When considering life insurance in Canada, timing is crucial. It's essential to assess your financial situation and long-term goals to determine the right time to purchase a policy. Typically, young and healthy individuals with no significant health issues or dependents may benefit from term life insurance, which provides coverage for a specific period. Conversely, those with families or financial responsibilities may opt for permanent life insurance, offering lifelong coverage and a cash value component. Understanding your needs, such as protecting your loved ones' financial well-being and covering expenses like mortgage payments or education costs, is key to making an informed decision about when to get life insurance in Canada.

What You'll Learn

- Life Stages: Understand when life insurance is essential, from early adulthood to retirement

- Financial Goals: Align life insurance with financial objectives like debt management and savings

- Health Considerations: Assess health impacts on insurance eligibility and coverage options

- Family Needs: Determine coverage based on family size, income, and long-term financial security

- Legal and Tax Implications: Explore legal and tax benefits of life insurance in Canada

Life Stages: Understand when life insurance is essential, from early adulthood to retirement

Life insurance is a crucial financial tool that provides a safety net for individuals and their families, ensuring financial security during challenging times. Understanding when to obtain life insurance is essential as it varies depending on one's life stage and personal circumstances. Here's a breakdown of when life insurance becomes a necessity, from early adulthood to retirement:

Early Adulthood: During the early years of adulthood, life insurance might not be the first thing on your mind, but it is a valuable consideration. As a young adult, you are likely building your career, starting a family, or pursuing personal goals. This stage is often characterized by financial independence and the establishment of long-term goals. Getting life insurance early can be advantageous for several reasons. Firstly, premiums are typically lower for younger individuals as the risk of death is statistically lower. This allows you to secure coverage at a more affordable rate, providing financial protection for your loved ones if something were to happen to you. Additionally, as a young adult, you might have a growing family or financial responsibilities, such as a mortgage or student loans. Life insurance can ensure that your dependents are financially secure and that your debts are managed if you were to pass away.

Starting a Family: When you welcome a child into your life, life insurance takes on even greater importance. The arrival of a child often means increased financial obligations and a desire to provide a secure future for your family. If you were to pass away, life insurance would provide a financial cushion to cover expenses like childcare, education, and daily living costs for your spouse or partner. It can also help with the emotional burden of losing a loved one by ensuring that your family's financial stability is not compromised. Moreover, as a parent, you might have specific goals, such as saving for your child's education or ensuring they are financially independent. Life insurance can help achieve these goals by providing a lump sum or regular payments to your beneficiaries.

Mid-Life and Career Advancement: As you progress through your career and enter mid-life, life insurance becomes even more critical. This stage often involves significant financial commitments and long-term goals. You might have substantial assets, investments, or a growing business. Life insurance can protect these assets and ensure that your family's financial future is secure. Additionally, mid-life is a time when individuals often take on more significant financial responsibilities, such as providing for children's education or supporting aging parents. Life insurance can help alleviate the financial burden associated with these commitments. It also allows you to plan for your family's long-term financial goals, such as retirement or the purchase of a second home.

Retirement: In retirement, life insurance can play a different role, primarily focusing on ensuring financial security and peace of mind. As you age, your health and financial needs may change, and life insurance can provide a safety net during this transition. It can help cover unexpected medical expenses or ensure that your estate is managed according to your wishes. Additionally, in retirement, you might have more disposable income, and life insurance can be used to leave a legacy for your beneficiaries, such as grandchildren or favorite charities.

In summary, life insurance is a versatile tool that adapts to various life stages. From providing financial security for a growing family to protecting assets in mid-life and ensuring a comfortable retirement, life insurance offers tailored benefits. It is essential to regularly review and adjust your life insurance policy as your circumstances change, ensuring that you and your loved ones are always protected.

Life Insurance: What You Need to Know

You may want to see also

Financial Goals: Align life insurance with financial objectives like debt management and savings

When considering life insurance in Canada, it's essential to align your coverage with your financial goals and objectives. Here's how life insurance can be a valuable tool for managing debt and saving for the future:

Debt Management: Life insurance can play a strategic role in debt reduction and management. If you have outstanding debts, such as a mortgage, student loans, or credit card balances, life insurance proceeds can be utilized to pay off these debts. By ensuring that your beneficiaries receive the insurance payout upon your passing, you can eliminate or significantly reduce the financial burden on your loved ones. This approach not only provides peace of mind but also helps prevent the accumulation of additional interest and fees associated with unpaid debts.

Savings and Financial Security: Life insurance can contribute to your long-term savings and financial security. Term life insurance, in particular, offers a fixed premium and death benefit for a specified period. During this term, you can allocate the regular premium payments towards your overall financial goals. For example, you might use the funds to build an emergency fund, invest in retirement accounts, or contribute to a child's education savings plan. By treating life insurance premiums as a regular expense, you can develop a disciplined savings habit and ensure that your financial objectives remain on track.

To align life insurance with your debt management and savings goals, consider the following steps:

- Assess Your Debts: Make a comprehensive list of all your debts, including their interest rates, outstanding balances, and payment terms. Identify the debts that would have the most significant impact on your financial situation if left unpaid.

- Determine the Insurance Amount: Calculate the amount needed to cover your identified debts. This will ensure that your beneficiaries can settle these obligations without incurring additional financial strain.

- Choose the Right Policy: Select a life insurance policy that aligns with your financial goals. Term life insurance is often preferred for debt management as it provides a temporary safety net. Permanent life insurance, on the other hand, offers lifelong coverage and a cash value component, which can be utilized for savings.

- Review and Adjust: Regularly review your financial situation and adjust your life insurance coverage as necessary. Life events like marriages, births, or significant debt repayments may trigger a need for policy adjustments to maintain alignment with your evolving financial goals.

By integrating life insurance into your financial strategy, you can effectively manage debt, build savings, and provide financial security for your loved ones. It is a proactive approach that ensures your financial objectives remain achievable, even in the face of unexpected life events. Remember to consult with a financial advisor or insurance professional to tailor your life insurance plan to your specific needs and goals.

Get the Best Life Insurance Rate: Tips and Tricks

You may want to see also

Health Considerations: Assess health impacts on insurance eligibility and coverage options

When considering life insurance in Canada, understanding the impact of your health is crucial. Insurance companies use health assessments to determine your eligibility and the terms of your policy. Here's a breakdown of how health considerations influence your life insurance journey:

Health Status and Underwriting: Insurance providers will scrutinize your medical history and current health condition. Pre-existing conditions, chronic illnesses, or recent health scares can significantly affect your eligibility. For instance, if you have a history of heart disease, diabetes, or cancer, insurers may require additional medical information or offer limited coverage. A healthy lifestyle, on the other hand, can lead to better rates and more comprehensive policies.

Age and Lifestyle: Age is a critical factor. Younger individuals often have more favorable rates due to a longer life expectancy and lower risk profiles. However, as you age, the likelihood of developing health issues increases, potentially impacting your insurance options. Additionally, lifestyle choices play a vital role. Non-smokers, regular exercisers, and those who maintain a healthy weight may qualify for lower premiums and more competitive coverage.

Medical Examinations: In some cases, insurers may request a medical examination to assess your overall health. This could involve blood tests, physical exams, or even a consultation with a specialist. The information gathered during these assessments helps insurers gauge your risk profile and determine the appropriate coverage and premiums.

Pre-existing Conditions: Disclosing pre-existing conditions is essential. Insurance companies will review your medical history to understand potential risks. While some conditions may not affect your eligibility, they can influence the terms of your policy. For instance, a pre-existing heart condition might lead to a higher premium or specific exclusions in the policy.

Improving Health for Better Coverage: If you have health concerns, taking proactive steps to improve your well-being can be beneficial. Quitting smoking, managing weight, and adopting a healthier diet can positively impact your insurance rates. Insurance companies often reward healthy lifestyle choices with more competitive coverage options.

Remember, being transparent about your health is essential. Misrepresenting your health status can lead to denied claims or legal issues. By understanding the relationship between your health and life insurance, you can make informed decisions to secure the coverage you need.

How to Sign Your Mother Up for Life Insurance

You may want to see also

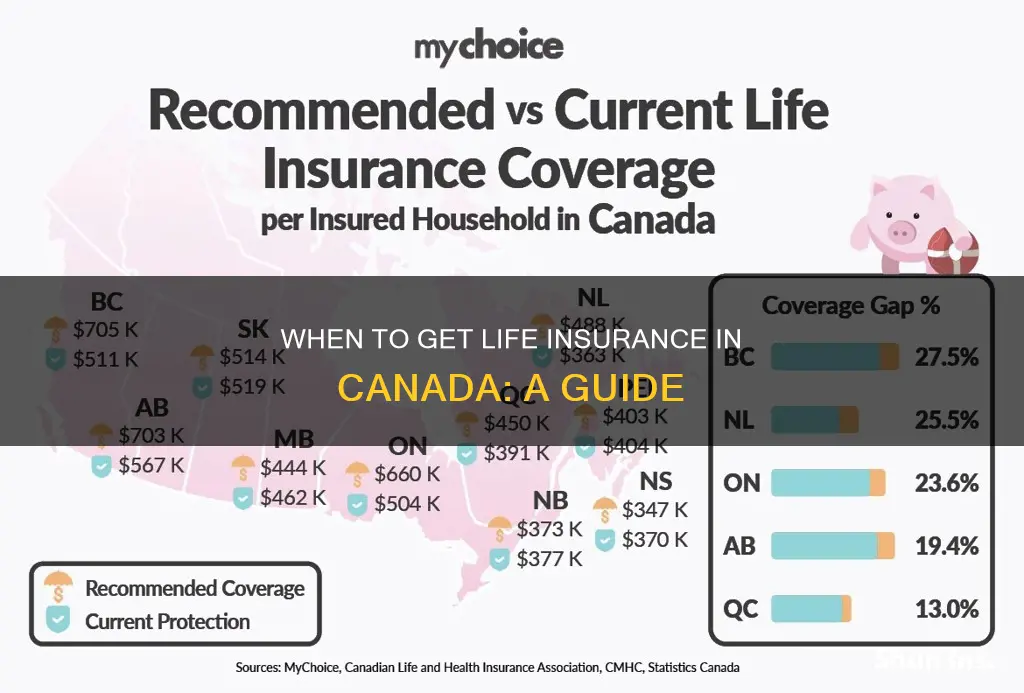

Family Needs: Determine coverage based on family size, income, and long-term financial security

When considering life insurance for your family, it's crucial to evaluate your unique circumstances and future financial obligations. Here's a breakdown of how to determine the right coverage:

Family Size and Dependents: The number of family members relying on your income is a significant factor. If you have a large family or dependents who depend on your financial support for their basic needs, education, or future goals, you'll need a substantial life insurance policy. This ensures that your loved ones can maintain their standard of living and cover essential expenses in the event of your passing.

Income and Financial Responsibilities: Your family's income and financial commitments play a vital role. Calculate your annual income and consider any additional sources of revenue, such as investments or side hustles. Then, factor in expenses like mortgage or rent, utilities, groceries, transportation, and other regular costs. The goal is to ensure that your life insurance payout can cover these expenses for a reasonable period, typically 10-15 years, to provide financial security for your family during their most vulnerable years.

Long-Term Financial Security: Life insurance is not just about covering immediate expenses. It's essential to think about your family's long-term financial goals and security. This includes funding your children's education, covering future medical expenses, or ensuring your spouse can maintain their lifestyle. Consider the potential future costs and choose a policy that provides a lump sum or regular payments to cover these needs.

Review and Adjust: Life circumstances change, and so should your insurance coverage. Regularly review your policy to ensure it aligns with your family's evolving needs. Major life events like marriages, births, or significant financial changes should prompt a policy review. Adjusting your coverage accordingly will ensure that your family is adequately protected throughout life's journey.

Remember, the goal is to provide financial peace of mind for your loved ones. By carefully assessing your family's unique situation, you can make an informed decision about the appropriate life insurance coverage, ensuring a secure future for your family even in the face of unforeseen circumstances.

Understanding Group Variable Life Insurance: A Comprehensive Guide

You may want to see also

Legal and Tax Implications: Explore legal and tax benefits of life insurance in Canada

When considering life insurance in Canada, it's essential to understand the legal and tax implications to make an informed decision. Here's an overview of the key points:

Legal Benefits:

Life insurance is a legally binding contract between the insured individual and the insurance company. It provides financial protection and peace of mind. In Canada, life insurance policies are regulated by provincial and territorial insurance regulatory bodies, ensuring fair practices and consumer protection. The legal framework allows for various types of coverage, including term life, whole life, and universal life insurance. Each type has its own benefits and is tailored to different needs. For instance, term life insurance offers coverage for a specified period, while whole life provides lifelong coverage with an accumulation of cash value. Understanding the legal aspects ensures that you choose a policy that aligns with your specific requirements.

Tax Advantages:

Life insurance can offer significant tax benefits in Canada. Premiums paid for life insurance policies are generally tax-deductible, reducing your taxable income. This can result in lower tax liabilities, especially for high-income earners. Additionally, the death benefit received from a life insurance policy is typically tax-free, providing a substantial financial benefit to the beneficiary. The Canadian government recognizes the value of life insurance as a tool for financial security and encourages its use through these tax advantages. It's important to note that the tax treatment may vary depending on the type of policy and the beneficiary's relationship to the insured. Consulting a tax professional can help you maximize these benefits while ensuring compliance with the law.

Estate Planning and Inheritance:

Life insurance can play a crucial role in estate planning. It can help ensure that your beneficiaries receive a tax-free inheritance, providing financial support during challenging times. The death benefit can be used to cover funeral expenses, outstanding debts, or even as a source of funds for the beneficiaries' future needs. Properly structured life insurance can also help minimize estate taxes, allowing more of your estate to pass on to your heirs. This is particularly beneficial for families with substantial assets or those seeking to leave a legacy.

Long-Term Financial Planning:

Incorporating life insurance into your long-term financial strategy can have legal and tax advantages. It can provide a safety net for your loved ones, ensuring financial stability even in your absence. The tax-deductible premiums and tax-free death benefit can contribute to a more secure financial future. Moreover, life insurance can be a valuable asset in estate planning, helping to preserve wealth and provide financial security for generations to come.

Understanding the legal and tax implications of life insurance is crucial for making informed decisions. Consulting with insurance professionals and tax advisors can help you navigate these aspects and ensure that your life insurance policy is tailored to your specific needs and provides the maximum benefits within the legal framework of Canada.

Becoming a Top Life Insurance Agent: Tips and Tricks

You may want to see also

Frequently asked questions

The ideal time to consider life insurance is when you have financial responsibilities or dependents who rely on your income. This could be when you start a family, purchase a home, or have significant debts. It's a good practice to review and assess your life insurance needs periodically, especially during major life events like getting married, having children, or changing careers.

Age is a significant factor in life insurance rates, and older individuals may face higher premiums. However, it's never too late to get covered. Many insurance providers offer policies tailored to older adults, and the benefits of having life insurance can still be valuable at any age. It's advisable to consult with an insurance advisor to explore your options and find a suitable plan.

Life insurance premiums generally increase with age due to the higher risk associated with insuring an older individual. As you age, the likelihood of health issues or pre-existing conditions may increase, leading to higher insurance rates. Additionally, older individuals might have accumulated more assets and financial responsibilities, making life insurance an even more critical part of their financial plan.

Yes, it is possible to obtain life insurance with pre-existing health conditions, but it may be more challenging and expensive. Insurance companies often consider factors like medical history, lifestyle choices, and family medical history when determining premiums. It's recommended to disclose all relevant health information to the insurance provider and seek professional advice to find the best coverage options.