Life insurance has a long and fascinating history, dating back to ancient civilizations. The concept of providing financial security for loved ones after one's passing can be traced as far back as the ancient Egyptians, who are believed to have practiced a form of life insurance known as mutual aid. This involved a group of people contributing to a fund to support the families of deceased members. However, the modern life insurance industry as we know it today began to take shape in the 17th century, with the establishment of the first insurance company in London, England, in 1688. This marked a significant milestone in the evolution of life insurance, as it laid the foundation for the development of more sophisticated and comprehensive insurance products in the centuries that followed.

| Characteristics | Values |

|---|---|

| Origins | Ancient civilizations, such as the Egyptians and Romans, had early forms of life insurance, with evidence of funeral funds and burial insurance. |

| Official Recognition | The first official life insurance company was established in 1762 in France, known as the "Societe d'Assurances sur la Vie." |

| Modern Era | The 19th century saw significant growth in life insurance, with the founding of numerous companies in the United States and Europe. |

| Innovation | In the late 19th and early 20th centuries, term life insurance and whole life insurance became popular, offering different coverage periods. |

| Global Expansion | Life insurance has become a global industry, with companies operating across countries and providing various products to meet diverse needs. |

| Technological Advancements | Modern technology has transformed the industry, allowing for online applications, digital policy documents, and improved risk assessment methods. |

| Regulatory Framework | Governments and financial authorities have implemented regulations to ensure fair practices, protect consumers, and maintain the stability of the life insurance market. |

| Market Trends | The industry is witnessing a shift towards index-linked life insurance, variable life insurance, and enhanced whole life policies. |

| Customer Focus | Companies are increasingly focusing on personalized services, customer engagement, and providing financial planning advice. |

| Future Outlook | The life insurance industry is expected to adapt to changing demographics, technological advancements, and evolving customer preferences. |

What You'll Learn

- Ancient Origins: Life insurance's roots trace back to ancient civilizations like Rome and China, where early forms of insurance emerged

- Medieval Europe: The concept of assurance gained traction in medieval Europe, with early life insurance-like practices emerging in the 14th century

- th Century: The 17th century saw the emergence of formal life insurance companies in Europe, marking a significant milestone in the industry's development

- Life Offices: The 18th century witnessed the establishment of life offices, which focused on providing financial security for individuals and families

- Modern Era: The 19th and 20th centuries brought significant advancements, with modern life insurance companies and policies becoming widespread

Ancient Origins: Life insurance's roots trace back to ancient civilizations like Rome and China, where early forms of insurance emerged

The concept of life insurance, as we know it today, has its ancient origins in the practices of early civilizations, particularly in Rome and China. These societies laid the foundation for what would become a global industry, offering a glimpse into the enduring nature of human risk management and financial security.

In ancient Rome, the practice of providing financial protection against unforeseen events can be traced back to the 2nd century BC. The Romans established a system known as "mutua," which was a form of mutual insurance. It involved a group of individuals pooling their resources to provide financial support to those who faced unexpected losses, such as the death of a breadwinner. This early form of life insurance was a response to the economic challenges of the time, ensuring that families could maintain their financial stability in the face of adversity.

Similarly, ancient China developed its own unique approach to insurance. The Chinese philosopher Han Fei, in the 3rd century BC, introduced the idea of "life insurance" in a philosophical context. He proposed the concept of "life insurance" as a means to protect the interests of the state and its citizens. This idea was further developed by the Han Dynasty, who established a system called "shi," which provided financial support to families in the event of a deceased family member's death. The Chinese approach to insurance was highly structured, with specific regulations and laws governing the practice, ensuring its effectiveness and reliability.

These ancient civilizations' practices were groundbreaking, as they introduced the concept of sharing financial risks and providing security to individuals and their families. The mutual support systems in Rome and the structured insurance models in China were early attempts to address the economic and social impacts of death and loss. These ancient origins showcase the enduring human need for financial protection and the ingenuity of early societies in creating innovative solutions.

The development of life insurance in these ancient civilizations set the stage for its evolution and global adoption. Over time, the concept evolved and expanded, with various cultures and societies contributing to its growth. The ancient roots of life insurance demonstrate that the idea of financial security and risk management is not a modern invention but an ancient practice that has stood the test of time.

Understanding Permanent Life Insurance: A Comprehensive Definition

You may want to see also

Medieval Europe: The concept of assurance gained traction in medieval Europe, with early life insurance-like practices emerging in the 14th century

The concept of life insurance, or 'assurance' as it was known in medieval Europe, has its roots in the 14th century, marking a significant development in the history of financial security. This period saw the emergence of early life insurance-like practices, which laid the foundation for the modern insurance industry.

In medieval Europe, the idea of assurance was closely tied to the concept of mutual aid and community support. During this era, guilds and fraternities played a crucial role in providing financial security to their members. These organizations often offered protection against various risks, including death, by pooling the resources of their members. When a member passed away, the guild or fraternity would provide financial assistance to the deceased's family or dependents, ensuring a level of financial stability during times of grief. This practice was an early form of life insurance, where the collective risk was shared among the group.

The 14th century witnessed the rise of these early insurance-like systems, particularly in the context of religious guilds and fraternities. These groups were often formed around shared religious beliefs and provided a sense of community and support. By contributing a regular fee, members could ensure that their families would receive financial aid in the event of their death. This practice was especially prevalent in the Catholic Church, where religious orders and fraternities offered such assurances to their members.

One notable example of these early life insurance practices is the 'guild of the Holy Ghost' in 14th-century England. This guild, also known as the 'Brotherhood of the Holy Ghost,' was a mutual aid society that provided financial security to its members. By paying a weekly fee, members could ensure that their families would receive a lump sum payment upon their death. This guild-based system was an early instance of life insurance, where the principle of collective risk-sharing was applied.

The emergence of these life insurance-like practices in medieval Europe was a significant step towards modern insurance. It demonstrated the concept of mutual aid and the idea that a community could provide financial security to its members. These early systems laid the groundwork for the development of more formal insurance institutions, eventually leading to the establishment of life insurance companies and the diverse insurance market we know today.

Whole Life Insurance: Splitting Term Insurance for Long-term Gain

You may want to see also

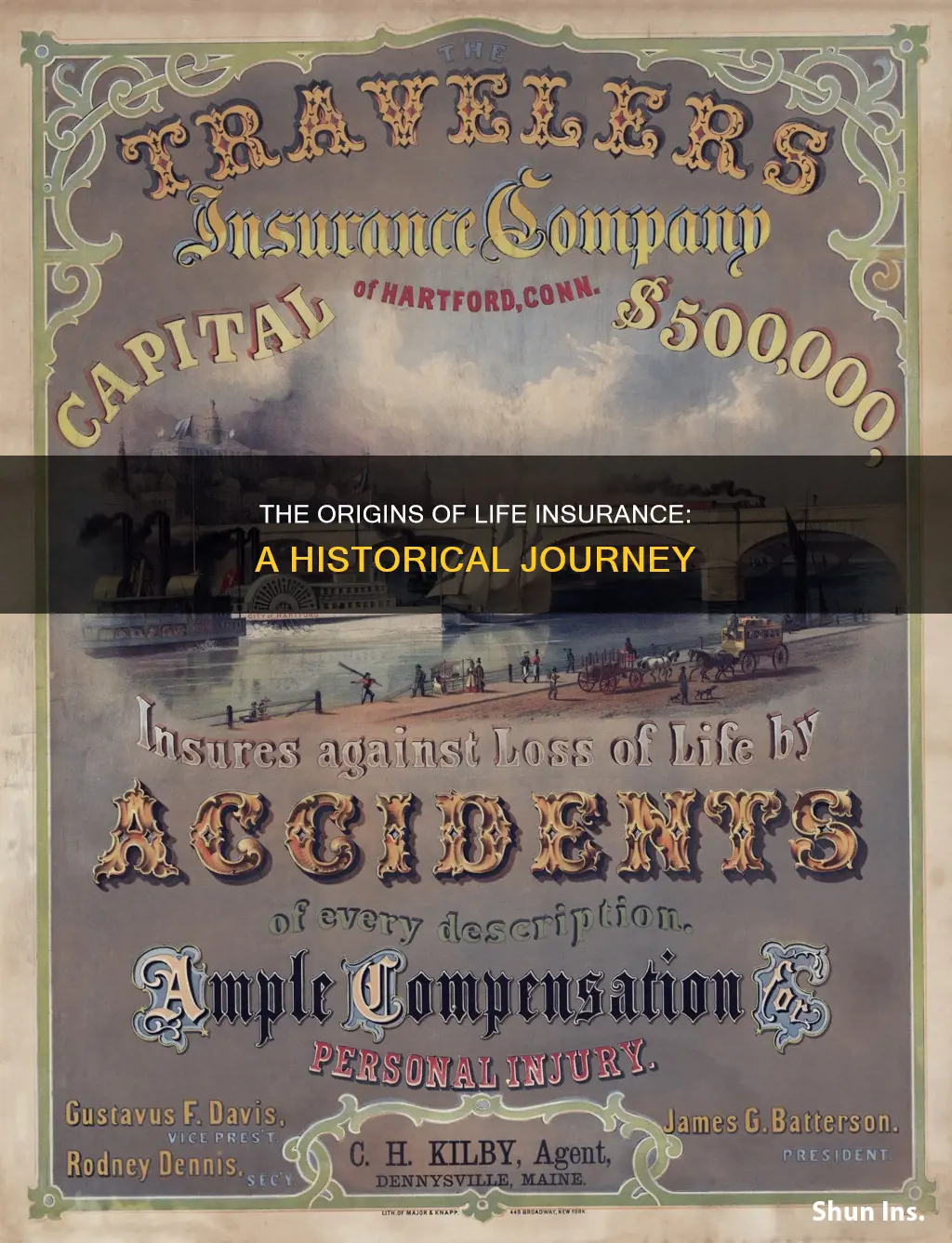

17th Century: The 17th century saw the emergence of formal life insurance companies in Europe, marking a significant milestone in the industry's development

The 17th century was a pivotal period in the evolution of life insurance, as it witnessed the establishment of the first formal life insurance companies in Europe. This era laid the foundation for the modern insurance industry, transforming the way people managed financial risks associated with death.

In the early 1600s, the concept of life insurance began to take shape in the form of mutual aid societies and friendly societies. These early organizations provided a sense of security and financial support to members in the event of death or illness. For instance, the 'Amicizia' in Venice, Italy, and the 'Bancassurance' in Amsterdam, Netherlands, were among the first such groups. They offered a form of insurance by pooling the resources of members to provide financial assistance to those who had contributed to the society.

However, it was in the mid-17th century that the idea of formal life insurance companies gained momentum. One of the earliest and most influential examples was the establishment of the 'Society for Equitable Assurances on Lives' in London, England, in 1688. This company, later known as the 'Equitable Life Assurance Society,' is considered a pioneer in the field. It introduced the concept of fixed-term insurance policies, where premiums were paid for a specific period, and the policyholder received a lump-sum payment upon death. This model provided a more structured and predictable form of insurance, marking a significant shift from the earlier mutual aid societies.

The emergence of these formal life insurance companies had a profound impact on society. It allowed individuals to plan for their families' financial well-being in the event of their untimely death. This was particularly important during a time when death was a constant presence, especially due to the frequent outbreaks of diseases and wars. The insurance provided a sense of security and peace of mind, knowing that one's loved ones would be financially protected.

The 17th century's developments in life insurance set the stage for the industry's rapid growth and diversification in the following centuries. It laid the groundwork for the establishment of insurance markets, regulatory frameworks, and the development of various insurance products. The formalization of life insurance companies during this period was a crucial step towards the sophisticated and global insurance industry we know today.

The Ultimate Guide to Understanding Blanket Life Insurance

You may want to see also

Life Offices: The 18th century witnessed the establishment of life offices, which focused on providing financial security for individuals and families

The 18th century marked a significant turning point in the history of financial security, as it saw the emergence of life offices, which laid the foundation for modern life insurance. These offices were instrumental in providing a sense of financial stability and peace of mind to individuals and their families during a time of great social and economic change.

Life offices, as the name suggests, were institutions dedicated to offering life insurance policies to the public. They were established with the primary goal of ensuring financial protection and support for the beneficiaries of the insured individual. This concept was revolutionary, as it allowed people to plan for the future and provide for their loved ones, even in the event of their untimely death. The 18th century was a period of rapid industrialization and urbanization, and life offices played a crucial role in addressing the financial concerns of a growing population.

These offices operated by collecting premiums from policyholders and using these funds to pay out death benefits to the designated beneficiaries when the insured individual passed away. The idea was to create a pool of resources that could be utilized to provide financial assistance during difficult times. Life offices often had a more localized focus, catering to the needs of specific communities or regions, which made them more accessible and relatable to the people they served.

The establishment of life offices during this era was a response to the increasing awareness of the financial risks associated with life's uncertainties. People began to recognize the importance of having a safety net, especially with the growing complexity of family structures and the rising costs of living. By the end of the 18th century, these offices had become a vital part of the financial landscape, offering a sense of security and stability to those who purchased their policies.

Over time, the life offices evolved and expanded their services, leading to the development of more comprehensive insurance products. This period laid the groundwork for the sophisticated insurance industry we know today, where life insurance has become a standard tool for risk management and financial planning. The 18th century's life offices were pioneers in the field, setting the stage for the industry's growth and its ability to provide financial security to millions of people worldwide.

Contract Fund Basics: Life Insurance Explained

You may want to see also

Modern Era: The 19th and 20th centuries brought significant advancements, with modern life insurance companies and policies becoming widespread

The 19th and 20th centuries marked a pivotal period in the evolution of life insurance, transforming it from a rudimentary concept to a widely recognized and essential financial tool. This era witnessed the emergence of modern life insurance companies and the establishment of standardized policies, making life insurance more accessible and reliable for the general public.

In the early 19th century, life insurance began to take shape as a formal institution. The first life insurance company in the United States, the New York Life Insurance Company, was founded in 1841. This company introduced the concept of term life insurance, offering coverage for a specific period, which was a significant departure from the traditional whole-life policies. The term life insurance provided a more affordable and flexible option, allowing individuals to secure their families' financial future for a defined duration. This innovation paved the way for the growth of the life insurance industry, as it catered to a broader range of customers.

As the century progressed, life insurance companies began to expand their operations and services. The introduction of mutual life insurance companies in the late 19th century was a notable development. These companies were owned by their policyholders, providing a more democratic and transparent approach to insurance. Mutual life insurance companies often offered lower premiums and better benefits, attracting a large customer base. The industry also saw the rise of specialized life insurance providers, catering to specific demographics or occupations, ensuring tailored coverage for diverse needs.

The 20th century brought further advancements, with the establishment of regulatory frameworks to govern the life insurance industry. Governments recognized the importance of consumer protection and introduced regulations to ensure fair practices. This era also saw the development of various types of life insurance policies, such as whole life, universal life, and variable life insurance, each offering unique features and benefits. The introduction of term life insurance with guaranteed death benefits and the ability to accumulate cash value made life insurance an attractive long-term financial investment.

During this period, life insurance companies also expanded their reach globally, adapting to different cultural and economic contexts. They tailored their products to meet the specific needs of various regions, making life insurance a universal financial security tool. The widespread adoption of modern life insurance policies and the establishment of reputable life insurance companies have contributed to the industry's stability and growth, ensuring that individuals and families can plan for the future with greater confidence.

Columbus Life Insurance: Is It a Good Choice?

You may want to see also

Frequently asked questions

The origins of modern life insurance can be traced back to the 17th century, with the establishment of the Amicable Society for a Perpetual Assurance Office in London, England, in 1706. This society is considered a pioneer in the field, offering a form of life insurance known as "perpetual assurance," which provided a lump-sum payment to the beneficiary upon the insured's death.

In ancient times, life insurance-like practices existed in various cultures. For instance, in ancient Rome, a practice called "decurions" involved wealthy individuals contributing to a fund to support the families of deceased soldiers. Similarly, in the Middle Ages, guilds in Europe provided financial support to the families of their members who died. These early forms laid the foundation for the development of formal life insurance systems.

The 19th century saw significant growth and evolution in life insurance. In the United States, the first life insurance company was founded in 1847, and by the end of the century, the industry had expanded rapidly. The introduction of the concept of "term life insurance" became popular, offering coverage for a specific period, often with lower premiums. This period also saw the rise of mutual or co-operative insurance companies, where policyholders owned the company and shared profits.

Yes, there are several milestones. In 1869, the first life insurance table, known as the "American Table," was published, providing a standardized way to calculate death rates and premiums. The 20th century brought advancements like the introduction of universal life insurance in the 1980s, offering flexibility in premium payments and death benefits. Additionally, the development of computer systems in the late 20th century revolutionized the industry, allowing for faster and more accurate processing of applications and claims.