If you're looking to cancel your Maryland auto insurance, there are a few things you need to know. Firstly, it is mandatory to have vehicle insurance at all times in Maryland, and you are required to return your license plate to the Motor Vehicle Administration (MVA) before canceling your insurance. You also need to make sure that you provide the MVA with the necessary information if you move out of the state and don't return your plates. In terms of the cancellation process, Maryland law states that a premium finance company must provide written notice of intent to cancel an insurance contract at least 10 days before canceling. This notice should include a clear statement informing the insured individual that they need to replace their automobile liability insurance within the 10-day notice period to avoid penalties for being uninsured.

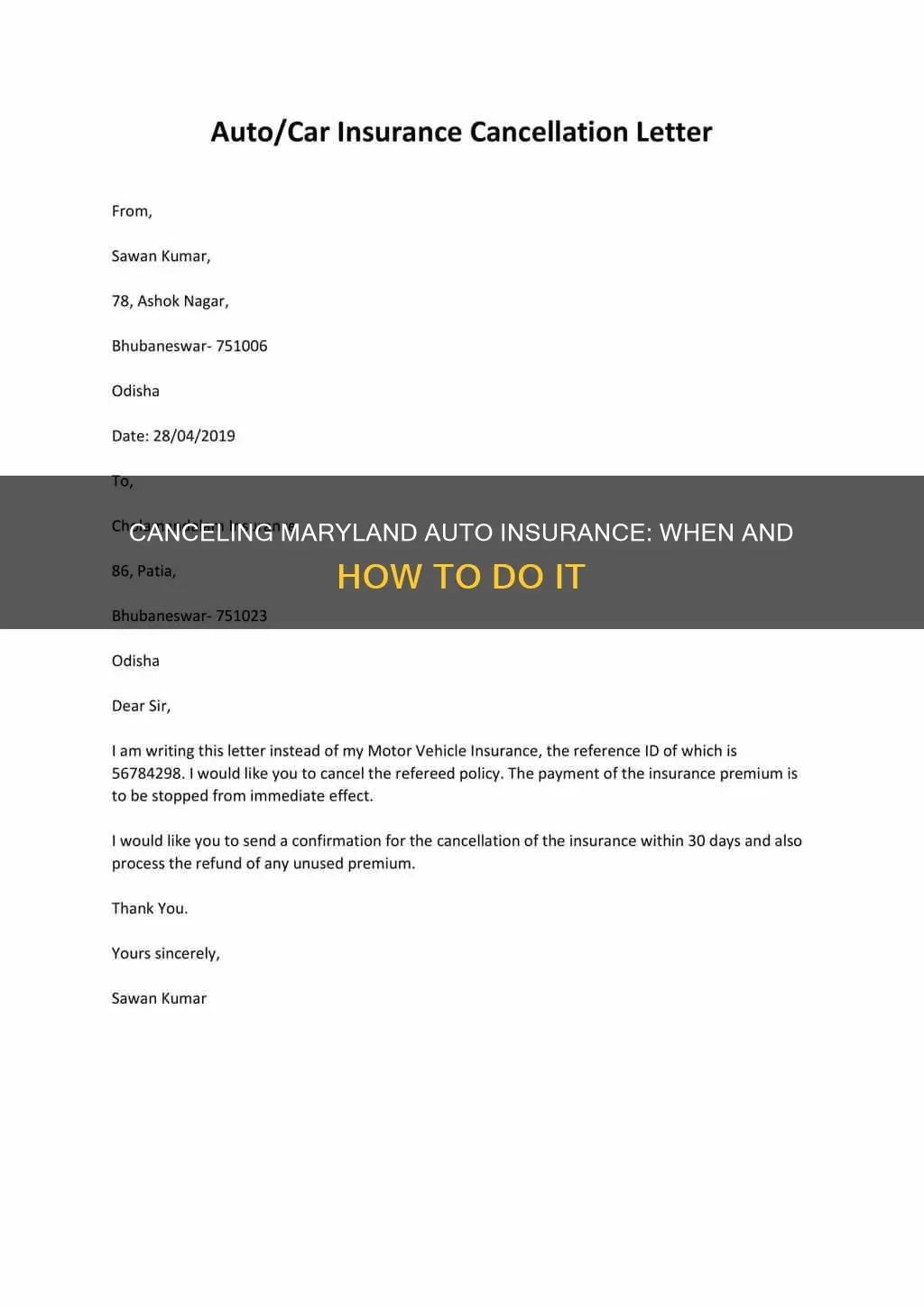

| Characteristics | Values |

|---|---|

| Minimum coverage for injuries/death to one person | $30,000 |

| Minimum coverage for injuries/death to more than one person | $60,000 |

| Minimum coverage for property damage | $15,000 |

| Notice period before cancellation | 10 days |

What You'll Learn

Cancelling insurance after moving out of Maryland

If you're moving out of Maryland, there are a few things you need to do to cancel your auto insurance and ensure you're following the proper procedures. Firstly, Maryland law requires that you return your license plate to a branch of the state's Motor Vehicle Administration (MVA) before canceling your insurance coverage. This is an important step that you must not forget.

If you have already moved out of Maryland and didn't get a chance to return your plates, don't worry. You can notify the MVA of your new address and provide them with some additional information, including a copy of your current registration, the date you obtained the title in your new state, your previous Maryland title and tag number, and your insurance information.

It's important to note that Maryland has specific insurance requirements that must be met while you are a resident. Your insurance policy must include a minimum of $30,000 to cover injuries or death to one person, $60,000 for more than one person in a single accident, and $15,000 for property damage. These are the minimum requirements, and you may want to consider higher coverage amounts for added protection.

When it comes to actually canceling your insurance contract, Maryland has a law that requires a premium finance company to give written notice of their intent to cancel at least 10 days in advance. This notice should include a clear statement that informs you of the consequences of failing to replace your automobile liability insurance within the 10-day notice period. These consequences include uninsured motorist penalties and the surrender of all evidences of registration to the MVA.

Remember, driving without insurance is illegal in Maryland, and there are significant fines and penalties for those who are caught. So, make sure you have canceled your Maryland auto insurance and obtained the necessary insurance in your new state of residence.

The Rich and Auto Insurance: Playing by Different Rules?

You may want to see also

Cancelling insurance before moving to Maryland

If you are moving to Maryland, you will need to obtain auto insurance to keep your vehicle on the road legally. Maryland Auto Insurance is the state's own insurance provider, but there are also over 1,400 other insurance providers to choose from.

Maryland requires all drivers to carry auto insurance, and driving without it can result in fines from the Motor Vehicle Administration (MVA). These fines can add up to $2,460 per year before interest.

When moving to Maryland, it is important to establish residency before cancelling your previous auto insurance policy. This is because you need to provide proof of insurance when registering your vehicle in the state. If you cancel your previous insurance before obtaining Maryland insurance, you may be subject to fines for driving without insurance.

To register your vehicle in Maryland, you will need to provide the following:

- Proof of ownership, such as the vehicle title or bill of sale.

- A completed Application for Certificate of Title.

- A completed Vehicle Registration Request Form.

- Proof of Maryland auto insurance.

- A completed Safety Inspection Certificate.

- Payment for the registration fee.

Once you have obtained Maryland auto insurance and registered your vehicle, you can then safely cancel your previous insurance policy. Be sure to follow up with your new insurance provider to ensure that all the necessary paperwork has been processed and that your coverage is active.

Auto Insurance Options: Understanding Your Coverage Choices

You may want to see also

Penalties for driving without insurance in Maryland

Unfortunately, I could not find specific information about the penalties for driving without insurance in Maryland. However, I can provide some general information about the consequences of driving without insurance and the auto insurance requirements in Maryland.

Maryland state law requires all drivers to carry automobile insurance. Driving without insurance can result in fines from the Motor Vehicle Administration, which can amount to up to $2,460 per year before interest. These fines are separate from any court-imposed penalties that may arise if you are involved in an accident while uninsured.

It is important to note that insurance not only helps you avoid penalties but also protects you, your passengers, and your property from losses incurred due to bodily injury or property damage sustained in a covered accident.

To reinstate your driving privileges after having your license suspended in Maryland, you may need to pay fees and complete other requirements, such as obtaining an SR-22 certificate of financial responsibility, similar to other states.

While the specific penalties for driving without insurance may vary by state, the consequences generally include fines, suspension of your driver's license, registration, and license plates, and requirements to provide proof of insurance or financial responsibility for reinstatement.

Shield Auto Insurance: Am I Covered?

You may want to see also

Required minimum insurance coverage in Maryland

To legally drive in Maryland, you need to have car insurance that meets the state's minimum requirements. Maryland requires minimum liability limits of 30/60/15, or $30,000 per person, $60,000 per accident for bodily injury, and $15,000 per accident for property damage. The state also requires uninsured motorist limits of 30/60/15, meaning $30,000 per person, $60,000 per accident for bodily injury, and $15,000 per person for property damage.

Personal Injury Protection, or PIP, is also a requirement. This covers medical expenses and lost income for you and your passengers injured in a covered accident, up to $2,500 per person. PIP can be waived for a reduced premium, but household relatives under 16 years old and certain others will still be covered.

In addition to the above, you may need to purchase further coverage if you have a loan on your car. For example, you may be required to purchase coverage that pays for damage to your car caused by striking another car or object, or coverage for damage caused by something other than a collision, such as theft, fire, hail, or animals.

Auto Insurance Savings: AARP's Benefits Explained

You may want to see also

Required insurance coverage for uninsured motorists in Maryland

Maryland state law requires that all drivers carry automobile insurance. Driving without insurance can result in fines from the Motor Vehicle Administration, which can add up to $2,460 per year before interest.

Maryland Auto Insurance provides a transitional solution for uninsured drivers who cannot obtain insurance in the private market. It is a unique organisation, with no similar entity in any other state.

Uninsured motorist coverage, referred to as UM or UMBI, is a type of car insurance that can pay for medical expenses if you or your passengers are injured in an auto accident caused by a driver who doesn't have any insurance, or whose insurance company denies coverage or goes out of business. It can also pay for car repairs and to replace the property in your car, as well as a rental car if you need one.

Underinsured motorist (UIM) insurance is similar but separate coverage, sometimes packaged with UM. UIM pays for medical bills and other expenses for you and your passengers if the driver who caused the accident doesn't have enough liability insurance to cover your medical bills.

Uninsured motorist property damage (UMPD) is also available in some states. It pays for your car's damages if an uninsured driver hits you.

Maryland Auto Insurance does not specify whether UMPD is required in Maryland, but it does state that collision coverage will be provided for the reasonable costs of a rental while your car is being repaired.

Beginning Auto Insurance: All State's Comprehensive Guide

You may want to see also

Frequently asked questions

You need to give at least 10 days' notice before canceling your auto insurance in Maryland.

You are required to return your license plate to a branch of the state's Motor Vehicle Administration (MVA) before canceling your insurance coverage.

If you don't return your plates, you need to notify the MVA and provide information including a copy of the current registration, the date you obtained the title in another state, your Maryland title and tag number, and your insurance information.