Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their loved ones. When considering the biggest life insurance coverage a person can have, it's important to understand that the term biggest can be interpreted in various ways. Some may view it as the highest monetary value, while others might prioritize the coverage that best aligns with their unique needs and circumstances. This introduction aims to explore the different aspects of life insurance, including the various factors that influence the determination of the biggest policy, such as age, health, lifestyle, and financial goals. By delving into these considerations, we can gain a comprehensive understanding of how to choose the most suitable life insurance coverage for an individual's specific situation.

What You'll Learn

- Maximum Coverage Limits: Understanding the highest payout available in life insurance policies

- Policy Types and Payouts: Exploring different policy types and their potential death benefits

- Age and Health Factors: How age and health impact the maximum insurance coverage

- Wealth Transfer and Estate Planning: Life insurance as a tool for wealth transfer and estate planning

- Regulatory Limits and Variations: Understanding legal and industry-specific limits on life insurance amounts

Maximum Coverage Limits: Understanding the highest payout available in life insurance policies

The concept of maximum coverage limits in life insurance is an essential aspect of financial planning, especially for those seeking comprehensive protection for their loved ones. When considering the biggest life insurance policy one can have, it's crucial to understand the factors that determine the highest payout and how to maximize coverage.

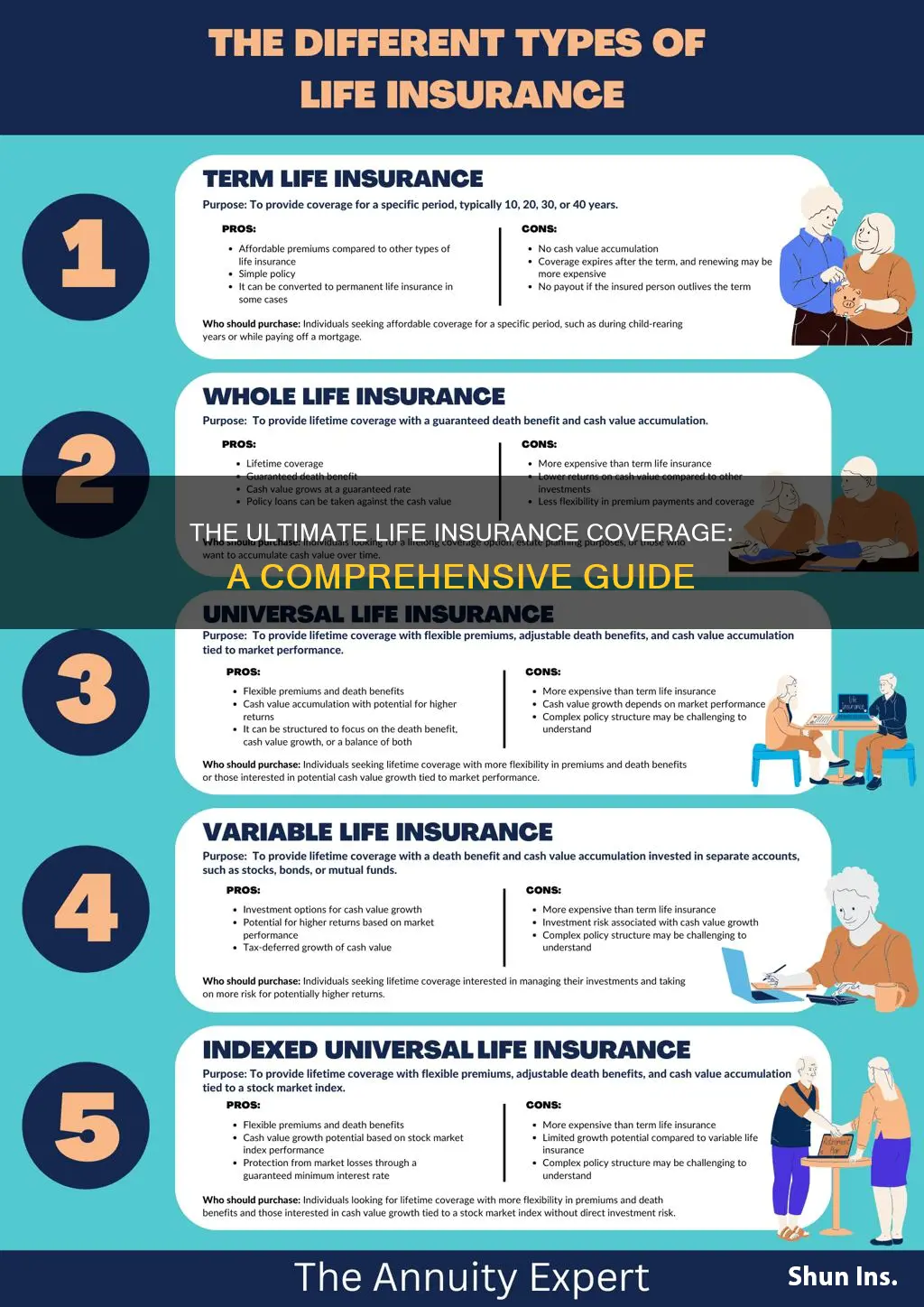

Life insurance policies typically offer a range of coverage options, and the maximum payout is often a significant consideration for individuals and families. The highest payout available can vary widely depending on several factors, including the type of policy, the insurer, and the individual's personal circumstances. Term life insurance, for instance, provides coverage for a specified period, and the payout is determined by the policy's term length and the insured individual's life. On the other hand, whole life insurance offers lifelong coverage, and the maximum payout is often tied to the policy's cash value accumulation over time.

One of the primary factors influencing the maximum coverage limit is the insured's age. Younger individuals often qualify for higher coverage amounts due to their longer life expectancy. As people age, the risk of death increases, and insurers may impose higher premiums and lower coverage limits. Additionally, the insured's health and medical history play a vital role. Insurers may offer higher payouts for individuals with excellent health, while those with pre-existing conditions might face limitations or higher costs.

Another critical aspect is the policy's type and features. Term life insurance, as mentioned earlier, provides straightforward coverage for a set period, making it ideal for specific needs. In contrast, permanent life insurance, such as whole life or universal life, offers lifelong coverage and additional benefits like cash value accumulation. These policies often have higher maximum payout potential due to their long-term nature and the insurer's obligation to pay out over the insured's entire life.

To maximize coverage and ensure the highest payout, individuals should carefully evaluate their insurance options. Consulting with financial advisors or insurance professionals can provide valuable insights into choosing the right policy. Understanding the maximum coverage limits and exploring various policy types will enable individuals to make informed decisions, ensuring their loved ones are adequately protected in the event of their passing.

Delay Clauses: Understanding Life Insurance Policies Better

You may want to see also

Policy Types and Payouts: Exploring different policy types and their potential death benefits

When considering the maximum life insurance coverage one can obtain, it's essential to delve into the various policy types and their associated death benefits. Life insurance policies come in different forms, each with its own unique features and payout structures. Understanding these variations is crucial for individuals seeking to maximize their insurance coverage and ensure their loved ones are financially protected.

One common type of policy is the term life insurance. This policy provides coverage for a specified period, often ranging from 10 to 30 years. The death benefit, or the amount paid out upon the insured's passing, remains fixed for the term duration. Term life insurance is known for its simplicity and affordability, making it an attractive option for those seeking temporary coverage. For instance, a 30-year term policy with a $500,000 death benefit would pay out that exact amount if the insured were to pass away during the 30-year period.

Whole life insurance, on the other hand, offers permanent coverage and a guaranteed death benefit. This policy type accumulates cash value over time, providing a double benefit. The death benefit in whole life insurance is typically equal to the total cash value accumulated, which grows at a fixed interest rate. This type of policy is more expensive than term life but offers lifelong coverage and a potential investment component. For example, a whole life policy with a $1 million death benefit could provide that exact amount to beneficiaries, ensuring financial security for an extended period.

Universal life insurance provides flexibility in both premiums and death benefits. Policyholders can adjust the death benefit over time, allowing for potential increases or decreases based on their needs. This policy type also accumulates cash value, which can be borrowed against or used to pay premiums. Universal life insurance offers a high degree of customization, making it suitable for those who want control over their coverage. For instance, a policyholder might start with a $500,000 death benefit and later increase it to $1 million if their financial situation improves.

In addition to these traditional policies, some insurance companies offer guaranteed issue life insurance, which provides coverage without a medical examination. However, the death benefit is often lower, and premiums may be higher due to the increased risk. These policies are designed for individuals who may have difficulty qualifying for standard life insurance.

Understanding the different policy types and their death benefits is crucial for making informed decisions about life insurance. By exploring options like term, whole, and universal life insurance, individuals can tailor their coverage to meet their specific needs and maximize their financial protection. It is always advisable to consult with a financial advisor or insurance professional to determine the most suitable policy type and coverage amount based on personal circumstances.

Employee-Funded Term Life Insurance: A Cost-Effective Way to Protect Your Family

You may want to see also

Age and Health Factors: How age and health impact the maximum insurance coverage

Age and health are critical factors that significantly influence the maximum life insurance coverage an individual can obtain. As one ages, the risk of developing health issues increases, which can directly impact the insurance company's assessment of the insured's health and, consequently, the insurance premium and coverage limits. Generally, younger individuals are considered lower-risk candidates for life insurance, as they have a longer life expectancy and are less likely to suffer from chronic illnesses or critical health conditions. Insurance companies often offer more competitive rates and higher coverage amounts to younger, healthier applicants.

For instance, a 30-year-old with no significant medical history and a healthy lifestyle may qualify for a substantial life insurance policy, sometimes even reaching millions of dollars in coverage. This is because the insurance company calculates the risk and potential payout based on the individual's age and overall health. Younger individuals have a higher chance of outliving the policy, thus justifying the higher coverage. In contrast, as individuals age, the risk of mortality and the likelihood of developing critical illnesses or conditions increase. This shift in health can lead to a decrease in the maximum insurance coverage available.

The impact of age on insurance coverage is evident in the premium rates. Older individuals often face higher premiums due to the increased risk associated with their age. Insurance companies may also impose medical underwriting, requiring a thorough review of the applicant's medical history and current health status. This process helps determine the extent of coverage and the premium rate. For instance, a 60-year-old with a history of heart disease or diabetes may be offered a lower coverage amount and higher premiums compared to a younger individual with similar coverage needs.

Additionally, an individual's health status plays a pivotal role in determining the maximum insurance coverage. Insurance companies assess the risk of insuring an individual based on their medical history, lifestyle choices, and current health conditions. A person with a history of smoking, obesity, or chronic illnesses may be considered a higher-risk candidate and may face limitations or higher costs for life insurance. In contrast, a healthy individual with no significant medical history is likely to secure more favorable terms and higher coverage limits.

Maintaining a healthy lifestyle can significantly impact the insurance coverage one can obtain. Regular exercise, a balanced diet, and avoiding harmful habits like smoking can improve overall health and potentially lead to better insurance rates and coverage. It is essential for individuals to be aware of their health status and take proactive measures to manage any existing conditions. This can help them secure the maximum insurance coverage available while also ensuring a healthier and more financially secure future.

Life Insurance and Depression: Can You Be Denied Coverage?

You may want to see also

Wealth Transfer and Estate Planning: Life insurance as a tool for wealth transfer and estate planning

Life insurance is a powerful financial tool that can significantly impact wealth transfer and estate planning strategies. When considering the "biggest life insurance" one can have, it's essential to understand its role in these areas. This type of insurance goes beyond providing financial security for loved ones; it becomes a strategic asset in managing and transferring wealth efficiently.

In the context of wealth transfer, life insurance can be a valuable mechanism to ensure that assets are distributed according to one's wishes. By utilizing life insurance policies, individuals can create a structured plan to pass on their wealth to beneficiaries, whether it's for education funds, business ventures, or retirement savings. The key advantage lies in the ability to control the distribution of assets, allowing for a more personalized and strategic approach to estate planning. For instance, a properly structured life insurance policy can enable the transfer of significant sums without triggering excessive tax liabilities, thus maximizing the value of the estate.

Estate planning is another critical aspect where life insurance shines. It provides a means to minimize estate taxes, ensuring that a larger portion of the insured's wealth remains with the intended beneficiaries. Through the use of various insurance products, such as term life insurance or permanent life insurance, individuals can create a safety net for their families while also addressing potential tax implications. The strategic placement of life insurance within an estate plan can result in substantial savings for heirs, allowing them to inherit a larger portion of the estate free from excessive taxation.

Furthermore, life insurance can facilitate the smooth transition of business ownership. Entrepreneurs and business owners can use insurance policies to fund buy-sell agreements, ensuring that the business remains within the family or is sold at a predetermined value. This strategy not only provides financial security for the business but also contributes to the overall wealth transfer plan.

In summary, the "biggest life insurance" is not merely about the monetary value but rather its strategic implementation in wealth transfer and estate planning. By understanding the various types of insurance policies and their tax implications, individuals can create comprehensive plans to protect and transfer their wealth effectively. This approach ensures that the insured's intentions are met while providing financial security for their loved ones and beneficiaries.

Gap Insurance: Understanding Loan Protection

You may want to see also

Regulatory Limits and Variations: Understanding legal and industry-specific limits on life insurance amounts

The concept of life insurance is a crucial financial tool, providing a safety net for individuals and their families in the event of the insured's death. When it comes to the maximum amount of life insurance one can have, it's important to understand the regulatory and industry-specific limits that exist to ensure fair practices and protect consumers. These limits can vary significantly depending on the jurisdiction and the insurance company's policies.

Regulatory bodies often set maximum limits on life insurance policies to prevent fraud and ensure that insurance companies can honor their commitments. For instance, in the United States, the Internal Revenue Service (IRS) imposes a limit of $100,000 on the amount of life insurance that can be exempt from income tax. This means that any life insurance policy exceeding this amount may be subject to income tax when paid out. Similarly, in the UK, the Financial Conduct Authority (FCA) has introduced rules to protect consumers, capping the maximum single-premium term life insurance policy at £100,000 for individuals under 70 years old. These regulatory limits ensure that insurance companies do not issue policies that could potentially lead to financial strain or fraud.

Industry-specific limits also play a significant role in shaping the maximum life insurance coverage available. Insurance companies often have their own policies and guidelines that determine the upper limit of a life insurance policy. For example, some insurance providers may offer policies with a maximum coverage amount of $1 million, while others might go up to $5 million or more, depending on various factors such as the insured's age, health, and lifestyle. These industry-specific limits are often influenced by the insurance company's risk assessment and their desire to maintain a balanced portfolio of policies.

It's worth noting that the concept of 'biggest' life insurance can be subjective and depends on individual circumstances. For high-net-worth individuals or those with substantial financial obligations, the maximum limit may be much higher, often requiring specialized policies and expert advice. Additionally, some insurance companies offer 'unlimited' or 'no-limit' life insurance policies, which can provide coverage up to a certain percentage of the insured's estate or net worth. These policies are typically tailored to meet the unique needs of high-value individuals or families.

Understanding these regulatory and industry-specific limits is essential for anyone considering life insurance. It ensures that individuals can make informed decisions about their coverage and helps them navigate the complexities of the insurance market. When purchasing life insurance, it is advisable to consult with financial advisors or insurance professionals who can guide you through the available options and help you choose a policy that meets your specific needs while adhering to legal and industry standards.

Life Insurance and Garnishment Laws in California

You may want to see also

Frequently asked questions

There is no universal maximum limit for life insurance coverage. The amount you can buy depends on various factors, including your age, health, lifestyle, and the insurance company's policies. Generally, older individuals may have higher coverage limits, while younger, healthier people might be offered more extensive policies.

While there is no set upper limit, it's essential to understand that very high coverage amounts may be challenging to obtain. Insurance companies often have maximum limits for individual policies, and extremely large coverage amounts might require additional medical exams, financial assessments, or even a medical board review.

A substantial life insurance policy can provide financial security for your beneficiaries in the event of your death. However, it's crucial to ensure that the coverage amount is appropriate for your needs and that you can afford the premiums. Excessive coverage might lead to higher costs and could potentially be seen as a financial burden if not managed properly.

Age can be a factor in determining the maximum life insurance coverage. Younger individuals often have more extended periods to benefit from the policy, and insurance companies may offer higher limits to those in their 30s, 40s, or 50s. However, older individuals can still obtain substantial coverage, and some companies specialize in providing high-limit policies for seniors.

The cost of a life insurance policy is typically calculated based on the coverage amount, your age, health, and other factors. Larger coverage amounts generally result in higher premiums. It's essential to strike a balance between the desired coverage and your financial capacity to ensure the policy remains affordable over the long term.