Children are typically considered high-risk drivers and are therefore subject to higher auto insurance premiums. This is due to their lack of driving experience and the fact that they are more likely to be involved in accidents. As a result, parents often add their children to their auto insurance policies, which can lead to increased costs. However, there is no definitive age at which children must obtain their own auto insurance policy, and they can remain on their parents' policy as long as they are still dependents or live in the same household. Factors such as marriage, financial independence, and sole vehicle ownership may influence the decision for children to obtain their own auto insurance. It is important to consider the potential risks and liabilities associated with keeping adult children on a parent's auto insurance policy.

| Characteristics | Values |

|---|---|

| Age of child | Children are considered adults for auto insurance at 18 years old, as this is when they are legally considered an adult and can enter into contracts. |

| Child's living situation | If the child moves out, they will need their own insurance policy. |

| Child's financial situation | If the child is financially independent, they should get their own insurance policy. |

| Child's marital status | If the child is married, they should get their own insurance policy. |

| Child's parental status | If the child has children of their own, they should get their own insurance policy. |

| Child's driving record | A child with a clean driving record may be able to get lower insurance rates as an adult. |

| Child's education | If the child is a full-time student, they can stay on their parent's insurance policy. |

| Child's employment | If the child has a job, they may be able to afford their own insurance policy. |

| Car ownership | If the child owns their own car, they will need their own insurance policy unless the parent is listed as a co-owner. |

| Car financing | If the child finances a car by themselves, they will need their own insurance policy unless the parent is a cosigner. |

What You'll Learn

- Children can be insured under their parents' policy if they are listed as a driver

- Children are considered insured drivers if they are resident relatives

- Parents can keep their children on their insurance policy for as long as they want

- Children can get their own insurance policy when they turn 18

- Parents can opt for separate car insurance for their children to avoid premium spikes

Children can be insured under their parents' policy if they are listed as a driver

Firstly, it's crucial to understand that adding a child as a driver to your policy will likely result in increased premiums due to the higher risk associated with young and inexperienced drivers. This increase in cost can be significant, especially if your child is a teenager. It's also worth noting that separate car insurance for children can help them build their own insurance history, potentially leading to lower rates in the future.

Secondly, there are specific situations where keeping your child on your insurance policy may not even be possible. If your child is no longer a dependent, has bought their own car, or has reached a certain age (typically 21 or 25), they will likely need to obtain their own insurance policy. The specifics may vary depending on your location and insurance provider, so it's essential to review their guidelines.

Additionally, if your child is involved in an accident while listed under your policy, you may be held liable, and your insurance rates could increase even further. This can have significant financial implications and even result in a lawsuit.

Moreover, keeping your child on your insurance policy may not provide them with comprehensive coverage in all scenarios. For example, if they rent a vehicle, drive a borrowed car, or are injured as a pedestrian or a passenger in another car, they may not be adequately covered by your policy. In such cases, purchasing a named non-owner auto policy or ensuring your child has their own policy can help bridge these coverage gaps.

Finally, when making this decision, it's essential to consider your child's level of financial independence. If they can support themselves and afford their own insurance, it may be more beneficial to have them obtain their own policy, even if you choose to reimburse them for the cost. This promotes financial independence and reduces your potential risks and liabilities.

In conclusion, while it is possible to insure your children under your policy by listing them as drivers, there are several important factors to consider. These include the potential increase in costs, the limitations of coverage, the risks associated with accidents, and your child's financial independence. Carefully weigh these factors before making a decision, and don't hesitate to consult with an insurance expert to find the best solution for your family's needs.

Broad Form Insurance: Which Auto Insurers Offer This Coverage?

You may want to see also

Children are considered insured drivers if they are resident relatives

Children are typically considered insured drivers if they are resident relatives. This means that if your child lives with you and drives your car, they need to be added to your car insurance policy. This is true regardless of their age, as anyone living in your household with access to your cars needs to be a listed driver.

There are some situations where you may not need to add your child to your car insurance policy. If they have a driver's license but don't plan on driving, you can usually exclude them from your policy by signing a form confirming that they won't be driving any of your vehicles. However, if they do drive and get into an accident, your insurance company will not cover the damages, and there may be other consequences such as policy cancellation.

It's important to note that drivers under the age of 18 are typically not allowed to purchase their own car insurance policies. This is because insurance policies are legally binding contracts, which minors cannot sign on their own. So, if your child is under 18 and driving, they will need to be added to your policy.

Adding your child to your car insurance policy will likely result in higher premiums due to the increased risk associated with inexperienced drivers. However, there may be some benefits, such as lower premiums for your child compared to them having their own policy, qualifying for new discounts, and simplified policy management.

In summary, children who are resident relatives and have access to your vehicles are generally considered insured drivers and need to be added to your car insurance policy. There may be some exceptions, but it's important to check with your insurance provider to ensure you have the appropriate coverage in place.

Mississippi's Electronic Verification System for Auto Insurance: What You Need to Know

You may want to see also

Parents can keep their children on their insurance policy for as long as they want

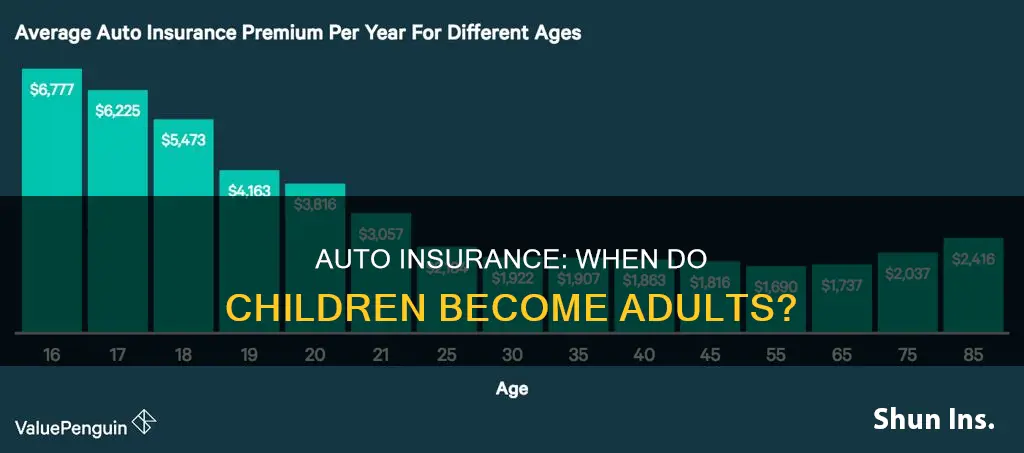

It is true that parents can keep their children on their auto insurance policy for as long as they want. However, there are several factors to consider when deciding whether or not to do so. One important consideration is the increased financial risk associated with young or inexperienced drivers. Teen drivers are four times more likely to be involved in a collision or crash, and insurance companies view them as high-risk, resulting in higher premiums. This risk, and the associated costs, generally decrease as drivers gain more experience, with significant reductions often occurring around the age of 21 or 25. As such, parents may choose to keep their children on their policy until they gain more driving experience and can obtain more affordable rates independently.

Another factor to consider is the child's living situation and level of dependency. If the child still lives at home or is a dependent, such as a college student, they can typically remain on their parent's policy. Some insurance companies may also allow children who have moved out to remain on their parent's policy, especially if the child's address is listed as the garaging address of the vehicle. However, it is important to note that once a child is no longer a dependent, owns their own car, and has reached the age of 21, it is generally recommended that they obtain their own auto insurance policy.

Additionally, parents should be aware of potential coverage gaps if their adult child is listed as a driver on their policy but is no longer considered an insured due to changes in residency or ownership. In such cases, purchasing a named non-owner auto policy or transferring the vehicle title to the child and ensuring they have their own policy can help bridge these coverage gaps.

It is worth noting that keeping a child on a parent's insurance policy can provide benefits such as lower premiums for the child and access to various discounts. However, parents may also want to consider the potential impact on their own insurance rates and the opportunity for their child to build their own insurance history and gain loyalty discounts by having a separate policy. Ultimately, the decision to keep a child on a parent's auto insurance policy depends on various factors, including the child's age, driving experience, living situation, and financial situation, as well as the parents' preferences and financial considerations.

Understanding Umbrella Auto Insurance: Comprehensive Coverage Explained

You may want to see also

Children can get their own insurance policy when they turn 18

When deciding whether to keep your child on your policy or have them obtain their own, it's essential to weigh the financial implications. Car insurance for 18-year-olds is generally quite expensive, and your child's premiums may be lower if they stay on your policy, assuming they live with you and your name is also on their vehicle. On the other hand, keeping your child on your policy may increase your premiums due to the higher risk associated with young and inexperienced drivers.

Another factor to consider is the potential liability you may incur if your child is involved in an accident while on your policy. In some cases, you could be held partially responsible or face increased premiums. By having your child obtain their own policy, you may reduce this risk and protect yourself from potential lawsuits.

Additionally, it's worth noting that some insurance companies offer discounts for good student grades or distant student status, which can help offset the cost of adding your child to your policy. However, these discounts may not be as significant as the potential increase in premiums.

Ultimately, the decision to keep your child on your policy or have them obtain their own depends on various factors, including your child's driving record, maturity, financial situation, and your own financial considerations. It may be helpful to consult with an insurance agent to discuss the different options and make an informed decision.

Reopening Auto Insurance Claims: Possible?

You may want to see also

Parents can opt for separate car insurance for their children to avoid premium spikes

When a child gets their driver's license, they need to be added to their parents' or guardians' car insurance policy. This is because insurance companies consider young and new drivers to be high-risk due to their lack of experience, making them more likely to be involved in accidents. This increased risk is reflected in higher insurance rates.

However, parents can opt to get separate car insurance for their children. While this may be more expensive, it can help parents avoid premium spikes associated with having a high-risk driver on their policy. It also allows the teen to build their own insurance history, potentially leading to lower rates in the future.

There are several factors to consider when deciding whether to keep a child on a parent's policy or get them separate insurance. One key consideration is the child's age. In most states, individuals can obtain their own car insurance policy when they turn 18, as this is the age of majority when individuals can enter into legally binding contracts. However, insurance rates for young adults remain relatively high until they gain more driving experience, typically around the age of 25. As such, some parents may choose to keep their children on their policy until they are older, provided they live in the same household or are financially dependent.

Another factor to consider is the child's driving record. If a child has a clean driving record, they may be able to obtain lower insurance rates as they are considered less risky. On the other hand, if a child has been involved in accidents or has received tickets, it may be more cost-effective to get them separate insurance to avoid premium increases on the parents' policy.

It's important to note that parents should consult with their insurance agent to understand the specific requirements and implications of their policy. Additionally, insurance rates vary based on location, so it's essential to compare rates from different providers to find the most suitable option.

Wells Fargo Auto Insurance: Understanding the Charges

You may want to see also

Frequently asked questions

You should add your child to your car insurance policy as soon as they get their driver's license.

If your child has a driver's license, lives in your household, and drives a car registered to your home, they need to be added to your car insurance policy. Failure to do so could result in consequences such as policy cancellation.

You will likely need your child's name, date of birth, and driver's license number. You may also need their Social Security number.

Yes, most insurance providers offer the option to exclude your child from your policy if they won't be using your vehicle, such as when they're away at college. However, remember to reinstate your child on your policy when they return home for breaks or vacations.

You can keep your adult child on your car insurance policy as long as they live in the same household or are a dependent, such as a college student. However, it's essential to consider the financial implications, as keeping them on your policy may result in higher premiums and expose them to coverage gaps.