When selling life insurance, it's crucial to ask the right questions to ensure you understand your client's needs and provide the best coverage. These questions can help you assess their financial situation, health, and lifestyle, allowing you to recommend a suitable policy. Some key questions to consider include the client's age, health status, income, and any existing life insurance coverage they may have. Additionally, inquiring about their financial goals, such as providing for their family or covering funeral expenses, can help tailor the policy to their specific requirements. By asking these questions, you can offer personalized advice and help your clients make informed decisions about their life insurance.

What You'll Learn

- Customer Needs: Understand client's financial goals and risk tolerance

- Policy Comparison: Compare different coverage options and benefits

- Cost Analysis: Evaluate premiums and ensure affordability

- Coverage Adequacy: Assess if the policy meets the client's needs

- Trust and Transparency: Build trust by explaining policy details clearly

Customer Needs: Understand client's financial goals and risk tolerance

When selling life insurance, it's crucial to understand your client's financial goals and risk tolerance. This knowledge will help you tailor your recommendations to their specific needs and ensure they receive the right coverage. Here are some key questions to ask:

Financial Goals:

- What is your primary financial goal for purchasing life insurance? Do they want to provide for their family in case of death? Pay off a mortgage? Fund their child's education? Understanding their specific goals will help you recommend appropriate coverage amounts and types.

- What is your current financial situation? Knowing their income, assets, debts, and savings will give you a comprehensive view of their financial health and help you assess how much coverage they can realistically afford.

- What is your time horizon for needing life insurance? Are they looking for short-term coverage until their children are financially independent? Or do they need long-term protection for their entire working life? This will influence the type of policy you recommend.

Risk Tolerance:

- How comfortable are you with risk? Some clients may be willing to take on more risk for potentially higher returns, while others prefer a more conservative approach. Understanding their risk tolerance will help you recommend appropriate investment options within their life insurance policy.

- What is your understanding of investment risks? It's important to assess their knowledge of investment risks and their willingness to learn about and manage those risks. This will help you choose the right investment vehicles for their policy.

- Have you considered alternative risk management strategies? In addition to life insurance, are there other ways they could manage financial risks, such as emergency funds, disability insurance, or estate planning? Understanding their overall risk management strategy will help you provide comprehensive financial advice.

By asking these questions, you can gain a deep understanding of your client's financial goals and risk tolerance. This will enable you to recommend the most suitable life insurance policy, ensuring they receive the protection they need while aligning with their financial objectives.

Probate Court and Life Insurance: What's the Connection?

You may want to see also

Policy Comparison: Compare different coverage options and benefits

When comparing life insurance policies, it's crucial to understand the various coverage options and benefits available to ensure you make an informed decision. Here's a detailed breakdown of how to compare policies and the key questions to consider:

- Coverage Amount: The first and most fundamental aspect is the death benefit or payout amount. This is the primary reason for purchasing life insurance, as it provides financial security to your loved ones in the event of your passing. Compare the coverage amounts offered by different insurers. Consider your financial goals and the needs of your family. For instance, if you have a large mortgage or dependent children, you might need a higher coverage amount to ensure their financial well-being.

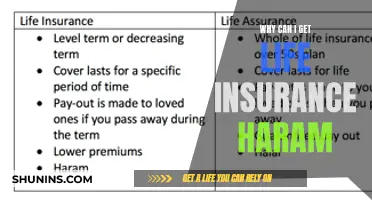

- Term Length: Life insurance policies typically offer two main types of coverage: term life and permanent life. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. If you're comparing policies, pay attention to the term length. Longer-term policies often have lower premiums but may not be necessary if your financial obligations are expected to decrease over time. Permanent life insurance, on the other hand, offers lifelong coverage but usually comes with higher premiums.

- Premium Costs: The cost of the policy is a significant factor. Premiums can vary widely depending on the insurer, coverage amount, and term length. When comparing policies, calculate the total cost over the term to determine which option is more affordable. Remember that cheaper premiums might not always equate to better value. Consider the financial stability and reputation of the insurance company to ensure they can honor their commitments.

- Additional Benefits and Riders: Many life insurance policies offer optional riders or add-ons that provide extra coverage or benefits. For example, an accidental death rider can increase the payout if your death is caused by an accident. Review the available riders and assess their relevance to your situation. Some riders might be worth the additional cost, especially if they provide valuable coverage, while others may not be necessary.

- Conversion Options: When comparing policies, inquire about conversion options. This feature allows you to convert a term life policy into a permanent policy without a medical examination, often at a guaranteed rate. It can be beneficial if you plan to maintain coverage long-term but want the flexibility of a term policy initially.

- Policy Flexibility: Consider the flexibility offered by different policies. Some insurers provide options to increase or decrease coverage over time, allowing you to adjust as your financial situation changes. This flexibility can be advantageous if you want to review and update your policy as needed without starting the entire process from scratch.

By carefully comparing these coverage options and benefits, you can make an informed decision when purchasing life insurance. It's essential to ask the right questions and understand the terms and conditions of each policy to ensure you receive the best value for your money.

Life Insurance and Debt Collection in New York

You may want to see also

Cost Analysis: Evaluate premiums and ensure affordability

When discussing life insurance with potential clients, understanding their financial situation and priorities is crucial. One essential aspect to explore is the cost analysis, which involves evaluating premiums and ensuring that the policy is affordable for the individual. Here's a breakdown of the key questions and considerations:

Understanding Premium Determinants: Start by educating your clients about the factors that influence life insurance premiums. These include age, health status, lifestyle choices, and the desired coverage amount. For instance, younger individuals often benefit from lower premiums due to a longer life expectancy, while those with pre-existing health conditions might face higher costs. By gathering this information, you can tailor your recommendations accordingly.

Assessing Affordability: It is imperative to assess the client's financial capacity to afford the insurance premium. Ask about their monthly income, expenses, and any existing financial commitments. Consider their ability to make regular payments and ensure that the life insurance premium fits comfortably within their budget. You can provide a cost-benefit analysis, highlighting the long-term financial security the policy offers compared to the short-term premium payments.

Exploring Payment Options: Life insurance policies often offer flexibility in payment terms. Discuss the various payment options available, such as annual, semi-annual, or monthly payments. Some companies might also provide the option to increase or decrease the premium amount based on the client's preferences. This flexibility can make the policy more affordable and adaptable to changing financial circumstances.

Reviewing Policy Features: Different life insurance policies come with various features and riders. Some policies may offer additional benefits like critical illness coverage or accidental death benefits, which can impact the overall cost. When evaluating premiums, consider the specific features the client requires and whether they are necessary for their unique situation. This ensures that the policy remains cost-effective while providing the desired level of protection.

Long-Term Cost Considerations: It's essential to have an honest conversation about long-term costs. Life insurance premiums might increase over time, especially if the policy includes an investment component. Discuss the potential for premium adjustments and provide clarity on the factors that could lead to such changes. By being transparent about long-term costs, you can help clients make informed decisions and plan accordingly.

Life Insurance and Court: When to File?

You may want to see also

Coverage Adequacy: Assess if the policy meets the client's needs

When assessing coverage adequacy, it's crucial to delve into the client's specific circumstances and financial obligations. Start by asking about their current financial commitments, including mortgage payments, outstanding debts, and any regular expenses. Understanding these obligations will help determine the necessary death benefit to ensure their loved ones are financially secure in the event of their passing. For instance, if a client has a substantial mortgage, a larger death benefit might be required to cover the remaining balance.

Inquire about the client's future plans and goals. Are they saving for their children's education? Do they have retirement savings or plans to retire early? These questions will help tailor the policy to their long-term financial needs. For example, if a client is planning to retire early, a larger death benefit could provide a more substantial financial cushion during their retirement years.

It's essential to consider the client's overall financial situation and risk tolerance. Ask about their investment portfolio, savings, and any other sources of income or assets. This information will help determine if the proposed policy's coverage is appropriate and if there are any alternative solutions that could better suit their financial profile. For instance, if a client has a well-diversified investment portfolio, they might be more comfortable with a lower death benefit, as their other assets could provide additional financial security.

Additionally, explore the client's understanding of their insurance needs. Have they considered the impact of inflation on their financial goals? Do they know how much coverage they require to maintain their standard of living for their dependents? Educating clients about the potential future value of their policy and how it can adapt to changing circumstances is vital. For example, a policy with an adjustable death benefit could increase over time to keep up with inflation and changing financial needs.

Lastly, don't forget to discuss the client's health and lifestyle. Certain medical conditions or risky hobbies might affect their insurance eligibility and premiums. By addressing these factors, you can ensure that the policy is not only adequate but also affordable and suitable for the client's unique circumstances. This comprehensive approach to assessing coverage adequacy will help you provide tailored solutions that meet the client's needs and expectations.

Life Insurance Payouts Without Beneficiaries: Who Gets the Money?

You may want to see also

Trust and Transparency: Build trust by explaining policy details clearly

In the world of life insurance sales, trust and transparency are paramount. Building a solid foundation of trust with your clients is essential for long-term success and a positive reputation. One of the most effective ways to achieve this is by ensuring that you provide clear and detailed explanations of the insurance policies you offer. When selling life insurance, it's crucial to remember that your clients are making significant financial decisions, and they need to understand the terms and conditions of their policies.

Start by educating your clients about the different types of life insurance available, such as term life, whole life, and universal life. Explain the unique features and benefits of each policy, ensuring that you use simple language and analogies to make complex concepts understandable. For instance, you could compare term life insurance to renting a house, where the policy provides coverage for a specific period, while whole life insurance is like owning a house, offering lifelong coverage and potential cash value accumulation.

Transparency is key when discussing policy details. Be open and honest about the coverage limits, exclusions, and any potential risks associated with the insurance. Provide clear examples of how the policy would pay out in different scenarios, such as death, critical illness, or disability. By doing so, you empower your clients to make informed decisions and understand the true value of their investment. For instance, explain how the policy's death benefit would be paid out to the designated beneficiaries and how the policy's cash value could be used to pay for future premiums or provide financial security.

Additionally, ensure that you provide a comprehensive breakdown of all associated costs, including premiums, fees, and any potential increases over time. Being transparent about these financial aspects allows clients to assess the long-term viability of the policy and make choices that align with their financial goals. It also demonstrates your commitment to honesty and ethical selling practices.

Remember, building trust through transparency is a powerful tool in the insurance sales process. By clearly explaining policy details, you not only ensure that your clients understand their coverage but also foster a sense of confidence in your expertise and integrity. This approach can lead to stronger client relationships, increased satisfaction, and a more successful and sustainable insurance business.

Coworker Life Insurance: A Smart Financial Safety Net

You may want to see also

Frequently asked questions

Determining your need for life insurance involves considering several factors. It's essential to evaluate your financial obligations, such as mortgage payments, children's education costs, or any other long-term commitments. If you have people who depend on your income or if your financial responsibilities are significant, life insurance can provide financial security for your loved ones in the event of your passing. Additionally, if you have a substantial amount of debt or assets that need to be protected, life insurance can be a valuable tool to ensure your family's financial well-being.

There are primarily three types of life insurance policies: Term Life, Permanent Life (also known as Whole Life or Universal Life), and Variable Life. Term life insurance provides coverage for a specified period, offering a straightforward and cost-effective solution for a defined duration. Permanent life insurance, on the other hand, offers lifelong coverage and includes a savings component, making it a more complex but potentially more valuable option. Variable life insurance allows for investment options, providing flexibility but also carrying more risk. Choosing the right type depends on your financial goals, risk tolerance, and the level of coverage you require. It's advisable to consult with a financial advisor to determine the best fit for your unique circumstances.

Absolutely! Here are a few key questions to consider:

- Can you explain the different policy options and their benefits in detail? Understanding the various features and riders available can help you make an informed decision.

- How do you determine the appropriate death benefit for my needs? Discuss your financial goals and obligations to ensure the policy provides adequate coverage.

- What are the policy's conversion options if I decide to switch to a different type of life insurance in the future? This is especially important if you prefer a more permanent coverage option.

- How often do you review and adjust premiums, and what factors influence these changes? Knowing the frequency and reasons for premium adjustments can help you plan your finances accordingly.