Federal Employees' Group Life Insurance (FEGLI) is a group term life insurance program for Federal and Postal employees and retirees. The Office of Personnel Management administers the Program and sets the premiums. To make changes to your FEGLI coverage, you must complete and submit an SF 2817, Life Insurance Election form. You can decrease your FEGLI coverage at any time, but there are specific opportunities to increase your coverage, such as during an open season or in conjunction with a qualifying life event.

| Characteristics | Values |

|---|---|

| Coverage | Basic life insurance coverage and three options |

| Eligibility | Most employees are eligible for FEGLI coverage |

| Cost of Basic Insurance | You pay 2/3 of the total cost and the government pays 1/3 |

| Cost of Optional Insurance | You pay the full cost of optional insurance, and the price depends on your age |

| Enrolment | Automatic for new federal employees |

| Optional Insurance Enrolment | Not automatic, you must take action to elect the options |

| Election Form | SF 2817 |

| Submission Address | Retirement and Employee Benefits Branch (REBB), 31 Center Drive, Bldg 31/Rm 1B37, Bethesda, MD 20892-2215 |

| Submission Deadline | Within 60 days after the date of the event |

| Qualifying Life Events | Marriage, divorce, death of spouse, acquisition of an eligible child |

| FEGLI Calculator | Allows you to determine the face value, calculate premiums, and see how different options change the insurance amount and premium withholdings |

What You'll Learn

Cancelling your federal FGLI life insurance

Federal Employees' Group Life Insurance (FEGLI) is the largest group life insurance program globally, covering over 4 million federal employees, retirees, and their family members. It is a group term life insurance policy, meaning it does not accumulate cash value over time.

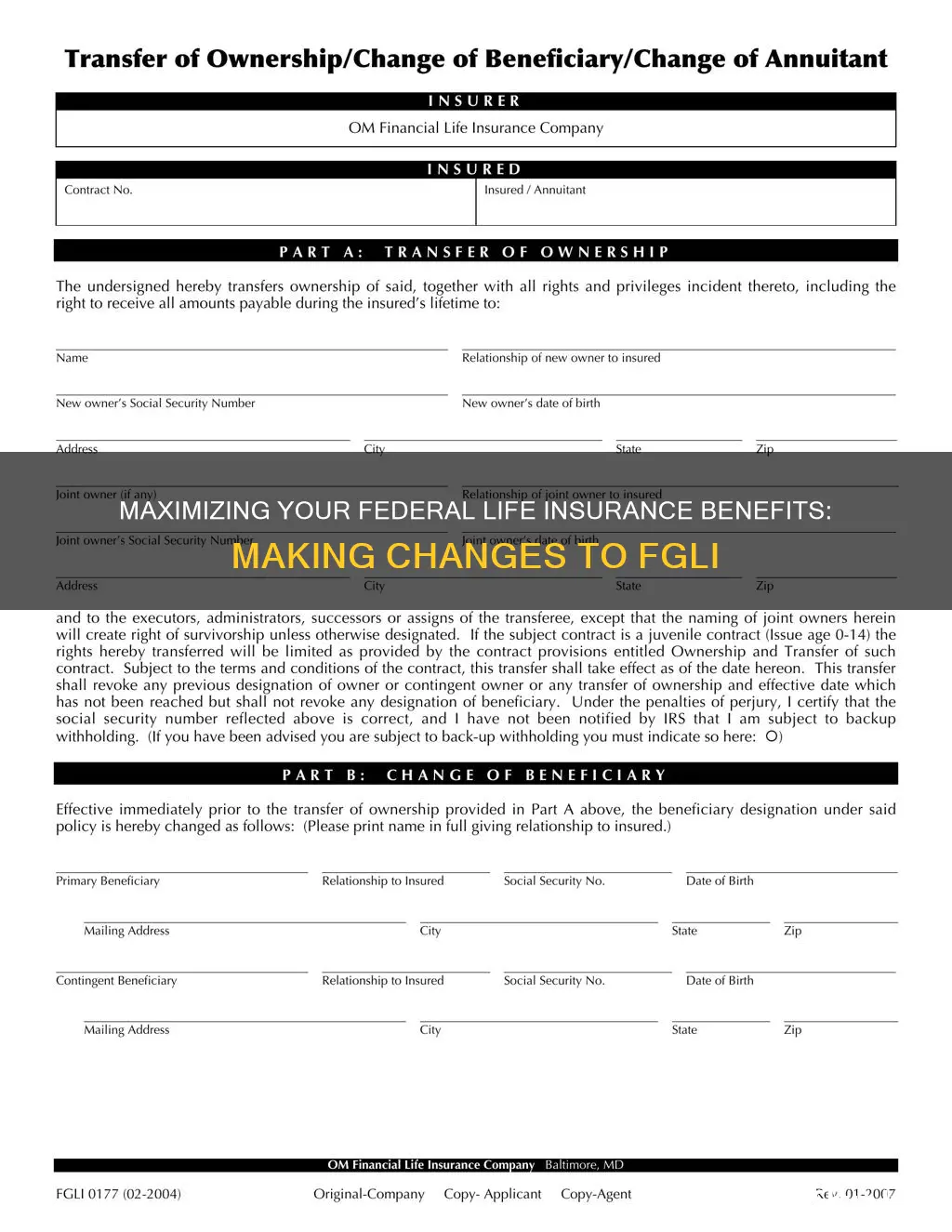

You may reduce or cancel your FEGLI coverage at any time. To do so, you must complete the Life Insurance Election Form, SF 2817. This form requires a wet/original signature rather than an electronic signature. If you wish to reduce your coverage, sign only for the coverage you want to keep. To cancel all coverage, sign in Box 5.

There is an exception to this process: if you have assigned your life insurance to another person or company by transferring ownership, you cannot cancel or reduce your Basic, Option A, or Option B coverage.

Once completed, submit the form to the Retirement and Employee Benefits Branch (REBB) at the following address:

> Retirement and Employee Benefits Branch (REBB)

> 31 Center Drive, Bldg 31/Rm 1B37

> Bethesda, MD 20892-2215

The REBB Office at NIEHS can also be contacted at the following address:

> Retirement and Employee Benefits Branch (REBB) at NIEHS

> PO Box 12233, Keystone/Rm 1105

> Research Triangle Park, NC 27709

Remember, you can only enroll in the FEGLI Program or increase your coverage during specific periods. These include a rare FEGLI Open Season, after a Qualifying Life Event (such as marriage, divorce, the death of your spouse, or acquiring an eligible child), or by taking a physical exam.

Credit Card Life Insurance: What Coverage Do You Get?

You may want to see also

Reducing coverage

Federal Employees' Group Life Insurance (FEGLI) is the largest group life insurance program in the world, covering over 4 million federal employees, retirees, and their family members. It provides term life insurance, which means it has no cash or paid-up value. As a federal employee, you are typically automatically enrolled in Basic life insurance, and you contribute 2/3 of the total cost while the government pays the remaining 1/3.

You may reduce or cancel your FEGLI coverage at any time. To do so, you must complete and submit the Life Insurance Election Form, SF 2817. This form must be submitted to the Retirement and Employee Benefits Branch (REBB) at the following address:

Retirement and Employee Benefits Branch (REBB)

31 Center Drive, Bldg 31/Rm 1B37

Bethesda, MD 20892-2215

Alternatively, you can submit the form to the REBB Office at NIEHS:

REBB Office at NIEHS

PO Box 12233, Keystone/Rm 1105

Research Triangle Park, NC 27709

If you wish to reduce your coverage, only sign for the coverage you want to keep. You cannot elect coverage that you don't already have. To cancel all life insurance coverage, sign in Box 5 of the form. Remember that a wet/original signature is required; electronic signatures are not accepted.

There are a few exceptions to reducing or cancelling your FEGLI coverage. If you have assigned your life insurance by transferring ownership to another person or entity, you cannot cancel or reduce your Basic, Option A, or Option B coverage. Additionally, there are specific times when you can enrol in the FEGLI Program or increase your coverage. These opportunities include a FEGLI Open Season (which is rare), experiencing a Qualifying Life Event (such as marriage, divorce, death of a spouse, or acquiring an eligible child), or taking a physical exam to request coverage if it has been at least one year since you waived coverage.

MetLife's Permanent Life Insurance: What You Need to Know

You may want to see also

Qualifying life events

Federal Employees' Group Life Insurance (FEGLI) is a group term life insurance program for Federal and Postal employees and retirees. It was established on August 29, 1954, and is the largest group life insurance program in the world, covering over 4 million Federal employees and retirees, as well as many of their family members.

FEGLI qualifying life events include significant changes in your life circumstances, such as:

- Marriage

- Divorce

- Death of a spouse

- Birth or adoption of a child

- Moving to a different ZIP code or county

- Gaining or losing health coverage

- Changes in income that affect your coverage

- Turning 26 and losing coverage through a parent's plan

- Becoming a U.S. citizen

These qualifying life events allow you to make changes to your FEGLI coverage outside of the usual open season. To do so, you must complete an SF 2817 Life Insurance Election Form and submit it to the relevant office.

Unpaid Life Insurance: Strategies to Sell and Gain Peace

You may want to see also

Cost of coverage

Federal Employees' Group Life Insurance (FEGLI) is a term insurance policy and has no cash value. The cost of Basic Life Insurance is shared between the employee and the government. You pay 2/3 of the total cost and the government pays 1/3. Your age is not a factor in calculating the cost of Basic Life Insurance. The enrollee premium rates are equal for the duration of the coverage period. This means a younger employee pays the same cost for Basic coverage as a 64-year-old retiree. The FEGLI Basic insurance premium is a level rate per one thousand dollars of coverage.

The FEGLI Basic insurance premium is a level rate per one thousand dollars of coverage. The level premium feature means the enrollee premium rates are equal for the duration of the coverage period. The rate for an individual enrollee does not change as the enrollee ages, although the rate structure for all enrollees is subject to periodic adjustments based on claims experience. This means that a younger employee pays the same cost for Basic coverage as an older one. For example, a 25-year-old active employee pays the same Basic Biweekly Cost (per $1000 of coverage) and the same Basic Monthly Cost (per $1000 of coverage). This feature balances the premium over time, making the enrollee cost more predictable. The enrollee pays an average cost over the term of their coverage.

As required by law, Basic insurance coverage uses a composite premium structure. This means the Basic premium rate is the same for each enrollee in the group policy, regardless of age or health status. As such, younger employees may pay a comparatively higher premium than they would with coverage based, in part, on age (like Optional insurance) or with a commercial individually underwritten policy. Younger employees are covered by an additional Basic insurance provision called the Extra Benefit, which doubles the amount of Basic insurance payable at no extra cost for enrollees age 35 or younger. Beginning on an enrollee's 36th birthday, the Extra Benefit decreases by 10% each year until age 45, after which there is no Extra Benefit. So, for a 40-year-old employee, the benefit increases by 10% for each year under age 45. In this example, the Extra Benefit would increase the Basic Insurance Amount (BIA) of $48,000 by an additional 50%.

You pay the full cost of Optional insurance, and the cost depends on your age. There are three types: Option A (standard optional insurance), which provides $10,000 of additional coverage; Option B (additional optional), which comes in 1, 2, 3, 4, or 5 multiples of your annual basic rate of pay; and Option C (family optional insurance), which insures your spouse for up to 5 multiples of $5,000 and/or eligible children for up to 5 multiples of $2,500.

Life Insurance and SSI: What Counts as an Asset?

You may want to see also

How to designate a beneficiary

To designate a beneficiary for your Federal Employees Group Life Insurance (FEGLI), you must complete an SF 2817, Life Insurance Election form. You cannot make changes to your beneficiary designation using Employee Express. You will need to submit the form to the Retirement and Employee Benefits Branch (REBB) at the following address:

31 Center Drive, Bldg 31/Rm 1B37, Bethesda, MD 20892-2215.

The REBB Office at NIEHS is located at:

PO Box 12233, Keystone/Rm 1105, Research Triangle Park, NC 27709.

It is important to note that a wet/original signature is required on the form, instead of an electronic signature. If you have assigned your life insurance by transferring ownership to another person or entity, you cannot cancel or reduce your Basic, Option A, or Option B coverage.

To reduce your FEGLI coverage, you will need to sign only for the coverage you want to keep. To cancel all life insurance coverage, you will need to sign in Box 5 of the form.

In terms of timing, there are specific opportunities to make changes to your FEGLI coverage. These include:

- A FEGLI Open Season, which is very rare.

- Experiencing a Qualifying Life Event, such as marriage, divorce, the death of your spouse, or acquiring an eligible child. In this case, you must submit a Life Insurance Election to your employing agency's human resources office within 60 days of the event.

- Taking a physical exam to request coverage if it has been at least one year since you waived coverage.

Life Insurance and Suicide: What Coverage Includes

You may want to see also

Frequently asked questions

To change your Federal Employees' Group Life Insurance (FEGLI) coverage, you must complete and submit an SF 2817, Life Insurance Election form. You can enrol or increase coverage, or cancel or reduce coverage, by filling out this form.

There are four types of FEGLI insurance coverage: Basic life insurance and three types of optional insurance (Option A, Option B, and Option C). Basic insurance is mandatory for federal employees unless waived, while the three optional types of insurance must be elected.

The cost of Basic insurance is shared between you and the government. You pay 2/3 of the total cost, while the government pays 1/3. The cost of Optional insurance is paid in full by you and depends on your age.

To designate a beneficiary, you must complete and submit an SF 2823 Designation of Beneficiary form.