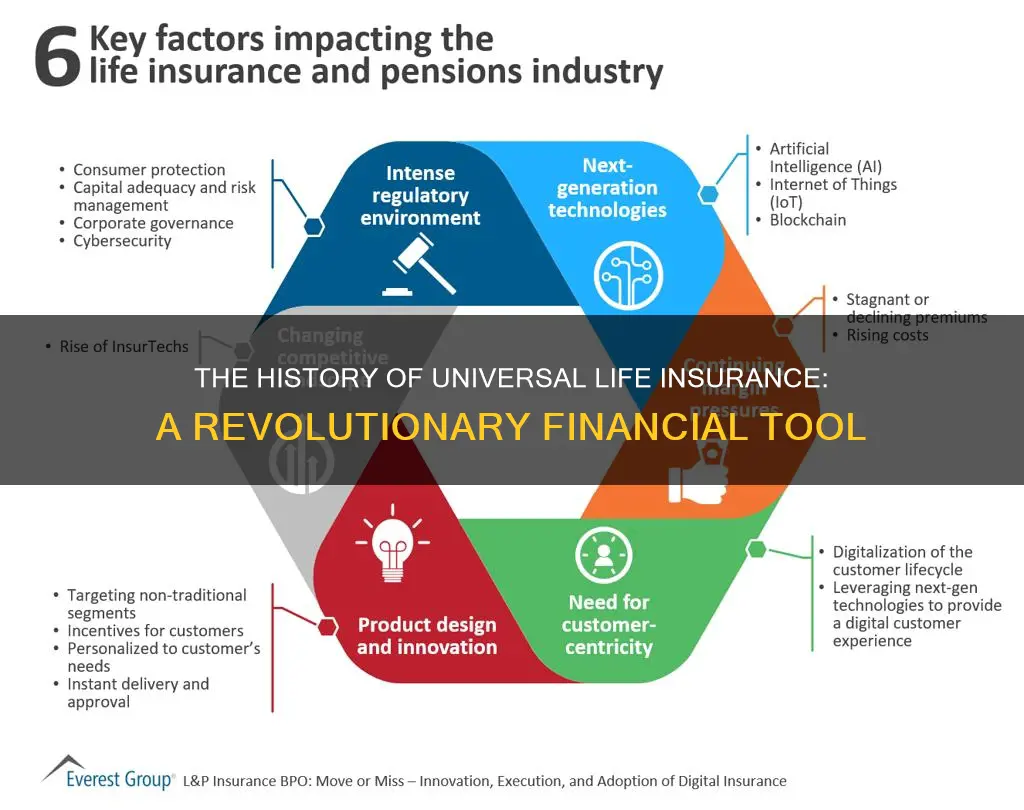

Universal life insurance, a type of permanent life insurance, emerged as a response to the limitations of traditional whole life insurance. The creation of universal life insurance was prompted by the desire to offer policyholders more flexibility and control over their insurance coverage. Unlike whole life, which provides a fixed premium and death benefit throughout the policy's term, universal life allows policyholders to adjust their premiums and death benefits over time. This flexibility was seen as a significant advantage, especially for those who wanted to adapt their insurance needs as their financial circumstances changed. The concept gained popularity due to its ability to provide long-term financial security while allowing for customization, making it an attractive option for individuals seeking a more adaptable insurance solution.

What You'll Learn

- Financial Security: The need for financial stability and protection against unforeseen events

- Longevity: Increasing life expectancy and the desire for long-term financial planning

- Wealth Transfer: Ensuring wealth is passed on to beneficiaries in a tax-efficient manner

- Legacy Planning: Creating a lasting legacy and providing for loved ones

- Risk Management: Mitigating risks associated with death and long-term care

Financial Security: The need for financial stability and protection against unforeseen events

The concept of financial security is a fundamental aspect of human life, and it has driven the creation of various financial instruments, including universal life insurance. The need for financial stability and protection against unexpected events has been a constant concern for individuals and families throughout history. As people strive to secure their financial future, they often seek ways to safeguard their assets and provide for their loved ones, especially in the face of life's uncertainties.

Financial security is about having the means to manage and control one's financial affairs effectively. It involves ensuring that individuals and families can maintain their standard of living, meet their financial obligations, and achieve their long-term goals, even in the absence of their primary income earner. This sense of security is particularly crucial for those with financial responsibilities, such as raising a family, supporting a business, or providing for aging parents.

The creation of universal life insurance can be traced back to the desire to provide a flexible and comprehensive financial solution. Traditional life insurance policies, such as term life insurance, offered a straightforward way to secure financial protection, but they had limitations. Universal life insurance, introduced in the late 19th and early 20th centuries, aimed to address these shortcomings by offering a more adaptable and permanent solution. It provided policyholders with the ability to build cash value within the policy, allowing them to borrow against it or use it as an investment vehicle.

This type of insurance offers a unique blend of insurance and investment benefits. Policyholders can make regular premium payments, which contribute to both the death benefit and the policy's cash value. Over time, the cash value grows, providing a financial cushion that can be used for various purposes. For instance, it can be borrowed against to cover educational expenses, business investments, or medical bills, ensuring that financial obligations remain manageable even in the face of emergencies.

In summary, the need for financial stability and protection against unforeseen events has been a driving force behind the development of universal life insurance. This financial product offers a comprehensive approach to securing one's financial future, providing both insurance coverage and investment opportunities. By addressing the limitations of traditional life insurance, universal life insurance has become a valuable tool for individuals seeking to protect their loved ones and maintain financial control in an uncertain world.

New York Life: Guaranteed Issue Insurance Availability and Options

You may want to see also

Longevity: Increasing life expectancy and the desire for long-term financial planning

The concept of universal life insurance emerged in response to the changing demographics and financial needs of society. As medical advancements and improved living standards led to an increase in life expectancy, individuals began to recognize the importance of long-term financial security. Universal life insurance was designed to address this growing demand for a flexible and adaptable insurance product.

The traditional life insurance policies of the time often had limitations, especially when it came to providing coverage for the entire lifespan of the insured individual. As people lived longer, they sought insurance solutions that could adapt to their changing needs over the long term. Universal life insurance offered a unique approach by combining the benefits of permanent life insurance with the flexibility of term life insurance.

This type of insurance provides a death benefit to the policyholder's beneficiaries while also accumulating cash value over time. The cash value can be used for various purposes, such as loaning money to the policyholder, paying for college tuition, or providing additional financial security during retirement. This feature was particularly attractive to individuals who wanted to ensure their financial well-being throughout their lives, especially as they entered retirement and needed to maintain their standard of living.

The increasing life expectancy has also led to a greater awareness of the potential financial risks associated with longevity. As people live longer, they face the challenge of outliving their savings and retirement funds. Universal life insurance provides a way to mitigate these risks by offering a guaranteed death benefit and the potential for tax-deferred growth of the cash value. This aspect of the policy allows individuals to build a substantial financial reserve that can be used to support themselves and their families over an extended period.

In summary, the creation of universal life insurance was prompted by the desire to meet the evolving needs of a population with increasing life expectancy. It offers a comprehensive solution for long-term financial planning, providing both a death benefit and a flexible investment component. This insurance product has become an essential tool for individuals seeking to secure their financial future and adapt to the challenges of an aging population.

Max Life Insurance: Trustworthy or Not?

You may want to see also

Wealth Transfer: Ensuring wealth is passed on to beneficiaries in a tax-efficient manner

The concept of wealth transfer is a crucial aspect of financial planning, especially for those with substantial assets. It involves the strategic distribution of wealth to beneficiaries in a way that minimizes tax implications and ensures a smooth transition of assets. This process is particularly important for high-net-worth individuals and families who want to preserve their financial legacy while also providing for their loved ones.

One of the primary methods to achieve efficient wealth transfer is through the use of various insurance products, including universal life insurance. Universal life insurance is a type of permanent life insurance that offers both death benefit protection and an investment component. It provides a flexible way to accumulate wealth over time, allowing policyholders to build cash value that can be borrowed against or withdrawn. This feature makes it an attractive tool for wealth transfer, as it combines insurance coverage with a potential source of funds for beneficiaries.

When considering wealth transfer, it is essential to understand the tax implications of different strategies. Traditional methods of transferring wealth, such as direct gifts or wills, may result in significant tax consequences for the beneficiaries. However, by utilizing the cash value accumulation within universal life insurance, individuals can create a tax-efficient way to pass on wealth. As the cash value grows, it can be used to pay premiums, ensuring the policy remains in force and the death benefit is maintained. This strategy allows the policyholder to control the growth of the policy's value and pass on a substantial sum to beneficiaries without triggering large tax liabilities.

Additionally, universal life insurance offers flexibility in premium payments. Policyholders can choose to pay premiums in various ways, such as lump sums, periodic payments, or even loaning against the policy's cash value. This adaptability enables individuals to manage their wealth transfer strategy according to their financial goals and circumstances. For example, during periods of financial abundance, higher premium payments can be made to accelerate the growth of the policy's cash value, and during leaner times, lower payments or loaning against the policy can be utilized.

In summary, wealth transfer is a critical process for individuals seeking to preserve and pass on their financial legacy. Universal life insurance provides a powerful tool within this context, offering both insurance protection and a means to accumulate wealth. By understanding the tax implications and utilizing the flexible features of universal life insurance, individuals can ensure that their wealth is transferred efficiently to their intended beneficiaries, providing financial security and peace of mind. This approach allows for a thoughtful and strategic transfer of assets, contributing to a comprehensive financial plan.

Cancel Your Reliance Nippon Life Insurance: A Step-by-Step Guide

You may want to see also

Legacy Planning: Creating a lasting legacy and providing for loved ones

Legacy planning is a crucial aspect of financial management, allowing individuals to create a lasting impact and ensure the well-being of their loved ones. It involves strategic decisions and careful consideration of various financial instruments to achieve long-term goals. When it comes to providing for your family and leaving a meaningful inheritance, it's essential to explore different options and tailor a plan that suits your unique circumstances.

One of the key components of legacy planning is understanding the needs and future goals of your beneficiaries. This process requires a deep dive into your personal and family history, as well as a clear vision for the future. By identifying the specific requirements of your loved ones, you can develop a comprehensive strategy. For instance, you might want to consider the education of your children or grandchildren, their future marriages, or the purchase of a home. These factors will influence the type of legacy you wish to create.

A popular and versatile tool in legacy planning is life insurance. While the primary purpose of life insurance is often associated with providing financial security in the event of an untimely death, it can also be a powerful tool for legacy creation. Universal life insurance, in particular, offers flexibility and long-term benefits. This type of policy allows policyholders to build cash value over time, which can be used for various purposes. For example, the cash value can be borrowed against or withdrawn to provide financial support for beneficiaries, ensuring that the legacy plan remains flexible and adaptable.

The creation of universal life insurance can be traced back to the need for a more flexible and customizable insurance product. Traditional life insurance policies often had fixed terms and limited options for policyholders. Universal life insurance emerged as a response, offering a more comprehensive approach. It provides a permanent insurance policy with a flexible premium payment structure, allowing policyholders to adjust their contributions as their financial situation changes. This adaptability is particularly useful for those who want to ensure their loved ones are provided for, regardless of life's twists and turns.

In the context of legacy planning, universal life insurance can be a valuable asset. It allows individuals to build a substantial cash reserve, which can be utilized in various ways. For instance, the policy's death benefit can provide a financial safety net for beneficiaries, ensuring they have the necessary resources to achieve their goals. Additionally, the cash value can be used to pay for long-term care, fund a trust, or even provide a tax-efficient way to pass on wealth to future generations. By incorporating universal life insurance into your legacy plan, you gain a powerful tool to create a lasting and meaningful impact.

Heart Disease: Getting Life Insurance Coverage

You may want to see also

Risk Management: Mitigating risks associated with death and long-term care

The concept of universal life insurance emerged as a response to the need for comprehensive risk management, particularly in the realms of death and long-term care. This type of insurance is designed to provide a flexible and adaptable solution for individuals seeking to protect themselves and their loved ones from the financial burdens associated with these risks.

One of the primary motivations behind the creation of universal life insurance was the recognition of the evolving nature of risk. In the past, life insurance primarily focused on providing a financial safety net in the event of death. However, as healthcare advancements extended life expectancy and the prevalence of chronic illnesses, the need for long-term care became increasingly prominent. Universal life insurance addresses this by offering a dual-purpose coverage, ensuring financial security in both the short and long term.

This insurance product is structured to provide a death benefit, which is a lump sum paid to the policyholder's beneficiaries upon their passing. Additionally, it includes an investment component, allowing policyholders to accumulate cash value over time. This cash value can be used to cover various expenses, including long-term care costs, medical bills, or even retirement income. The flexibility of universal life insurance lies in its ability to adapt to the changing needs of the policyholder, providing a tailored risk management solution.

For individuals, purchasing universal life insurance is a strategic decision. It involves assessing one's risk tolerance, financial goals, and future healthcare needs. By understanding these factors, individuals can choose a policy that aligns with their specific requirements. For instance, those with a higher risk profile or a family history of chronic illnesses might opt for a policy with a higher death benefit and investment potential to ensure comprehensive coverage.

In summary, the creation of universal life insurance was driven by the need to address the evolving risks associated with death and long-term care. This insurance product offers a versatile and comprehensive solution, providing financial security and adaptability to individuals facing these challenges. By carefully considering their unique circumstances, individuals can harness the power of universal life insurance to mitigate risks and secure their financial future.

Cashing Out Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

The creation of Universal Life Insurance was primarily driven by the need to provide individuals with a more flexible and permanent insurance solution compared to the limited-term policies available at the time. The idea was to offer a product that could adapt to the changing financial needs of policyholders throughout their lives, ensuring long-term financial security.

Universal Life Insurance evolved from the traditional whole life insurance policy, which offered a fixed death benefit and premiums. The innovation came in the form of adjustable premiums and benefits, allowing policyholders to increase or decrease coverage as their financial circumstances changed. This flexibility was a significant departure from the traditional insurance models.

The development of Universal Life Insurance is often attributed to several key figures. One of the pioneers was John Hancock, an American businessman and insurance executive. He is credited with introducing the first universal life insurance policy in the United States in 1909. Additionally, the work of insurance mathematicians and actuaries was instrumental in designing the complex calculations and structures that underpin this type of insurance.

Universal Life Insurance provides several advantages. Firstly, it offers a flexible premium structure, allowing policyholders to pay lower premiums in their younger years and increase them later as they age. Secondly, the policy's cash value grows over time, providing a source of funds that can be borrowed against or withdrawn. This feature also enables policyholders to build a substantial cash reserve, which can be used for various financial goals. Additionally, the death benefit is typically guaranteed, providing financial security for beneficiaries.