As a newlywed, I was thrilled to start this new chapter of my life with my husband. However, as we delved into the details of our marriage, we realized the importance of planning for the future, especially in terms of financial security. One of the key decisions we made was to purchase life term insurance. My husband, being the responsible and thoughtful person he is, wanted to ensure that our family would be taken care of in the event of his untimely passing. He understood the value of having a financial safety net for our loved ones and wanted to provide that peace of mind. This decision was not just about the insurance policy itself, but also about the reassurance it brings to our relationship and the future we are building together.

What You'll Learn

- Financial Security: Life insurance ensures your spouse's financial well-being in case of death

- Debt Management: It helps cover debts and mortgage payments, providing stability

- Children's Future: Insurance funds education and future expenses for your children

- Medical Expenses: Covers unexpected medical costs, ensuring quality healthcare

- Peace of Mind: Knowing your family is protected brings emotional reassurance

Financial Security: Life insurance ensures your spouse's financial well-being in case of death

Life insurance is a crucial aspect of financial planning, especially when you are newly married. It provides a safety net and peace of mind, knowing that your spouse and family will be financially secure in the event of your untimely demise. When your husband expresses a desire for life term insurance, it is essential to understand the reasons behind this decision and the benefits it offers.

The primary purpose of life insurance is to provide financial security to your loved ones. In the event of your husband's death, the life insurance policy will pay out a lump sum amount, known as the death benefit, to your spouse. This financial cushion can help cover various expenses and ensure that your spouse is taken care of, especially if they are now solely responsible for the household and any dependent children. The death benefit can be used to pay off any outstanding debts, such as mortgages or loans, and provide a stable income for your spouse's daily living expenses.

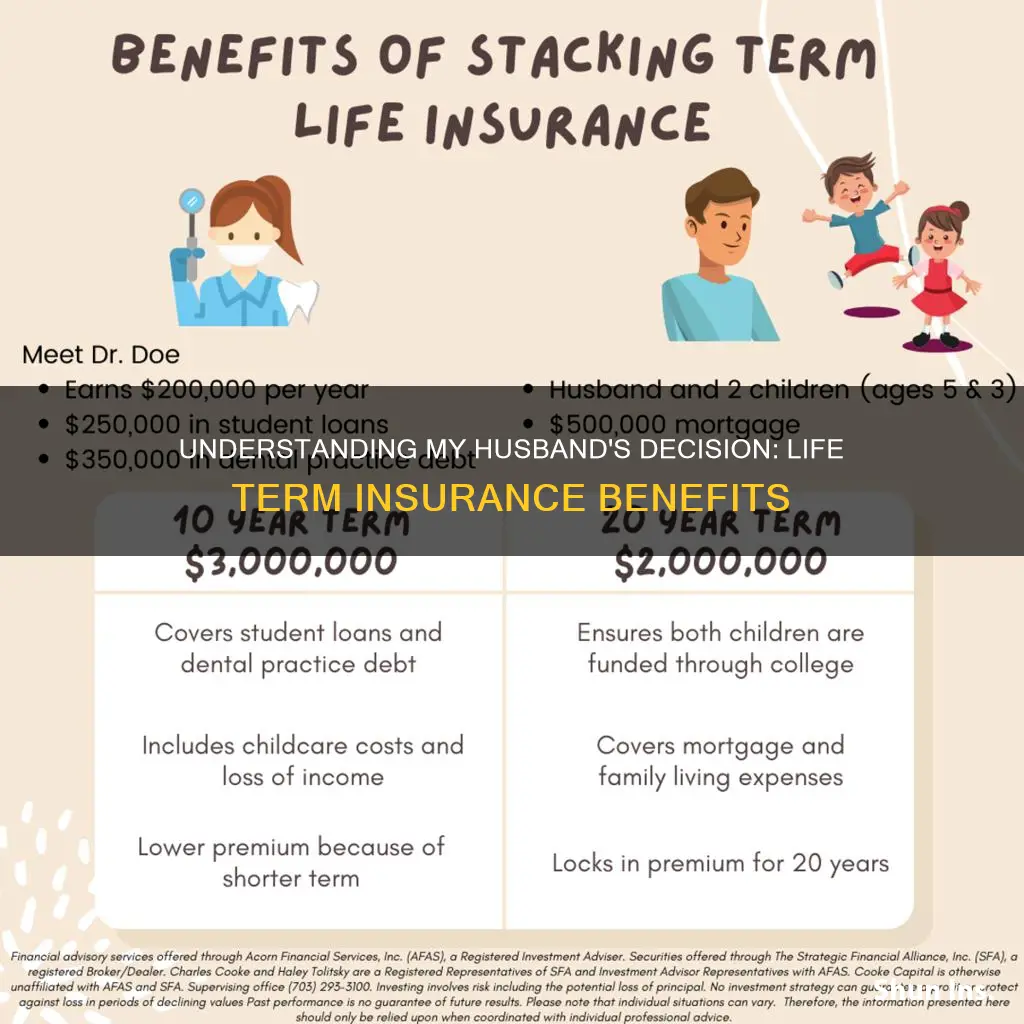

Term life insurance, in particular, offers a straightforward and cost-effective solution. It provides coverage for a specific period, typically 10, 20, or 30 years, and is often more affordable than permanent life insurance. During this term, the policy remains in force, and if your husband passes away within the covered period, the death benefit is paid out. This type of insurance is ideal for covering financial obligations that are expected to last for a certain duration, such as mortgage payments or children's education expenses.

Having life insurance can also help your spouse avoid the emotional and financial burden of dealing with complex financial matters during a difficult time. Without insurance, your spouse might struggle to navigate the legal and administrative processes required to settle your estate, which can be emotionally draining and time-consuming. The insurance company will typically handle the claims process, providing a swift and efficient resolution, ensuring that your spouse receives the financial support they need.

In summary, life term insurance is a valuable tool for ensuring your spouse's financial security and well-being. It provides a financial safety net, covers essential expenses, and offers peace of mind, knowing that your family will be protected even in the worst-case scenario. By understanding the importance of this insurance, you can support your husband's decision and take a proactive approach to safeguarding your family's future.

AMAC Life Insurance: What You Need to Know

You may want to see also

Debt Management: It helps cover debts and mortgage payments, providing stability

When considering life term insurance, it's important to understand the various aspects that can benefit you and your family, especially in the context of debt management and financial stability. One of the key advantages is its ability to cover debts and mortgage payments, ensuring that your loved ones are protected even in the event of your passing. This financial safety net can provide peace of mind, knowing that your family's financial obligations will be met, and your home will remain a secure asset for your spouse and any dependents.

In the event of your death, the life insurance policy will pay out a lump sum or regular payments to your beneficiaries. This financial support can be crucial for covering outstanding debts, such as credit card balances, personal loans, or any other financial commitments you may have. By having this insurance, your spouse can avoid the stress of dealing with debt collectors and focus on grieving and moving forward with their life. Moreover, it ensures that the mortgage payments are covered, preventing the risk of foreclosure, which can be a devastating consequence of financial loss.

The stability provided by life term insurance is particularly beneficial for long-term financial planning. It allows your spouse to maintain their current standard of living and provides the means to continue making mortgage payments, ensuring the family home remains a secure and comfortable residence. This financial security can also enable your spouse to make necessary lifestyle adjustments, such as returning to the workforce or pursuing further education, to support the family and manage the household effectively.

Additionally, the insurance policy can be structured to align with your family's specific needs. For instance, you can choose the amount of coverage that best suits your financial obligations and the number of years you wish to ensure coverage for. This flexibility ensures that the insurance policy is tailored to your unique circumstances, providing the most relevant and valuable protection.

In summary, life term insurance is a valuable tool for debt management and financial stability. It offers a comprehensive solution to cover debts and mortgage payments, providing peace of mind and a secure future for your loved ones. By understanding the benefits and customizing the policy to your needs, you can make an informed decision that will benefit your family in the long term.

Navigating Life Insurance After Unemployment: Your Essential Guide

You may want to see also

Children's Future: Insurance funds education and future expenses for your children

When considering life insurance, especially in the context of a new marriage, it's essential to explore the various reasons why your husband might want to secure this financial protection. One crucial aspect often overlooked is the long-term financial security it provides for your children's future. Here's how insurance can be a valuable tool in funding their education and covering future expenses:

Education Funding: One of the most significant expenses a family might face is the cost of education. From primary school to university, and even beyond for further studies, the financial burden can be substantial. By taking out a life insurance policy, your husband can ensure that a dedicated fund is set aside for your children's education. This financial safety net can cover school fees, textbooks, and other educational resources, ensuring that your children's academic journey remains uninterrupted.

Future Expenses: Life insurance doesn't just provide financial security during the policyholder's lifetime; it also offers a safety net for future expenses. As your children grow, they may require financial support for various milestones. This could include marriage funds, down payments for a house, or even starting their own businesses. With a life insurance policy in place, the proceeds can be utilized to cover these significant life events, ensuring your children have the financial means to make important decisions without incurring substantial debt.

Peace of Mind: Perhaps the most valuable aspect of life insurance is the peace of mind it provides. Knowing that your family's financial future is protected can reduce stress and anxiety. This security allows your husband to focus on building a life with you, confident that his family will be taken care of if anything were to happen to him. It's a way to ensure that your children's needs are met, even in the event of the unthinkable.

In summary, life insurance is not just about providing financial security for your husband during his lifetime; it's also a powerful tool for securing your children's future. By allocating funds for education and future expenses, you can ensure that your children have the resources they need to pursue their dreams and build successful lives. It's a thoughtful and responsible step that demonstrates a commitment to your family's well-being.

Understanding Life Insurance: Commission Breakdown for $1,000,000 Policies

You may want to see also

Medical Expenses: Covers unexpected medical costs, ensuring quality healthcare

When it comes to the topic of life insurance, especially term life insurance, it's important to understand the various benefits it can provide, particularly in the context of covering medical expenses. Your new husband's interest in this type of insurance is likely driven by a desire to ensure financial security for your family, especially in the event of unforeseen medical emergencies. Here's a detailed look at how medical expenses coverage fits into the picture:

Medical emergencies can be financially devastating, and having a safety net in place is crucial. Term life insurance offers a comprehensive solution by providing a lump sum payment, known as a death benefit, to your beneficiaries upon your passing. This benefit can be utilized to cover a wide range of medical expenses, including hospital stays, surgeries, emergency treatments, and even long-term care. By having this financial cushion, your family can focus on your health and recovery without the added stress of financial burdens.

The beauty of term life insurance is its simplicity and affordability. It provides a fixed period of coverage, typically 10, 20, or 30 years, during which the premiums remain consistent. This predictability allows your husband to plan and budget effectively, ensuring that the insurance remains a priority in your financial plan. Moreover, the coverage amount can be tailored to your family's needs, ensuring that the financial impact of medical expenses is minimized.

In the event of a medical emergency, the funds from the life insurance policy can be a game-changer. It allows you to access the best healthcare without worrying about the cost. Whether it's a routine procedure or a complex surgery, the insurance payout can cover the expenses, ensuring you receive the necessary treatment. This is particularly important in cases where medical bills can quickly accumulate, and having the financial means to address them promptly is essential.

Additionally, term life insurance provides peace of mind, knowing that your family is protected. It ensures that your loved ones are financially secure, even if you are no longer around. This aspect of the insurance is often overlooked but is a powerful motivator for many individuals to consider it. By covering medical expenses, the insurance empowers your family to make decisions based on your health and well-being, rather than financial constraints.

In summary, your husband's interest in term life insurance is a thoughtful consideration for your family's future. The medical expenses coverage aspect ensures that you have the financial means to access quality healthcare when needed. It provides a sense of security and enables your family to navigate medical emergencies with the support and resources required. This type of insurance is a valuable tool in managing financial risks and ensuring a brighter, healthier future for your loved ones.

Finding the Right Life Insurance: A Comprehensive Guide

You may want to see also

Peace of Mind: Knowing your family is protected brings emotional reassurance

The decision to purchase life insurance is a significant one, especially when it comes to ensuring the financial security of your loved ones. For a newlywed, the thought of providing for their spouse and family long-term can be a powerful motivator. This is particularly true when considering life term insurance, a policy that offers coverage for a specific period, typically the duration of a mortgage or until a child's education is funded.

One of the primary benefits of life term insurance is the peace of mind it provides. Knowing that your family will be financially secure in the event of your untimely death can be incredibly reassuring. This type of insurance ensures that your loved ones will have a steady income to cover essential expenses, such as mortgage payments, utility bills, and daily living costs. It also provides funds for unexpected expenses, such as medical bills or funeral costs, which can be a significant burden without proper financial planning.

The emotional reassurance of knowing your family is protected is a powerful incentive. It allows you to focus on building a life together without constantly worrying about the financial implications of your death. This peace of mind can foster a deeper sense of security and trust in your relationship, knowing that you've taken proactive steps to safeguard your loved ones' future.

Moreover, life term insurance can be a valuable tool for long-term financial planning. It provides a structured approach to saving, allowing you to build a substantial financial cushion over time. This can be particularly useful if you're planning to start a family or have other long-term financial goals, such as purchasing a home or funding your children's education.

In summary, the decision to purchase life term insurance is a thoughtful and responsible choice. It offers peace of mind, ensuring that your family will be financially secure in the event of your death. This emotional reassurance can strengthen your relationship and provide a solid foundation for building a future together. By taking this step, you're not only protecting your loved ones but also demonstrating your commitment to their well-being and financial stability.

Employee Life Insurance: Tax Implications When Paid by Employer

You may want to see also

Frequently asked questions

Life term insurance is a type of coverage that provides financial protection for a specific period, typically the duration of your marriage. It ensures that your spouse has a financial safety net during the years you are together, especially if you were the primary breadwinner. This policy can cover various expenses, such as mortgage payments, children's education, or daily living costs, should the unthinkable happen and you were to pass away during the policy term.

This insurance policy is designed to provide financial security to your loved ones in the event of your untimely death. The death benefit, which is the amount paid out by the insurance company, can be used to cover funeral expenses, outstanding debts, or any other financial obligations you may have left behind. It ensures that your family can maintain their standard of living and have the financial resources to cover essential costs, even if you are no longer there to provide for them.

Term life insurance is generally more affordable and offers a higher death benefit compared to permanent life insurance. It is a straightforward and cost-effective way to secure financial protection for a specific period. Unlike permanent policies, term insurance does not accumulate cash value, making it a pure protection tool. This simplicity and focus on providing coverage for a defined term make it an attractive choice for those seeking an affordable way to protect their loved ones.

Yes, many term life insurance policies offer the option to convert them into a permanent life insurance policy, such as whole life or universal life, at a later stage. This conversion privilege allows you to switch to a policy with additional features, like cash value accumulation, which can be useful for long-term financial planning. It provides flexibility, ensuring that your insurance coverage can adapt to your changing needs and financial goals over time.