Cash value life insurance is a type of permanent life insurance that includes a cash value feature. This means that a portion of each premium payment is allocated to the cost of insurance, while the remainder is deposited into a cash value account. This account earns interest over time, and taxes are deferred on the accumulated earnings. As the cash value of the life insurance increases, the insurance company's risk decreases, because the accumulated cash value offsets part of the insurer's liability.

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance |

| Premium payments | Higher than term life insurance |

| Cash value | A portion of each premium payment is deposited into a cash value account |

| Interest | Accrues over time |

| Risk | Decreases for the insurance company as the cash value increases |

| Use | The cash value can be used to make premium payments, borrow money, or withdraw cash |

What You'll Learn

How does cash value life insurance work?

Cash value life insurance is a type of permanent life insurance that includes a cash value feature. It is also known as whole life insurance or universal life insurance. Cash value life insurance has higher premiums than term life insurance because of the cash value element.

A portion of each premium payment is allocated to the cost of insurance, and the remainder is deposited into a cash value account. This cash value account earns interest over time, and taxes are deferred on the accumulated earnings. As the cash value increases, the insurance company's risk decreases because the accumulated cash value offsets part of the insurer's liability.

As your policy's accumulated cash value grows, you can use it to make premium payments, borrow money, or even withdraw cash. The cash value can be used to cover significant expenses, such as a down payment on a home, retirement, paying down a mortgage, or an unforeseen emergency.

The cash value feature is included in permanent life insurance types like whole life insurance and universal life insurance. Since final expense life insurance is a type of whole life insurance, it can also have cash value and can be a more affordable option for obtaining a policy with cash value.

Permanent Life Insurance: No-Lapse Guarantee Explained

You may want to see also

What are the benefits of cash value life insurance?

Cash value life insurance is a type of permanent life insurance that includes a savings feature. A portion of every premium payment goes into an account that collects interest over time. This cash value can be used to make premium payments, borrow money, or even withdraw cash.

As the cash value of life insurance increases, the insurance company's risk decreases. This is because the accumulated cash value offsets part of the insurer's liability. For example, if you have a $25,000 death benefit policy, the higher the cash value, the lower the risk to the insurer.

The cash value feature is included in permanent life insurance types like whole life insurance and universal life insurance. Since final expense life insurance is a type of whole life, it can also have cash value and can be a more affordable option for obtaining a policy with cash value.

As your policy's accumulated cash value grows, you can borrow against it to cover significant expenses, like a down payment on a home, paying for your child's education, or even retirement.

Aviva Life Insurance: Understanding Client ID Significance

You may want to see also

How does cash value life insurance compare to term life insurance?

Cash value life insurance is a type of permanent life insurance that includes a savings feature. A portion of each premium payment is allocated to the cost of insurance and the remainder is deposited into a cash value account. This account earns interest over time, and taxes are deferred on the accumulated earnings. As the cash value increases, the insurance company's risk decreases because the accumulated cash value offsets part of the insurer's liability.

Term life insurance, on the other hand, does not have a cash value component. It is a type of insurance that provides coverage for a specific period, or term, and typically has lower premiums than cash value life insurance. While term life insurance can be more affordable in the short term, it does not offer the same long-term savings potential as cash value life insurance.

One of the key benefits of cash value life insurance is the flexibility it offers. As the policy's accumulated cash value grows, you can use it to make premium payments, borrow money, or even withdraw cash. This can be particularly useful for covering significant expenses, such as a down payment on a home, retirement, or paying for a child's education.

Additionally, cash value life insurance can provide peace of mind and financial protection in the event of unforeseen circumstances. The cash value account can serve as a safety net, helping to cover unexpected costs or providing a source of funds during retirement.

It's important to note that while cash value life insurance offers potential long-term benefits, it may not be the best option for everyone. The higher premiums associated with cash value life insurance may be a significant consideration for some individuals, especially those on a tight budget. Term life insurance can provide adequate coverage for a specific period at a lower cost, making it a more suitable choice in certain situations.

When deciding between cash value and term life insurance, it's essential to consider your long-term financial goals, budget, and specific needs. Cash value life insurance can be a valuable tool for building wealth and protecting your loved ones, but it may not be the most cost-effective option in the short term. By understanding the differences between these two types of insurance, you can make an informed decision that aligns with your financial priorities.

Credit Life Insurance: Unfair, Deceptive, or Abusive?

You may want to see also

What types of life insurance include a cash value feature?

Cash value life insurance is a type of permanent life insurance that includes a cash value feature. This means that a portion of each premium payment is allocated to the cost of insurance, while the remainder is deposited into a cash value account. This cash value account earns interest over time, and taxes are deferred on the accumulated earnings. As the cash value increases, the insurance company's risk decreases because the accumulated cash value offsets part of the insurer's liability.

Cash value life insurance policies typically have higher premiums than term life insurance policies because of the cash value element. The cash value feature is included in permanent life insurance types like whole life insurance and universal life insurance. Since final expense life insurance is a type of whole life insurance, it can also have cash value and can be a more affordable option for obtaining a policy with cash value.

As your policy's accumulated cash value grows, you can use it to make premium payments, borrow money, or even withdraw cash. The cash value can be used to cover significant expenses, such as a down payment on a home, retirement, paying down a mortgage, or unforeseen emergencies.

Life Insurance Rejection: What Are the Legal Risks?

You may want to see also

How can you use cash value life insurance to protect your assets?

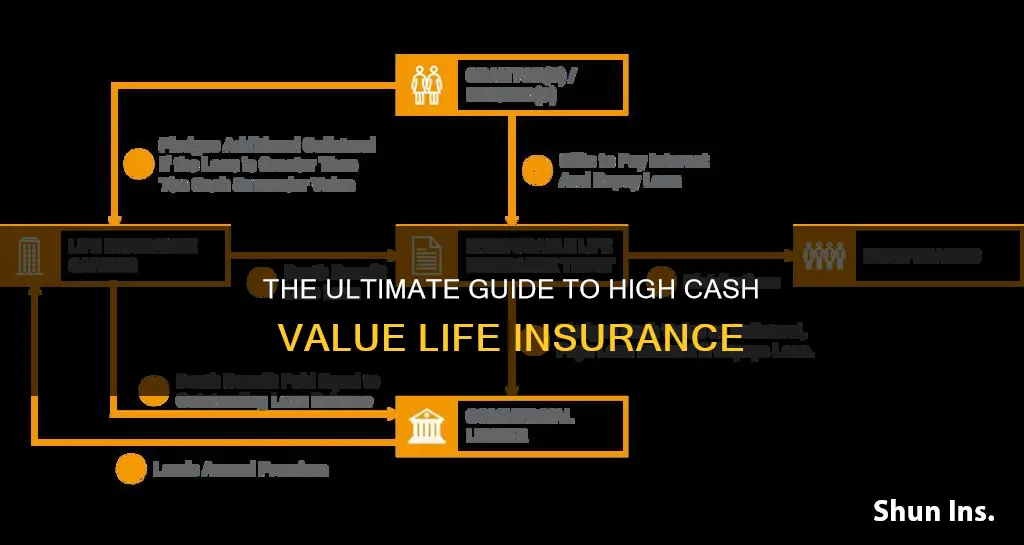

Cash value life insurance is a type of permanent life insurance that includes a cash value feature. This means that a portion of each premium payment is allocated to the cost of insurance, while the remainder is deposited into a cash value account. This cash value account earns interest over time, and taxes are deferred on the accumulated earnings.

As the cash value of the life insurance policy increases, the insurance company's risk decreases, because the accumulated cash value offsets part of the insurer's liability. This means that, as your policy's accumulated cash value grows, you can use it to make premium payments, borrow money, or even withdraw cash.

You can use cash value life insurance to protect your assets by borrowing against the cash value to cover significant expenses, such as a down payment on a home, paying down a mortgage, or sending your child to college. It can also be used to cover unforeseen emergencies or long-term savings needs, such as retirement.

By using cash value life insurance to protect your assets, you can ensure that you have access to funds when you need them, without having to sell off other investments or assets. This can help you maintain your financial stability and security, even in the face of unexpected expenses or emergencies.

Life Insurance for Seniors: Options for 60-Year-Olds

You may want to see also

Frequently asked questions

High cash value life insurance is a type of permanent life insurance that includes a cash value savings component. A portion of each premium payment is allocated to the cost of insurance and the remainder is deposited into a cash value account. This cash value account earns interest over time.

As your policy's accumulated cash value grows, you can use it to make premium payments, borrow money, or even withdraw cash. You can borrow against the cash value to cover significant expenses, like a down payment on a home, or for long-term savings needs such as retirement.

High cash value life insurance can be a good investment as it serves as an investment-like savings account within the policy. It can also be more affordable than other types of permanent life insurance.