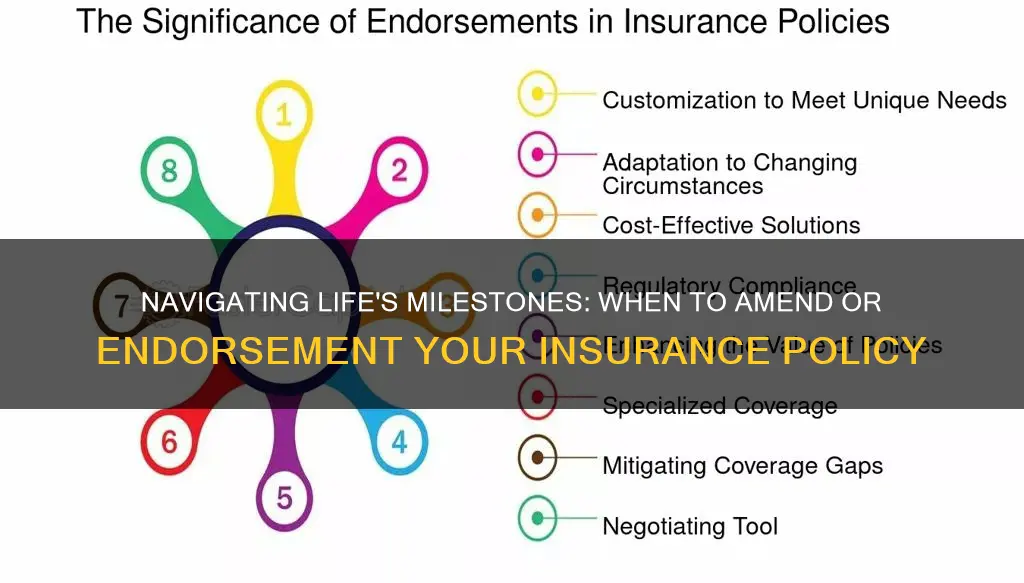

When it comes to life insurance, understanding the nuances between amending and endorsing your policy is crucial. Amending a life insurance policy typically involves making changes to the existing coverage, such as adjusting the death benefit, adding or removing beneficiaries, or modifying the policy's terms and conditions. This process is often necessary when your circumstances change, such as getting married, having a child, or purchasing a new home. On the other hand, endorsing a life insurance policy usually refers to adding riders or riders to the policy, which can provide additional coverage for specific events like critical illness, accidental death, or long-term care. Endorsements can enhance the policy's benefits and provide extra financial protection for you and your loved ones. Knowing when to amend or endorse your life insurance policy is essential to ensure that your coverage remains appropriate and effective throughout your life's various stages.

What You'll Learn

- Policy Review: Regularly assess your insurance needs and adjust coverage accordingly

- Life Changes: Major life events like marriage or divorce warrant policy adjustments

- Financial Goals: Align insurance with financial objectives, such as retirement or education

- Health Improvements: Enhanced health may lead to lower premiums; review and adjust

- Market Trends: Stay informed about industry changes to make informed endorsement decisions

Policy Review: Regularly assess your insurance needs and adjust coverage accordingly

Regular policy reviews are an essential part of maintaining and optimizing your life insurance coverage. Life is a dynamic journey, and your insurance needs can change over time. It's crucial to periodically assess your circumstances and ensure that your insurance policies reflect your current situation accurately. Here's a guide to help you navigate the process of reviewing and adjusting your life insurance:

Life Changes and Insurance Needs: Life events such as marriage, the birth of a child, purchasing a home, or significant career advancements can significantly impact your insurance requirements. For instance, becoming a parent might necessitate increasing your coverage to protect your family's financial future. Similarly, a promotion or a substantial increase in income could warrant a review to ensure your insurance benefits align with your new financial status. These life changes often require a re-evaluation of your policy to provide adequate protection.

Reviewing Policy Documents: Start by thoroughly examining your insurance policy documents. Understand the terms, conditions, and coverage limits. Identify any gaps or areas where your current coverage might not meet your needs. Look for any policy riders or optional benefits that you may have added and assess their relevance to your current situation. This process will help you make informed decisions about potential amendments or endorsements.

Assess Your Current Coverage: Evaluate your existing coverage limits and compare them to your current financial obligations and goals. Consider factors such as mortgage payments, children's education expenses, income replacement needs, and other financial commitments. If your financial responsibilities have increased, you may need to increase your death benefit or adjust other policy features to ensure your loved ones are adequately protected.

Adjustments and Endorsements: Based on your review, you might decide to make changes to your policy. Endorsements can be added to an existing policy to enhance its coverage. For example, you could endorse a term life insurance policy to convert it into a permanent life insurance plan. Alternatively, you may choose to amend the policy by increasing or decreasing the coverage amount, changing the policy term, or adding or removing riders. It's essential to consult with your insurance provider or a financial advisor to understand the options available and the potential impact of these changes.

Regular Review Schedule: Establish a routine for policy reviews. Annually or whenever significant life events occur, schedule a comprehensive review of your insurance portfolio. This practice ensures that your coverage remains relevant and effective throughout your life's various stages. Regular reviews also provide an opportunity to take advantage of any new policy features or benefits introduced by your insurance company.

By actively reviewing and adjusting your life insurance policies, you can ensure that you have the right level of protection when it matters most. It empowers you to make informed decisions about your financial security and provides peace of mind, knowing that your loved ones are safeguarded against life's uncertainties. Remember, insurance is a long-term commitment, and staying proactive in managing your policies is a key aspect of a successful financial strategy.

Understanding UTMA: A Comprehensive Guide to Life Insurance

You may want to see also

Life Changes: Major life events like marriage or divorce warrant policy adjustments

When significant life events occur, such as getting married or divorced, it's crucial to review and potentially adjust your life insurance policy to ensure it aligns with your current circumstances and needs. These major life changes can have a substantial impact on your financial situation and the coverage you require, making policy adjustments essential.

Marriage, for instance, often brings about a series of financial and lifestyle changes. You may now be responsible for supporting a new family member, and your income and expenses might increase. It's a good idea to reassess your insurance needs to ensure that your policy provides adequate coverage for your new family. You might consider increasing the policy amount or adjusting the beneficiaries to include your spouse and any children. This way, you can ensure that your loved ones are financially protected in the event of your untimely demise.

Divorce, on the other hand, can also trigger a need for policy changes. After a divorce, your financial obligations and lifestyle may have shifted, and you might no longer need the same level of coverage as when you were married. Reviewing your policy and making the necessary amendments can help you avoid over-insuring yourself. This could involve reducing the policy amount or even canceling the insurance if your ex-spouse is no longer a beneficiary. It's important to stay updated on these changes to avoid any potential financial complications.

In both cases, it's advisable to consult with a financial advisor or insurance professional who can provide personalized guidance. They can help you navigate the process of amending or endorsing your policy, ensuring that the changes reflect your current life situation accurately. Regularly reviewing and updating your life insurance policy is a proactive approach to financial planning, allowing you to adapt to life's twists and turns while maintaining the necessary protection for your loved ones.

Understanding Whole Life and Group Life Insurance: A Comprehensive Guide

You may want to see also

Financial Goals: Align insurance with financial objectives, such as retirement or education

When it comes to insurance, aligning your coverage with your financial goals is crucial for a secure future. Here's how you can strategically use insurance to support your long-term financial objectives:

Retirement Planning: Insurance can play a vital role in ensuring a comfortable retirement. Consider the following:

- Pension Plans: If you have a pension plan, review your insurance coverage within this context. Ensure that your pension provider offers insurance benefits, such as guaranteed income riders, which can provide a steady stream of income during retirement.

- Long-Term Care: As you age, long-term care insurance becomes essential. This type of insurance can cover medical expenses and daily living costs, allowing you to maintain your independence and financial stability in retirement.

- Investment-Linked Insurance: Some insurance companies offer investment-linked policies that grow your money over time. These policies can be a valuable tool for retirement savings, providing potential returns that can outpace traditional savings accounts.

Education Funding: Insurance can also be a powerful tool for saving for your children's or grandchildren's education.

- Education Savings Plans: Look for insurance products specifically designed for education funding. These plans often offer tax advantages and investment options tailored to long-term educational goals.

- Endowments and Trust Accounts: Insurance companies may provide endowment policies or trust accounts that accumulate value over time. These can be structured to pay out a lump sum or regular income for educational expenses.

Financial Security for Dependents: Protecting your loved ones' financial future is a critical aspect of insurance.

- Life Insurance for Dependents: Ensure that your life insurance policy provides sufficient coverage to support your family's lifestyle and financial needs if something happens to you. This includes covering daily expenses, mortgage or rent payments, and future education costs.

- Income Replacement: Consider term life insurance, which offers a death benefit to your beneficiaries for a specified period. This can replace lost income and provide financial security during the working years.

Regular Review and Adjustment: Insurance needs and financial goals evolve over time. It's essential to periodically review your insurance policies and make adjustments as necessary. Life events like marriages, births, or significant financial milestones may trigger the need for policy amendments. Endorsing or amending your insurance can ensure that your coverage remains relevant and aligned with your current financial situation and objectives.

By strategically utilizing insurance products and regularly reviewing your coverage, you can effectively align your insurance with your financial goals, ensuring a more secure and prosperous future. Remember, insurance is a powerful tool to manage risk and protect your financial well-being.

Life Insurance Options for Antidepressant Users: AARP's Policy

You may want to see also

Health Improvements: Enhanced health may lead to lower premiums; review and adjust

When it comes to life insurance, maintaining a healthy lifestyle can significantly impact your policy and potentially lead to lower premiums. Here's a guide on how enhanced health can influence your insurance journey and what actions you should take:

Understanding the Connection:

Improved health often translates to a reduced risk for insurance providers. Lowering your risk profile can result in more favorable terms and potentially lower premiums. For instance, maintaining a healthy weight, regular exercise, and managing pre-existing health conditions can all contribute to a healthier overall assessment. This is especially relevant for term life insurance, where health factors play a crucial role in determining eligibility and rates.

Taking Action:

- Regular Health Check-ups: Schedule routine medical check-ups to monitor your health. This proactive approach allows you to identify and manage any potential health issues early on. By maintaining a healthy status, you can ensure that your insurance policy reflects your current risk level accurately.

- Lifestyle Changes: Embrace a healthier lifestyle by incorporating regular exercise, a balanced diet, and stress management techniques. These changes can lead to improved overall health, potentially lowering your blood pressure, cholesterol levels, and other risk factors associated with life insurance.

- Manage Pre-existing Conditions: If you have existing health issues, consistent management is key. Keep your medical providers informed and follow their recommendations. Regular monitoring and treatment can demonstrate stability and potentially lead to better insurance terms.

Review and Adjust:

Periodically reviewing your life insurance policy is essential, especially when it comes to health improvements. Here's how you can navigate this process:

- Policy Review: Request a policy review from your insurance provider. This review will assess your current health status and determine if any adjustments are necessary. It's an opportunity to highlight any health achievements and discuss potential premium reductions.

- Documentation: Gather and provide updated medical records, including any recent health assessments or test results. This documentation will support your claim for improved health and help insurance companies make informed decisions.

- Negotiate and Adjust: If you've made significant health improvements, you may be entitled to lower premiums or even policy endorsements. Discuss these options with your insurance agent and negotiate any necessary changes to ensure your policy accurately reflects your current situation.

Remember, maintaining a healthy lifestyle is a long-term investment in your well-being and your life insurance policy. By taking proactive steps and staying informed, you can ensure that your insurance coverage remains relevant and cost-effective as your health improves. Regular reviews and open communication with your insurance provider will help you navigate the process smoothly.

Variable Life Insurance: Loan Provisions and Their Benefits

You may want to see also

Market Trends: Stay informed about industry changes to make informed endorsement decisions

Staying abreast of market trends and industry changes is crucial for making informed decisions when it comes to life insurance endorsements. The life insurance market is dynamic, with constant shifts in regulations, product offerings, and consumer preferences. Keeping yourself updated ensures that your endorsements are timely, relevant, and aligned with the evolving landscape.

One of the primary reasons to stay informed is the impact of regulatory changes. Insurance regulators frequently update policies and guidelines, which can affect the terms and conditions of life insurance policies. For instance, changes in underwriting guidelines might influence the eligibility criteria for certain endorsements, such as adding a rider for critical illness coverage. By keeping track of these updates, you can ensure that your endorsements comply with the latest regulations, avoiding potential issues during claim settlements.

Market trends also reveal shifts in consumer behavior and preferences. As customer awareness and sophistication grow, they demand more personalized and tailored insurance solutions. Endorsing a policy with features that cater to the current market demand can enhance customer satisfaction and loyalty. For example, there might be a growing trend towards incorporating wellness programs or lifestyle-based incentives into life insurance policies, allowing for endorsements that encourage healthy living or provide additional benefits for policyholders who actively participate in these programs.

Additionally, industry changes often lead to the introduction of new products or modifications to existing ones. Insurance companies frequently update their portfolios to meet evolving needs. Staying informed allows you to identify these changes and determine if they align with your clients' goals. For instance, a new term life insurance product with a simplified underwriting process might be more appealing to a specific demographic, and endorsing it could be a strategic move to attract and retain customers.

In summary, keeping up with market trends is essential for making informed endorsement decisions in the life insurance industry. Regulatory changes, evolving consumer preferences, and industry innovations all play a role in shaping the market. By staying informed, you can ensure that your endorsements are timely, compliant, and tailored to meet the needs of your clients, ultimately contributing to their financial security and your business success.

Best Term Life Insurance: AM Ratings and Reviews

You may want to see also

Frequently asked questions

Amending your life insurance policy is a significant decision and should be considered when there are substantial changes in your life that may impact your coverage. Common reasons for making amendments include getting married or divorced, having children, purchasing a home, or experiencing a significant health change. It's essential to review your policy regularly to ensure it aligns with your current circumstances and needs.

Amending your policy can provide several advantages. Firstly, it allows you to increase or decrease the coverage amount based on your evolving financial situation and risk factors. For instance, you might want to enhance your coverage if you've recently started a new, high-risk job or if your family's financial responsibilities have grown. Additionally, amendments can help update the policy to reflect changes in your health, occupation, or lifestyle, ensuring that your insurance remains relevant and beneficial.

It is recommended to review your life insurance policy annually or whenever there are significant life events. These events could include getting married, having a child, changing jobs, purchasing a home, or experiencing a major health issue. Regular reviews ensure that your policy remains up-to-date and tailored to your current needs, providing adequate coverage during life's unpredictable changes.

The process of amending a life insurance policy may involve certain fees, but these can vary depending on the insurance company and the specific changes being made. Typically, there are no penalties for adjusting the coverage amount, but there might be charges for adding or removing riders, changing the policy term, or making other modifications. It's advisable to consult your insurance provider to understand the potential costs associated with the amendments you wish to make.