consequently, individuals engaging in such sports might find it more difficult to obtain comprehensive life insurance coverage, and if available, the premiums could be significantly higher.

It is important for individuals to be aware of these factors and understand how their occupation and hobbies can influence their insurability. Some insurance companies offer specialized policies tailored to specific professions or hobbies, providing coverage despite the associated risks. However, these policies may come with additional exclusions or limitations, and the underwriting process can be more rigorous.

In summary, when considering life insurance, it is crucial to disclose all relevant information about your occupation and hobbies. Insurance providers will assess the risk associated with your chosen career path and recreational activities, which can impact the terms and cost of the policy. Being transparent and providing accurate details will help ensure you receive the appropriate coverage and potentially save on insurance premiums in the long run.

Understanding Life Insurance Cash Surrender Value

You may want to see also

Frequently asked questions

There are several factors that can lead to a rejection or higher premiums when applying for life insurance. These include pre-existing health conditions, such as chronic diseases or severe obesity, which may indicate higher health risks. Age is also a significant factor, as younger individuals often have lower premiums due to a longer life expectancy. Additionally, lifestyle choices like smoking, excessive alcohol consumption, or drug use can negatively impact your insurance eligibility and rates.

Certain occupations and hobbies can be considered risky by insurance providers, potentially leading to higher premiums or denial of coverage. High-risk jobs, such as those in construction, mining, or emergency services, may require additional proof of health and fitness. Extreme sports enthusiasts, like skydiving or racing car drivers, might also face challenges in obtaining life insurance due to the perceived increased likelihood of accidents.

Yes, financial stability and creditworthiness play a role in the life insurance application process. Insurance companies often assess an individual's financial health to determine their ability to meet premium payments. A poor credit score or a high level of debt may indicate financial instability, which could lead to higher insurance rates or rejection. Additionally, a lack of stable income or employment history might raise concerns for the insurer.