Life insurance is a crucial financial tool that provides protection and peace of mind for individuals and their loved ones. However, there may be situations where canceling or modifying a life insurance policy becomes necessary. This could include changes in personal circumstances, such as improved health, marriage, or the birth of a child, which may warrant an adjustment in coverage. Additionally, financial considerations, such as a significant reduction in income or the sale of assets, could prompt a reevaluation of insurance needs. Understanding the reasons and implications of canceling life insurance is essential to ensure that you make the best decision for your current situation and long-term financial goals.

What You'll Learn

- Financial Stability: Only cancel if you're financially secure and have no dependents

- Health Improvements: Review policy if health significantly improves, ensuring new rates are favorable

- Redundant Coverage: Cancel if you have excess coverage, ensuring you don't over-insure

- Cost Benefits: Assess if premium costs outweigh benefits, especially with lower risk profile

- Legal Requirements: Understand legal obligations and consult professionals before canceling any insurance

Financial Stability: Only cancel if you're financially secure and have no dependents

When considering whether to cancel your life insurance policy, financial stability should be at the forefront of your decision-making process. Life insurance is a financial safety net that provides coverage for your loved ones in the event of your passing. It is a commitment that should not be taken lightly, especially when you have financial responsibilities or dependents relying on your income.

Financial security is a crucial factor in determining if canceling life insurance is the right choice. If you are in a position where you have a stable income, a robust emergency fund, and a secure financial future, then you may have less of a need for the insurance coverage. However, if you are in a vulnerable financial position, with outstanding debts, a limited savings account, or a lack of financial resources, canceling life insurance could leave your dependents in a difficult situation. It is essential to assess your financial health and ensure that you have the means to support your loved ones without relying on the insurance payout.

Having dependents, such as a spouse, children, or other family members who depend on your income, further emphasizes the importance of financial stability. If you have a family that relies on your financial contributions for their daily needs, education, or long-term goals, then canceling life insurance might not be the best decision. The primary purpose of life insurance is to provide financial security and peace of mind to your beneficiaries. By canceling the policy, you risk leaving your dependents without the financial support they need to maintain their standard of living and achieve their goals.

To ensure financial stability, consider building an emergency fund and a robust financial plan. This may include saving for unexpected expenses, paying off any debts, and investing in assets that can provide a steady income stream. By improving your financial situation, you can make an informed decision about life insurance. If you feel confident that you have the financial resources to support your dependents without the insurance payout, then you may explore the option of canceling the policy. However, if your financial stability is still a concern, it might be more prudent to review and adjust your life insurance policy to better suit your current circumstances.

In summary, financial stability is a critical consideration when deciding whether to cancel life insurance. It is essential to evaluate your financial health, assess your ability to support your dependents, and make a well-informed decision. By ensuring financial security, you can provide the necessary protection for your loved ones and make the right choice regarding your life insurance coverage.

Understanding Actual Cash Value in Life Insurance Policies

You may want to see also

Health Improvements: Review policy if health significantly improves, ensuring new rates are favorable

When it comes to life insurance, reviewing and potentially canceling the policy can be a significant decision, especially if your health has improved. Here's a detailed guide on why and how to approach this situation:

Health Improvements and Policy Review:

If you've experienced a notable improvement in your health, it's essential to re-evaluate your life insurance policy. Health changes can impact your insurance rates and coverage, and ensuring that your policy reflects your current well-being is crucial. For instance, if you've successfully managed a chronic condition through lifestyle changes or medical treatments, your risk profile as an insurance company may view you has likely improved. This could lead to more favorable rates or even the possibility of canceling the policy if your health is now considered lower-risk.

Steps to Take:

- Consult a Healthcare Professional: Before making any decisions, consult your doctor or healthcare provider. They can assess your health status and provide a professional opinion on whether your condition has improved significantly. This medical confirmation is essential when reviewing your insurance policy.

- Review Your Policy: Examine your life insurance policy documents carefully. Understand the terms and conditions, especially regarding health-related clauses. Look for provisions that allow for policy adjustments based on health changes. Some policies may offer discounts or rate reductions if you've made significant health improvements.

- Compare Current Rates: Obtain quotes from your insurance provider and compare them with the rates you initially paid. If your health has improved, you may find that the new rates are more competitive. This could be an opportunity to negotiate better terms or even consider canceling the policy if the savings are substantial.

- Consider Cancellation: If your health has improved significantly and the new rates are favorable, you might decide to cancel the policy. This decision should be based on a comprehensive assessment of your financial situation and future insurance needs. Ensure that you have adequate coverage in place for any remaining risks.

Benefits of Timely Review:

- Accurate Coverage: Keeping your policy up-to-date ensures that you have the appropriate level of coverage based on your current health status.

- Financial Savings: Improved health can lead to lower insurance premiums, allowing you to save money over time.

- Peace of Mind: Knowing that your policy reflects your current health accurately provides reassurance and helps you make informed financial decisions.

Remember, life insurance policies are designed to adapt to your changing circumstances. By regularly reviewing your policy, especially when health improvements are significant, you can make informed choices that benefit your financial well-being.

Understanding Life Insurance: Cash Surrender Value Explained

You may want to see also

Redundant Coverage: Cancel if you have excess coverage, ensuring you don't over-insure

When it comes to life insurance, having the right amount of coverage is crucial, and sometimes, you might find yourself with more insurance than you actually need. This situation, known as "redundant coverage," can lead to unnecessary financial burdens and potential risks. Here's a guide to help you understand when and how to cancel life insurance due to excess coverage.

Assess Your Current Needs: The first step is to evaluate your life insurance policy and understand its purpose. Life insurance is typically designed to provide financial security to your loved ones in the event of your passing. It helps cover expenses such as funeral costs, outstanding debts, mortgage payments, or any other financial obligations you may have left behind. If you have recently reviewed your policy and realized that the coverage amount is significantly higher than what is required to support your family and cover your debts, it might be a sign of redundant coverage.

Calculate the Required Amount: Determine the actual financial needs of your beneficiaries. Consider the expenses that your loved ones would incur if you were no longer around. This includes daily living expenses, education costs for children, mortgage or rent payments, and any other long-term financial commitments. By summing up these expenses, you can estimate the minimum coverage amount required to ensure your family's financial stability.

Review Policy Details: Examine your life insurance policy carefully. Pay attention to the terms and conditions, especially the death benefit amount. If the policy's death benefit exceeds your calculated financial needs, it could indicate excess coverage. Look for any clauses or riders that might increase the coverage without your explicit consent, as these could be unnecessary additions.

Consider the Cost: Excess coverage can lead to higher premiums, which can be a significant financial burden over time. If you find that the cost of maintaining the current policy is disproportionately high compared to the benefits it provides, it might be a sign that you have redundant coverage. In such cases, canceling the policy or reducing the coverage amount could result in substantial savings.

Consult a Financial Advisor: If you're unsure about the right course of action, consider seeking advice from a financial advisor or insurance specialist. They can help you analyze your financial situation, review your policy, and provide personalized recommendations. These professionals can assist in determining the appropriate coverage level and guide you through the process of canceling or adjusting your policy if necessary.

Remember, the goal is to have adequate coverage without over-insuring yourself. Regularly reviewing and assessing your life insurance needs is essential to ensure that you and your loved ones are protected appropriately.

Life Insurance Options for the Paralyzed: What You Need to Know

You may want to see also

Cost Benefits: Assess if premium costs outweigh benefits, especially with lower risk profile

When considering whether to cancel your life insurance policy, a thorough cost-benefit analysis is essential. This assessment is particularly important if you have a lower risk profile, meaning you are generally healthier and less likely to require a payout. Here's a detailed breakdown of how to approach this decision:

Understanding the Costs:

Life insurance premiums can vary significantly depending on factors like your age, health, lifestyle, and the type of policy you have. Generally, younger and healthier individuals pay lower premiums. If your risk profile has improved over time (e.g., you've quit smoking, maintained a healthy weight, or improved your financial situation), your premiums might have decreased accordingly. However, if your risk factors have remained stable or increased, your premiums may still be relatively high.

Evaluating the Benefits:

The primary benefit of life insurance is financial security for your loved ones in the event of your death. If you have a family that relies on your income or if you have significant financial obligations (e.g., a mortgage, children's education funds), life insurance can provide crucial financial support.

Cost-Benefit Analysis:

- Weigh the Premiums Against Potential Payouts: If your health has improved significantly and you no longer have a high-risk occupation or lifestyle, the chances of a payout might be lower. In this case, the premium costs might be disproportionately high compared to the potential benefit.

- Consider Alternative Financial Security: Explore other ways to provide financial security for your loved ones. This could include building an emergency fund, purchasing term life insurance for a specific period, or investing in other financial instruments that align with your goals.

- Review Policy Options: Some life insurance policies offer flexibility. You might be able to convert a term life policy to a permanent policy later, ensuring coverage for life. Alternatively, you could explore policy riders or adjustments that better suit your current needs and risk profile.

Making the Decision:

Canceling life insurance should be a well-informed decision. If your risk profile has improved, and you have alternative means of financial security, the premium costs might no longer be justified. However, if your financial obligations remain significant and you still need long-term coverage, keeping the policy might be beneficial.

Remember, life insurance is a personal decision, and what works for one person may not work for another. It's crucial to consult with a financial advisor or insurance professional who can provide tailored advice based on your unique circumstances.

Who Can Sell Life Insurance? Anyone or Only Some?

You may want to see also

Legal Requirements: Understand legal obligations and consult professionals before canceling any insurance

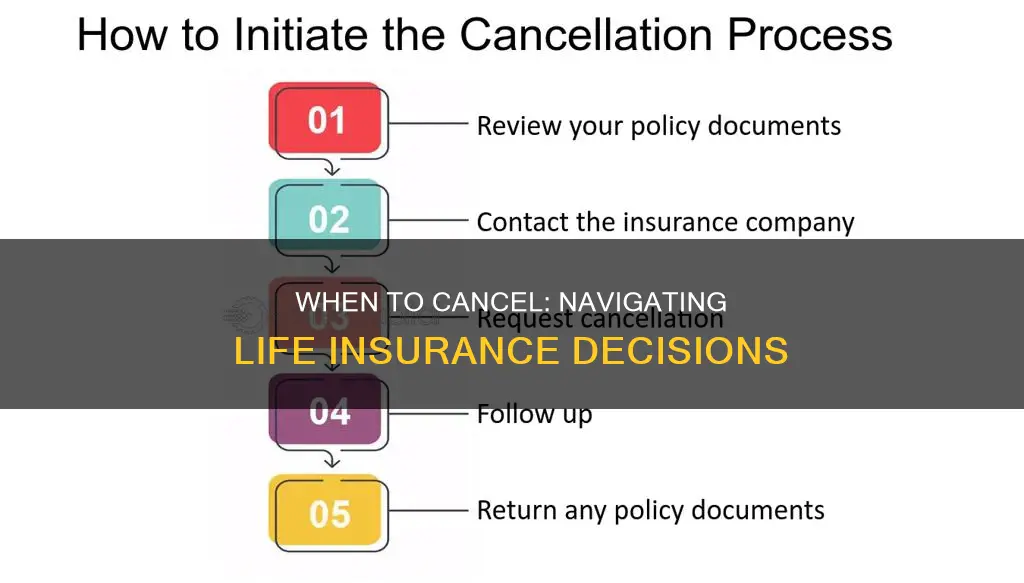

When considering canceling a life insurance policy, it's crucial to understand the legal requirements and potential implications to ensure you make an informed decision. The process of canceling insurance can have legal consequences, and it's essential to navigate it carefully to avoid any future disputes or financial complications. Here's an overview of the legal considerations:

Legal Obligations and Contracts: Life insurance policies are legally binding contracts between the policyholder and the insurance company. When you cancel a policy, you are essentially terminating this contract. Before taking any action, review the terms and conditions of your specific policy. Insurance companies often have specific procedures and requirements for policy cancellation, which may include providing a notice period and adhering to certain guidelines. Failure to follow these procedures could result in legal issues and potential disputes. It is advisable to carefully read the policy documents and understand the cancellation process to avoid any misunderstandings.

Refund and Surrenders: In some cases, canceling a life insurance policy might allow you to receive a refund of any premiums paid, minus any applicable fees or surrender charges. However, the insurance company may have specific rules regarding refunds, and the amount you receive may vary depending on the policy type and your coverage period. It is essential to check the policy's surrender value and understand the financial implications before proceeding with cancellation. Consulting a financial advisor or insurance professional can provide clarity on the potential financial impact.

Tax and Legal Implications: Canceling a life insurance policy can have tax consequences. If you receive a cash value or surrender the policy, it may be subject to taxation. Additionally, there could be legal implications if the policy was taken out for a specific purpose, such as estate planning or business continuity. It is crucial to consult a tax advisor or legal professional to understand the potential tax liabilities and any legal obligations associated with canceling the policy. They can provide guidance on how to structure the cancellation to minimize any adverse effects.

Consulting Professionals: Given the complexity of legal and financial matters, seeking professional advice is highly recommended. Insurance brokers, financial advisors, or legal experts can provide valuable insights tailored to your specific situation. They can help you navigate the legal requirements, assess the potential risks, and make an informed decision. These professionals can also assist in negotiating with the insurance company if you encounter any issues or disputes during the cancellation process.

By understanding the legal obligations and seeking professional guidance, you can ensure that canceling a life insurance policy is done smoothly and in compliance with the law. It is essential to approach this decision with caution and thorough research to avoid any unnecessary complications. Remember, each insurance policy is unique, so personalized advice is crucial to making the right choice for your circumstances.

Borrowing Money: Life Insurance Policy Loan Eligibility

You may want to see also

Frequently asked questions

The decision to cancel a life insurance policy should be made after careful consideration of your current financial situation and future needs. If you no longer require the financial protection that life insurance offers, such as when you've paid off significant debts or have built an adequate savings cushion, it might be a good time to review your policy. Additionally, if your health has improved significantly and you no longer qualify for the same level of coverage, or if you've found a more affordable alternative, these could also be valid reasons to cancel.

Yes, there can be penalties or surrender charges associated with canceling a life insurance policy before the end of the initial term. These charges are typically a percentage of the premiums paid and are designed to cover the insurance company's costs for providing the coverage during the early years. It's important to review the policy's terms and conditions to understand any potential fees and to calculate whether the benefits of canceling outweigh the costs.

If you cancel your life insurance policy and then decide to re-insure in the future, you may face challenges. Insurance companies often consider your health and lifestyle factors when assessing your insurability. If you've made significant changes that negatively impact your health, such as quitting smoking or improving your fitness, these could be seen as positive changes. However, if you've canceled coverage for an extended period, the insurance company might view you as a higher-risk candidate, potentially leading to higher premiums or even denial of coverage.

The refund process for canceling a life insurance policy varies depending on the insurance company and the type of policy. Some policies offer a full refund of premiums paid, while others may provide a partial refund, especially if you've had the policy for a short period. It's essential to review the policy's surrender value clause, which outlines the amount you can expect to receive if you cancel. Additionally, consider the time it takes for the insurance company to process the cancellation and any associated fees or taxes that might apply.