Universal life insurance is a type of permanent life insurance that offers a flexible investment component, allowing policyholders to build cash value over time. This feature makes it an attractive option for those seeking both insurance coverage and a way to grow their money. The cash value can be used to pay premiums, take loans, or withdraw funds, providing a financial safety net and a potential investment opportunity. This unique aspect of universal life insurance makes it a versatile savings and investment vehicle, offering both insurance protection and the potential for long-term wealth accumulation.

What You'll Learn

- Universal Life Insurance: A flexible savings plan with a permanent insurance component

- Investment Growth: Offers potential for long-term wealth accumulation through investment options

- Death Benefit: Provides a guaranteed payout to beneficiaries upon the insured's passing

- Cash Value: Accumulates cash value over time, which can be borrowed against

- Tax Advantages: May offer tax-deferred growth and tax-free withdrawals for qualified distributions

Universal Life Insurance: A flexible savings plan with a permanent insurance component

Universal Life Insurance is a unique financial product that combines insurance coverage with a savings or investment component, offering individuals a flexible and customizable way to secure their financial future. This type of insurance provides a permanent safety net while also serving as a long-term savings plan, making it an attractive option for those seeking both insurance protection and investment growth.

At its core, Universal Life Insurance is a type of permanent life insurance that offers a flexible premium payment structure. Unlike traditional term life insurance, which provides coverage for a specified period, universal life insurance offers lifelong coverage. This means that once the policy is in force, the insured individual is protected for the rest of their life, ensuring financial security for their loved ones. The beauty of this product lies in its adaptability; policyholders can adjust their premiums and death benefits over time to align with their changing financial circumstances.

The savings aspect of Universal Life Insurance is designed to accumulate cash value over time. Policyholders pay premiums, which are invested by the insurance company. These investments can grow tax-deferred, providing a potential source of funds for various financial goals. The cash value can be used to pay future premiums, providing long-term financial security. Additionally, policyholders can borrow against the cash value, allowing them to access funds for major purchases or investments without selling the policy. This feature offers a level of financial flexibility that is not typically found in other investment vehicles.

One of the key advantages of Universal Life Insurance is its customization. Policyholders can tailor the policy to their specific needs. They can choose the initial death benefit, which represents the amount of coverage provided, and adjust it as their financial situation changes. Moreover, the investment options within the policy can be customized to match the policyholder's risk tolerance and financial objectives. This level of flexibility ensures that the insurance plan can adapt to various life stages and financial goals.

In summary, Universal Life Insurance is a powerful financial tool that combines insurance protection with a flexible savings plan. It provides individuals with a way to secure their loved ones' financial future while also offering a potential investment avenue. The ability to customize premiums, death benefits, and investment strategies makes it an attractive choice for those seeking long-term financial security and growth. By understanding and utilizing the features of Universal Life Insurance, individuals can create a comprehensive financial plan that adapts to their evolving needs.

Life Insurance and Bank Accounts: What's the Connection?

You may want to see also

Investment Growth: Offers potential for long-term wealth accumulation through investment options

Universal life insurance is a versatile financial product that can be utilized as a powerful tool for long-term wealth accumulation and investment growth. This type of insurance offers policyholders a unique opportunity to build a substantial financial portfolio over time, providing a solid foundation for their financial future.

One of the key advantages of investment growth within universal life insurance is the ability to access a wide range of investment options. Policyholders can choose from various investment vehicles, such as stocks, bonds, mutual funds, and even real estate investment trusts (REITs). This flexibility allows investors to tailor their portfolios according to their risk tolerance, financial goals, and market conditions. By strategically selecting investments, individuals can potentially maximize their returns and build a robust financial nest egg.

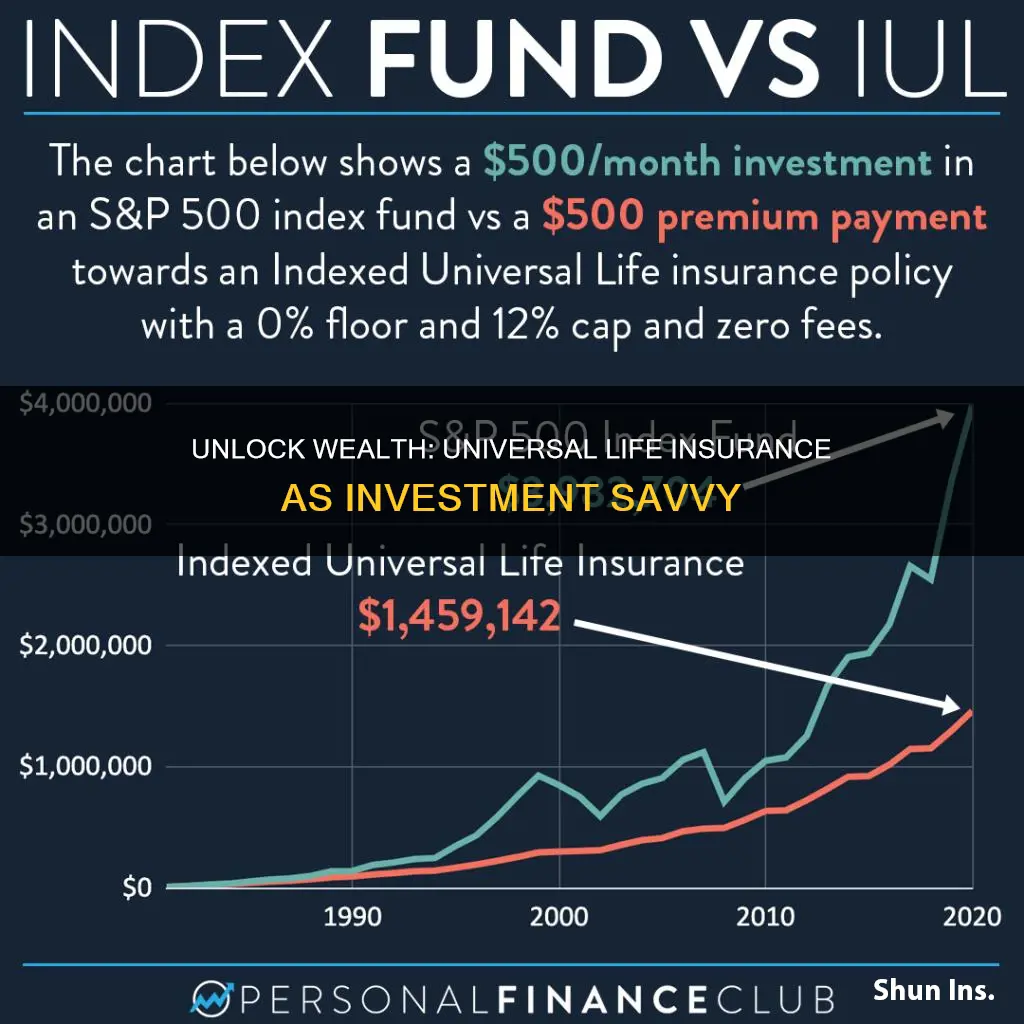

The investment growth aspect of universal life insurance is particularly appealing for long-term wealth accumulation. As the policyholder, you have the freedom to allocate a portion of your insurance premiums towards investments. Over time, these investments can grow, and the accumulated assets can be used to build a substantial financial reserve. The power of compounding interest means that even small contributions can grow significantly, especially when invested in a well-diversified portfolio. This strategy enables individuals to work towards their financial objectives, such as retirement, education funding, or even starting a business, with a solid investment-backed plan.

Furthermore, universal life insurance policies often provide policyholders with the ability to adjust their investment strategies as their financial goals evolve. This adaptability is crucial for long-term success, as it allows investors to stay aligned with their changing needs and market dynamics. Whether it's rebalancing the portfolio, taking advantage of market opportunities, or adjusting risk exposure, policyholders can make informed decisions to optimize their investment growth.

In summary, universal life insurance with investment growth potential offers a compelling avenue for long-term wealth accumulation. It provides individuals with the flexibility to choose diverse investment options, the opportunity to benefit from compounding interest, and the ability to adapt their strategies over time. By integrating investment growth into universal life insurance, individuals can secure their financial future and work towards achieving their most important financial milestones.

Max Life Insurance: Understanding Client ID Significance

You may want to see also

Death Benefit: Provides a guaranteed payout to beneficiaries upon the insured's passing

The death benefit is a crucial aspect of universal life insurance, offering a guaranteed financial safety net for the insured's beneficiaries in the event of their passing. This feature is a cornerstone of the policy, ensuring that the intended recipients receive a specified amount of money when the insured individual dies. The death benefit is typically a fixed amount agreed upon at the inception of the policy, providing a sense of security and predictability for the policyholder's loved ones.

Upon the insured's death, the insurance company is obligated to pay out the death benefit to the designated beneficiaries. This payout can be a significant financial support system for the family, covering various expenses such as funeral costs, outstanding debts, or even providing long-term financial security for dependent family members. The death benefit is often tax-free, ensuring that the entire amount goes directly to the beneficiaries without any deductions.

One of the key advantages of the death benefit is its flexibility. Policyholders can choose the amount of the death benefit, allowing them to tailor the policy to their specific needs and financial goals. This customization ensures that the insurance policy aligns with the individual's vision for their family's financial well-being. Additionally, the death benefit can be adjusted over time, providing an opportunity to increase the payout if the insured's financial situation improves or if their family's needs change.

Universal life insurance policies often offer various options for the death benefit, such as a guaranteed minimum death benefit or a variable death benefit that can grow with the policy's investment performance. The choice between these options depends on the insured's risk tolerance and financial objectives. For instance, a guaranteed minimum death benefit provides a fixed amount, offering stability and peace of mind, while a variable death benefit allows for potential growth but carries more risk.

In summary, the death benefit is a critical component of universal life insurance, providing a secure and guaranteed financial safety net for beneficiaries. It offers flexibility in terms of customization and potential adjustments, ensuring that the policy aligns with the insured's vision for their family's financial future. By understanding the death benefit's role, individuals can make informed decisions about their insurance policies, ensuring their loved ones are protected and financially supported when it matters most.

Life Insurance and THC: What You Need to Know

You may want to see also

Cash Value: Accumulates cash value over time, which can be borrowed against

Universal life insurance is a type of permanent life insurance that offers a unique combination of insurance protection and investment opportunities. One of its key features is the ability to accumulate cash value, which can be utilized in various ways to benefit the policyholder.

Cash value is essentially the monetary equivalent of the insurance policy's growth over time. It is built up through regular premium payments and investment returns. As the policyholder pays premiums, a portion of the money goes towards covering the cost of insurance, while the remaining amount is invested. This investment component allows the policy's cash value to grow, often outpacing the rate of return on traditional savings accounts. Over time, this accumulated cash value can be a valuable asset for the policyholder.

The beauty of this feature is that the cash value can be borrowed against, providing a source of funds for various purposes. Policyholders can take out loans against their cash value, which can be particularly useful for major purchases, business ventures, or consolidating debt. These loans are typically interest-free, as they are secured by the policy's cash value, which acts as collateral. This borrowing option can be advantageous as it allows individuals to access funds without selling their investments or disrupting their long-term financial plans.

Additionally, the borrowed amount can be repaid with interest, and the policy continues to grow, ensuring that the insurance coverage remains in place. This flexibility enables policyholders to access funds when needed while still maintaining the potential for long-term growth and the security of a life insurance policy. It is a strategic approach to managing finances, especially for those who want to maximize their savings and have a safety net in place for unexpected expenses.

In summary, universal life insurance with its cash value accumulation provides a powerful tool for individuals to build wealth and secure their financial future. The ability to borrow against this cash value offers a unique advantage, allowing policyholders to access funds for various financial needs while still benefiting from the long-term growth potential of their investments. This feature sets universal life insurance apart as a versatile savings and investment vehicle.

Understanding Tricaqre: Primary or Secondary Insurance Coverage?

You may want to see also

Tax Advantages: May offer tax-deferred growth and tax-free withdrawals for qualified distributions

Universal life insurance is a type of permanent life insurance that offers a unique combination of insurance protection and investment opportunities. One of its key advantages is the potential for significant tax benefits, which can make it an attractive savings or investment vehicle for many individuals.

The tax advantages of universal life insurance are primarily derived from its tax-deferred growth and the ability to make tax-free withdrawals under certain conditions. When you invest in a universal life policy, the cash value of the policy grows on a tax-deferred basis. This means that the earnings and interest accrued within the policy are not subject to annual income tax as they grow. Over time, this can result in substantial tax savings, especially for long-term investors.

Tax-deferred growth is particularly beneficial because it allows your investments to compound without the immediate impact of taxes. As the cash value of the policy increases, you can use this growth to build a substantial savings pool. Additionally, when you make premium payments, they are typically tax-deductible, providing an immediate tax benefit.

Another advantage is the potential for tax-free withdrawals. Universal life policies allow policyholders to take out loans or make withdrawals from the cash value without incurring taxes on those distributions. This is a significant benefit, especially during retirement, as it provides access to funds without triggering a tax liability. Withdrawals can be made to cover living expenses, fund education, or support other financial goals, all while maintaining the tax-deferred status of the remaining policy value.

Furthermore, the tax advantages of universal life insurance can be particularly appealing for long-term wealth accumulation. As the policy grows, you can build a substantial financial asset that can be used to secure your family's future or for various investment purposes. The tax-deferred nature of the growth means that your investments can potentially accumulate value more rapidly, providing a powerful tool for building wealth over time.

Life Insurance Policy Surrender: What You Need to Know

You may want to see also

Frequently asked questions

Universal life insurance is a type of permanent life insurance that offers a flexible premium and a permanent death benefit. It is designed to provide coverage for the entire life of the insured and is often used as a long-term savings and investment tool. With universal life, policyholders can allocate a portion of their premium payments to a cash value account, which grows tax-deferred. This cash value can be used to pay for future premiums, providing a source of funds that can be invested or borrowed against.

Universal life insurance allows you to build a substantial cash value over time, which can be a powerful tool for savings and investment. Here's how it works: You can make additional payments beyond the minimum required premium, and these extra funds go into the cash value account. The cash value grows tax-deferred, earning interest and investment returns. You can then use this accumulated cash value in several ways: taking out loans to invest in other assets, using it as an emergency fund, or even withdrawing it as a tax-free lump sum (subject to certain conditions).

AA: While universal life insurance offers investment opportunities, it's important to understand the associated risks. The investment performance of the cash value account depends on the investment options provided by the insurance company. These investments may include stocks, bonds, and other securities, which carry market risks. Additionally, policyholders should be aware of the fees and charges associated with the policy, as these can impact the overall returns. It's crucial to carefully review the policy terms, consult financial advisors, and ensure that the investment strategy aligns with your financial goals and risk tolerance.