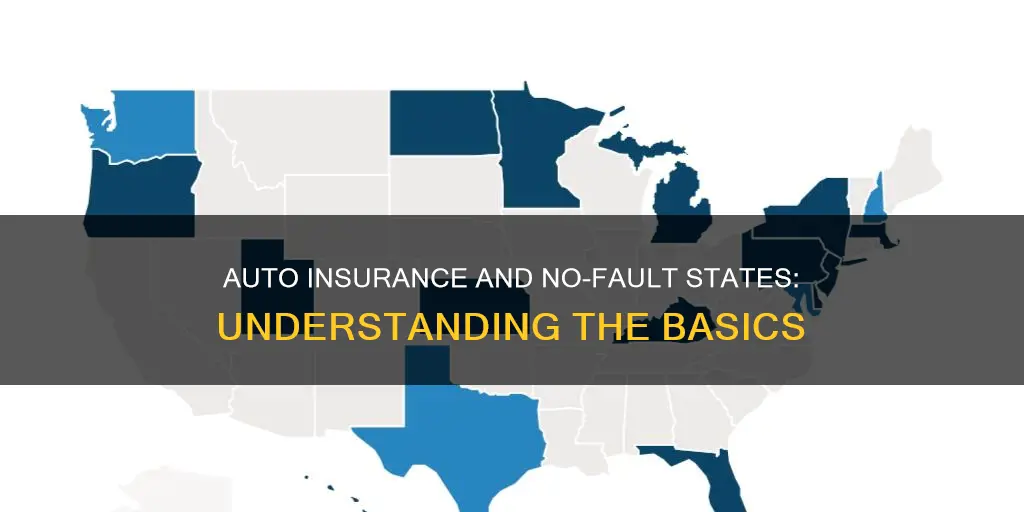

No-fault insurance states are those that require drivers to file claims for bodily injury with their own insurer, regardless of who is at fault for the accident. There are 12 no-fault states in the US: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. In these states, drivers are required to carry a minimum amount of personal injury protection (PIP) coverage, which helps to cover the cost of treating any injuries sustained in a car accident, as well as lost wages and funeral expenses.

No-Fault Auto Insurance States

| Characteristics | Values |

|---|---|

| Number of no-fault states | 12 |

| No-fault states | Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah |

| States that allow drivers to opt out of no-fault insurance | Kentucky, New Jersey, and Pennsylvania |

| States that require or allow drivers to buy PIP coverage without restricting their right to sue | Oregon (PIP required) and Texas (PIP optional) |

| States that allow drivers to choose between limited tort restrictions of no-fault insurance and full tort liability | Florida, Hawaii, and North Dakota |

| States that don't require PIP insurance but offer it as optional coverage | Arizona, Connecticut, Maryland, South Dakota, Virginia, and Washington |

| States that require drivers to carry personal injury protection | All no-fault states |

| States with add-on no-fault insurance | 10 states |

| Minimum PIP coverage requirements | Vary by state |

What You'll Learn

No-fault insurance states

No-fault insurance, also referred to as personal injury protection insurance (PIP), covers medical expenses, loss of income, and other costs in the event of a car accident, regardless of who is at fault. As of February 2023, there are 12 pure or "true" no-fault insurance states in the US, with an additional three "choice no-fault" states.

Pure No-Fault Insurance States

Florida, Hawaii, Kansas, Massachusetts, Michigan, Minnesota, New York, North Dakota, and Utah are among the 12 states with no-fault insurance laws. In these states, drivers are required to carry a minimum amount of PIP coverage to help cover the cost of injuries sustained in a car accident. This coverage is in addition to auto coverages such as bodily injury and property damage liability.

Choice No-Fault Insurance States

Kentucky, New Jersey, and Pennsylvania are "choice no-fault" states, where drivers can choose between the limited tort restrictions of no-fault insurance and full tort liability. In these states, drivers who opt for a no-fault policy give up their right to sue for injuries sustained in an accident, regardless of severity.

Add-On No-Fault Insurance States

In addition to the pure and choice no-fault states, there are also "add-on no-fault" states, where drivers can add personal injury protection to their policies but are not required to do so. Oregon and Texas are examples of states that offer add-on coverage.

No-Fault Insurance Claims

In no-fault states, each driver must file a claim with their own insurance company, regardless of who is at fault in the accident. This can lead to faster claims processing and lower insurance costs by reducing the number of small lawsuits resulting from car accidents. However, it's important to note that no-fault insurance does not cover property damage, and drivers will need separate liability coverage for that.

Does BECU Offer Auto Insurance? Here's What You Need to Know

You may want to see also

Personal Injury Protection (PIP)

In a no-fault state, if a policyholder is injured in a car crash, their own insurance policy will cover their medical care, regardless of who caused the accident. Policyholders with PIP coverage can receive benefits even if the other driver is uninsured. PIP coverage also often provides payments for lost income, childcare, and funeral expenses related to the accident.

As of September 2023, PIP auto insurance is required in 15 states and Puerto Rico. These states include Delaware, Florida, Hawaii, Kansas, Kentucky, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, Pennsylvania, and Utah. The minimum coverage requirements are set by the state governments and can vary from state to state.

In contrast to PIP, liability insurance does not cover the policyholder's medical bills if they are at fault for the accident. It only covers expenses incurred by third parties. Liability insurance is required in all states, while PIP is only required in 15 or 16 states, depending on the source.

Strategies to Reduce Your Progressive Auto Insurance Policy Costs

You may want to see also

Add-on no-fault insurance

No-fault insurance, also known as personal injury protection (PIP), is a system of car insurance laws that requires drivers to use their own coverage to pay for basic medical expenses after a car accident, regardless of fault. In no-fault states, drivers are required to carry personal injury protection (PIP) to cover their medical expenses.

"Add-on" no-fault insurance is an option that drivers in some states can add to their auto policy for extra personal injury protection. It requires a driver's insurance company to pay for their medical and other expenses, regardless of fault. In most states, this coverage is optional, while in others, it is mandatory.

- Arkansas: PIP is optional, but insurers must offer it

- Delaware: PIP is required ($15,000 per person and $30,000 per accident)

- District of Columbia: PIP is optional

- Maryland: PIP is optional, but insurers must offer it

- Oregon: PIP is required ($15,000 per person)

- South Dakota: PIP is optional

- Texas: PIP is optional, but insurers must offer it

- Virginia: PIP is optional

- Washington: PIP is optional, but insurers must offer it

No-Fault States

There are 12 no-fault states for car insurance: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. In these no-fault states, each driver's car insurance provider pays their medical claims after an accident, regardless of who was at fault.

Nebraska Auto Insurance: Understanding No-Fault Laws and Regulations

You may want to see also

Choice no-fault insurance

In a no-fault state, if a driver is injured in an accident, they would file a claim with their own insurance company, regardless of who is at fault. This type of insurance is often called Personal Injury Protection, or PIP, and it covers medical bills and other expenses resulting from the accident. No-fault states typically require drivers to carry this type of insurance.

On the other hand, in a fault-based insurance system, the insurance company of the driver who is at fault pays for all the damage costs. In these states, drivers have the right to sue for injuries suffered in an accident, regardless of severity.

Pennsylvania, for example, is a "choice no-fault" state. Drivers in Pennsylvania must choose between "limited tort" and "full tort" coverage when buying car insurance. Limited tort coverage limits the right of the insured person and their family members to seek financial compensation for injuries and losses caused by another driver. With this option, the claimant can seek recovery for medical treatment and other out-of-pocket losses but not for pain and suffering, unless the injuries are deemed "serious". Full tort coverage, on the other hand, gives the insured person and their family members unlimited rights to seek financial compensation for injuries and losses. This option is more expensive but allows for recovery of medical costs, pain and suffering, and other non-monetary losses, even if the injuries are not considered serious.

Factors Influencing Auto Insurance Premiums: A Percentage Breakdown

You may want to see also

Tort states

In the US, there are 38 tort states, meaning that the at-fault driver is financially responsible for damages and injuries caused to others. In these states, the insurance company of the individual found to be at fault pays for all damage costs in the event of an accident.

In a tort state, if you’re at fault for a car crash, you are responsible for paying the other driver’s medical bills. This is in contrast to no-fault states, where drivers file claims for bodily injury with their own insurer, regardless of who is at fault.

Tort insurance is available in at-fault states for drivers who want the most flexibility in pursuing legal recourse after a car accident. With full tort insurance, your right to sue the at-fault driver for pain and suffering is unlimited. However, limited tort insurance excludes this right unless your injuries are severe.

Suing Auto Insurers: Your Rights Explored

You may want to see also

Frequently asked questions

A no-fault state requires drivers to file claims for bodily injury with their own insurer, rather than the at-fault driver's insurance.

No-fault insurance, sometimes referred to as personal injury protection (PIP), covers medical expenses, loss of income, and more in the event of an accident, regardless of who is at fault.

There are 12 no-fault states: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah.

In an at-fault state, the driver who caused the accident pays for the injuries and property damage of the other. Claims tend to take longer in at-fault states as insurers must determine fault.

The no-fault auto insurance system is meant to lower insurance costs by reducing the number of small lawsuits resulting from auto accidents. This generally speeds up the claims process, as there is no lengthy litigation involved for smaller claims.