Permanent life insurance is a powerful financial tool that offers a range of benefits that can provide long-term financial security and peace of mind. Unlike term life insurance, which provides coverage for a specific period, permanent life insurance is designed to last a lifetime. This type of insurance offers a combination of features, including a death benefit, a cash value component, and the potential for investment growth. The death benefit ensures that your loved ones are financially protected in the event of your passing, while the cash value can be used to build equity over time, providing a source of funds for various financial needs. Additionally, permanent life insurance can offer tax advantages and the potential for loan features, making it a versatile and valuable asset in your financial portfolio. Understanding the benefits of permanent life insurance can help individuals make informed decisions about their long-term financial planning and ensure that their loved ones are protected.

What You'll Learn

- Financial Security: Protects your loved ones financially in the event of your death

- Long-Term Planning: Ensures financial stability for your family's future goals

- Peace of Mind: Provides reassurance knowing your family is protected

- Asset Protection: Preserves wealth and assets for beneficiaries

- Tax Benefits: May offer tax advantages, depending on the policy type

Financial Security: Protects your loved ones financially in the event of your death

When it comes to ensuring the financial well-being of your loved ones, permanent life insurance can be a powerful tool. This type of insurance provides a lifelong coverage, offering a sense of security and peace of mind. Here's how it can be a crucial aspect of your financial strategy:

Financial Security for Dependents: One of the primary reasons to consider permanent life insurance is to protect your family's financial future. If you were to pass away, the insurance policy would provide a substantial death benefit, ensuring that your loved ones have a financial safety net. This benefit can cover various expenses, such as mortgage payments, education costs, daily living expenses, and even help with the overall financial burden that often accompanies the loss of a primary income earner. By having this insurance, you can provide long-term financial security, allowing your family to maintain their standard of living and achieve their financial goals.

Long-Term Coverage: Permanent life insurance, as the name suggests, offers coverage for life. Unlike term life insurance, which provides coverage for a specific period, permanent insurance remains in force as long as the premiums are paid. This feature is particularly valuable as it ensures that your loved ones are protected throughout their lives, regardless of changes in their financial situation or life circumstances. With permanent insurance, you can rest assured that your family will have the necessary financial support, even if your income-earning years extend beyond the initial coverage period.

Tax-Advantaged Accumulation: Another advantage of permanent life insurance is its potential for tax-advantaged accumulation. The cash value component of the policy grows tax-deferred, meaning it can accumulate over time without being subject to annual income taxes. This feature allows you to build a substantial cash value, which can be borrowed against or withdrawn for various purposes, such as funding education, starting a business, or supplementing retirement income. Additionally, the death benefit received by your beneficiaries is generally tax-free, providing a significant financial benefit to your loved ones.

Flexibility and Customization: Permanent life insurance policies offer flexibility in terms of coverage and premium payments. You can choose the amount of coverage that aligns with your family's needs and adjust it over time as your financial circumstances change. Moreover, you can select the premium payment option that suits your budget, whether it's level premiums or increasing premiums to match your income growth. This customization ensures that the insurance remains affordable and relevant throughout your life.

In summary, permanent life insurance is a valuable asset for anyone seeking to provide long-term financial security for their loved ones. It offers a reliable safety net, ensuring that your family can maintain their financial stability and achieve their goals, even in the face of unexpected circumstances. By considering this type of insurance, you can take a proactive approach to protecting your family's future and leave a lasting legacy of financial security.

Accidental Death and Dismemberment Insurance: What You Need to Know

You may want to see also

Long-Term Planning: Ensures financial stability for your family's future goals

Long-term planning is a crucial aspect of ensuring financial stability and security for your family's future goals. It involves creating a comprehensive strategy to manage and grow your wealth over an extended period, often spanning decades. This approach is essential as it allows you to prepare for various life events and ensure that your family's financial needs are met, even in the absence of your income. One of the key tools to facilitate this long-term planning is permanent life insurance.

Permanent life insurance provides a unique and powerful financial instrument that offers lifelong coverage. Unlike term life insurance, which provides coverage for a specified period, permanent insurance remains in force for the entire life of the insured individual. This feature is particularly valuable for long-term planning as it ensures that your family is protected financially for the long haul. The death benefit of permanent life insurance is typically paid out as a tax-free sum, providing a substantial financial cushion for your loved ones when it matters most.

The benefits of permanent life insurance extend beyond providing financial security. It also serves as a valuable asset that can be utilized for various financial goals. One of the key advantages is its potential to accumulate cash value over time. This cash value can be borrowed against or withdrawn, providing access to funds that can be used for various purposes, such as funding education, starting a business, or covering unexpected expenses. Additionally, the cash value can grow tax-deferred, allowing your money to grow faster than in a traditional savings account.

Incorporating permanent life insurance into your long-term financial plan offers several advantages. Firstly, it provides a sense of peace of mind, knowing that your family's financial future is secure. This insurance ensures that your loved ones can maintain their standard of living, cover daily expenses, and achieve their long-term goals, even if you are no longer around. Secondly, it can be a valuable investment tool, allowing you to build wealth over time. The cash value accumulation can be utilized to grow your net worth, providing financial security and flexibility.

When considering permanent life insurance, it is essential to evaluate your specific needs and goals. Consult with a financial advisor who can help you understand the various types of permanent insurance policies available, such as whole life and universal life insurance. They can assist in determining the appropriate coverage amount and policy features to align with your long-term financial objectives. By integrating permanent life insurance into your long-term planning, you can ensure that your family's financial stability and future goals are well-protected.

Unraveling Credit Life Insurance: Exploring the Maximum Coverage Limits

You may want to see also

Peace of Mind: Provides reassurance knowing your family is protected

The concept of permanent life insurance offers a profound sense of security and peace of mind, especially for those with a family to care for. This type of insurance provides a financial safety net that remains constant throughout your life, ensuring that your loved ones are protected even in your absence. The primary purpose of permanent life insurance is to provide long-term coverage, and it does so by offering a death benefit that is paid out as a lump sum upon your passing. This financial cushion can be a powerful tool in ensuring that your family's financial obligations are met, even if you are no longer around to fulfill them.

One of the most significant advantages of permanent life insurance is the peace of mind it brings. Knowing that your family has a reliable source of financial support can alleviate a significant amount of stress and worry. It allows you to focus on the present and future, knowing that your loved ones' well-being is secure. This reassurance is invaluable, especially when considering the various financial responsibilities that come with family life, such as mortgage payments, education costs, and daily living expenses.

With permanent life insurance, you can rest easy knowing that your family's financial stability is guaranteed. The insurance policy acts as a long-term commitment, providing coverage for your entire life, which is a stark contrast to term life insurance, which only provides coverage for a specified period. This longevity ensures that your family is protected even as they grow and their needs evolve. For instance, if your child is born with a medical condition that requires ongoing care, the death benefit from permanent life insurance can cover these expenses, ensuring your child receives the necessary treatment without financial strain.

Furthermore, permanent life insurance offers flexibility in terms of policy customization. You can tailor the coverage to your family's specific needs, ensuring that the death benefit is sufficient to cover their financial requirements. This adaptability is a key factor in providing comprehensive protection for your loved ones. Whether it's covering the cost of a child's college education, paying off a mortgage, or simply ensuring that daily expenses are met, the flexibility of permanent life insurance allows you to create a personalized safety net.

In summary, permanent life insurance provides an essential layer of security and peace of mind for families. It ensures that your loved ones are financially protected, allowing them to focus on their well-being and future. With its long-term coverage, flexibility, and ability to adapt to changing family needs, permanent life insurance is a powerful tool for anyone seeking to provide a stable and secure future for their family. By taking this step, you can rest assured that your family's financial security is in place, offering a sense of reassurance that is invaluable in today's uncertain world.

Commercial Life Insurance: What Businesses Need to Know

You may want to see also

Asset Protection: Preserves wealth and assets for beneficiaries

Owning permanent life insurance can be a powerful tool for asset protection and wealth preservation. This type of insurance provides a lifelong coverage, ensuring that your beneficiaries receive a death benefit regardless of your age or health status. Here's how it can help in preserving wealth and assets for your loved ones:

Long-Term Financial Security: Permanent life insurance offers a unique advantage by providing coverage for an entire lifetime. Unlike term life insurance, which has a specific period of coverage, permanent insurance remains in force as long as the premiums are paid. This long-term commitment ensures that your beneficiaries are protected financially, even in the event of your passing. The death benefit can be used to cover various expenses, such as funeral costs, outstanding debts, or even provide a financial cushion for your family to maintain their standard of living.

Asset Accumulation and Growth: One of the key features of permanent life insurance is its potential to accumulate cash value over time. With each premium payment, a portion of the premium goes towards building cash value, which grows tax-deferred. This accumulated cash value can be borrowed against or withdrawn, providing access to funds without disrupting the insurance coverage. By utilizing the cash value, you can strategically build and preserve wealth, ensuring that your assets are protected and potentially growing.

Wealth Transfer and Estate Planning: Permanent life insurance plays a crucial role in estate planning and wealth transfer. The death benefit received by your beneficiaries is generally free from income tax, providing a significant financial asset that can be passed on to heirs. This can help in minimizing estate taxes and ensuring that your wealth is distributed according to your wishes. Additionally, the flexibility of permanent insurance allows you to adjust the coverage amount or policy terms as your financial goals and circumstances change, making it a versatile tool for long-term asset protection.

Protection Against Financial Loss: In the event of your death, permanent life insurance provides a guaranteed payout, which can prevent the erosion of your family's financial stability. Without this insurance, the loss of income or the burden of outstanding debts could significantly impact your beneficiaries' financial well-being. By having permanent coverage, you create a safety net that safeguards your assets and ensures that your loved ones are financially secure, even in the face of unexpected circumstances.

In summary, permanent life insurance is an effective strategy for asset protection and wealth preservation. Its lifelong coverage, potential for cash value accumulation, and tax-advantaged benefits make it a valuable tool for individuals seeking to secure their financial legacy and provide long-term financial security for their beneficiaries.

Understanding High Cash Value Life Insurance: A Comprehensive Guide

You may want to see also

Tax Benefits: May offer tax advantages, depending on the policy type

When it comes to permanent life insurance, one of the key advantages often overlooked is the potential for significant tax benefits. This type of insurance offers a unique financial strategy that can provide long-term financial security while also providing tax advantages. Understanding these benefits can be crucial for individuals looking to optimize their financial planning and potentially reduce their tax liability.

The tax benefits of permanent life insurance can vary depending on the specific policy type and the country's tax laws. One common advantage is the ability to build cash value within the policy, which grows tax-deferred. This means that the earnings on the policy's cash value are not subject to annual income taxes as they accumulate. Over time, this can result in substantial tax-free growth, allowing the policyholder to accumulate a larger sum of money. For example, if you invest $10,000 in a permanent life insurance policy with a 5% annual return, after 20 years, you could have over $26,000 in cash value, all of which has grown tax-free.

Additionally, permanent life insurance policies often provide tax-deductible premiums. This means that the amount you pay into the policy each year may be eligible for a tax deduction, reducing your taxable income. The specific rules and limits for deductions can vary, so it's essential to consult with a tax professional to understand how this benefit applies to your individual circumstances. In some cases, the entire premium payment may be tax-deductible, especially for older individuals or those with lower incomes, as it can be seen as a form of long-term savings.

Furthermore, upon the death of the insured individual, permanent life insurance policies typically provide a tax-free death benefit. This means that the beneficiary receives the full death benefit without incurring any tax liability. This is in contrast to other forms of insurance, where the death benefit may be subject to income tax. By choosing permanent life insurance, you can ensure that the financial support you provide for your loved ones is not only secure but also free from unnecessary tax burdens.

In summary, permanent life insurance offers a range of tax benefits that can be advantageous for individuals seeking long-term financial security. From tax-deferred cash value growth to potential tax deductions on premiums and tax-free death benefits, this type of insurance provides a comprehensive financial strategy. It is essential to explore these benefits in the context of your specific tax situation and seek professional advice to maximize the advantages of permanent life insurance.

Assignee Signature: Life Insurance Form Essential

You may want to see also

Frequently asked questions

Permanent life insurance, also known as whole life insurance, offers several advantages. Firstly, it provides lifelong coverage, ensuring financial protection for your loved ones even after your passing. This type of insurance builds cash value over time, which can be borrowed against or withdrawn, offering a potential source of funds for various financial needs. Additionally, permanent life insurance guarantees a fixed death benefit, meaning the payout to beneficiaries is certain and does not fluctuate with market conditions.

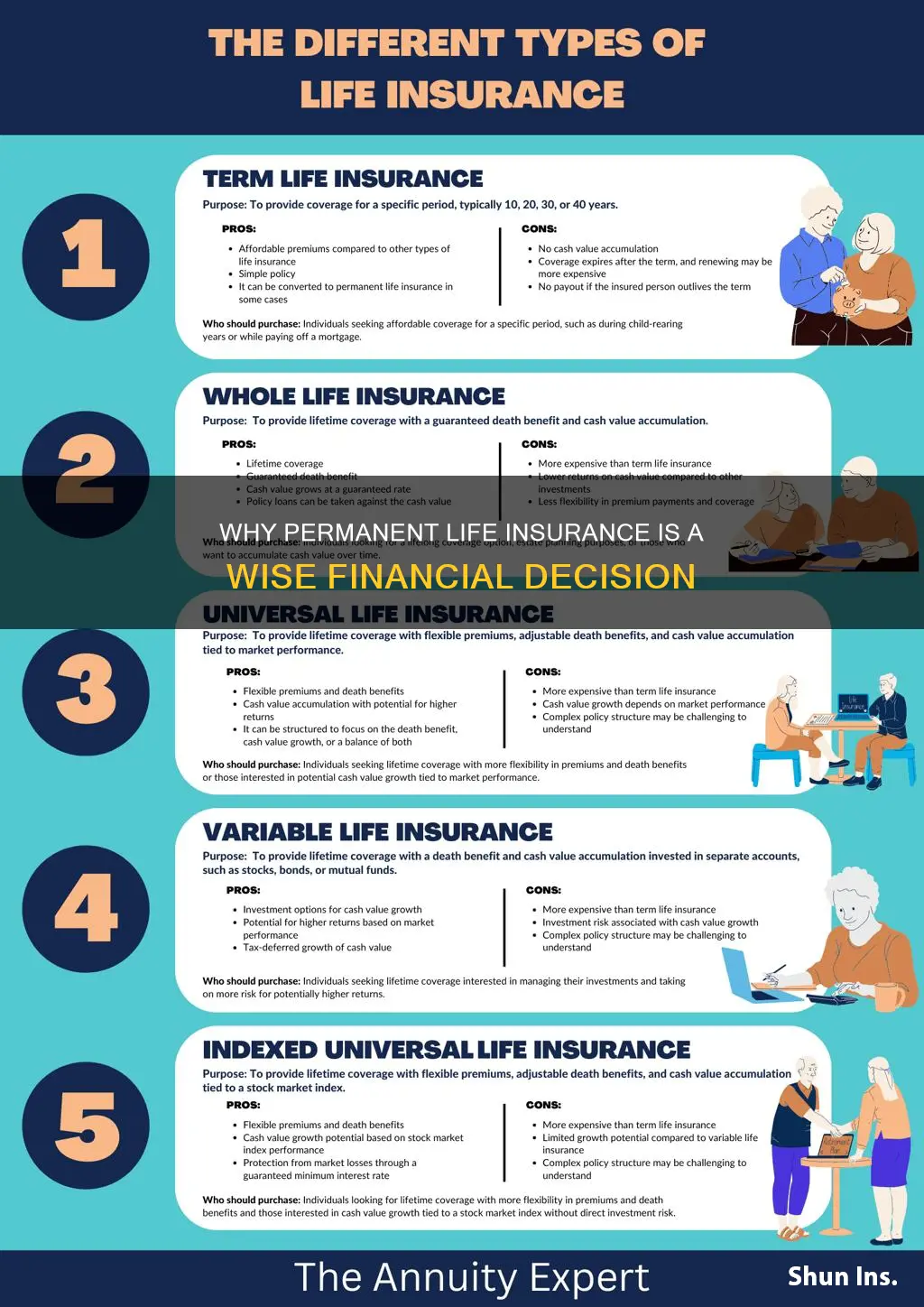

The primary distinction lies in the duration of coverage. Term life insurance provides protection for a specified period, typically 10, 20, or 30 years. If you die within this term, the beneficiaries receive the death benefit. In contrast, permanent life insurance offers coverage for your entire life, providing long-term financial security. Term life is generally more affordable, making it suitable for short-term needs, while permanent life ensures coverage throughout your life, often with additional features like cash value accumulation.

Yes, permanent life insurance can offer tax benefits. The cash value accumulation within the policy grows tax-deferred, allowing it to potentially accumulate a substantial amount over time. Additionally, the death benefit paid to beneficiaries is generally income tax-free, providing a tax-efficient way to pass on wealth. Some policies also offer tax-deductible premiums, especially for younger individuals, making permanent life insurance an attractive option for long-term financial planning and wealth preservation.

Absolutely. One of the key features of permanent life insurance is the cash value component. Policyholders can access this cash value through partial withdrawals or loans, providing financial flexibility. This feature is particularly useful for funding education expenses, starting a business, or covering unexpected costs without selling the policy or disrupting the coverage. It also ensures that the insurance coverage remains in place even if you need to access some of the policy's funds.