Life insurance is a crucial financial safety net for your loved ones, and understanding the nuances of different policies is essential. While term life insurance offers temporary coverage for a specific period, whole life insurance provides permanent protection for your entire life. The question arises: can we split the limit of term insurance to extend it over our whole life? The answer is yes, and this process is known as laddering.

Laddering involves purchasing multiple term life insurance policies with different durations and amounts to match specific financial obligations. For instance, you can buy a 10-year, $500,000 term policy, a 20-year, $300,000 term policy, and a 30-year, $200,000 term policy. This strategy ensures that your loved ones receive the necessary financial support, with the payout amounts decreasing as your financial responsibilities change over time.

However, it's important to remember that life insurance companies typically cap the total amount of coverage based on your income, as it is designed to replace your earning power rather than significantly increase your beneficiaries' wealth. Additionally, while laddering can be cost-effective if your coverage needs remain constant, buying a single policy with adjustable coverage may be more suitable if your needs are unpredictable.

| Characteristics | Values |

|---|---|

| Number of policies | There is no limit to the number of life insurance policies you can have |

| Total amount of coverage | There is a limit to the total amount of coverage you can get. This limit is tied to your income or net worth. |

| Cost | Term life insurance is cheaper than whole life insurance. |

| Policy length | Term life insurance covers a set period of time, whereas whole life insurance covers your entire life. |

| Cash value | Term life insurance has no cash value, but whole life insurance has a cash value component that earns interest over time. |

| Death benefit | The death benefit from whole life insurance policies typically pays out whenever the policyholder dies. |

| Conversion | Some term life insurance policies can be converted to whole life insurance before the end of the term. |

What You'll Learn

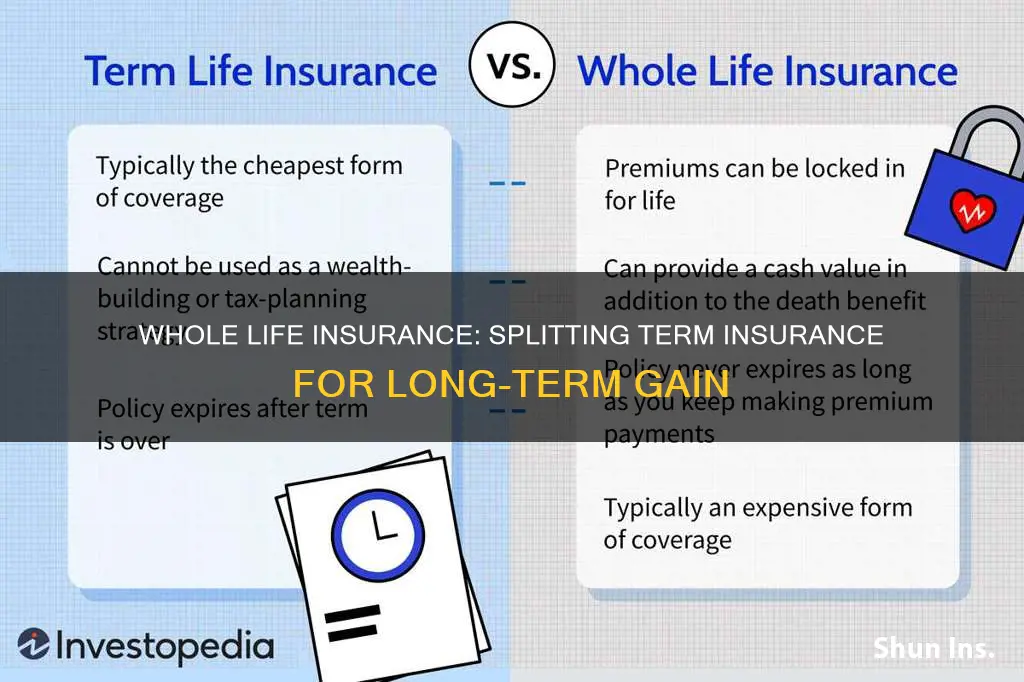

Term life insurance vs. whole life insurance

Term life insurance and whole life insurance are the two most common types of life insurance policies. While both offer financial protection for your loved ones when you pass away, there are some key differences between the two.

Term Life Insurance

Term life insurance provides coverage for a set period, typically between 10 and 30 years. If the policyholder passes away during this period, the beneficiary will receive a payout. Term life insurance is usually cheaper than whole life insurance because there is only a payout if the policyholder dies within the specified term. It is also customizable, allowing you to choose a term length that suits your unique situation, which can help reduce costs in the long run. This makes term life insurance a popular choice for young families who want lower premiums upfront and for seniors considering their long-term plans. However, one downside of term life insurance is that if you outlive the term, your coverage will end and you won't receive any benefits.

Whole Life Insurance

Whole life insurance, on the other hand, provides coverage for your entire life. It is typically more expensive than term life insurance because it serves as an investment. This investment, known as the cash value, grows tax-free over your lifetime. Whole life insurance premiums remain the same throughout the policy, and the death benefit is guaranteed. The cash value can be used in several ways, such as borrowing against it, using it to make premium payments, or surrendering the policy to supplement retirement income. Whole life insurance is a popular choice for those looking to maximize their financial potential. However, one disadvantage of whole life insurance is that you cannot choose the length of the policy.

The choice between term and whole life insurance depends on your financial goals, budget, and individual needs. Term life insurance is generally sufficient for most people, especially those who only need coverage for a specific period, such as while their children are still dependent on them. It is also a good option for those who want the most affordable coverage, as term life insurance usually has lower premiums, especially for young and healthy individuals.

On the other hand, whole life insurance may be a better choice if you want coverage that lasts your entire life, such as for end-of-life planning or if you have lifelong dependents. Whole life insurance is also a good option if you want life insurance that builds guaranteed cash value, which can provide greater financial flexibility. Additionally, consider consulting a financial professional to help you understand your options and make the best decision for your specific circumstances.

Whole Life Insurance: Joint Policies' Value Increase Explained

You may want to see also

The pros and cons of each

Pros of Converting Term Life Insurance to Whole Life Insurance

- You can obtain permanent coverage, often at a cheaper rate than if you purchased a new whole life policy when you’re older.

- Medical exams aren’t generally required when you convert term to whole life insurance.

- You may be able to obtain permanent coverage if you’ve developed a new health issue that could prevent you from qualifying in a standard underwriting process.

- You can build cash value over time. Each time you make a premium payment, a portion of it is invested and grows tax-free.

- You can have peace of mind knowing you can still provide for your loved ones when you pass away.

Cons of Converting Term Life Insurance to Whole Life Insurance

- You may have to add a conversion rider to your term policy, which could increase your term life premium.

- Your whole policy will cost more than your term policy once you convert.

- You may be limited in the types of policies you can convert to.

- You may have more options if you simply purchase a new policy.

Life Insurance and Synthetic Urine: What's the Verdict?

You may want to see also

When to choose term life insurance

Term life insurance is a good option if you only want coverage for a specific period of time. For example, if you're a new parent, you might take out a 20-year policy to cover you until your child is financially independent.

Term life insurance is also the most affordable option, especially if you're young and healthy. You can also choose the length of the term and the coverage amount, such as $500,000.

You might also opt for term life insurance if you think you might want permanent life insurance in the future but can't afford it right now. Many term life policies can be converted into permanent coverage at a later date, although the deadline for conversion varies by policy and not all policies offer this option.

Term life insurance is also a good choice if you don't want to use life insurance to accumulate cash value. Because term life insurance doesn't build cash value, you can save what you would have paid for a whole life policy and perhaps invest the money elsewhere.

However, if you can comfortably afford the higher premiums of whole life insurance, this might be a better option for you. Whole life insurance is a lifelong commitment, so you need to be sure you can afford it. Whole life insurance also offers coverage that essentially lasts your lifetime and has an added cash value component that earns interest over time.

Whole life insurance is a good option if you have a lifelong dependent, such as a child with disabilities. In this case, life insurance can fund a trust to provide care for your child after you're gone.

Whole life insurance is also a good choice if you want life insurance that builds guaranteed cash value. The cash value of whole life policies grows at a guaranteed rate set by the insurer.

Variable Life Insurance: Partial Surrender Possibilities

You may want to see also

When to choose whole life insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the insured person's life. It is more expensive than term life insurance, which only covers the insured person for a fixed period. Whole life insurance also has a cash value component, which grows over time and can be borrowed against or withdrawn.

- You have maxed out your retirement accounts: If you are a high-net-worth individual who has already maximised contributions to tax-advantaged accounts, such as 401(k) plans or individual retirement accounts, a whole life insurance policy can be used to supplement your savings. The cash value of the policy will grow over time, and you can surrender the policy for cash when you retire.

- You have a lifelong dependent: Whole life insurance typically provides coverage for the entirety of the insured person's life, making it a good option for those with lifelong dependents, such as a child with a disability. This ensures that your family has financial stability and can provide care for your dependent after you are gone.

- You want to help your family pay estate taxes: The cash value component of whole life insurance acts as a form of "forced savings". This can provide your loved ones with the money they need to pay estate taxes without dipping into other accounts.

- You want to diversify your investment portfolio: The cash value of whole life insurance grows at a set rate, providing dependable returns that are not subject to market volatility. This can be an attractive option for those seeking to diversify their investments and reduce risk.

- You want coverage for the rest of your life: Unlike term life insurance, which covers you for a specific period, whole life insurance provides coverage for your entire life. This can be beneficial if you want the peace of mind that comes with knowing you will always have coverage, regardless of how long you live.

- You want guaranteed cash value growth: The cash value of whole life insurance grows at a guaranteed, fixed rate set by the insurer. This predictable growth can be advantageous if you want to ensure a minimum level of returns.

It is important to note that whole life insurance may not be the best option for everyone. The high premiums associated with whole life insurance may be unaffordable for some, and the cash value may grow slowly, taking 10 to 15 years or more to build up enough value to borrow against. Additionally, the cash value rate of return can be low compared to other investments, and policyholders have limited control over their investment portfolio.

ETFs: A Viable Alternative to Life Insurance Policies?

You may want to see also

How to choose between the two

Term life insurance and whole life insurance are two different types of life insurance policies, and it's important to understand the differences between them before deciding which one is right for you. Here are some key points to consider when choosing between term and whole life insurance:

Length of Coverage:

- Term life insurance covers you for a specific period, typically 10, 20, or 30 years. It is ideal if you only want coverage for a certain period, such as while raising children or paying off a mortgage.

- Whole life insurance, on the other hand, provides coverage for your entire life, usually until you reach a specific age like 90, 100, or 120. It is a good choice if you want lifelong coverage, especially if you have lifelong dependents like children with special needs.

Cost:

- Term life insurance is generally the cheapest option and offers temporary coverage without building cash value. It is a good choice if you are looking for the most affordable coverage, especially when young and healthy.

- Whole life insurance premiums are significantly higher because the coverage lasts a lifetime and the policy grows in cash value. Consider whole life insurance if you can comfortably afford the higher premiums.

Cash Value:

- Term life insurance does not have a cash value component, so you cannot borrow against or cash out the policy.

- Whole life insurance has a cash value component that grows at a guaranteed rate set by the insurer. This can be useful if you want to borrow against the policy or surrender it for cash.

Conversion Options:

- Term life insurance policies may offer the option to convert to whole life insurance before the end of the term. This can be beneficial if your health has declined and you want to avoid medical underwriting.

- Whole life insurance policies are permanent and do not require conversion. They offer lifelong coverage as long as you continue paying the premiums.

Flexibility:

- Term life insurance provides flexibility in choosing the policy length and adjusting the coverage over time. It is a good choice if your coverage needs may change.

- Whole life insurance offers less flexibility in terms of policy length and adjustments. It is better suited for those who are certain about their long-term coverage needs.

Dependents and Beneficiaries:

- Term life insurance is suitable if you want coverage for a specific period to support dependents, such as children or a spouse who relies on your income.

- Whole life insurance is ideal if you want to leave an inheritance or fund a trust for a lifelong dependent, ensuring they are taken care of after you're gone.

In summary, term life insurance is sufficient for most families and individuals who want affordable, flexible coverage for a specific period. On the other hand, whole life insurance is a better option for those seeking lifelong coverage, cash value growth, and the ability to provide for lifelong dependents. Consider your financial situation, long-term goals, and the needs of your dependents when deciding between term and whole life insurance.

Life Insurance: Paid-Up Policies Explained

You may want to see also

Frequently asked questions

There is no limit to the number of life insurance policies you can have, but there is a limit to the total amount of coverage you can get. This limit is usually based on your income or net worth.

Yes, you can have multiple life insurance policies from different companies. However, it may be easier to manage them if they are from the same insurer.

There are several reasons why someone might want to have more than one life insurance policy. For example, they may want to supplement a permanent policy with a term policy, or they may need additional coverage for a specific period, such as when they have dependent children or a large mortgage.

Your financial needs, both current and future, should drive the number and type of policies you buy. Consult a financial professional to help you assess your needs and explore your options.

Some term life insurance policies can be converted to whole life insurance, but this depends on the specific policy and insurance company. Check your policy documents or contact your insurance provider to find out if this option is available to you.