Driving without insurance is illegal and can lead to severe consequences. In most countries, having car insurance is a legal requirement for drivers, and it provides essential protection for both the driver and others on the road. It covers various risks, including accidents, theft, and damage to the vehicle, and it can also help with financial liabilities in case of an accident. This paragraph aims to emphasize the importance of insurance for drivers and the potential risks of driving without it.

What You'll Learn

- Legal Requirement: Driving without insurance is illegal in most countries

- Financial Protection: Insurance covers damages and injuries in accidents

- Vehicle Coverage: Different types of insurance for cars, motorcycles, etc

- Personal Liability: Protects against lawsuits for accidents causing harm

- Cost and Benefits: Insurance costs vary, but offer peace of mind

Legal Requirement: Driving without insurance is illegal in most countries

Driving without insurance is a serious offense and a legal requirement in most countries. It is a fundamental aspect of road safety and a legal obligation for all drivers. The primary purpose of car insurance is to provide financial protection and peace of mind for both the driver and other road users in the event of an accident or damage. Without insurance, drivers risk facing significant financial liabilities and legal consequences.

In many jurisdictions, driving without insurance is considered a criminal offense and can result in severe penalties. These penalties may include fines, license suspension or revocation, and even imprisonment. The specific legal consequences vary by country and region, but the underlying principle remains the same: driving without insurance is illegal and can have serious repercussions.

The legal requirement to have insurance is in place to ensure that drivers are financially responsible for their actions on the road. It provides a safety net for victims of accidents, covers medical expenses, and helps repair or replace damaged vehicles. Insurance companies also play a crucial role in managing risks and providing compensation, which is essential for maintaining a fair and efficient road system.

When driving, it is essential to understand the insurance requirements in your specific location. These requirements are typically outlined in the country's motor vehicle act or road traffic regulations. Failure to comply with these regulations can lead to legal action and penalties. It is the driver's responsibility to ensure they have the necessary insurance coverage before getting behind the wheel.

Obtaining the correct insurance coverage is a straightforward process. Drivers can choose from various insurance providers and policies, ensuring they select the coverage that best suits their needs and budget. By doing so, they not only comply with the law but also protect themselves and others from potential financial burdens. It is a small price to pay for the peace of mind that comes with knowing you are legally and financially protected while driving.

Canceling 21st Century Auto Insurance: A Step-by-Step Guide

You may want to see also

Financial Protection: Insurance covers damages and injuries in accidents

When it comes to driving, insurance is a crucial aspect that often gets overlooked, especially by those who believe they can manage without it. The question of whether you need insurance to drive is a valid one, and the answer is a resounding yes. Insurance provides a vital layer of financial protection, ensuring that you are prepared for unforeseen circumstances on the road.

In the event of an accident, insurance coverage becomes your safety net. It covers the financial burden of damages and injuries sustained by both you and others involved in the incident. Without insurance, the consequences of an accident can be devastating, leading to significant financial strain. For instance, if you were to cause an accident that results in property damage, medical expenses for the affected parties, and potential legal fees, the costs could quickly escalate. Insurance policies are designed to mitigate these risks, providing a comprehensive solution to protect your finances.

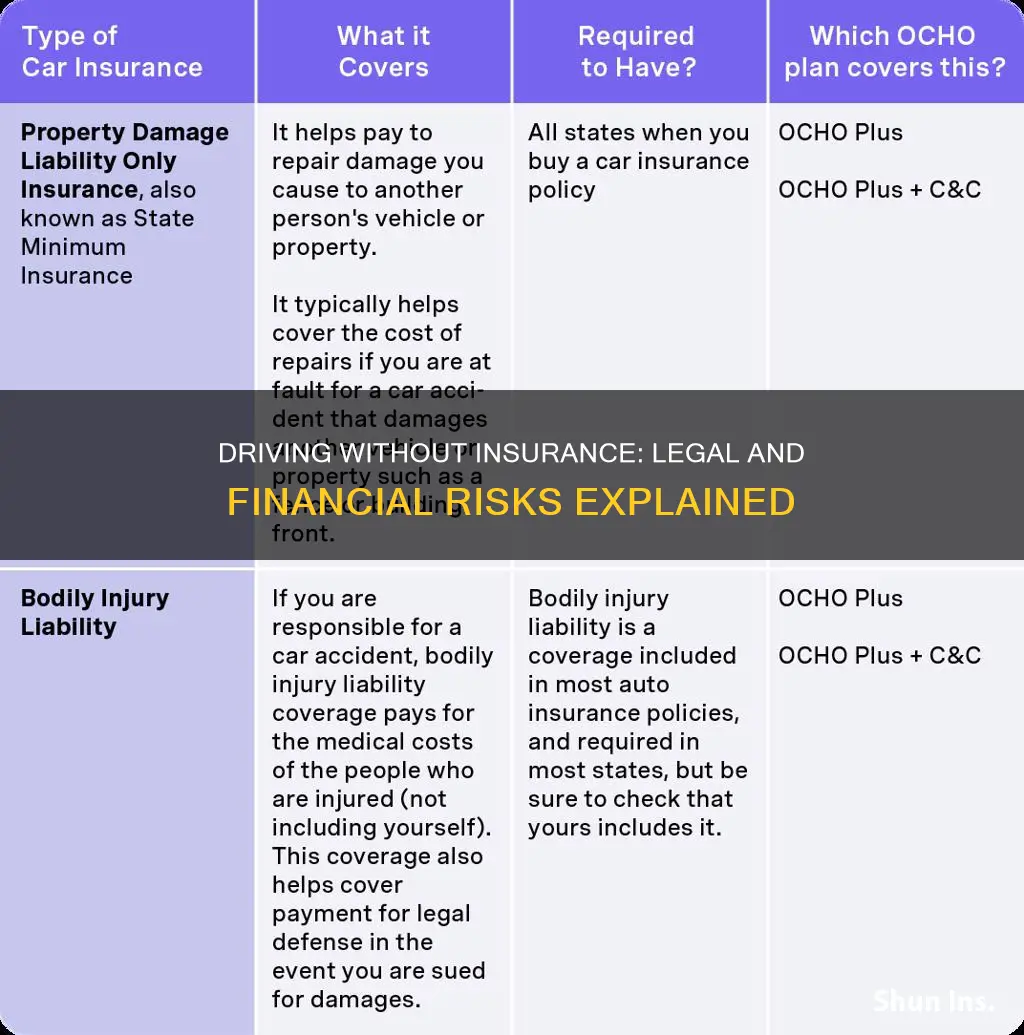

The coverage offered by insurance companies typically includes liability insurance, which is essential for covering the costs associated with accidents you may cause. This type of insurance ensures that you are financially responsible for any injuries or damages you inflict on others. Additionally, comprehensive and collision coverage can protect your vehicle in the event of an accident, regardless of fault. These policies cover repairs or replacement costs, ensuring that you are not left with substantial out-of-pocket expenses.

Furthermore, insurance also provides coverage for medical expenses related to injuries sustained in an accident. This is particularly important as medical costs can be exorbitant, and without insurance, individuals might struggle to afford necessary treatments. Personal injury protection (PIP) is a common feature in insurance policies, ensuring that you and your passengers are covered for medical bills and related expenses.

In summary, having insurance to drive is not just a legal requirement in many places but also a wise financial decision. It offers a comprehensive approach to financial protection, ensuring that you are prepared for the unexpected. By understanding the coverage provided by insurance policies, you can make informed choices to safeguard your assets and well-being on the road. Remember, the goal is to drive with confidence, knowing that you have a reliable safety net in place.

Stop Harassing Vehicle Insurance Calls Now

You may want to see also

Vehicle Coverage: Different types of insurance for cars, motorcycles, etc

When it comes to driving, having the right insurance coverage is essential for both you and your vehicle. Whether you're behind the wheel of a car, a motorcycle, or any other type of vehicle, insurance provides financial protection and peace of mind. Here's an overview of the different types of insurance you should consider:

Auto Insurance: This is the most common and essential type of coverage for car owners. Auto insurance typically includes liability coverage, which protects you if you're at fault in an accident and covers the other party's medical expenses and property damage. It also often includes collision coverage, which pays for repairs to your vehicle if it's damaged in an accident, regardless of fault. Additionally, comprehensive coverage is available to protect against non-collision incidents like theft, vandalism, natural disasters, or hitting an animal. Other optional add-ons may include roadside assistance, rental car coverage, and personal injury protection (PIP) for medical expenses.

Motorcycle Insurance: Similar to auto insurance, motorcycle insurance provides financial protection for riders. It typically includes liability coverage to protect against bodily injury and property damage to others in the event of an accident. Collision coverage is also common, covering repairs to your motorcycle. Some policies offer additional benefits like medical payments for the rider and passengers, roadside assistance, and custom bike parts coverage.

Other Vehicle Coverage: Depending on your specific needs and the type of vehicle, there are other insurance options to consider. For example, if you own a boat or an RV, you might need specialized insurance to cover these recreational vehicles. Additionally, classic car owners may require classic car insurance, which often includes agreed-upon value coverage and limited usage options.

When choosing insurance, it's crucial to assess your individual needs and the value of your vehicle. Factors like the age and condition of the vehicle, your driving record, and the likelihood of potential risks in your area will influence the type and level of coverage you require. It's always advisable to consult with insurance professionals who can provide tailored advice and ensure you have the appropriate protection.

Remember, having the right insurance coverage not only safeguards your financial well-being but also ensures that you can drive with confidence, knowing that you're prepared for any unexpected events on the road.

Allstate Auto Insurance: Customer Ratings and Reviews

You may want to see also

Personal Liability: Protects against lawsuits for accidents causing harm

Personal liability is a crucial aspect of insurance coverage, especially when it comes to driving and operating vehicles. It is a fundamental principle that ensures individuals are financially protected in the event of an accident that causes harm to others. This type of insurance coverage acts as a safeguard, providing peace of mind and financial security to policyholders.

When you drive, you inherently take on a certain level of risk. Road accidents can happen due to various factors, including human error, vehicle malfunctions, or unforeseen circumstances. In such situations, if your actions or negligence result in harm to others, you could be held legally and financially responsible. This is where personal liability insurance comes into play. It provides a critical layer of protection by covering the costs associated with lawsuits and legal claims arising from accidents.

The primary purpose of personal liability insurance is to shield you from the financial burden of lawsuits. If someone is injured or their property is damaged in an accident caused by your vehicle, they may file a lawsuit against you. These legal proceedings can be costly, time-consuming, and emotionally draining. Personal liability insurance steps in to cover the damages awarded in such lawsuits, including medical expenses, property repairs, and legal fees. This coverage ensures that you are not left with significant financial losses that could potentially ruin your life.

For instance, imagine a scenario where you are driving and accidentally hit another car, causing injuries to the other driver and damage to their vehicle. Without personal liability insurance, you would be solely responsible for covering the medical bills, car repairs, and any potential legal fees. However, with the right insurance coverage, you can file a claim, and the insurance company will work to settle the damages on your behalf, protecting your financial well-being.

It is essential to understand that personal liability coverage is not limited to car accidents alone. It can also apply to various activities and hobbies that involve potential risks. For example, if you own a boat or a motorcycle, or if you engage in sports that carry a certain level of danger, personal liability insurance can provide coverage for any accidents or injuries that occur during these activities. This comprehensive protection ensures that your liability is covered across different aspects of your life.

Finding Your Auto Insurance Member ID: A Quick Guide

You may want to see also

Cost and Benefits: Insurance costs vary, but offer peace of mind

When it comes to driving, one of the most important considerations is insurance. While it may seem like an unnecessary expense, having insurance can provide numerous benefits and peace of mind. The cost of insurance can vary depending on several factors, including your location, driving history, vehicle type, and coverage options. Understanding these costs and the advantages they offer is crucial for making informed decisions.

Insurance costs can vary significantly from one region to another. Urban areas often have higher insurance premiums due to increased traffic density, higher accident rates, and a greater number of potential claims. In contrast, rural areas might offer lower rates due to fewer accidents and lower claim frequencies. Additionally, insurance companies may consider the specific demographics and crime rates of an area, which can further influence the cost. For instance, a driver in a high-crime neighborhood might face higher premiums due to the increased risk of vehicle theft or damage.

Your driving history plays a pivotal role in determining insurance costs. Insurance providers assess your risk profile based on factors such as previous accidents, traffic violations, and claims. A clean driving record with no accidents or violations will typically result in lower premiums. Conversely, a history of accidents or frequent violations can lead to higher insurance rates as the company considers you a higher-risk driver. It is essential to maintain a safe driving record to keep insurance costs manageable.

The type of vehicle you own also impacts insurance costs. Different vehicles have varying levels of risk associated with them. Sports cars and luxury vehicles, for example, might be more expensive to insure due to their higher value and potential for more costly repairs. Additionally, vehicles with advanced safety features and anti-theft systems may qualify for discounts, as they reduce the risk of accidents and theft.

Insurance offers a sense of security and financial protection. It covers various expenses related to accidents, such as medical bills, property damage, and legal fees. Without insurance, you would be financially responsible for these costs, which can be substantial. For instance, a comprehensive insurance policy can provide coverage for medical expenses, ensuring that you are not burdened with unexpected and potentially overwhelming bills. Moreover, insurance can also protect you from legal consequences and the financial impact of third-party claims.

In summary, insurance costs can vary based on location, driving history, vehicle type, and coverage choices. While it may seem like an additional expense, insurance provides valuable benefits, including financial protection and peace of mind. Understanding these costs and the advantages they offer is essential for drivers to make informed decisions and ensure they are adequately covered while on the road.

Accident-Prone: Will American Family Cancel My Auto Insurance?

You may want to see also

Frequently asked questions

In most places, having car insurance is mandatory by law. It is a legal requirement to have at least a basic level of coverage, which typically includes liability insurance. This insurance protects you and your vehicle in case of accidents, covering damages and injuries to others. Without insurance, you risk facing legal consequences and financial liabilities if you're involved in an accident.

Driving without insurance can lead to severe penalties. If caught, you may face fines, license suspension, or even imprisonment. Insurance companies also often require proof of insurance to register and license your vehicle. It's essential to obtain the necessary coverage to avoid these legal issues and ensure you're protected on the road.

Full coverage insurance provides comprehensive protection and is not always mandatory. However, it offers more extensive coverage, including collision, comprehensive, and personal injury protection. While it may increase your premium costs, it provides added financial security in case of accidents, theft, or natural disasters. Consider your financial situation and the value of your vehicle when deciding on the level of coverage.

Temporary or short-term insurance is available for specific situations, such as when you're borrowing a friend's car or renting a vehicle. These policies provide coverage for a limited period, usually a few days to a month. However, they may not be suitable for long-term use, and the coverage might not be as comprehensive as a standard policy. Always check the terms and conditions to ensure you have adequate protection.

Classic car insurance is designed specifically for antique or vintage vehicles. Standard auto insurance policies may not provide adequate coverage for these unique cars due to their age and value. Classic car insurance often offers specialized coverage, including agreed value protection, which ensures you receive the full insured amount in case of a total loss. It's essential to research and find the right insurance provider for your classic car.