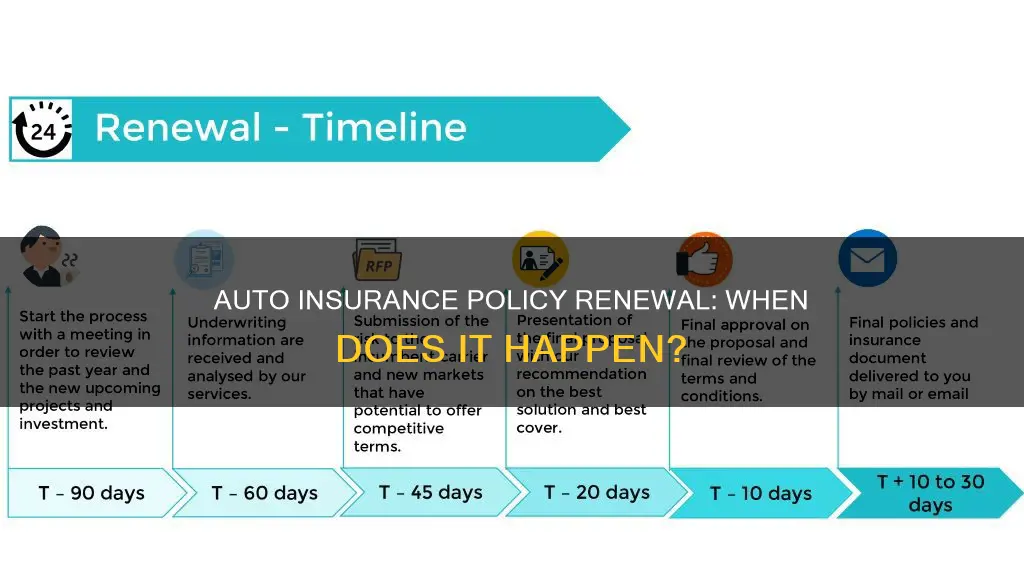

Auto insurance policies are typically renewed every six or 12 months, with the renewal process often being automatic. However, it is important to confirm the renewal with your provider to avoid a lapse in coverage. Before the renewal date, your insurer will send you an updated rate, which you can accept by making an initial payment or paying the renewal quote in full. If you choose not to renew, you must inform your insurer before the renewal date, especially if you have set up automatic payments. While you can cancel your policy at any time, you may be charged a cancellation fee or additional costs if done mid-term. Driving without active auto insurance is illegal in most places and can result in fines or license suspension.

| Characteristics | Values |

|---|---|

| Renewal Period | Every 6 or 12 months |

| Renewal Process | Automatic or manual |

| Renewal Notification | Mailed or emailed |

| Renewal Requirements | Review new documents, make payments |

| Non-Renewal Consequences | Lapse in coverage, increased rates, penalties |

| Non-Renewal Reasons | Rate increase, coverage changes, customer dissatisfaction |

| Cancellation Reasons | License suspension, non-payment, fraud, medical issues |

| Non-Renewal Reasons | Policy duration, claims, business decisions |

| Lapsed Coverage Consequences | Fines, license suspension, out-of-pocket expenses |

| Lapsed Coverage Solutions | Reinstate policy, buy new policy |

What You'll Learn

Auto insurance renewal is usually automatic

A month before your policy expires, you'll get a letter or an email from your insurance company about the renewal, along with information about your new car insurance premium, a new declarations page, and new insurance cards. If you do nothing and keep making payments, your policy will automatically renew, and new premium rates will apply on your renewal dates. The new rates are based on your driving history, age, and other factors, including claim rates for your state. It's possible for your rates to increase even if you've never made a claim or had any strikes against you.

If your car insurance is set to automatically renew and you're happy with the new rates, you don't need to do anything except continue making payments and swap out your new insurance cards. If your car insurance payments are automatic, they'll most likely continue into your new policy term.

Some insurers may require you to sign off on your personal information before your policy renews. If this is the case, you'll be prompted to review your information when it's time for renewal.

If you don't want to renew your policy, inform your insurer before the renewal date. If you've set up automatic payments, be sure to contact your insurer and cancel before the first payment of the renewal term is automatically paid. If you don't, you can still cancel your renewal policy at any time, but you may be charged a cancellation fee or additional costs if you cancel your policy during the term. Check with your insurer to see if you need to submit a written letter of cancellation or if you can cancel online or over the phone.

Auto Insurance for Children: When Do They Need Coverage?

You may want to see also

Renewal periods are typically 6 or 12 months

Renewal periods for auto insurance policies are typically 6 or 12 months. This means that, depending on the length of your policy term, you will have to renew your auto insurance every half a year or once a year.

Most insurance companies will notify you of your upcoming renewal by mail or email about a month before your policy expires. This is when you might learn that your rates are going up. Your insurer may then automatically renew your policy, or they might prompt you to confirm that your basic information is still the same before they renew. You can usually do this online.

If you are enrolled in automatic payments, your insurer will charge the new premium to your account and you will maintain coverage. However, if you do not want to renew your policy, it is important to inform your insurer before the renewal date. If you have set up automatic payments, be sure to cancel before the first payment of the new term is automatically paid.

If you miss the renewal deadline, you may still be able to renew your policy, but there may be a lapse in coverage between the date your policy was supposed to renew and the date it was actually renewed. If you are unable to renew your previous policy, you can always purchase a new one, either with your previous insurer or a different company.

Report Auto Insurance Fraud in Florida: Step-by-Step Guide

You may want to see also

You may be able to renew an expired policy

If you let your car insurance policy expire, you may still be able to renew it. However, this situation is more complicated than simply letting your policy automatically renew. It's important to act as soon as possible, as a lapse in coverage can cause your rates to increase once you're insured again. If you get into an accident while your coverage has lapsed, you'll have to pay for any expenses out of pocket.

Your insurance company might be willing to reinstate your policy, but you'll likely be charged a penalty fee. If you can't renew your old policy, you can always purchase a new one. You can opt to stay with your previous insurer or switch companies.

In certain states, some insurers may require signed forms or other actions to execute the policy renewal. The amount of time required for notice of nonrenewal varies by state. If your insurer cancels or won't renew your policy, you'll need to find new coverage quickly to avoid a lapse.

Auto Insurance: Can You Negotiate?

You may want to see also

Non-renewal is when a company terminates your policy at the end of its term

Non-renewal is when an insurance company decides not to renew your policy at the end of its term. This can happen for a variety of reasons, including:

- The company reducing the types of insurance it offers

- The company reducing its service area

- Missed payments

- You've had multiple accidents in the past three years, especially if they were your fault

- You filed too many insurance claims

- You have a poor driving record

- You have a criminal record

- You have a history of drug or alcohol abuse

If your insurer decides not to renew your policy, they must notify you in advance and explain their reasons for non-renewal. You have the right to appeal the non-renewal decision and may be able to purchase insurance from an alternative provider, such as your state's insurance plan.

It's important to note that non-renewal is different from cancellation, which can occur at any time during the policy term and may make it more difficult to obtain insurance from another carrier in the future. Non-renewal, on the other hand, happens at the end of the policy term, and it is generally easier to get covered after a non-renewal.

To avoid a lapse in coverage, it's recommended to purchase a new policy before your current one expires. This can be done by shopping around for different quotes and comparing them to your current insurer's offer. You may also want to consider switching insurers if you find a more attractive policy. However, if you cancel a policy that you paid for in advance, your insurer will likely refund you for the unused portion.

Root Auto Insurance: Trustworthy?

You may want to see also

Cancelling a policy mid-term may incur a fee

Auto insurance policies are typically renewed every six or 12 months, and many policies are set to automatically renew. However, if you need to cancel your policy mid-term, you may incur a fee.

Understanding Insurance Premiums and Cancellation Fees

Insurance premiums are calculated based on the assumption that the insurance company will provide you with coverage for a full year. When you cancel your policy early, you are breaking the terms of this year-long contract. As a result, insurance companies typically charge a cancellation fee, also known as a short-rate cancellation penalty. This fee helps cover the administrative costs associated with setting up the policy, regardless of whether the policy is in force for a week or the entire year.

Calculating the Short-Rate Cancellation Penalty

The short-rate cancellation penalty is not a flat fee but a percentage of your total insurance premium for the year. The percentage charged depends on the insurance company's short-rate cancellation tables and the number of days the policy was in force. For example, if you cancel your policy after 30 days, you may owe a total of $64, including a $34 short-rate cancellation penalty. However, if you cancel after 11 months, the penalty decreases to only $3.

Other Things to Keep in Mind

When cancelling your insurance policy early, there are a few other things to consider:

- Monthly payments may not stop immediately, and insurance companies typically require a few banking days' notice to stop pre-authorized payments.

- You may not always receive a cancellation refund. If you've paid more than the amount owing for the time on risk, you'll receive a refund for the difference. If you've paid less, you'll owe the insurance company the remaining amount.

- Switching insurance companies mid-policy will result in a short-rate cancellation fee. It may be more cost-effective to wait until the renewal date to switch companies.

- Cancelling your policy may result in losing multi-line discounts or other rewards associated with your current policy.

- Some insurance companies may require a written letter of intent or a completed cancellation form to cancel your policy, while others may accept a simple phone call.

Hyundai Lease: Gap Insurance Included?

You may want to see also

Frequently asked questions

Auto insurance policies are typically renewed automatically every six or 12 months. Your insurance provider will contact you via mail or email with your updated rate, and you simply need to accept this rate and make the initial payment.

If you choose not to renew your auto insurance policy, you must inform your insurer before the renewal date. If you have set up automatic payments, be sure to cancel these before the first payment is taken. Driving without insurance is illegal in most places and can result in fines or a license suspension.

In some cases, you may be able to renew your auto insurance policy after it has expired, but this depends on the insurer and how long you have been uninsured. There may be a lapse in coverage between the date your policy expired and the date it was reinstated.

Yes, an insurer may refuse to renew your auto insurance policy for various reasons, including issues with your driving record or missed insurance payments. Insurers must notify you in advance and explain their reasons for non-renewal.