A rider is an optional add-on to an insurance policy that provides additional benefits or amends the terms of the basic policy. They are designed to meet the specific needs of the policyholder and can be added to policies covering life, homes, autos, and rental units. Riders come at an extra cost and can be added when the policy is initiated or at a later date, depending on the type of rider and the insurance company. One example of a rider that ends when the insured becomes a certain age is the guaranteed insurability rider, which allows the policyholder to purchase additional insurance coverage at certain times, usually up to a maximum age of 40. This rider may end at a certain age, and the age limit can vary depending on the insurance provider.

Explore related products

What You'll Learn

Waiver of Premium Rider

A waiver of premium rider is an optional add-on to a life insurance policy that provides financial security during difficult times. This rider waives or pays your life insurance premiums if you become disabled and unable to work due to injury, illness, or physical impairment. This ensures your policy remains in force even if you can no longer afford the premiums yourself, preventing a lapse in coverage.

The specifics of this rider, such as costs, waiting periods, and coverage, can vary among insurance providers. Most waiver of premium riders contain a waiting period of about six months, during which you cannot claim benefits. This period is in place to confirm that the disability or illness is long-term. The rider then remains in effect until the policyholder recovers or reaches a certain age specified in the policy, often 60 or 65. If the policyholder recovers before that age, they must resume their premium payments.

To purchase a waiver of premium rider, you may need to meet certain age and health requirements, and it may not be available to those with pre-existing conditions or physical impairments. The rider is added to an insurance policy for an additional fee, which can increase the cost of a life insurance policy by 10% to 25%.

This rider is particularly valuable for the main breadwinners of families, as disability can have a crippling effect on their ability to provide. With a waiver of premium rider, policyholders can redirect their limited personal funds to critical needs such as palliative care, personal finances, and living expenses.

Liability Insurance: Bonding or Not?

You may want to see also

Accidental Death Rider

An accidental death rider is an optional add-on to a life insurance policy. It provides an additional death benefit if the policyholder dies due to an accident. This is also known as a double indemnity rider because the benefit paid out is often double the original policy amount, meaning the insured's family gets twice the amount.

The cost of an accidental death rider is influenced by the policyholder's age, health, lifestyle, and coverage amount. The rider's cost may increase over time and could significantly raise the premiums on the original policy. The rider typically ends when the insured reaches a certain age, such as 60, 70, or 80.

It's important to note that the definition of "accident" varies by insurer, and many policies won't pay out if the death occurs during risky activities or while under the influence of drugs or alcohol.

Billing Insurance for Drug Rehab: Navigating the Complexities of Coverage

You may want to see also

Long-Term Care Rider

A long-term care rider is a living benefit that can be added to a life insurance policy. It allows the policyholder to access a portion of the policy's death benefit every month to pay for long-term care expenses. This includes the cost of a nursing home, home care, or other long-term care needs that traditional health insurance does not cover.

To be eligible for the benefit, a medical professional must certify that the policyholder is unable to perform at least two activities of daily living, such as eating, dressing, or using the bathroom, or that they require substantial supervision due to a cognitive impairment like Alzheimer's or dementia.

The long-term care rider will have a maximum monthly benefit, which could range from 1% to 4% of the policy's death benefit per month, and a maximum lifetime benefit. Each payment received through the rider will reduce the policy's death benefit, resulting in a smaller payout for beneficiaries.

Some advantages of long-term care riders include affordability compared to standalone long-term care policies, the ability to use benefits outside the United States, and no requirement to submit bills or receipts for care. Additionally, some policies guarantee a minimum death benefit even if the policy's long-term care benefits are exhausted.

When considering a long-term care rider, it is important to carefully review the terms and conditions, as benefit amounts, qualifying conditions, waiting periods, and payout methods can vary.

Updating Your Address: A Guide to NAIC Insurance Address Changes

You may want to see also

Explore related products

Family Income Benefit Rider

A family income benefit rider is an optional add-on to a term life insurance policy. In the event of the insured's death, it provides their family with a steady flow of income, paid out in monthly instalments, for the remaining length of the policy's term. This type of rider is typically purchased by individuals who are the sole breadwinners of their families.

When buying a family income benefit rider, you need to determine the number of years your family will receive the benefit for. This ensures that, in the event of your death, your family will face fewer financial difficulties thanks to the regular monthly income from the rider.

The rider will generally increase your monthly premium, but in return, you'll get coverage that exceeds standard policies. Family income benefit riders are often affordable and sometimes even included in term policies at no extra cost.

The benefit must be claimed within a certain time frame after the insured's death; otherwise, it may expire. This time period is generally specified within the terms of the policy.

Family income riders are offered for little or no cost to policyholders because the death benefits are earning interest while held by the insurance company as distributions are made.

The rider does not last forever. Like a term life insurance policy, it has a set period of time before it expires altogether if the insured does not die in the interim.

Becoming an Insurance Broker: Alberta's Requirements and Steps

You may want to see also

Guaranteed Insurability Rider

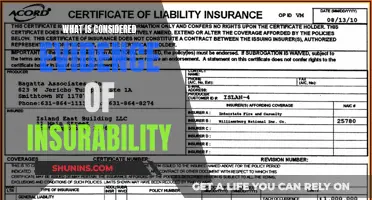

A guaranteed insurability rider is an optional add-on that can be attached to a permanent life insurance policy. It allows the policyholder to purchase additional insurance coverage at specified intervals in the future without having to provide evidence of insurability. This means that the policyholder can increase their coverage without undergoing a medical examination or answering health questions. The rider is available at standard premium rates, regardless of the insured's health, but it must typically be exercised within a certain time frame, such as 90 days of the listed option date.

The guaranteed insurability rider is particularly useful for individuals who anticipate significant changes in their life circumstances, such as marriage, the birth of a child, or an increase in income. It also provides peace of mind for those who may experience a decline in health as they age, as they can apply for extra coverage without worrying about their insurability. This rider is commonly used by parents or grandparents who want to give their children or grandchildren the option to increase their coverage when they start their own families.

Option dates for the guaranteed insurability rider can be predetermined calendar dates or based on life events. For example, getting married or having a child may trigger a window of time during which the policyholder can purchase a higher death benefit. Pre-determined option dates usually occur every three to five years from the start of the policy. Most guaranteed insurability riders have an age limit, often around 40, after which the policyholder will need to undergo a medical exam and new underwriting to increase their life insurance payout.

It is important to note that adding a guaranteed insurability rider will result in a small increase in the cost of the life insurance premium for the duration of the policy. Therefore, individuals should carefully consider their needs and circumstances before adding this rider to their policy.

Navigating Certificate Holder Updates: A Guide to Changing Insurance Information

You may want to see also

Frequently asked questions

A rider is an add-on to an insurance policy that provides additional benefits or amends the terms of the basic insurance policy.

There are several types of riders, including long-term care, term conversion, waiver of premiums, and exclusionary riders.

A rider is typically added to an existing policy for an additional fee. The cost of a rider is usually low because it involves minimal underwriting.

Riders are typically added when purchasing a new policy. However, some riders may be added at a later date, depending on the insurance company and the specific rider.

Yes, most insurance companies allow policyholders to remove a rider by filling out a form authorizing its removal.