For new drivers, finding affordable insurance can be a challenge. The cost of insuring a car can vary significantly depending on several factors, including the driver's age, driving experience, the type of vehicle, and the insurance company. In this article, we will explore some of the cheapest ways to insure a new driver, offering practical tips and strategies to help young drivers get on the road safely and affordably.

What You'll Learn

- Budget-Friendly Options: Compare rates from multiple insurers to find the lowest-cost policies

- State-Specific Rates: Insurance costs vary by state; research local averages

- Good Driver Discounts: Maintain a clean driving record to qualify for discounts

- Usage-Based Insurance: Pay based on driving habits to save money

- Parent-Involved Programs: Parent-supervised driving can lead to lower premiums

Budget-Friendly Options: Compare rates from multiple insurers to find the lowest-cost policies

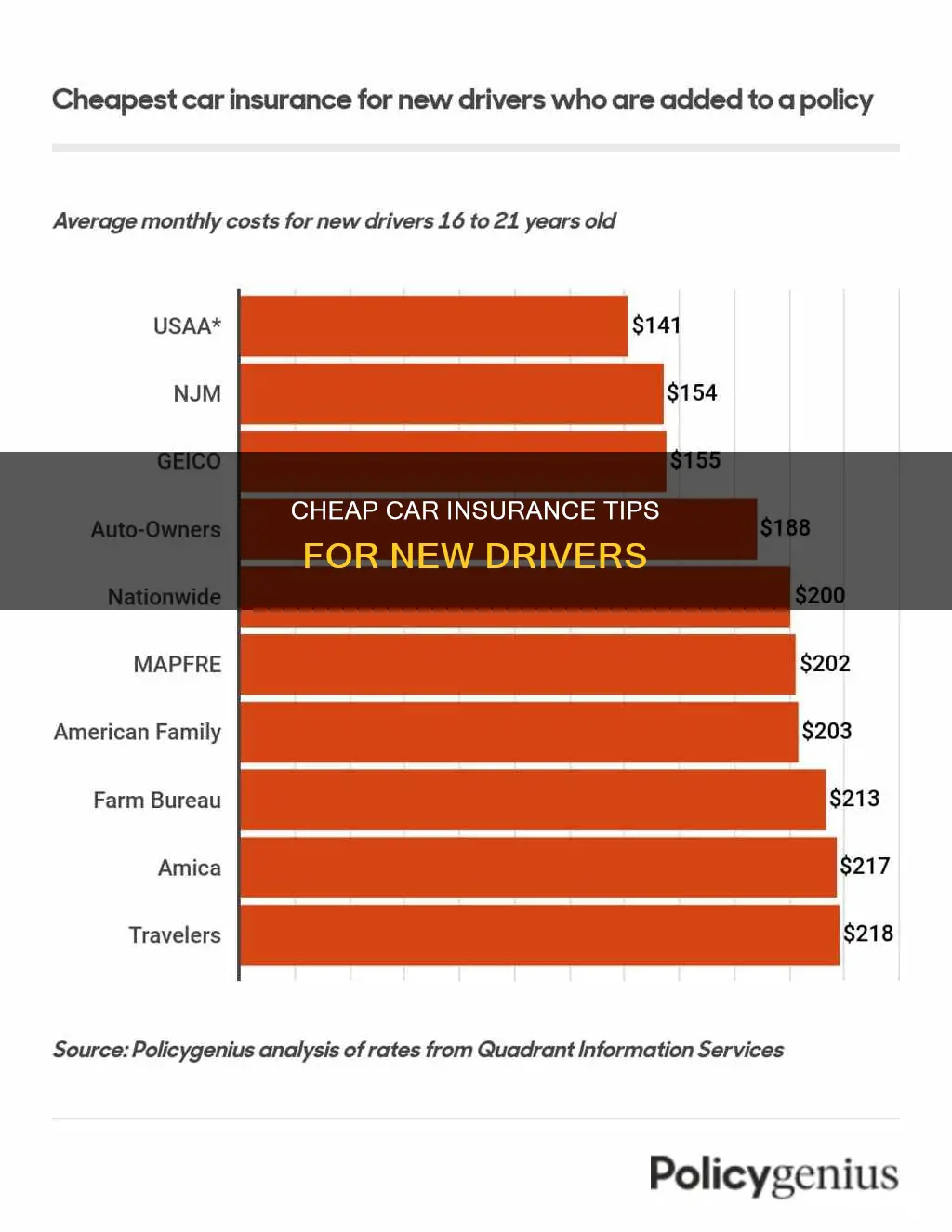

When it comes to finding the cheapest insurance for a new driver, comparing rates from multiple insurers is a crucial step in securing budget-friendly coverage. Here's a detailed guide on how to approach this process:

- Understand Your Needs: Begin by assessing the specific requirements of the new driver. Consider factors such as the type of vehicle they will be driving, the level of coverage needed, and any additional benefits or discounts that might be applicable. For instance, if the driver is a student, they may qualify for good student discounts, which can significantly reduce premiums. Understanding these details will help in narrowing down the insurance options.

- Research and Compare Quotes: Utilize online resources and insurance comparison websites to gather quotes from various insurers. Provide accurate and consistent information during the quote request process to ensure you receive relevant and comparable rates. Obtain quotes from at least three to five insurers to have a comprehensive view of the market. This step allows you to identify the insurers offering the most competitive prices for the desired coverage.

- Consider Discounts and Incentives: Insurance companies often provide discounts and incentives to attract new drivers. Look for insurers that offer good student discounts, multi-policy discounts (if the driver has other insurance policies with the same company), or loyalty discounts for long-term customers. Additionally, some insurers provide discounts for safe driving records, low-mileage driving, or taking defensive driving courses. These discounts can substantially lower the overall cost of insurance.

- Evaluate Coverage Options: When comparing quotes, pay close attention to the coverage options provided. Ensure that the basic coverage meets the legal requirements in your region, but also consider additional coverage types that might be beneficial. For example, liability coverage is often a minimum requirement, but adding collision or comprehensive coverage can provide financial protection in case of accidents or damage to the vehicle. Weigh the costs of different coverage options to find a balance between affordability and adequate protection.

- Review and Negotiate: After gathering and comparing quotes, review the details of each policy. Check for any hidden fees, exclusions, or additional costs associated with the quotes. If you find discrepancies or areas where you can negotiate, don't hesitate to contact the insurers. Many companies are open to customizing policies to meet specific needs, which might result in further cost savings.

By following these steps, new drivers can effectively compare rates and find insurers offering the most competitive prices. It's essential to remember that the cheapest option might not always provide the best coverage, so finding the right balance between cost and protection is key to making an informed decision.

Hurricane Harvey: Auto Insurance Companies Impacted and Their Response

You may want to see also

State-Specific Rates: Insurance costs vary by state; research local averages

When it comes to insuring a new driver, it's important to understand that rates can vary significantly depending on your location. This is primarily due to the unique regulations and factors that influence insurance costs in each state. Here's a breakdown of why researching state-specific rates is crucial:

State Regulations and Market Factors: Each state has its own insurance regulatory body that sets guidelines and minimum requirements for car insurance. These regulations can impact the cost of coverage. For instance, states with higher accident rates or more stringent liability laws may have pricier insurance premiums. Additionally, market competition and the availability of insurance providers can vary by state, affecting the overall cost.

Local Averages and Trends: Researching local averages is essential because insurance rates can fluctuate based on regional trends. For example, urban areas might have higher insurance costs due to increased traffic density and a higher risk of accidents. In contrast, rural areas may offer lower rates due to fewer claims and a lower accident rate. Understanding these local trends can help new drivers identify potential savings.

Comparative Analysis: By comparing insurance rates across different states, new drivers can make informed decisions. Some states might offer more affordable coverage due to lower operating costs or a higher concentration of insurance providers. Online resources and insurance comparison websites can provide valuable insights into state-by-state rates, allowing drivers to identify the most cost-effective options.

Discounts and Incentives: Different states may also offer unique discounts and incentives to encourage safe driving and loyalty. For instance, some states provide discounts for completing defensive driving courses or for having multiple policies with the same insurer. Understanding these state-specific incentives can further reduce insurance costs for new drivers.

Local Insurance Providers: Exploring local insurance providers is essential as they often have a better understanding of the state's unique risks and regulations. Local agents or brokers can provide tailored advice and may offer competitive rates based on their knowledge of the local market.

In summary, insuring a new driver requires a thorough understanding of state-specific rates and local factors. By researching local averages, comparing rates, and considering state-offered discounts, new drivers can make informed choices to find the cheapest and most suitable insurance coverage for their needs.

Auto Insurance: Forced Coverage and its Implications

You may want to see also

Good Driver Discounts: Maintain a clean driving record to qualify for discounts

When it comes to finding the cheapest way to insure a new driver, one of the most effective strategies is to focus on good driver discounts. Insurance companies often offer these discounts to drivers who maintain a clean driving record, which can significantly reduce the cost of car insurance. Here's how you can take advantage of this opportunity:

Understand the Importance of a Clean Record: A clean driving record is crucial for securing good driver discounts. Insurance providers typically offer these discounts to drivers who have not been involved in accidents, traffic violations, or any other incidents that could compromise their safety on the road. By maintaining a spotless driving history, you demonstrate responsibility and lower the risk for the insurance company, which often translates to lower premiums for you.

Start with Safe Driving Habits: To qualify for these discounts, it's essential to adopt safe driving practices from the beginning. Avoid reckless driving, obey traffic rules, and always be cautious on the road. New drivers should especially focus on being extra careful, as they are more susceptible to accidents due to their lack of experience. By practicing safe driving habits, you not only protect yourself and others but also build a positive driving record.

Shop Around and Compare Quotes: Insurance companies vary in their criteria for offering good driver discounts. Some may require a certain number of accident-free years, while others might consider your overall driving history. It's advisable to shop around and compare quotes from multiple insurance providers. Get in touch with local and national insurers, and don't be afraid to ask about their specific requirements for good driver discounts. This process will help you find the best rates and the most suitable insurance company for your needs.

Maintain a Record of Safe Driving: Keep a record of your safe driving habits and any achievements you've made. For instance, if you've received any commendations or awards for safe driving, make sure to inform your insurance provider. Additionally, if you've completed a defensive driving course or have a certain number of accident-free years, these can also qualify you for discounts. Providing accurate and up-to-date information to your insurer will ensure that you receive the discounts you're entitled to.

Stay Informed and Review Your Policy: Insurance policies can change, and so can the requirements for good driver discounts. Stay informed about any updates or changes in your insurance provider's policies. Regularly review your car insurance policy to ensure that you are still eligible for the discounts you were initially offered. This proactive approach will help you maintain the lowest possible premiums over time.

Humana's Auto Insurance: What You Need to Know

You may want to see also

Usage-Based Insurance: Pay based on driving habits to save money

Usage-based insurance, also known as pay-as-you-drive or usage-based insurance programs, is a relatively new concept in the insurance industry that can be a game-changer for new drivers. This type of insurance is designed to reward safe and responsible driving habits by allowing drivers to pay for car insurance based on their actual driving behavior. It's an innovative approach that can significantly reduce costs for young and new drivers who are often considered high-risk by traditional insurance companies.

The concept is simple: instead of paying a premium based on age, driving experience, or the car's value, usage-based insurance tailors the cost to the individual's driving habits. This can include factors such as the number of miles driven, the time of day driven, the frequency of driving, and most importantly, the safety of the driving behavior. By monitoring these factors, insurance companies can offer personalized rates that are often lower than traditional insurance policies.

New drivers can benefit immensely from this type of insurance. Since they are considered high-risk due to their lack of experience, usage-based insurance can provide a more affordable option. The program typically involves the installation of a small device in the car, often referred to as a 'telematics box' or 'usage monitor'. This device tracks various driving metrics and sends the data to the insurance company. The more safe and responsible the driving, the lower the premium, and vice versa.

For instance, if a new driver maintains a clean driving record, avoids accidents, and drives during off-peak hours, they are likely to receive a lower premium. This not only encourages safe driving but also provides an incentive for young drivers to improve their driving skills and habits. Additionally, some usage-based insurance programs offer rewards for good driving, such as a discount on the next premium or a gift card, further motivating safe driving practices.

Usage-based insurance is a cost-effective solution for new drivers as it directly links the cost of insurance to the driver's behavior. It provides an opportunity for young drivers to prove their responsibility and potentially save money on insurance premiums. This type of insurance is an excellent option for those who want to manage their insurance costs while also encouraging safer driving habits.

Auto Insurance and Bike Coverage: What Cyclists Need to Know

You may want to see also

Parent-Involved Programs: Parent-supervised driving can lead to lower premiums

Many insurance companies recognize the value of parental involvement in a new driver's learning process and offer incentives through parent-involved programs. These programs are designed to encourage parents to actively participate in their teen's driving education and safety, which can result in significant cost savings on insurance premiums. By implementing these strategies, parents can not only ensure their teen's safety on the road but also potentially lower their insurance costs.

One of the primary ways parent-involved programs work is by promoting supervised driving. Insurance companies often offer discounts to parents who actively supervise their teen's driving. This supervision can take various forms, such as accompanying your teen on practice drives, providing feedback on their driving skills, and monitoring their driving habits. The more involved parents are, the more likely insurance providers are to perceive the teen as a lower-risk driver, which can lead to reduced premiums. For instance, companies might offer discounts for completing a parent-supervised driving course or for maintaining a log of supervised driving hours.

These programs often emphasize the importance of parental guidance and education. Insurance providers may partner with driving schools or offer resources to help parents become better driving instructors. By attending workshops, online courses, or parent-teacher conferences, parents can gain the knowledge and skills needed to effectively teach their teens about safe driving practices. This not only improves the teen's driving habits but also demonstrates to the insurance company that the parent is committed to their teen's safety, potentially resulting in lower premiums.

Additionally, parent-involved programs often encourage open communication between parents and their teens. Regular discussions about driving experiences, challenges, and lessons learned can help teens develop a better understanding of the risks associated with driving. Insurance companies may offer discounts for parents who maintain open lines of communication with their teens, as this indicates a proactive approach to safety. By fostering a supportive and educational environment, parents can significantly impact their teen's driving behavior and, consequently, their insurance rates.

In summary, parent-involved programs are a powerful tool for new drivers and their parents to achieve lower insurance premiums. By actively supervising their teen's driving, parents can demonstrate their commitment to safety and reduce the perceived risk to the insurance company. These programs also encourage parental education and open communication, further reinforcing safe driving practices. Implementing these strategies can lead to significant savings on insurance costs while also ensuring a safer driving environment for everyone.

Auto Insurance and Water Leaks: What You Need to Know

You may want to see also

Frequently asked questions

Finding affordable insurance for new drivers can be challenging, but several strategies can help. Firstly, consider getting a learner's permit and practicing driving with a licensed adult to build experience and potentially negotiate lower rates. Shopping around and comparing quotes from multiple insurance companies is essential, as prices can vary significantly. Additionally, look for discounts; many insurers offer reduced rates for good students, safe driving records, or multiple policy holdings.

It's a common practice for parents to add their teen driver as a dependent on their existing policy, which can sometimes be more cost-effective. However, this approach may not always be the cheapest. Getting a separate policy for a new driver can provide more tailored coverage and potentially lower rates, especially if the teen driver has a clean driving record. It's advisable to compare both options and choose the one that offers the best value for your budget.

Several factors contribute to the cost of insurance for new drivers, and insurers consider these when determining premiums. Age, driving experience, location, type of vehicle, and driving record are significant factors. Teenagers and young adults often face higher premiums due to their lack of driving history and perceived risk. Additionally, the type of coverage, deductibles, and policy limits chosen can impact the overall cost.

Yes, many governments and insurance regulatory bodies offer assistance programs to support new drivers. These programs may provide discounts or subsidies to help reduce insurance costs. For example, some regions offer graduated licensing programs that encourage safe driving habits and provide incentives for completing driver education courses. Additionally, government-backed initiatives like the National Teen Driver Safety Week aim to raise awareness and promote safe driving practices among young drivers.