When considering purchasing life insurance, it's crucial to evaluate your financial goals, health status, and the level of coverage needed. Assess your family's financial obligations and long-term needs, such as mortgage payments, education costs, and living expenses. Additionally, consider your age, health, and lifestyle, as these factors influence premium costs and policy terms. Understanding the different types of life insurance, such as term and permanent policies, is essential to ensure you select the best fit for your circumstances. It's also wise to research and compare various insurance providers to find the most competitive rates and comprehensive coverage options.

What You'll Learn

- Coverage Needs: Assess your financial obligations and choose a policy that provides adequate coverage

- Term Length: Determine the duration of coverage based on your long-term goals and financial situation

- Premiums: Evaluate the cost of premiums and ensure they fit your budget

- Health Factors: Consider your health status and any pre-existing conditions that may impact insurance rates

- Beneficiary Selection: Choose beneficiaries carefully, ensuring they align with your wishes and legal requirements

Coverage Needs: Assess your financial obligations and choose a policy that provides adequate coverage

When purchasing life insurance, one of the most critical aspects to consider is coverage needs, which directly relates to your financial obligations and future commitments. This step is essential to ensure that your loved ones are financially protected in the event of your passing. Here's a detailed guide on how to approach this:

Assess Your Financial Obligations: Start by making a comprehensive list of all your financial responsibilities. This includes long-term commitments such as mortgage payments, rent, or any other debts you may have. Also, consider your family's current and future expenses. These could include education costs for your children, regular household expenses, and any other recurring financial obligations. It is crucial to account for both immediate and long-term needs to ensure that your policy can cover all bases. For instance, if you have a large mortgage remaining, you'll want to ensure that the insurance payout can help clear this debt, providing financial relief to your family.

Calculate the Coverage Amount: The next step is to determine the appropriate coverage amount. A common rule of thumb is to ensure that your life insurance policy pays out a sum equal to seven to ten times your annual income. This calculation takes into account your current earnings and can help cover the aforementioned financial obligations. For example, if your annual income is $50,000, you might consider a policy with a coverage amount of $350,000 to $500,000, providing a safety net for your family's financial stability.

Consider Long-Term Needs: Life insurance should not just cover immediate financial obligations but also consider long-term needs. This includes funding your children's education, ensuring your spouse or partner can maintain their standard of living, and providing for any other long-term goals or commitments. For instance, if you have a child with special needs who requires ongoing care, you might want to consider a policy that can cover these specific expenses for an extended period.

Review and Adjust Regularly: Financial circumstances change over time, and so should your life insurance policy. It is essential to review your coverage needs periodically, especially during significant life events like getting married, having children, or purchasing a home. These events often bring about new financial obligations, and your insurance policy should reflect these changes. Regularly assessing your coverage ensures that you are adequately protected and that your loved ones' financial security is maintained.

By carefully assessing your financial obligations and choosing a policy with appropriate coverage, you can provide peace of mind, knowing that your family's financial future is secure. This process ensures that your life insurance becomes a valuable tool in managing and mitigating financial risks.

Life Insurance After Cancer: Is It Possible?

You may want to see also

Term Length: Determine the duration of coverage based on your long-term goals and financial situation

When considering term life insurance, the duration of coverage is a critical aspect to determine based on your unique circumstances and long-term financial goals. This decision will significantly impact the overall cost and effectiveness of your insurance policy. Here's a guide to help you navigate this important choice:

Assess Your Long-Term Needs: Start by evaluating your financial obligations and goals. Consider the duration for which you need coverage. For instance, if you have a mortgage or children's education expenses that will extend beyond a certain period, you might want to ensure that your insurance policy aligns with these milestones. Typically, longer-term policies provide coverage for an extended period, such as 10, 20, or 30 years, and are suitable for those with long-term financial responsibilities.

Evaluate Your Financial Situation: Your financial health plays a vital role in determining the term length. Longer-term policies often come with higher premiums, so it's essential to assess your current and future financial capabilities. If you have a stable income, a robust emergency fund, and a secure financial future, you might opt for a longer term to cover a more extended period. Conversely, if your financial situation is more precarious, a shorter-term policy might be more feasible, allowing you to manage the premium payments without straining your finances.

Consider the Cost and Flexibility: Term life insurance offers a cost-effective way to secure coverage for a specific period. The premiums are typically lower compared to permanent life insurance, making it an attractive option for those seeking affordable coverage. When choosing the term length, consider your ability to afford the premiums over the selected period. Additionally, some policies offer the flexibility to convert to a permanent policy later, allowing you to adapt to changing financial circumstances.

Review and Adjust: Life insurance needs can change over time due to various life events, such as marriage, the birth of children, or career advancements. Regularly reviewing and adjusting your policy ensures that it remains aligned with your current situation. For instance, if you've paid off your mortgage or your children have started their careers, you might consider reducing the term length to match your updated financial obligations.

In summary, determining the term length involves a careful assessment of your long-term goals, financial stability, and ability to manage costs. By choosing the right duration, you can ensure that your life insurance policy provides the necessary protection during the most critical periods of your life, offering peace of mind and financial security.

Permanent Life Insurance: No-Lapse Guarantee Explained

You may want to see also

Premiums: Evaluate the cost of premiums and ensure they fit your budget

When considering life insurance, one of the most critical aspects to evaluate is the cost of premiums. Premiums are the regular payments you make to maintain your insurance policy, and they can vary significantly depending on several factors. Understanding these factors and assessing your financial situation is essential to ensure that the premiums are manageable and align with your budget.

The cost of life insurance premiums is influenced by various personal and health-related factors. Firstly, age plays a significant role; younger individuals typically pay lower premiums as they are considered less risky to insure. As you age, premiums tend to increase due to the higher likelihood of health issues and potential medical expenses. Additionally, your health status is a crucial determinant. Insurers often assess your medical history and current health to calculate premiums. Factors such as smoking, obesity, pre-existing conditions, and lifestyle choices can all impact the cost. For instance, a non-smoker with a healthy weight and no significant medical history may pay lower premiums compared to a smoker with health issues.

Another critical factor is your lifestyle and occupation. Insurers may consider your daily habits, such as alcohol consumption, drug use, and even your hobbies. Extreme sports enthusiasts, for example, might face higher premiums due to the increased risk associated with their activities. Similarly, certain occupations, especially those deemed high-risk, can lead to higher insurance costs. Jobs in construction, emergency services, or high-altitude work may fall into this category.

It's important to note that the type of life insurance policy you choose will also affect the premium. Term life insurance, which provides coverage for a specified period, generally has lower premiums compared to whole life insurance, which offers lifelong coverage and includes a savings component. Additionally, the amount of coverage you select will impact the cost. Higher coverage amounts result in higher premiums as the insurer takes on more risk by paying out a substantial sum in the event of your passing.

To ensure that the premiums fit your budget, it's advisable to shop around and compare quotes from different insurance providers. Each company may offer varying rates based on the same factors, and you can take advantage of this by negotiating and comparing. Additionally, consider increasing your deductible, which is the amount you pay out of pocket before the insurance coverage kicks in. A higher deductible can lower your premiums, but ensure you can afford the initial payment. Lastly, review your policy regularly and consider adjusting your coverage as your financial situation changes.

Managing General Agents: Life Insurance Money-Makers

You may want to see also

Health Factors: Consider your health status and any pre-existing conditions that may impact insurance rates

When it comes to purchasing life insurance, your health status and any pre-existing medical conditions play a crucial role in determining the cost and availability of coverage. Insurance companies use health factors as a key consideration to assess the risk associated with insuring an individual. Here's a detailed breakdown of how health factors influence your life insurance journey:

Understanding Health Impact: Insurance providers carefully evaluate your overall health and medical history. Certain health conditions can significantly impact the premium rates and even eligibility for coverage. For instance, individuals with chronic illnesses like diabetes, heart disease, or cancer may face higher insurance costs due to the potential long-term medical expenses and treatment requirements associated with these conditions. Similarly, lifestyle factors such as smoking, excessive alcohol consumption, or a sedentary lifestyle can also affect rates, as these habits often contribute to an increased risk of various health issues.

Pre-existing Conditions: Any pre-existing medical conditions or health issues you have had in the past can influence the insurance company's decision. Conditions like hypertension, asthma, or a history of mental health disorders may require additional medical information and could potentially lead to higher premiums or even a denial of coverage. It is essential to disclose all relevant health details accurately to ensure fair pricing and avoid any surprises during the claims process.

Medical History and Examinations: During the application process, insurance companies often request detailed medical records and may conduct medical examinations. This information helps them assess your current health status and identify any potential risks. Providing accurate and up-to-date medical history is vital, as it allows the insurer to make an informed decision about your coverage. In some cases, a medical exam might be required, especially if you have a history of serious health issues or are applying for a higher coverage amount.

Improving Your Profile: If you have health concerns or pre-existing conditions, there are steps you can take to potentially improve your insurance profile. Maintaining a healthy lifestyle through regular exercise, a balanced diet, and managing any existing health issues can positively impact your rates. Additionally, ensuring that you have regular check-ups and follow-up treatments can demonstrate responsible health management to the insurance company.

Customized Quotes: The impact of health factors on life insurance rates can vary. Insurance providers often offer customized quotes based on individual health profiles. By providing detailed health information, you can receive tailored quotes that accurately reflect the potential risks and costs associated with your specific circumstances. This personalized approach ensures that you get the most suitable coverage at a competitive price.

Life Insurance and Suicide in California: What's Covered?

You may want to see also

Beneficiary Selection: Choose beneficiaries carefully, ensuring they align with your wishes and legal requirements

When purchasing life insurance, one of the most crucial decisions you make is selecting the right beneficiaries. This decision is significant as it determines who will receive the death benefit payout upon your passing. Choosing beneficiaries carefully is essential to ensure your wishes are respected and to comply with legal requirements. Here are some key considerations to keep in mind:

Understand the Legal Implications: Different types of life insurance policies have specific rules regarding beneficiaries. For instance, in some policies, you can name multiple primary beneficiaries and even secondary beneficiaries. It's important to understand these nuances to ensure your preferences are accurately reflected. Always review the policy documents and seek clarification from your insurance provider if needed.

Consider Family and Close Relatives: Typically, the first and most obvious choice for beneficiaries is your family, especially your spouse or domestic partner, children, and parents. Ensuring that your primary beneficiaries are those who depend on you financially and emotionally is essential. This selection often aligns with your wishes to provide for your loved ones and can also help simplify the distribution of assets.

Designate Specific Amounts or Percentages: You can specify the exact amount or percentage of the death benefit that each beneficiary should receive. This level of detail ensures that your wishes are followed precisely. For instance, you might want to allocate a larger portion to your spouse to cover immediate expenses and a smaller amount to each child for their future education.

Appoint Guardians for Minors: If you have minor children, it is crucial to name a guardian or guardians in your beneficiary selection. This appointment ensures that your children will be cared for by the individuals you trust in the event of your death. The legal system will typically honor these designations, providing peace of mind for both your family and the court.

Review and Update Regularly: Life circumstances change, and so should your beneficiary designations. Major life events such as marriages, births, deaths, or significant financial changes should prompt a review of your beneficiary choices. Regularly updating your policy ensures that your beneficiaries remain aligned with your current wishes and legal requirements.

Life Insurance: A Misunderstood Financial Tool

You may want to see also

Frequently asked questions

The initial step is to evaluate your personal and financial situation. Determine your income, expenses, debts, and the number of dependents you have. This assessment will help you understand the coverage amount you need and the type of policy that suits your requirements.

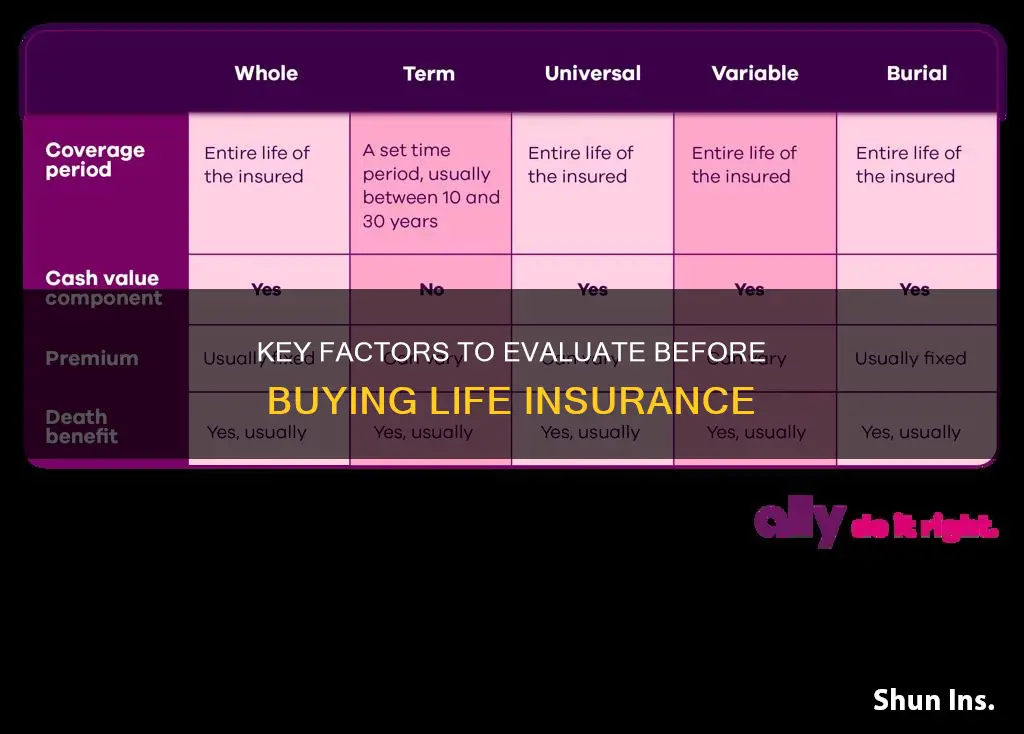

There are two primary types: Term Life Insurance and Permanent (Whole Life) Insurance. Term life provides coverage for a specified period, offering a straightforward and cost-effective solution. Permanent life insurance, on the other hand, offers lifelong coverage and includes a savings component. Consider your financial goals, the duration of coverage needed, and your long-term financial plans when making this decision.

Several factors impact the premium you pay for life insurance. Age is a significant determinant, as younger individuals typically pay less. Your health and medical history play a crucial role, as insurers may require medical exams or ask about pre-existing conditions. Lifestyle choices, such as smoking, drinking, or engaging in extreme sports, can also affect premiums. Additionally, the coverage amount, policy term, and the insurer's guidelines will influence the cost.

Yes, it is possible to obtain life insurance with pre-existing health conditions. However, the process may be more complex, and the terms and rates could vary. Insurers often consider factors like the severity and management of the condition, recent medical history, and any necessary medical exams. It's essential to disclose all relevant health information accurately to ensure proper coverage and avoid potential issues during claims.

Regular policy reviews are crucial to ensure your life insurance remains adequate and relevant. Life events like marriage, the birth of a child, purchasing a home, or significant financial changes may trigger the need for policy adjustments. It's recommended to review your policy annually or whenever your circumstances change. Consulting with a financial advisor can help you navigate these changes and make informed decisions regarding your life insurance coverage.