BECU has partnered with Farmers GroupSelect, a leading provider of auto, home, and renter's insurance, to give its members access to affordable insurance coverage. With Farmers Insurance Choice, BECU members can get personalized quotes from highly-rated insurance carriers, review coverage options and premiums online, and access competitive rates and bundling discounts. BECU members can also take advantage of special pricing and good driver rewards. Policyholders saved an average of $562 on auto insurance with Farmers GroupSelect.

| Characteristics | Values |

|---|---|

| Name of Insurance | Auto Insurance |

| Provider | BECU |

| Partnered With | Farmers GroupSelect |

| Features | Personalized quotes from highly-rated insurance carriers, ability to review coverage options and premiums online, access to competitive rates and bundling discounts, special BECU member pricing and good driver rewards |

| Coverages | Comprehensive, collision, uninsured motorist, and liability coverage for both bodily injury and property damage |

| Average Savings | $562 |

| Phone Number | 844-271-6361 |

What You'll Learn

BECU's auto insurance partners

BECU has partnered with Farmers GroupSelect, a leading provider of auto, home, and renter's insurance, to give its members access to affordable insurance coverage. With Farmers Insurance Choice, BECU members can get personalized quotes from highly-rated insurance carriers, compare coverage options and premiums online, and access competitive rates and bundling discounts.

Farmers GroupSelect automatically includes replacement cost for total loss and replacement cost for special parts policy coverages in its auto insurance. It also offers discounts for qualified individuals, such as those with a history of claim-free driving, those who bundle home and auto policies, those who insure multiple vehicles, and those who are good drivers.

BECU members can also take advantage of special member pricing and good driver rewards. On average, policyholders saved $562 on auto insurance with Farmers GroupSelect.

To get started with auto insurance through BECU and Farmers GroupSelect, you can visit Farmers Insurance Choice to compare multiple personalized quotes and choose the policy that best fits your needs. You can also call 844-271-6361 to speak with an advisor.

Auto Insurance and Paint Damage: What's Covered?

You may want to see also

Types of auto insurance coverage

Auto insurance coverage can be divided into several types, each offering protection in different situations. Here is a detailed overview of the various types of auto insurance coverage:

Liability Coverages:

Liability coverages are designed to protect you financially if you are at fault in an accident. This includes:

- Bodily Injury Liability: This coverage pays for damages related to bodily injury or death resulting from an accident caused by the insured driver. It helps cover the medical expenses of those injured in the accident.

- Property Damage Liability: This coverage pays for damages to someone else's property resulting from an accident caused by the insured driver. It covers the costs of repairing or replacing the damaged property.

Medical Payments Coverage:

Medical Payments Coverage, often referred to as MedPay, covers the initial medical expenses for the driver and their passengers, regardless of who is at fault in the accident. It is meant to provide immediate financial assistance for medical treatment.

Personal Injury Protection Coverage:

Personal Injury Protection (PIP) coverage is similar to MedPay but offers additional benefits. It covers medical expenses, lost wages, and other accident-related expenses, regardless of who caused the accident. PIP may also include funeral costs and child care expenses.

Uninsured and Underinsured Motorist Coverages:

These coverages protect you in the event of an accident with a driver who has insufficient or no insurance. Uninsured Motorist Coverage pays for injuries and property damage caused by an uninsured driver, while Underinsured Motorist Coverage fills the gap when the at-fault driver's insurance limits are too low.

Collision Coverage:

Collision coverage pays for damage to your vehicle when it collides with another object or vehicle, regardless of who is at fault. It covers the cost of repairing or replacing your car after an accident.

Comprehensive Coverage:

Comprehensive coverage protects your vehicle from incidents other than collisions. It covers damage to your car resulting from theft, vandalism, fire, floods, and other covered losses. It also includes events beyond your control, such as weather events and accidents involving animals.

Additional Auto Insurance Coverages:

In addition to the standard coverages mentioned above, there are several optional coverages that you can add to your policy. These include:

- Emergency Road Service: This coverage provides assistance for breakdowns and towing services.

- Rental Reimbursement: It covers the cost of a rental car while your vehicle is being repaired due to a covered accident.

- Mechanical Breakdown Insurance: This coverage helps with the cost of repairs or replacement parts if your vehicle breaks down, even if there is no external cause of damage.

- Custom Parts and Equipment Value Coverage: This coverage is designed for vehicles with modifications, such as custom wheels or a stereo system. It helps pay for repairs or replacement of these custom parts.

- Classic Car Insurance: This specialized coverage is designed for vintage and classic car collectors, insuring their vehicles for their full appreciated value.

The types of auto insurance coverage you choose will depend on your personal needs, budget, and state requirements. It is important to understand the different coverages available to make an informed decision about your auto insurance policy.

The Auto Insurance Age Conundrum: Unraveling the Mystery of '25

You may want to see also

Average savings on auto insurance

BECU does offer auto insurance to its members. By partnering with Farmers GroupSelectSM, a leading provider of auto, home, and renter's insurance, BECU members can get access to affordable insurance coverage.

Now, let's discuss average savings on auto insurance.

The average cost of car insurance in the US is $2,278 per year for full coverage and $621 per year for minimum coverage. However, these costs can vary significantly depending on factors such as age, gender, driving record, credit score, vehicle type, and location.

Age and Gender

Age and gender play a role in determining auto insurance rates. Younger drivers, especially teens, tend to pay more for auto insurance due to their higher risk of accidents and distracted driving. Men also tend to pay more than women since they are more likely to engage in riskier driving behaviors. However, the difference in rates between men and women tends to decrease with age.

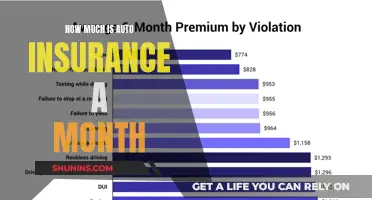

Driving Record

A clean driving record can result in significant savings on auto insurance. Drivers with an at-fault accident on their record may pay around 47% more, while those with a DUI conviction may pay up to 98% more. Maintaining a good driving record and avoiding incidents like speeding tickets, accidents, and DUIs can help keep insurance costs down.

Credit Score

In most states, a good credit score can positively impact auto insurance rates. Drivers with poor credit are considered higher-risk and may pay nearly 87% more for full coverage than those with good credit. Improving your credit score and maintaining a solid credit history can lead to lower insurance costs.

Vehicle Type

The type of vehicle you drive also influences insurance rates. Factors such as the price, repair costs, safety features, and the likelihood of theft can affect insurance premiums. Generally, high-end and luxury vehicles are more expensive to insure due to their higher replacement and repair costs. SUVs, vans, and larger vehicles may also have higher insurance rates since they can cause more damage in accidents.

Location

The state you live in can significantly impact your auto insurance rates. For example, drivers in Idaho, Vermont, Maine, Ohio, and Washington benefit from cheaper annual full coverage rates, while those in Louisiana, New York, Florida, Nevada, and Colorado pay the highest average rates.

Discounts and Cost-Saving Strategies

There are several strategies to reduce auto insurance costs:

- Shop around and compare quotes: Getting multiple quotes from different insurance companies and types of providers can help you find the most competitive rates.

- Bundle your insurance policies: Insuring multiple vehicles or combining home and auto insurance with the same company can often lead to significant discounts.

- Maintain a good driving record: Safe driving behaviors and a clean driving record can result in lower insurance rates.

- Improve your credit score: Establishing a solid credit history and maintaining a good credit score can positively impact your insurance costs.

- Choose a higher deductible: Opting for a higher deductible can lower your premium costs, but ensure you have enough savings to cover the higher deductible in case of a claim.

- Take advantage of low mileage discounts: Driving fewer miles than the average or carpooling to work may qualify you for lower insurance rates.

- Seek out group insurance: Some companies offer discounts if you get insurance through your employer or certain professional, business, or alumni groups.

- Look for other discounts: Ask your insurer about other available discounts, such as good student discounts, safe driver discounts, or discounts for taking a defensive driving course.

Auto Rental Insurance: Understanding Water Damage Coverage

You may want to see also

How to get started with BECU auto insurance

BECU has partnered with Farmers GroupSelect, a leading provider of auto, home, and renter's insurance, to give its members access to affordable insurance coverage that fits their current needs. Here is a step-by-step guide on how to get started with BECU auto insurance:

Step 1: Understand Your Needs and Budget

Before purchasing a car, it is essential to know your budget and the features you need in a car. Consider your monthly income, expenses, credit score, and how much you can devote to paying for your car, insurance, gas, and other needs. BECU offers resources such as the BECU Budget Planner to help you create an initial budget and determine how much you can afford.

Step 2: Visit Farmers Insurance Choice

BECU members can access Farmers Insurance Choice, an online tool that allows you to compare service and coverage options from multiple providers. This platform enables you to get personalized quotes, review coverage options and premiums, and access competitive rates and bundling discounts.

Step 3: Compare Quotes and Choose a Policy

Obtain multiple personalized quotes from highly-rated insurance carriers through Farmers Insurance Choice. Compare the quotes based on coverage options, premiums, and discounts offered. Choose the policy that best fits your needs and budget. You can also call 844-271-6361 to speak with an advisor if you prefer not to get your quote online.

Step 4: Finalize the Insurance Policy

Once you have selected the policy that suits your needs, finalize the details and purchase the auto insurance policy. Remember to review the coverage options, premiums, and any special pricing available to you as a BECU member.

Step 5: Stay Informed and Review Your Policy

It is important to stay informed about your insurance policy and review it periodically. Keep yourself updated on any changes in rates, coverage options, or discounts offered. Additionally, consider doing an annual premium check to ensure your insurance continues to meet your needs.

Does AARP Offer Home and Auto Insurance Bundling?

You may want to see also

Additional costs of owning a car

BECU does offer auto insurance through its partnership with Farmers GroupSelectSM, a leading provider of auto, home, and renter's insurance. Members can get personalized quotes, review coverage options and premiums online, and access competitive rates and bundling discounts.

Now, here is some information on the additional costs of owning a car:

Fuel

Fuel is one of the most variable costs of owning a car, with prices fluctuating almost daily. According to AAA, the average driver paid around 15.93 cents per mile for regular unleaded gasoline in early 2023. For a 15,000-mile year, that equates to $2,390 in fuel costs annually. Electric vehicle charging costs are based on a rate of 15.8 cents per kilowatt-hour. The type and size of the vehicle impact fuel costs, with sedans typically achieving better gas mileage than larger vehicles like trucks and SUVs.

Maintenance and Repairs

The average cost of repairs, maintenance, and tires is $123 per month for a new car, according to AAA. Common maintenance includes oil changes and tire rotations, typically done at 5,000-mile intervals, or three times per year. While some repairs may be covered under the factory or extended warranty, it is advisable to set aside funds for unexpected repairs.

Registration, Fees, and Taxes

These costs vary by state and vehicle characteristics. According to AAA, the average car owner will pay $762 in 2023 for licensing, registration, and taxes to legally operate their vehicle. The vehicle registration fee includes the cost of registering the vehicle, issuing a title, and the cost of license plates. It is influenced by factors such as the car's current value, fuel efficiency, age, and sometimes weight. Sales tax is another significant cost, which, like the registration fee, can range from a few hundred to a few thousand dollars.

Insurance

Insurance is another essential cost of owning a car. Almost every state requires some level of auto insurance coverage. The average annual premium for full-coverage insurance is $1,765, according to AAA. However, the cost can vary based on factors such as the selected coverage, the type of vehicle, age, driving record, and location.

Depreciation

While not a direct payment, depreciation results in a loss of value over time. In a typical market, cars lose around 15% to 20% of their value in the first year and about 15% in each of the following four years. To estimate depreciation, compare current offers for the same make and model or use services like Kelley Blue Book to determine the vehicle's resale value.

These are some of the key additional costs associated with owning a car. It is important to consider these expenses when budgeting for a vehicle to ensure a more accurate understanding of the overall costs beyond the initial purchase price.

Auto Insurance: Why So Expensive?

You may want to see also

Frequently asked questions

BECU has partnered with Farmers GroupSelect, a leading provider of auto, home, and renter's insurance, to give members access to affordable insurance coverage.

Farmers GroupSelect is a provider of auto, home, and renter's insurance. Policyholders on average saved $562* on auto insurance with Farmers GroupSelect.

Visit Farmers Insurance Choice to get started. Compare multiple personalized quotes, then choose the policy that best fits your needs.