When a life insurance policy is distributed, it can trigger various tax implications that policyholders and beneficiaries should be aware of. Understanding the tax obligations associated with life insurance distribution is crucial to ensure compliance with the law and to make informed financial decisions. This paragraph will explore the different types of taxes that may apply, including income tax, estate tax, and gift tax, and provide insights into how these taxes can impact the distribution of life insurance proceeds.

What You'll Learn

- Taxable Income: Proceeds from life insurance may be considered taxable income

- Exempt Amounts: Policies with high coverage may have exempt amounts

- Deductions: Premiums paid can be deducted from taxable income

- State Variations: Tax laws vary by state, affecting distribution taxes

- Estate Taxes: Life insurance can impact estate tax calculations

Taxable Income: Proceeds from life insurance may be considered taxable income

The distribution of life insurance proceeds can have tax implications for the recipient, and understanding these rules is essential for financial planning. In many jurisdictions, the proceeds from a life insurance policy are generally considered taxable income. This means that the amount received as a payout from a life insurance policy may be subject to income tax, and the recipient must report it as part of their annual income.

When an individual receives a life insurance payout, it is typically included in their taxable income for that year. The tax treatment can vary depending on the type of life insurance policy and the jurisdiction's tax laws. For instance, in some countries, the first $1,000 or so of life insurance proceeds may be tax-free, but any amount exceeding this threshold could be taxable. It is crucial to consult the specific tax regulations in your region to determine the exact rules.

The tax authorities often consider life insurance proceeds as taxable income because they are essentially a form of financial compensation or benefit. Just like any other income, such as wages or business profits, life insurance payouts are subject to taxation. The tax rate applied to these proceeds can vary, and it is typically based on the recipient's overall income for the year. Higher-income earners may face a higher tax rate on life insurance distributions.

To avoid any surprises or penalties, individuals should be aware of the tax implications and plan accordingly. One strategy is to consider the tax consequences when choosing a life insurance policy. Some policies offer tax-deferred growth, allowing the proceeds to accumulate without immediate taxation. Additionally, understanding the tax rules can help individuals make informed decisions about how to utilize the life insurance payout, such as investing it or using it for specific financial goals.

In summary, life insurance proceeds can be taxable income, and recipients should be aware of the tax implications to ensure compliance with the law. Consulting tax professionals or financial advisors can provide personalized guidance on navigating the tax rules surrounding life insurance distributions. Being proactive in understanding these tax considerations can help individuals make the most of their life insurance benefits while minimizing potential tax liabilities.

Unum Life Insurance: What You Need to Know

You may want to see also

Exempt Amounts: Policies with high coverage may have exempt amounts

When it comes to life insurance distributions, understanding the tax implications is crucial to ensure you're not caught off guard by unexpected financial obligations. One important aspect to consider is the concept of exempt amounts, particularly for policies with high coverage.

In many jurisdictions, life insurance policies with substantial coverage amounts may be subject to specific tax regulations. These regulations often aim to prevent individuals from using life insurance as a means to avoid taxes on large sums of money. As a result, there are typically exempt amounts set by the tax authorities, which means that distributions within these limits may not be subject to taxation.

The exempt amount varies depending on the country and the specific tax laws in place. For instance, in some countries, the exempt amount for life insurance distributions might be a certain percentage of the policy's total value or a fixed monetary amount. It's essential to consult the relevant tax legislation or seek professional advice to determine the exact exempt amount applicable to your situation.

For policies with high coverage, the exempt amount can significantly impact the tax treatment of the distribution. If the death benefit exceeds the exempt threshold, the excess amount may be subject to taxation. This could include income tax, estate tax, or other relevant taxes, depending on the jurisdiction and the nature of the policyholder's estate.

To navigate this complex area of tax law, it is advisable to consult with a tax professional or financial advisor who specializes in insurance and estate planning. They can provide personalized guidance based on your specific circumstances, ensuring that you understand your tax obligations and take advantage of any available exemptions or deductions.

Personal Lines Insurance: Does It Cover Life Insurance?

You may want to see also

Deductions: Premiums paid can be deducted from taxable income

When it comes to life insurance, understanding the tax implications is crucial for effective financial planning. One essential aspect to consider is the deduction of premiums paid for life insurance policies. Here's a detailed explanation of how this deduction works:

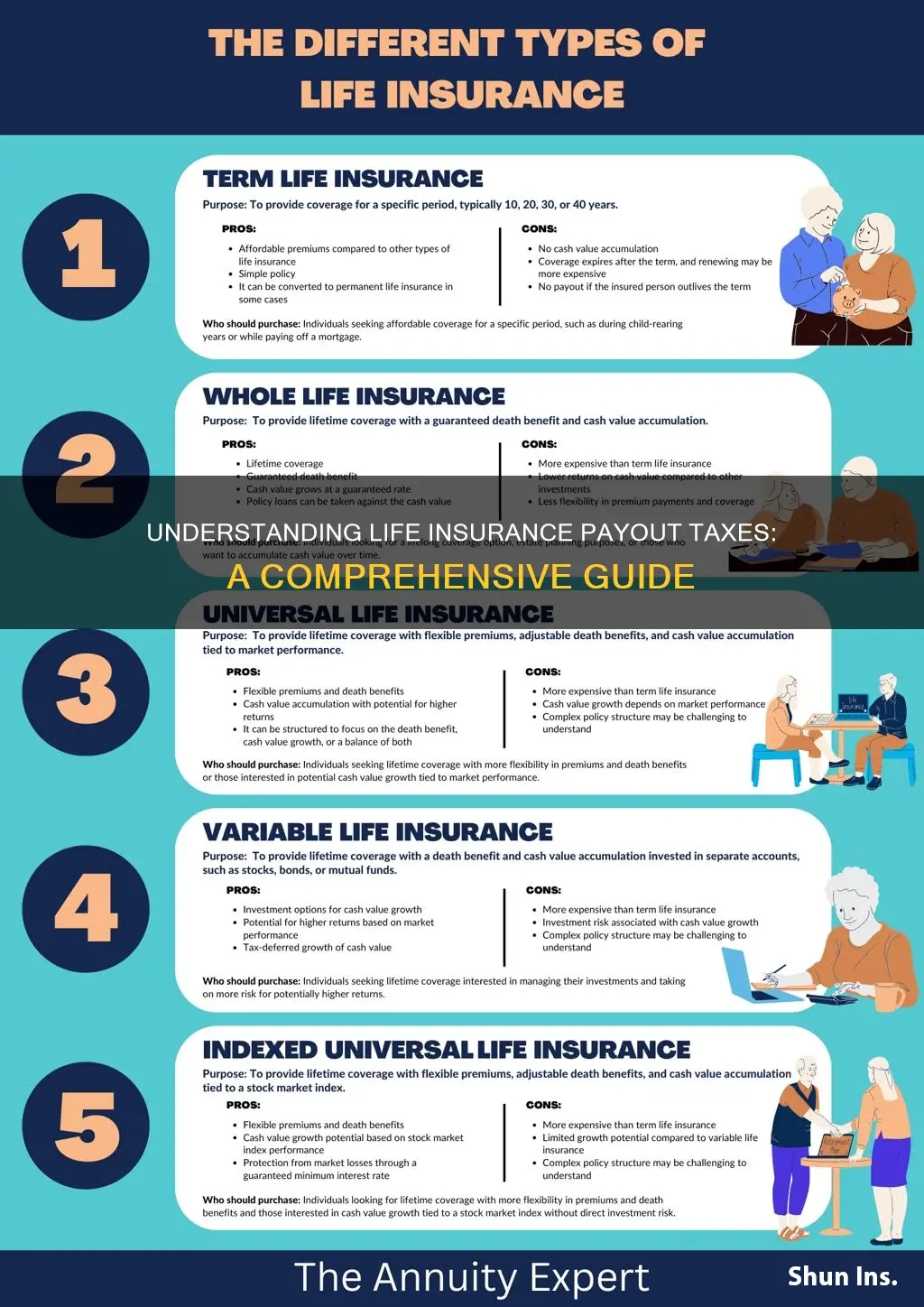

Life insurance premiums paid by an individual can be a significant expense, and fortunately, it is deductible from taxable income. This deduction is a valuable benefit for policyholders, as it helps reduce their overall tax liability. The Internal Revenue Service (IRS) allows individuals to claim a deduction for the premiums paid for certain types of life insurance policies. This deduction is available for both term life insurance and permanent life insurance, provided the policy meets specific criteria.

To be eligible for this deduction, the life insurance policy must be considered a "qualified" or "nondeductible" policy. "Qualified" policies typically include term life insurance and certain types of permanent life insurance, such as whole life or universal life. These policies provide coverage for a specific period or until the insured individual's death, whichever comes first. On the other hand, "nondeductible" policies may include variable life insurance or certain types of permanent policies with investment components.

When calculating the deduction, individuals can claim the total premiums paid for the policy during the tax year. This deduction is generally limited to the amount of premium paid in that year. For example, if you paid $5,000 in premiums for a term life insurance policy in the current tax year, you can deduct that full amount from your taxable income. It's important to keep in mind that this deduction is not a credit but rather a reduction in taxable income, which directly impacts the overall tax bill.

It's worth noting that there are specific rules and limitations to consider. The deduction is generally allowed for the insured individual's share of the premium, even if the policy is owned by a trust or another entity. Additionally, there are income limits and phase-out rules that may apply, especially for high-income earners. These rules ensure that the deduction is targeted towards those who can benefit the most from reducing their taxable income.

In summary, the deduction of life insurance premiums paid is a valuable tax benefit that can significantly impact an individual's financial planning. By understanding the criteria for eligibility and the rules surrounding this deduction, policyholders can make informed decisions and optimize their tax strategy.

Life Insurance Interest: Commercial Policies and Earning Interest

You may want to see also

State Variations: Tax laws vary by state, affecting distribution taxes

Tax laws regarding life insurance distribution can vary significantly from one state to another, creating a complex landscape for policyholders and financial advisors. These variations often stem from the unique tax policies and regulations each state has in place, which can impact the taxation of life insurance proceeds. Understanding these state-by-state differences is crucial for individuals to ensure they comply with the correct tax laws and avoid potential penalties.

In some states, life insurance proceeds are generally not subject to income tax. For instance, in states like New York, life insurance payments are typically exempt from state income tax. This means that the beneficiary of the policy can receive the full amount without owing any state taxes on that distribution. However, it's important to note that federal taxes may still apply, and the proceeds could be taxable as ordinary income if the policy was owned by the deceased and was not an irrevocable life insurance trust (ILIT).

On the other hand, certain states impose income taxes on life insurance distributions. For example, in California, life insurance proceeds are subject to state income tax unless the policy is held in an ILIT. This means that the beneficiary might have to pay taxes on the full amount received, which can be a significant consideration, especially for larger policies. The tax rates in these states can vary, and the impact on the beneficiary's overall tax liability can be substantial.

Additionally, some states have specific rules regarding the taxation of life insurance distributions based on the relationship between the insured and the beneficiary. For instance, in states like Florida, life insurance proceeds paid to a spouse or dependent are often exempt from state income tax. This provision can significantly benefit beneficiaries who are closely related to the insured, as it may result in a larger tax-free distribution.

Navigating these state variations requires careful consideration and planning. Policyholders should consult with tax professionals or financial advisors who are well-versed in the tax laws of their specific state. These experts can provide tailored advice on how to structure life insurance policies and beneficiaries to minimize tax liabilities and ensure compliance with state regulations. Understanding these state-specific tax laws is essential to making informed decisions regarding life insurance distribution.

Unraveling Life's Mysteries: Understanding Insurance's Role

You may want to see also

Estate Taxes: Life insurance can impact estate tax calculations

Estate taxes are a complex area of taxation, and life insurance can significantly influence the amount owed. When an individual passes away, their estate, which includes all assets and possessions, is subject to estate tax. The value of the estate is calculated, and any amount exceeding the federal estate tax exemption is taxed at a specific rate. This is where life insurance can play a crucial role.

Life insurance proceeds paid out upon the insured's death are generally not included in the taxable estate. This means that the death benefit from a life insurance policy can be substantial and may not be subject to estate tax, depending on the policy's value and the beneficiary's status. However, there are some important considerations. Firstly, the insurance company may withhold a portion of the death benefit as income tax until the beneficiary files an income tax return. This is known as the "income tax withholding" and can vary depending on the state and the beneficiary's tax situation.

Secondly, if the life insurance policy is owned jointly with the right of survivorship, the proceeds may be exempt from estate tax. In such cases, the policy is owned by two individuals, and upon the death of one owner, the policy automatically passes to the surviving owner. This can be a strategic way to avoid estate tax on the death benefit. However, it is essential to understand the legal implications and consult with a tax professional to ensure compliance with the relevant laws.

Additionally, the timing of the life insurance payout can also impact estate tax calculations. If the life insurance proceeds are received before the insured's death, they may be considered part of the taxable estate. This could occur if the policy is surrendered for cash value or if the beneficiary is the insured's estate. In these scenarios, the proceeds would be included in the taxable estate and subject to estate tax.

In summary, life insurance can have a significant impact on estate tax calculations. Understanding the tax implications of life insurance policies is crucial for effective estate planning. By considering the policy's value, ownership structure, and beneficiary status, individuals can make informed decisions to minimize estate tax liabilities and ensure a smooth transfer of assets to their intended beneficiaries. It is always advisable to consult with tax professionals and estate planners to navigate these complex tax matters.

Avoiding Interpleader Actions: Strategies for Life Insurance Disputes

You may want to see also

Frequently asked questions

When a life insurance policy is paid out, the proceeds are generally considered taxable income to the recipient. The tax treatment depends on the type of policy and the beneficiary. Typically, the entire amount is taxable, but there are some exceptions and deductions that can apply.

The tax is calculated based on the recipient's income tax rate. The proceeds are added to the individual's total income for the year, and then taxed accordingly. For example, if the policy pays out $100,000 and the recipient's marginal tax rate is 30%, they would owe $30,000 in taxes on that amount.

Yes, there are certain exclusions and deductions that can reduce the taxable amount. For instance, the first $500 of life insurance proceeds received by an individual in a calendar year is often exempt from taxation. Additionally, if the policy was taken out as a business expense, a portion of the payout may be deductible.

No, not all policies are taxable. Term life insurance policies, where the coverage is for a specific period, are generally not taxable if the recipient is the insured individual. However, if the policy is a permanent life insurance or has a cash value component, the tax treatment may differ.

Yes, there are strategies to minimize the tax impact. One approach is to take a portion of the payout in a lower tax bracket year, thus reducing the overall tax liability. Another method is to consider tax-efficient investments or retirement accounts where the proceeds can grow tax-deferred or be tax-free.