Being laid off can be a stressful and uncertain time, and it's important to have a plan for managing your finances. One aspect that may require attention is your life insurance policy. If you're currently paying premiums on a life insurance policy, it's important to consider your options after being laid off. This article will explore the different ways to handle your life insurance policy during this challenging period, including the possibility of adjusting your coverage or exploring alternative financial strategies.

| Characteristics | Values |

|---|---|

| Review Policy Details | Understand the terms and conditions of your life insurance policy, including any provisions related to job loss or unemployment. |

| Check for Unemployment Benefits | Research and apply for unemployment insurance benefits if available in your region. This can provide temporary financial support. |

| Consider Loan Options | Some life insurance policies offer loans against the cash value. This can provide immediate funds, but be aware of potential penalties and interest charges. |

| Review Investment Options | If your policy includes an investment component, assess the performance and consider adjusting your investments to align with your current financial situation. |

| Contact the Insurance Provider | Reach out to your insurance company to discuss options and potential solutions. They may offer assistance or guidance tailored to your circumstances. |

| Explore Other Income Sources | Look for alternative income streams, such as freelance work, side gigs, or selling unwanted items, to supplement your finances during the layoff period. |

| Update Your Will and Estate Plan | Given the potential changes in your financial situation, review and update your will, power of attorney, and other estate planning documents. |

| Seek Professional Advice | Consult a financial advisor or insurance specialist who can provide personalized guidance based on your specific policy and financial goals. |

| Prioritize Debt Management | If you have outstanding debts, create a plan to manage them effectively. Prioritize high-interest debts to minimize long-term costs. |

| Consider Long-Term Care | Evaluate your long-term care needs and explore options like long-term care insurance or self-funding solutions. |

What You'll Learn

- Review Your Policy: Understand your insurance coverage and benefits

- Payment Options: Explore payment plans and options if you can't afford premiums

- Beneficiary Changes: Update beneficiaries if necessary due to life changes

- Lapse Prevention: Consider temporary solutions to avoid policy lapse

- Financial Planning: Reassess your financial goals and adjust insurance accordingly

Review Your Policy: Understand your insurance coverage and benefits

When you find yourself in a situation where you've been laid off, it's a crucial time to review your life insurance policy and ensure that you're making the most of the coverage you have. This review process is essential to understand the full extent of your benefits and to make informed decisions about your financial security. Here's a step-by-step guide to help you navigate this process:

- Gather Your Policy Documents: Start by collecting all the relevant documents related to your life insurance policy. These documents typically include the insurance policy itself, any rider or endorsement forms, and the application paperwork. Having these documents readily available will make it easier to review the details of your coverage.

- Understand Your Coverage: Life insurance policies can be complex, so take the time to thoroughly understand the terms and conditions. Review the policy to identify the type of coverage you have (e.g., term life, whole life, universal life). Understand the death benefit amount, which is the payout the insurance company will provide to your beneficiaries upon your passing. Also, check for any additional benefits like accidental death coverage or critical illness riders.

- Check for Policy Loans or Cash Value: Some life insurance policies offer the option to borrow against the cash value of the policy or take out a loan. If you have a policy with a significant cash value accumulation, you might be able to access funds during a financial crisis. Review the policy to see if this option is available and understand the terms and interest rates associated with any loans.

- Assess Your Beneficiaries: Confirm that your beneficiaries are up-to-date and correctly listed. In the event of your passing, the insurance company will distribute the death benefit to the individuals or entities you've designated. Ensure that your beneficiaries are aware of their rights and the process to claim the insurance money.

- Consider Policy Adjustments: Depending on your current financial situation and goals, you may want to consider making adjustments to your policy. For instance, if you no longer have a significant financial dependency on your income, you might explore the possibility of converting a term life policy to a permanent one. Alternatively, if you've recently become a homeowner, you could consider increasing the death benefit to cover any new mortgage obligations.

- Stay Informed and Review Regularly: Life insurance policies can change over time, especially if you've made any policy adjustments or if the insurance company has made updates to their offerings. It's a good practice to review your policy annually or whenever there are significant life changes. This ensures that your coverage remains appropriate and aligned with your current needs.

Canvassing Life Insurance: Effective Strategies for Success

You may want to see also

Payment Options: Explore payment plans and options if you can't afford premiums

When you find yourself in a situation where you've been laid off and can no longer afford your life insurance premiums, it's important to explore all available options to ensure your policy remains in force. Many life insurance companies offer payment plans and flexibility to help policyholders navigate financial challenges. Here's a detailed guide on how to approach this situation:

Review Your Policy and Options: Start by carefully reviewing your life insurance policy documents. Look for any provisions related to payment flexibility or grace periods. Some policies may offer a temporary reduction in premiums or a grace period during which you can pay late without incurring penalties. Understanding the terms of your policy is crucial to making informed decisions.

Contact Your Insurance Provider: Reach out to your life insurance company and inform them about your current financial situation. They may have specific programs or options to assist policyholders in your circumstances. Many insurers are willing to work with customers to find a solution, as they understand that job loss or financial hardship can impact premium payments.

Explore Payment Plan Options: Insurance companies often provide payment plan options to make premiums more manageable. These plans typically involve spreading the annual premium over several months. You can request a payment plan that suits your current financial situation, allowing you to make smaller, more affordable payments. This approach can provide immediate relief and ensure your policy remains active.

Consider Temporary Policy Adjustments: In some cases, insurers might offer temporary adjustments to your policy. This could include reducing the death benefit or converting the policy to a term life insurance plan with a lower premium. These adjustments can provide short-term financial relief while you work on getting back on your feet. However, it's essential to understand the implications of these changes and how they might affect your coverage.

Negotiate and Communicate: Don't be afraid to negotiate and communicate your situation openly. Insurance providers want to retain valuable customers and may be open to finding a mutually beneficial solution. You can propose a payment arrangement that works for you and discuss potential discounts or waivers that could reduce your premium costs.

Seek Professional Advice: If you're unsure about your options or need further guidance, consider consulting a financial advisor or insurance specialist. They can provide personalized advice based on your unique circumstances and help you navigate the available payment options effectively.

Remember, being proactive and seeking assistance from your insurance provider can help you maintain your life insurance coverage during challenging times. It's essential to act promptly to avoid any gaps in your protection and to take advantage of the support systems available to policyholders.

Whole Life Insurance Dividends: Are They Guaranteed Payouts?

You may want to see also

Beneficiary Changes: Update beneficiaries if necessary due to life changes

When you experience a significant life event like being laid off, it's crucial to review and potentially update the beneficiaries of your life insurance policy. This step is essential to ensure that your loved ones receive the intended financial support during a challenging time. Here's a guide on how to approach beneficiary changes:

Identify Life Changes: Start by reflecting on any recent or upcoming life changes that might impact your insurance needs. This could include marriage, divorce, the birth of a child, the death of a family member, or a significant change in your financial situation. For instance, if you've recently married and want to ensure your spouse is the primary beneficiary, this is a critical update. Similarly, if you've started a new family, you might want to name your child as a beneficiary to provide financial security for their future.

Review Your Policy: Carefully examine your life insurance policy documents. These documents will outline the current beneficiaries and the process for making changes. Look for any specific instructions or requirements for updating beneficiaries. Some policies might require a formal written request, while others may allow for changes through a phone call or online portal. Understanding the policy's procedures is essential to avoid any delays or complications.

Update the Insurance Company: Contact your insurance provider and inform them of the necessary changes. They will guide you through the process, which may involve filling out forms, providing new beneficiary information, and sometimes even updating your policy's terms. Be prepared to provide details such as the full name, relationship to you, and contact information for the new beneficiary. The insurance company will then process the change, ensuring that your policy reflects the updated beneficiary information.

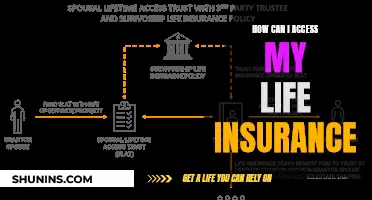

Consider a Trust: For more complex situations, you might consider setting up a trust to manage your life insurance benefits. A trust can provide a structured way to distribute funds to beneficiaries according to your wishes. This option can be particularly useful if you have multiple beneficiaries or want to ensure that the distribution of benefits aligns with your long-term financial goals. Consulting a legal professional can help you navigate the trust-setting process effectively.

Regularly Review: Life is full of surprises, and it's essential to keep your beneficiary information up-to-date. Regularly review your life insurance policy and make adjustments as your life circumstances change. This proactive approach ensures that your loved ones are always protected, even during unexpected life events.

Becoming a Top Life Insurance Agent: Tips and Tricks

You may want to see also

Lapse Prevention: Consider temporary solutions to avoid policy lapse

When facing unemployment, it's crucial to take proactive steps to ensure your life insurance policy remains active. One of the primary concerns during a layoff is the potential lapse in coverage, which can occur if premium payments are not made on time. Here are some temporary solutions to consider that can help you avoid a lapse in your policy:

Review Your Policy and Payment Options: Start by thoroughly understanding your life insurance policy. Contact your insurance provider to clarify the terms and conditions, especially regarding premium payments. Many policies offer grace periods, typically ranging from 10 to 30 days, after which a policy may lapse if the premium is not paid. Knowing these details will help you plan accordingly.

Explore Payment Flexibility: Insurance companies often provide options to make payments more manageable during challenging times. You might be able to negotiate a payment plan or opt for a reduced payment period. This could involve making smaller, more frequent payments or extending the term of the policy, which can lower the monthly cost.

Consider Temporary Income Sources: Look for temporary ways to generate income to cover the insurance premiums. This could include taking on freelance work, selling items you no longer need, or utilizing any savings or investments you have. Even a small amount of additional income can help you maintain your policy payments.

Review Your Budget and Prioritize: Assess your financial situation and create a budget that includes the life insurance premium as a necessary expense. Prioritize this payment to ensure it is not overlooked. You might need to make some temporary adjustments to your spending habits to allocate funds for the insurance premium.

Seek Professional Advice: Consult a financial advisor or insurance specialist who can provide tailored guidance based on your circumstances. They can help you explore various options, such as temporary policy adjustments or alternative insurance solutions, to ensure your coverage remains intact during this period of unemployment.

By implementing these temporary solutions, you can take control of your life insurance policy and minimize the risk of a lapse, providing peace of mind during a challenging life event. It's essential to act promptly and seek appropriate support to navigate this situation effectively.

Canceling BDO Life Insurance: A Step-by-Step Guide

You may want to see also

Financial Planning: Reassess your financial goals and adjust insurance accordingly

When you find yourself in a situation where you've been laid off, it's a crucial time to reassess your financial goals and make necessary adjustments to your insurance coverage. This period can be financially challenging, and ensuring your insurance policies are aligned with your current needs is essential. Here's a detailed guide on how to approach this process:

Evaluate Your Current Financial Situation: Start by taking a comprehensive look at your financial affairs. Calculate your monthly income and expenses, including any new or increased costs that may have arisen due to the layoff. This assessment will help you understand your cash flow and identify areas where adjustments are needed. Consider your short-term and long-term financial goals, such as covering living expenses, paying off debts, or saving for future goals.

Review Your Insurance Policies: Go through your existing life insurance policies, including term life, whole life, or any other types you might have. Understand the coverage you currently have and the associated costs. Determine if your policy provides sufficient coverage for your family's needs in the event of your death. If you have dependents or a spouse, ensure that the payout amount is adequate to support them financially. Consider the duration of your policy and whether it aligns with your current financial goals.

Adjust Insurance Coverage: Based on your financial evaluation, decide on the necessary adjustments to your insurance. Here are a few options:

- Decrease Coverage: If your financial situation has changed and you no longer require extensive coverage, consider reducing the policy's death benefit. This can lower your insurance premiums, making it more affordable.

- Convert to Term Life: Term life insurance offers coverage for a specific period, which can be an excellent choice if you want to ensure your family is protected for a defined time, such as until your children finish school or you reach a certain age.

- Review and Adjust Premiums: Some insurance providers offer flexibility in premium payments. You might be able to adjust the payment frequency or opt for a lower premium payment to better match your current financial capabilities.

Consider Alternative Insurance Options: Explore other insurance products that might better suit your current circumstances. For instance, disability insurance can provide income replacement if you become unable to work due to an illness or injury. This can be a valuable addition to your financial safety net. Additionally, consider critical illness insurance, which can offer financial support if you are diagnosed with a serious medical condition.

Regularly Review and Update: Financial planning is an ongoing process. As your life circumstances change, so should your insurance coverage. Schedule regular reviews of your insurance policies to ensure they remain appropriate. Life events like marriage, the birth of a child, or significant financial milestones should prompt you to reassess and adjust your insurance accordingly.

By taking a proactive approach to financial planning during this challenging period, you can ensure that your insurance coverage remains relevant and beneficial, providing the necessary protection for your loved ones while also aligning with your evolving financial goals.

Unraveling the Mystery: Life Insurance Enricher Explained

You may want to see also

Frequently asked questions

If you've been laid off and your life insurance policy is coming up for renewal, it's important to take action to ensure your coverage doesn't end. Contact your insurance provider and inform them of your situation. They may offer you options to keep your policy active, such as a temporary premium reduction or a payment plan. Explore these options to maintain your coverage during a challenging time.

Yes, you can still collect life insurance benefits even if you lose your job. The payout is typically based on the terms of your policy and the specific circumstances of your death. As long as you meet the policy's requirements, your beneficiaries will receive the death benefit. It's advisable to review your policy documents to understand the conditions and any potential impact of unemployment on your coverage.

Being laid off can potentially impact your life insurance premiums, especially if your income decreases significantly. Insurance companies often consider your occupation and income when setting premiums. If you're no longer employed, you might be offered a reduced premium or a policy with a different classification. It's best to discuss this with your insurer to understand the options available and ensure your policy remains affordable.

If you're facing financial difficulties due to unemployment and can no longer afford your life insurance premiums, consider the following: First, review your policy and check if there are any grace periods or options to suspend payments temporarily. Some policies offer reduced-rate coverage or conversion options that could provide more affordable alternatives. Additionally, you can explore other insurance providers or consider term life insurance, which may be more cost-effective during this period.