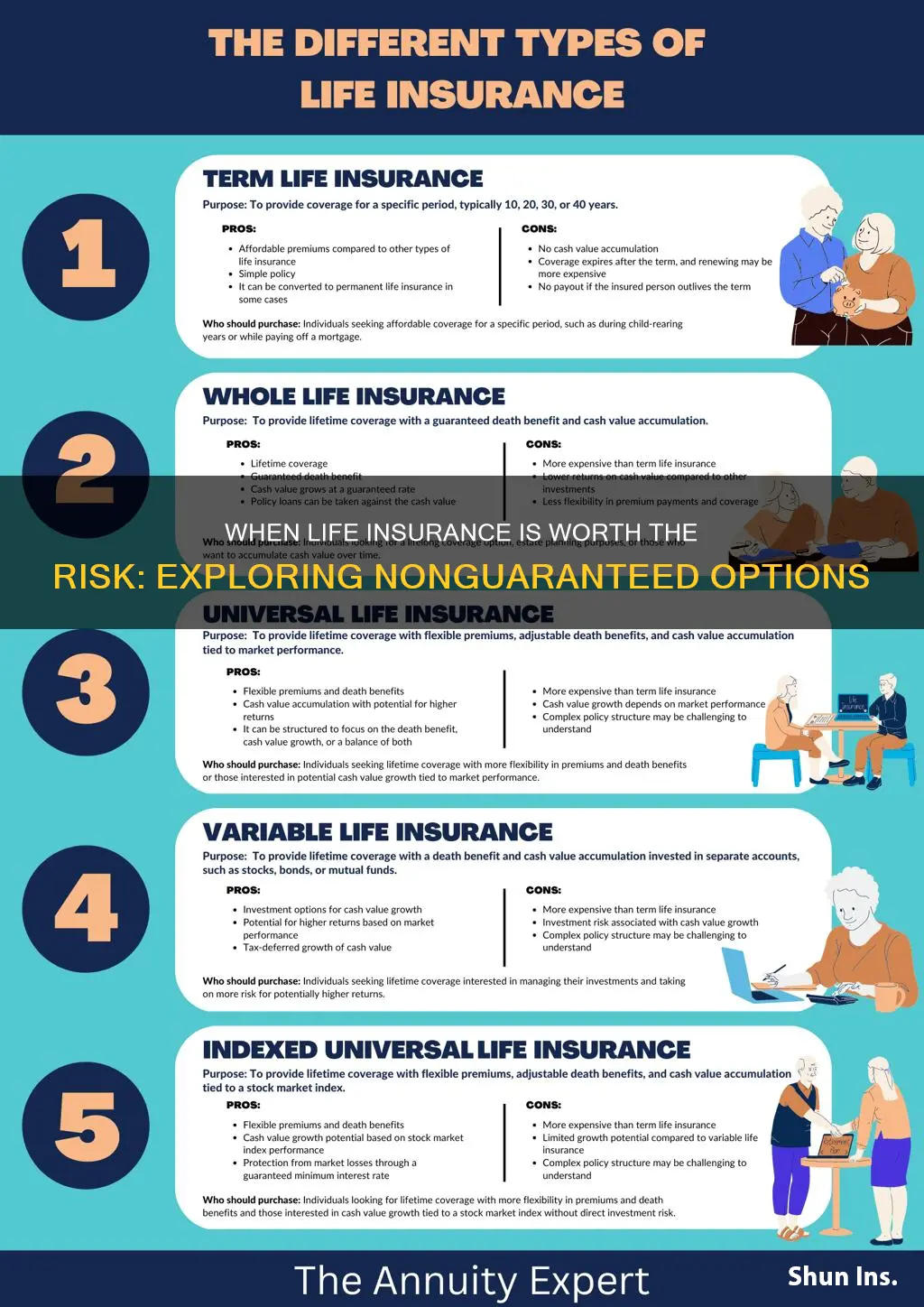

When considering life insurance, many people opt for guaranteed policies, which offer a fixed payout upon the insured's death. However, non-guaranteed life insurance, also known as term life insurance, can be a more cost-effective and flexible option for certain individuals. This type of insurance provides coverage for a specified period, typically 10, 15, or 20 years, and does not accumulate cash value. It is a good choice for those who want to secure financial protection for a defined period, such as covering mortgage payments, providing for children's education, or funding a business venture. Understanding the benefits and limitations of non-guaranteed life insurance can help individuals make informed decisions about their insurance needs.

What You'll Learn

- Cost-Effective Coverage: Nonguaranteed life insurance is ideal when you need affordable coverage for a short period

- Flexibility: This type of insurance offers flexibility to adjust coverage as your needs change

- No Medical Exam: It's a good choice if you're healthy and prefer a quick, no-exam application process

- Term Life: Consider nonguaranteed life for term life insurance, which provides coverage for a specific period

- Supplemental Insurance: Use it to supplement existing coverage, especially if you have limited medical history

Cost-Effective Coverage: Nonguaranteed life insurance is ideal when you need affordable coverage for a short period

Nonguaranteed life insurance, often referred to as term life insurance, is a cost-effective solution for individuals seeking temporary coverage without the long-term commitments and higher costs associated with permanent life insurance. This type of insurance is particularly beneficial in situations where you require protection for a specific period, such as covering debts, providing financial security for your family during a specific life stage, or insuring a business venture with a limited duration.

The primary advantage of nonguaranteed life insurance is its affordability. Since this insurance is designed for a defined term, typically ranging from one to ten years, the premiums are generally lower compared to permanent life insurance. This makes it an excellent choice for those who want to secure their loved ones' financial future without incurring significant expenses. For instance, if you are a young professional with a mortgage and a growing family, you might consider a 10-year term life insurance policy to ensure that your family is protected in case of your untimely demise, all while keeping the financial burden manageable.

Another scenario where nonguaranteed life insurance shines is when insuring a business. Startups and small businesses often require liability coverage for a specific project or venture. In such cases, a term life insurance policy can provide the necessary protection without the long-term financial commitment. As the business evolves, you can adjust the policy or opt for a different type of insurance as needed.

Furthermore, this type of insurance is ideal for individuals who want to build their financial portfolio gradually. By starting with a short-term policy, you can assess your financial needs and future goals before making a long-term commitment. This approach allows you to explore other investment options or adjust your insurance coverage as your financial situation changes.

In summary, nonguaranteed life insurance is a smart choice when you require cost-effective coverage for a limited time. It provides a flexible and affordable solution, ensuring that you can manage your finances effectively while still protecting your loved ones or business interests. Whether it's for personal or business-related needs, this type of insurance offers a practical approach to securing financial stability during specific life events.

VA Life Insurance: What Veterans Need to Know

You may want to see also

Flexibility: This type of insurance offers flexibility to adjust coverage as your needs change

When it comes to life insurance, having the flexibility to adapt your coverage to your changing circumstances is invaluable. Non-guaranteed life insurance provides exactly that—a dynamic approach to protection. This type of insurance is particularly beneficial for those who anticipate significant life changes or have evolving financial goals. For instance, if you're planning to start a family, purchase a home, or embark on a career change, non-guaranteed life insurance allows you to adjust your policy accordingly. You can increase or decrease your coverage as needed, ensuring that your insurance remains relevant and aligned with your current situation. This flexibility is a powerful tool, allowing you to make the most of your insurance without being tied down to a one-size-fits-all policy.

The beauty of non-guaranteed life insurance lies in its ability to keep pace with your life's transitions. As your financial responsibilities grow or shift, so can your insurance coverage. For example, if you've recently become a parent, you might want to increase your policy to account for the new financial commitments and the well-being of your child. Conversely, if you've paid off your mortgage or are approaching retirement, you may choose to reduce your coverage, saving on premiums without compromising your insurance protection. This adaptability ensures that your insurance strategy remains effective and cost-efficient throughout your life's journey.

One of the key advantages of this flexibility is the potential to save money. By adjusting your coverage, you can avoid overpaying for insurance that might be more than you need at any given time. This is especially relevant for those who have already built a substantial financial safety net or have other sources of insurance coverage. For instance, if you have a comprehensive health insurance plan, you might not require extensive life insurance coverage for medical expenses. By tailoring your life insurance policy, you can allocate your resources more efficiently, ensuring that your financial decisions are aligned with your overall well-being.

Furthermore, the flexibility offered by non-guaranteed life insurance provides peace of mind. Knowing that you can adapt your policy to suit your evolving needs can be reassuring. Life is unpredictable, and having the option to adjust your insurance coverage allows you to stay in control of your financial future. Whether it's a sudden career change, a significant health development, or a major life event, you can respond swiftly and effectively, ensuring that your insurance remains a reliable safeguard.

In summary, non-guaranteed life insurance is a smart choice for those who value the ability to customize their insurance coverage. It empowers individuals to make informed decisions about their financial well-being, ensuring that their insurance strategy remains relevant and beneficial. With this type of insurance, you can navigate life's twists and turns with confidence, knowing that your insurance will adapt to your changing needs.

Life Insurance for Seniors: Understanding Medicare's Offerings

You may want to see also

No Medical Exam: It's a good choice if you're healthy and prefer a quick, no-exam application process

If you're a healthy individual who values convenience and speed, opting for no-medical-exam life insurance can be an excellent decision. This type of policy is designed for those who want to secure their loved ones' financial future without the hassle and potential delays associated with a traditional medical examination. Here's why it might be the right choice for you:

The primary advantage of no-medical-exam life insurance is the simplicity and speed of the application process. As the name suggests, this policy type skips the medical exam, which is a significant departure from the standard life insurance application procedure. Typically, insurers require a medical examination to assess your health and determine the risk associated with insuring you. However, with no-medical-exam insurance, you can bypass this step, making the process quicker and more convenient. This is particularly beneficial if you have a busy schedule or simply prefer a faster approach to securing coverage.

For healthy individuals, the absence of a medical exam can be a significant advantage. Since the policy doesn't require a physical examination, you won't need to undergo the potential stress and inconvenience of a doctor's visit. This type of insurance is often underwritten based on your self-reported health information and lifestyle factors. As long as you provide accurate details, the approval process can be swift, allowing you to obtain coverage without the typical delays caused by a medical exam.

Furthermore, no-medical-exam life insurance is often more accessible to those with pre-existing conditions or health concerns. Traditional life insurance may be challenging to obtain or come with higher premiums if you have a medical history that requires a thorough examination. With no-medical-exam policies, insurers can offer coverage based on your self-assessment, making it a viable option for individuals who might otherwise be considered high-risk.

When considering this type of insurance, it's essential to be transparent and honest about your health. While a medical exam is absent, insurers will still review your application and may ask for specific health-related information. Providing accurate details is crucial to ensure that the policy is tailored to your needs and that you receive the appropriate coverage.

In summary, no-medical-exam life insurance is an ideal choice for healthy individuals who prioritize convenience and speed. By skipping the medical examination, this policy type offers a streamlined application process, making it an attractive option for those seeking quick coverage. It is a practical solution for individuals who want to secure their family's financial future without the typical delays and potential stress associated with traditional life insurance applications.

The US Term Life Insurance Industry: Size and Scope

You may want to see also

Term Life: Consider nonguaranteed life for term life insurance, which provides coverage for a specific period

Term life insurance is a type of coverage that offers a straightforward and often more affordable way to protect your loved ones during a specific period. Unlike permanent life insurance, which provides coverage for your entire life, term life insurance is designed to cover a set duration, such as 10, 20, or 30 years. This type of insurance is particularly appealing to those who want a simple and cost-effective solution to ensure their family's financial security for a defined period.

The beauty of term life insurance lies in its simplicity and flexibility. When you purchase a term policy, you agree to pay a premium for a predetermined number of years. During this term, the policy provides a death benefit to your beneficiaries if you pass away. The key advantage is that term life insurance is typically more affordable than permanent life insurance because it doesn't accumulate cash value or provide lifelong coverage. This makes it an excellent choice for individuals who need coverage for a specific goal, such as covering mortgage payments, funding their children's education, or providing financial security for a certain number of years.

One of the critical aspects of term life insurance is that it is non-guaranteed. This means that the insurance company does not guarantee a payout if you outlive the term period. However, this non-guaranteed nature also makes term life insurance highly customizable and adaptable to your changing needs. As your life circumstances evolve, you can adjust your coverage by renewing the policy or purchasing a new one with an extended term. This flexibility ensures that you can always find a solution that aligns with your current financial goals and priorities.

For example, if you're a young professional with a growing family and a substantial mortgage, a 20-year term life insurance policy could provide the necessary financial protection during this critical period. As your children grow older and your mortgage is paid off, you might consider transitioning to a shorter-term policy or even a permanent life insurance plan to ensure ongoing coverage. This adaptability is a significant advantage of term life insurance, allowing you to make the most of your insurance dollars without over-insuring or paying for coverage you no longer need.

In summary, term life insurance is a strategic choice for individuals seeking a focused and affordable way to protect their loved ones. Its non-guaranteed nature provides flexibility, allowing you to adapt the coverage as your life changes. Whether you're a young family looking to secure your home or an entrepreneur with specific financial goals, term life insurance offers a tailored solution to meet your unique needs during a defined period.

Understanding Tax Implications of Life Insurance Cash Surrender

You may want to see also

Supplemental Insurance: Use it to supplement existing coverage, especially if you have limited medical history

When considering life insurance, it's important to understand the different types available and their unique purposes. Nonguaranteed life insurance, also known as term life insurance, is a popular choice for those seeking affordable coverage for a specific period. However, it's not always the best fit for everyone, especially those with a limited medical history. This is where supplemental insurance comes into play, offering a valuable layer of protection.

Supplemental insurance is designed to complement your existing coverage, ensuring you have comprehensive protection tailored to your needs. If you have a limited medical history or have been denied coverage by traditional insurance companies, supplemental insurance can be a game-changer. It provides an additional safety net, filling in the gaps where your primary insurance might fall short. For instance, if your primary policy has a low coverage amount or excludes certain health conditions, supplemental insurance can offer extended benefits to ensure you're adequately protected.

The primary purpose of supplemental insurance is to enhance your overall insurance portfolio. It's particularly useful for individuals who want to ensure their loved ones are financially secure in the event of their passing. By supplementing your existing life insurance, you can create a more robust financial safety net. This is especially crucial if you have a family that relies on your income or if you have significant financial obligations that need to be covered.

When considering supplemental insurance, it's essential to evaluate your current coverage and identify potential gaps. For those with limited medical history, this could mean having a policy that doesn't cover pre-existing conditions or doesn't provide sufficient benefits. Supplemental insurance can bridge these gaps, offering additional coverage for critical illnesses, accidents, or other specified events. This ensures that you and your family are protected against unforeseen circumstances, providing peace of mind.

In summary, supplemental insurance is a strategic addition to your life insurance strategy, especially for those with limited medical history. It allows you to customize your coverage, ensuring you have the protection you need. By supplementing your existing policy, you can create a comprehensive financial safety net, safeguarding your loved ones and providing financial security for your future. Remember, when it comes to insurance, understanding your options and tailoring your coverage is key to making informed decisions.

Locating Your SBI Life Insurance Customer ID

You may want to see also

Frequently asked questions

Non-guaranteed life insurance, often referred to as term life insurance, can be a good choice when you need coverage for a specific period and want a more affordable option. This type of insurance provides coverage for a set term, such as 10, 20, or 30 years, and it's typically more cost-effective than permanent life insurance because it doesn't have a cash value component. It's ideal for individuals who want to ensure their family is financially protected during a particular life stage, like when they have children or a mortgage, and they don't need coverage for the rest of their lives.

The main advantage is its affordability. Term life insurance is generally less expensive than permanent policies because it doesn't accumulate cash value. This makes it accessible to a broader range of people. Additionally, it provides a clear and defined period of coverage, which can be advantageous if your needs change over time. For example, you might want to ensure your children are financially secure during their upbringing and then opt for a different type of insurance later in life.

The key difference lies in their permanence and cost. Permanent life insurance, such as whole life or universal life, provides coverage for the entire lifetime of the insured individual. It also includes a cash value component that grows over time, allowing policyholders to borrow against it or withdraw funds. In contrast, non-guaranteed term life insurance is temporary and does not have a cash value. It's designed to provide coverage for a specific period, making it more flexible and cost-efficient.

Yes, many term life insurance policies offer the option to convert to a permanent policy before the term ends. This conversion feature allows you to switch to a more comprehensive coverage without a medical examination, as the risk is already assessed during the initial policy purchase. However, it's essential to review the terms and conditions of your specific policy to understand the conversion process and any associated costs.

While non-guaranteed life insurance is generally a good choice for many, it may not be the best fit for everyone. If you require coverage for an extended period, such as until retirement or a specific age, permanent life insurance might be more appropriate. Additionally, if you have significant financial goals or want to build a cash value, permanent policies could be more advantageous. It's essential to assess your long-term needs and consult with a financial advisor to determine the most suitable insurance type.