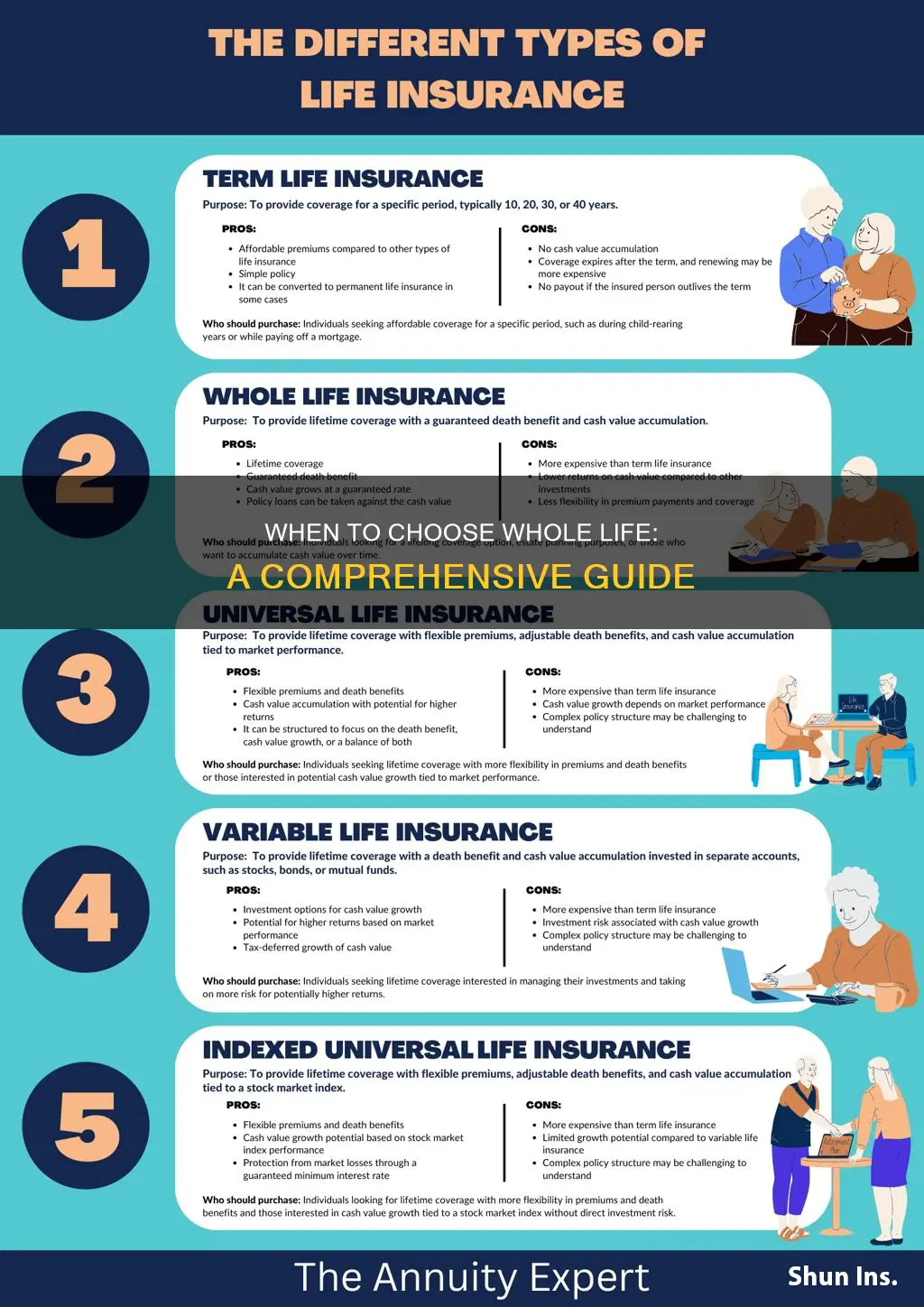

Whole life insurance is a long-term financial product that provides coverage for the entire lifetime of the insured individual, offering both death benefit and investment components. It is a permanent insurance policy that can be an appropriate choice for those seeking a stable and predictable financial plan. This type of insurance is particularly suitable for individuals who want to ensure their loved ones are financially protected and also want to build a valuable asset over time. It offers consistent premiums and a guaranteed death benefit, making it a reliable option for long-term financial security. Understanding when whole life insurance is the right choice can help individuals make informed decisions about their insurance needs.

What You'll Learn

- Age and Longevity: Whole life is suitable for older individuals seeking long-term coverage

- Financial Stability: It's appropriate when you have a stable financial situation and consistent income

- Legacy Planning: Whole life can be used to create a financial legacy for beneficiaries

- Guaranteed Benefits: The policy offers guaranteed death benefits, making it attractive for risk management

- Investment Component: The investment aspect of whole life can provide financial growth over time

Age and Longevity: Whole life is suitable for older individuals seeking long-term coverage

For older individuals, whole life insurance can be a valuable financial tool, especially when seeking long-term coverage. As people age, their health and life expectancy become more critical factors in insurance decisions. Whole life insurance, a permanent life insurance policy, offers a unique advantage in this regard. It provides coverage for the entire lifetime of the insured, hence the name, ensuring that the policyholder and their beneficiaries are protected financially for as long as they live. This is particularly beneficial for older individuals who may have specific long-term financial goals or those who want to ensure their loved ones are taken care of, regardless of their age.

One of the key advantages of whole life insurance for older individuals is the guaranteed death benefit. This means that, regardless of the insured's age at the time of death, the policy will pay out a predetermined amount to the beneficiaries. This guarantee is especially important for older adults, as their life expectancy may be uncertain, and they might have specific financial needs that need to be met over an extended period. With whole life, the coverage is assured, providing peace of mind and financial security.

Additionally, whole life insurance policies typically accumulate cash value over time, which can be borrowed against or withdrawn. This feature can be particularly useful for older individuals who may have accumulated significant equity in their policy. They can access this cash value for various purposes, such as supplementing retirement income, funding long-term care, or covering unexpected expenses. The ability to leverage the policy's cash value provides older adults with a financial safety net and flexibility, ensuring they can maintain their desired standard of living.

Furthermore, the long-term nature of whole life insurance aligns well with the needs of older individuals. As people age, their financial priorities may shift, and they might require coverage for an extended period to secure their family's future. Whole life insurance offers a solution by providing lifelong protection, ensuring that the insured's loved ones are cared for, even if the insured outlives their initial expectations. This long-term perspective is crucial for older adults who want to leave a lasting legacy and provide for their families over the years.

In summary, whole life insurance is well-suited for older individuals seeking long-term coverage. Its guaranteed death benefit, accumulation of cash value, and lifelong protection make it an attractive option for those who want to secure their family's future and maintain financial stability as they age. By considering whole life insurance, older adults can ensure they have the necessary financial tools to achieve their goals and provide for their loved ones, regardless of their age or life expectancy.

Life Insurance and Missing Persons: What's Covered?

You may want to see also

Financial Stability: It's appropriate when you have a stable financial situation and consistent income

When considering whole life insurance, having a stable financial situation and consistent income is a crucial factor to evaluate its appropriateness. This type of insurance is a long-term commitment, and ensuring you can meet the regular premium payments is essential. A stable financial position indicates that you are in a better position to handle the financial responsibility of whole life insurance. It provides peace of mind, knowing that your loved ones will be financially protected in the event of your passing.

Financial stability allows you to plan for the future and make informed decisions about insurance coverage. With a consistent income, you can assess your financial needs and determine the appropriate level of coverage. This assessment is vital as it ensures that the insurance policy aligns with your financial goals and provides the necessary protection for your family. A stable financial situation also enables you to consider the long-term benefits of whole life insurance, such as building cash value and providing a guaranteed death benefit.

Having a secure financial foundation allows you to make regular premium payments without compromising your other financial obligations. This consistency in payments is critical, as it ensures the insurance policy remains active and provides the intended coverage. Additionally, a stable financial situation may allow you to explore other financial opportunities or investments while maintaining the insurance policy, providing a comprehensive financial strategy.

In summary, financial stability and consistent income are key considerations when determining the appropriateness of whole life insurance. It enables you to make informed decisions, plan for the future, and ensure the policy's long-term viability. By assessing your financial situation, you can make the right choice regarding insurance coverage, providing both financial security and peace of mind.

Life Insurance: NerdWallet's Guide to Term Policies

You may want to see also

Legacy Planning: Whole life can be used to create a financial legacy for beneficiaries

Whole life insurance can be a powerful tool for legacy planning, allowing individuals to leave a financial legacy for their loved ones. This type of insurance provides a guaranteed death benefit, ensuring that a specified amount is paid out upon the insured's passing. By utilizing whole life insurance, individuals can secure a financial safety net for their beneficiaries, providing them with a substantial sum that can be used for various purposes.

One of the key advantages of whole life insurance in legacy planning is its long-term financial security. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers permanent coverage. This means that the death benefit is locked in, and the policy will continue to provide financial support to beneficiaries for the entire life of the insured. This long-term commitment ensures that the legacy is secure and provides a stable financial foundation for the intended recipients.

When considering whole life insurance for legacy planning, it is essential to evaluate the insured's financial goals and the needs of the beneficiaries. The death benefit amount should be carefully calculated to meet the specific requirements of the family's financial plan. For example, it could cover educational expenses for children, provide a comfortable retirement fund for a spouse, or contribute to the purchase of a family home. By tailoring the policy to these needs, individuals can create a meaningful and effective financial legacy.

Additionally, whole life insurance offers flexibility in terms of policy customization. Policyholders can choose the premium payment options that suit their financial situation, such as level or increasing premiums. This flexibility allows for better financial planning and ensures that the insurance remains affordable and manageable over time. Furthermore, some policies offer investment components, allowing the cash value of the insurance to grow, which can be borrowed against or withdrawn to meet financial needs.

In summary, whole life insurance is an excellent strategy for legacy planning as it provides a guaranteed death benefit, ensuring financial security for beneficiaries. Its long-term nature and flexibility in policy customization make it a valuable tool for individuals who want to leave a lasting financial legacy. By carefully considering the insured's goals and the needs of the beneficiaries, whole life insurance can be tailored to create a meaningful and effective financial plan.

Term Life Insurance: 5-Year Policy Benefits

You may want to see also

Guaranteed Benefits: The policy offers guaranteed death benefits, making it attractive for risk management

When considering life insurance, one of the most appealing aspects of whole life insurance is its guaranteed death benefit. This feature is particularly attractive for those seeking a reliable and secure financial plan for their loved ones. With a whole life policy, the insurance company promises to pay out a specific amount upon the insured individual's death, providing a sense of financial security and peace of mind. This guarantee is a stark contrast to term life insurance, where the death benefit is only paid out if the policy is in force at the time of the insured's passing.

The guaranteed death benefit of whole life insurance is a powerful tool for risk management. It ensures that your beneficiaries will receive a predetermined sum, regardless of market fluctuations or the insurance company's financial performance. This predictability is especially valuable for long-term financial planning, as it allows individuals to set aside a specific amount for their family's future needs, such as education expenses, mortgage payments, or living expenses. By locking in this benefit, policyholders can provide a financial safety net, knowing that their loved ones will be taken care of even if other assets or investments underperform.

Furthermore, the guaranteed death benefit can be a strategic asset for estate planning. It enables individuals to pass on a substantial sum to their heirs, potentially reducing estate taxes and ensuring a legacy for future generations. This aspect of whole life insurance is particularly beneficial for those with substantial assets or businesses, as it provides a way to protect and transfer wealth effectively.

In addition to the financial security it offers, the guaranteed death benefit also simplifies the decision-making process for policyholders. Without the uncertainty associated with market-linked policies, individuals can make informed choices about their insurance coverage, focusing on the specific needs of their family rather than the potential volatility of investment-based policies. This clarity can lead to more confident and comprehensive financial planning.

In summary, the guaranteed death benefit of whole life insurance is a compelling reason to consider this type of policy. It provides a reliable and secure financial foundation, offering peace of mind and a sense of control over one's legacy. By understanding the value of this guarantee, individuals can make informed decisions about their insurance needs, ensuring that their loved ones are protected and their financial goals are met.

Understanding Indemnity Health Insurance: Philadelphia Life Coverage Explained

You may want to see also

Investment Component: The investment aspect of whole life can provide financial growth over time

The investment component of whole life insurance is a powerful feature that can significantly contribute to your long-term financial goals. This aspect allows you to harness the potential of your premiums and build a substantial investment portfolio over time. Here's how it works and why it's a valuable addition to your financial strategy:

When you purchase a whole life insurance policy, a portion of your premium goes towards covering the cost of insurance, ensuring death benefit protection. The remaining amount is allocated to an investment account. This investment account grows over time, often with the help of professional fund managers, and can accumulate value through various investment strategies. The beauty of this investment component is that it offers a way to build wealth while also ensuring a safety net for your loved ones.

The investment aspect of whole life insurance is designed to provide financial growth and security. It typically involves a combination of investment options, such as stocks, bonds, and other securities. These investments are carefully selected and managed to balance risk and return, aiming for long-term capital appreciation and income generation. As the investment account grows, it can accumulate a significant amount of value, which can be used for various purposes.

One of the key advantages of the investment component is its potential to outpace traditional savings accounts or fixed-income investments. Over time, the power of compounding interest and investment returns can lead to substantial growth in your investment account. This growth can be particularly beneficial for those who want to build a substantial nest egg for retirement or other financial milestones. Additionally, the investment aspect provides an opportunity to diversify your portfolio, reducing risk through a well-rounded investment strategy.

It's important to note that the investment performance of whole life insurance can vary, and it is influenced by market conditions and the investment choices made by the insurance company. However, with proper management and a long-term perspective, the investment component can be a valuable tool for financial growth. When considering whole life insurance, it is essential to review the investment options available, understand the associated risks, and ensure that the policy aligns with your financial objectives and risk tolerance.

End-of-Life Insurance: Understanding Cash Value and Benefits

You may want to see also

Frequently asked questions

Whole life insurance is a permanent life insurance policy that provides coverage for your entire life, hence the name. It is appropriate when you want a policy that offers a guaranteed death benefit and a cash value component that grows over time. This type of insurance is ideal for those seeking long-term financial security and a consistent payout to beneficiaries. It is often chosen by individuals who want to ensure their family's financial stability, especially for major expenses like education or mortgage payments, as it provides a reliable source of funds.

Whole life insurance offers several benefits that make it a preferred choice for many. Firstly, it provides lifelong coverage, ensuring your loved ones are protected even if you outlive the initial term. Secondly, the cash value accumulation means you can borrow against it or use it as an investment, providing financial flexibility. Additionally, whole life insurance has a fixed premium, which means your monthly payments remain the same, providing long-term budget certainty.

Yes, absolutely! While standard whole life insurance policies may be more challenging to obtain with certain health issues, there are options available. Many insurance companies offer modified or graded whole life policies that provide coverage despite pre-existing conditions. These policies typically have a lower death benefit and may require a medical exam, but they can still offer valuable financial protection. It's best to consult with an insurance advisor to find the most suitable option based on your health status.

The cost of whole life insurance can vary depending on factors like age, health, and the amount of coverage. Generally, it is more expensive than term life insurance, especially for higher coverage amounts. However, the premium remains level throughout the policy's life, providing stability. The cash value growth also means that over time, the policy can become a valuable asset. For those seeking long-term financial planning and a consistent insurance solution, the slightly higher cost of whole life insurance can be justified by its comprehensive benefits.