BDO Life Assurance Company, Inc. is a life insurance company and wholly-owned subsidiary of BDO Unibank, Inc. It offers a range of peso and dollar-denominated life insurance products. If you want to cancel your BDO life insurance, you can surrender your policy by following a few steps. First, you need to find out the current cash/fund value of your policy by reaching out to your servicing financial advisor or by calling the BDO Life Customer Care Hotline. Then, you need to prepare the necessary requirements, including the surrender of the policy form and other relevant documents. Finally, you can submit the requirements to your servicing financial advisor or any BDO Life branch near you. It's important to note that there may be financial implications to cancelling your policy, such as surrender charges and the impact on the cash value.

| Characteristics | Values |

|---|---|

| How to cancel | Call the BDO Life Call Center, or send a written request via email or mail |

| When to cancel | When you no longer need coverage, when you are changing your investment strategy, when you cannot afford the premiums, or when you are switching policies or insurance companies |

| Money back | Depends on the type of policy and when you cancel. Permanent life insurance policies may provide a cash payout upon cancellation, but surrender fees could reduce the amount |

What You'll Learn

Cancelling BDO life insurance within the free look period

If you've just purchased a BDO life insurance policy, you're likely within the "free look" period, which typically lasts 10 to 30 days, depending on your location. This period allows you to cancel your policy without any financial penalty and receive a full refund of any premiums you've paid.

To cancel your BDO life insurance policy within the free look period, contact your insurance company by phone or in writing to inform them of your decision. You can also stop sending in premium payments or cancel any automatic payments you've set up. It's a good idea to keep a written record of the cancellation and confirmation that your policy has been cancelled.

Cancelling within the free look period gives you a risk-free opportunity to reconsider your decision and get a full refund of premiums paid. However, if you cancel after this period, you may still be able to get a partial refund or payout based on the cash surrender value of your policy, minus any surrender charges and outstanding loans.

Before cancelling your BDO life insurance, consider your options. If you're thinking of cancelling because you need a more permanent solution, check if your policy includes a conversion rider, which allows you to switch to a permanent policy without a new medical exam. If premiums have become difficult to manage, your insurance agent may be able to help you reduce the policy's face amount, lowering premium payments and making the policy more affordable.

If you decide to cancel your BDO life insurance policy within the free look period, you can do so by contacting the company and stopping premium payments. This will ensure the policy is properly cancelled, and you will receive a full refund of any premiums paid during this time.

Life Insurance for Veterans: Affordable Options Available

You may want to see also

Cancelling a term life insurance policy

Understand the implications:

Before initiating the cancellation process, it's important to understand the financial implications. Term life insurance policies generally do not accumulate any cash value, so cancelling the policy means you won't receive a payout. Additionally, if you decide to purchase life insurance again in the future, your rates may be higher due to changes in age or health status.

Check the free-look period:

Many life insurance policies offer a "free-look" period, typically ranging from 10 to 30 days, during which you can cancel the policy without any financial penalty and receive a full refund of premiums paid. If you are still within this period, contact your insurance company by phone or in writing to inform them of your decision to cancel.

Stop premium payments:

One of the simplest ways to cancel a term life insurance policy is to stop paying the premiums. Contact your insurance company to end any automatic payment arrangements. Keep in mind that simply stopping payments may result in a lapse in coverage, and you should confirm the cancellation directly with your insurance agent or carrier to ensure there are no further obligations on your part.

Complete any necessary forms:

Most insurance companies have specific forms or online options to finalize the cancellation process. Contact your insurance provider to obtain the necessary documentation and follow their instructions for submitting the cancellation request.

Keep records:

Maintain a written record of the cancellation and confirmation that your term life policy has been successfully terminated. This will help prevent any future misunderstandings or discrepancies.

Explore alternative options:

Before cancelling your term life insurance policy, consider exploring other options. If you're thinking of cancelling due to financial constraints, you may be able to reduce the policy's face amount to lower premium payments while still maintaining some level of coverage. Alternatively, if you're considering a more permanent solution, check if your policy includes a conversion rider, which allows you to switch to a permanent policy without undergoing a new medical exam.

Life Insurance: Long-Term Plans for Peace of Mind

You may want to see also

Cancelling a permanent life insurance policy

Understanding the Cancellation Process

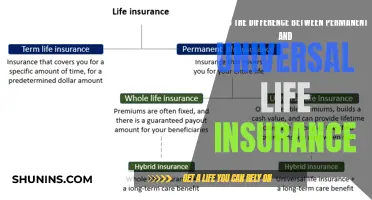

You can typically cancel a life insurance policy at any time, but the process and financial implications can vary depending on the type of policy you hold. For permanent life insurance policies, such as whole life or universal life, there are a few more steps involved compared to cancelling a term life insurance policy.

Contact Your Insurance Company

The first step is to get in touch with your insurance company. You can do this by phone, email, or in writing. They will guide you through their specific cancellation process and let you know of any requirements or forms that need to be completed. It is important to follow their instructions carefully to avoid delays or additional fees.

Understand the Financial Implications

When cancelling a permanent life insurance policy, you may be subject to surrender charges and other fees. These charges can vary but are typically a percentage of the policy's face value. Additionally, if you have borrowed against your policy or made any withdrawals, these amounts will be deducted from the cash value. It's important to understand that the cash value you receive upon cancellation may be significantly lower than expected due to these fees and deductions.

Consider the Timing

The timing of your cancellation can also impact the financial implications. If you cancel during the early years of the policy, surrender charges tend to be higher. Over time, these fees decrease, so it may be beneficial to wait if you are not in a rush to cancel. Additionally, consider if there is a \"free look\" period, which typically lasts 10 to 30 days, where you can cancel without any financial penalty and receive a full refund of premiums paid.

Explore Alternative Options

Before cancelling your permanent life insurance policy, consider exploring alternative options. For example, you may be able to use the accumulated cash value to cover your premium payments or convert your term policy to a permanent one without a new medical exam. Another option is to sell your policy through a life settlement, which can provide a lump sum of cash. Weigh the pros and cons of each option and consider consulting a financial advisor to make an informed decision.

Weigh the Benefits and Costs

Finally, consider the benefits and costs of cancelling your permanent life insurance policy. Evaluate your current financial situation, the policy's cash value, and any potential surrender charges. If you rely on the policy's death benefit, cancelling might not be the best option. Carefully consider all aspects before making a decision.

Life Insurance: Asset or Liability?

You may want to see also

Surrendering a permanent life insurance policy

Surrendering your life insurance policy will cancel your coverage immediately. Your insurer will terminate the contract and send you a cheque for the policy's cash surrender value. This is the money a policyholder receives for ending their coverage before the maturity date or their passing. The cash surrender value is the policy's cash value minus any surrender fees and taxes on earnings. Surrender fees typically range from 10-35% and are usually high in the early years of the policy.

When you surrender your life insurance policy for its cash surrender value, you are essentially cancelling your coverage. After receiving the cash value, minus any surrender fees owed to the insurance provider, your insurance coverage ends.

- Contact your insurance company: You can initiate the surrender process over the phone. The insurance agent will guide you through the steps and documentation required to collect any cash surrender value. They can also inform you about any fees you'll be charged.

- Submit documentation: You will need to supply a surrender request form to your life insurance provider.

- Receive cash surrender value: After the provider has processed your request, you will receive the cash surrender value funds via cheque or electronic transfer.

- Obtain policy termination confirmation: Upon receiving the cash surrender value, you should expect to receive a confirmation of policy termination by mail. If they do not provide this, you can request it.

It is important to note that surrendering your life insurance policy has consequences. Firstly, you will no longer have life insurance coverage. Secondly, surrendering the policy can result in a financial loss, as the cash surrender value is often lower than the total premiums paid. Additionally, you may be responsible for paying surrender fees and could end up with a tax bill if you have an outstanding loan from the policy.

Whole Life Insurance: Capital Gains or Smart Investment?

You may want to see also

Cancelling life insurance due to unaffordable premiums

Cancelling a life insurance policy is a big decision and should not be taken lightly. There are several reasons why you may want to cancel your life insurance policy, including if you no longer need coverage or if the premiums have become unaffordable.

If you are considering cancelling your life insurance due to unaffordable premiums, there are a few things you should keep in mind. First, review your budget and see if there are any non-essential expenses that you can cut down on to free up some money for your premiums. You should also consider if you have any other insurance policies where you may be overpaying, such as your home or auto insurance. By reducing your spending in other areas, you may be able to continue affording your life insurance premiums.

If, after reviewing your budget, you still feel that you cannot afford your life insurance premiums, there are a few options to consider before cancelling your policy. If you have a term life insurance policy, you may be able to reduce your coverage amount, which can lower your premium payments while still providing some level of coverage. You can also explore the option of converting your term policy to a permanent policy, which may offer more affordable payment options.

If you have a permanent life insurance policy, you may be able to use the cash value of your policy to cover your premium payments. This can help you keep your policy active without needing to make out-of-pocket payments. However, it's important to note that borrowing against your cash value may reduce the death benefit for your beneficiaries.

Another option to consider is to sell your life insurance policy. This can provide you with a lump sum payment, which may be more than what you would receive if you simply cancelled your policy. However, by selling your policy, you forfeit your right to the death benefit, so this may not be a suitable option if your family relies on this benefit.

Finally, if you decide to cancel your life insurance policy due to unaffordable premiums, be sure to follow the proper steps to ensure a smooth cancellation process. Contact your insurance company to inform them of your decision and stop making premium payments. If you have automatic payments set up, you may need to cancel these directly with your bank. Keep a written record of your cancellation request and confirmation that your policy has been cancelled.

Contacting American Amicable Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

To cancel your BDO life insurance, you will need to fill out a surrender of policy form, which must be signed by the policy owner and the irrevocable beneficiary, if any. You will also need to provide a clear photocopy of a valid government-issued ID for both the policy owner and the irrevocable beneficiary, if any.

Upon cancelling your BDO life insurance, you may receive a payout from the cash value of your policy. However, this may be reduced by surrender charges, especially if you haven't held the policy for many years.

If you are considering cancelling your BDO life insurance policy, you could explore the following alternatives:

- Using the cash value of your policy to cover your premium payments or mortality costs.

- Requesting a tax-free exchange to get rid of your life insurance policy and replace it with a new one without paying taxes.

- Selling your life insurance policy, either through a viatical settlement or a life settlement.

A viatical settlement involves selling your life insurance policy to a third party when you have a terminal illness and a life expectancy of less than two years. A life settlement is usually considered by policyholders who are over the age of 65 and in reasonably good health but no longer need the policy or can no longer afford the premiums.

To update your name and contact information on your BDO life insurance policy, you can either submit a Policy Amendment Request Form (PARF) or call the BDO Life Customer Care Hotline at (+632) 8885-4110 or 1800-1888-6603 (PLDT Toll-Free).