When it comes to life insurance, the decision to stop carrying coverage as a widow can be a complex and personal one. It's important to consider various factors, such as financial goals, the remaining dependents, and the overall financial situation. In this article, we will explore the key considerations and provide insights into when and how to make this important decision, ensuring that widows can make informed choices about their insurance coverage.

What You'll Learn

- Age and Health: When an individual reaches a certain age and maintains good health, they may no longer need extensive life insurance coverage

- Financial Goals: Achieving financial milestones, like paying off debts or saving for retirement, may reduce the need for life insurance

- Income Replacement: If income sources diversify or decrease, the need for life insurance as a primary income replacement may diminish

- Family Structure: Changes in family dynamics, such as children moving out or the death of a spouse, can impact insurance needs

- Wealth Accumulation: Building a substantial personal and family wealth may reduce the reliance on life insurance for financial security

Age and Health: When an individual reaches a certain age and maintains good health, they may no longer need extensive life insurance coverage

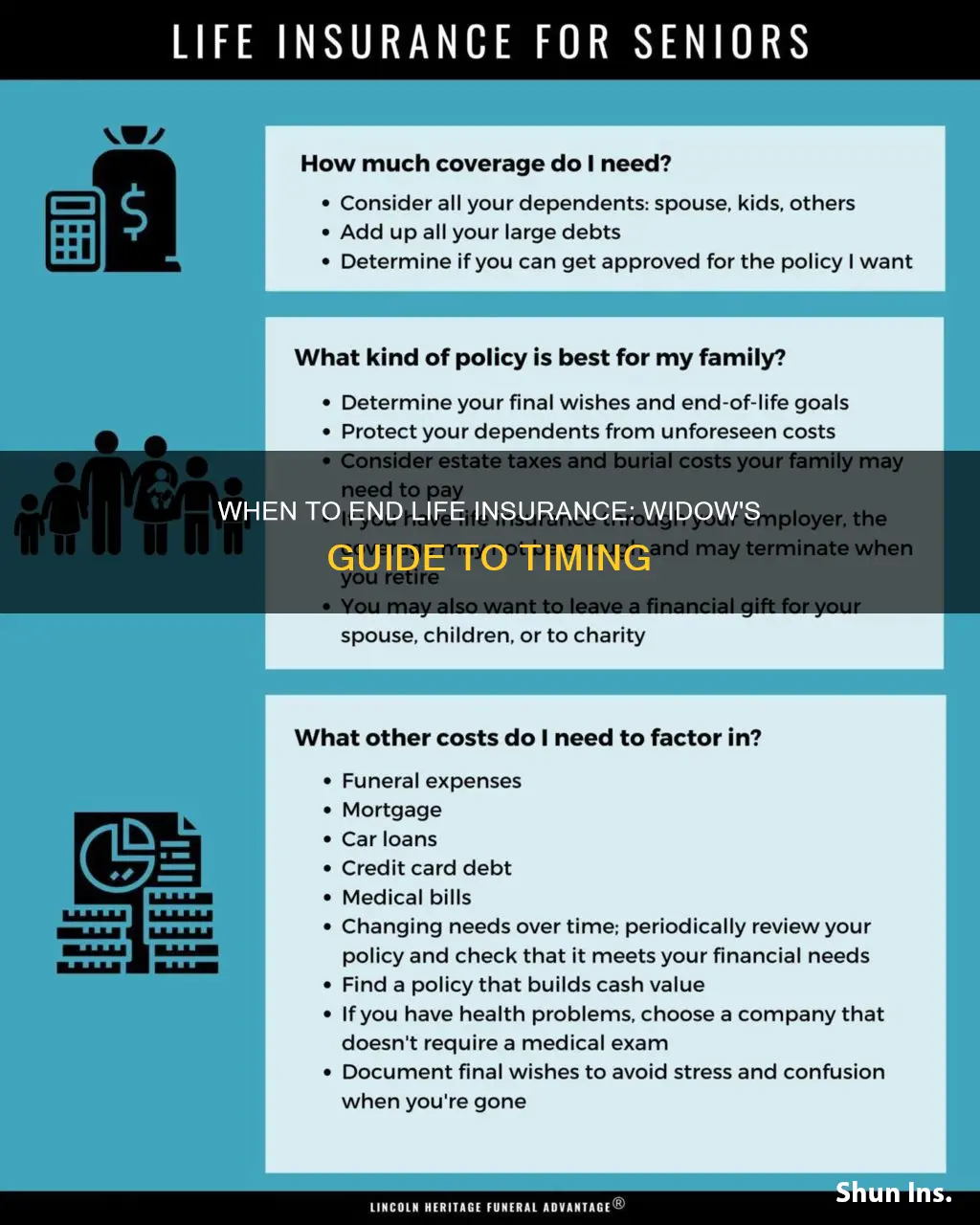

As individuals age, their financial obligations and risks often change, which can impact the need for life insurance. While life insurance is a crucial tool for providing financial security to loved ones, there are certain age-related factors that may prompt individuals to reconsider their insurance needs. One of the primary considerations is the decreasing reliance on income replacement. As people approach retirement age, they typically have fewer financial dependents and may have accumulated sufficient savings or retirement funds to support their lifestyle. In this stage of life, the primary purpose of life insurance may shift from providing income replacement to covering specific expenses, such as outstanding debts or mortgage payments.

Age also plays a significant role in health considerations. Older individuals who have maintained good health and have no significant medical conditions may find that their risk of premature death decreases. This is because the likelihood of developing severe health issues that could lead to an early demise often increases with age. As a result, the need for extensive life insurance coverage may diminish, especially if the individual has already provided for their family's financial well-being through other means.

Additionally, the concept of long-term care should be considered. As people age, the risk of requiring long-term care services, such as nursing home care or in-home assistance, increases. This aspect of aging can be financially burdensome, and some individuals may choose to self-insure by setting aside funds specifically for long-term care expenses. By doing so, they can avoid the potential costs associated with life insurance premiums while still having a plan in place for future care needs.

It is important to note that age alone is not the sole determinant of when to stop carrying life insurance. Individual circumstances, such as financial status, family responsibilities, and personal preferences, also play a crucial role. For those who have already provided for their family's financial security and have no outstanding debts, reducing or eliminating life insurance coverage may be a viable option. However, it is essential to consult with a financial advisor or insurance professional to assess your specific situation and make an informed decision.

In summary, as individuals reach a certain age and maintain good health, they may no longer require extensive life insurance coverage. The decreasing need for income replacement, improved health, and the potential for long-term care expenses are factors to consider. By evaluating these aspects, individuals can make informed choices about their life insurance needs, ensuring they have adequate protection while also managing their financial resources effectively.

Life Insurance After Cancer: Is It Possible?

You may want to see also

Financial Goals: Achieving financial milestones, like paying off debts or saving for retirement, may reduce the need for life insurance

Achieving financial milestones can significantly impact your decision regarding life insurance coverage, especially when considering the needs of a widow. As you work towards financial goals, such as paying off debts or saving for retirement, you may find that your life insurance needs evolve and change. Here's how these financial achievements can influence your life insurance strategy:

Debt Management: One of the primary reasons individuals purchase life insurance is to provide financial security for their loved ones in the event of their passing. When you have outstanding debts, such as a mortgage, student loans, or credit card balances, life insurance can ensure that these debts are settled, preventing your family from incurring additional financial burdens. As you diligently work towards paying off these debts, the coverage provided by life insurance may become less critical. For instance, if you successfully pay off your mortgage, the need for a large death benefit to cover this debt diminishes.

Retirement Savings: Building a robust retirement fund is a common financial goal, and this journey often coincides with a reduction in life insurance requirements. As you accumulate savings, investments, and retirement accounts, the financial security you provide for your family may transition from covering immediate debts to supporting long-term financial stability. In this phase, you might consider adjusting your life insurance policy to reflect the changing nature of your financial obligations. For example, you may opt for a lower death benefit or even explore term life insurance, which provides coverage for a specific period, aligning with the duration of your retirement savings goals.

Financial Security and Legacy Planning: Achieving financial milestones often involves a comprehensive approach to wealth management. As you progress in your financial journey, you may develop strategies to secure your assets and plan for the future. This could include establishing trusts, creating wills, or implementing estate planning techniques. During this process, you might discover that your life insurance needs have shifted. For instance, you may no longer require a substantial death benefit to cover debts, and instead, focus on ensuring your loved ones' long-term financial well-being through other means.

Regular Review and Adjustment: It is essential to periodically review and adjust your life insurance policy as your financial situation changes. Life events, such as marriage, the birth of children, or significant career advancements, can trigger a reevaluation of your coverage. Similarly, as you achieve financial milestones, you should reassess your life insurance needs. This proactive approach ensures that your policy remains relevant and aligned with your current circumstances, providing the necessary protection without unnecessary financial overhead.

In summary, reaching financial goals, such as debt repayment and retirement savings, can significantly impact your life insurance requirements. As you progress in these areas, you may find that your life insurance policy needs adjustment to reflect the changing nature of your financial obligations. Regularly reviewing and updating your insurance coverage will ensure that you maintain the appropriate level of protection for your loved ones while also optimizing your financial resources.

Life Insurance While Hospitalized: Is It Possible?

You may want to see also

Income Replacement: If income sources diversify or decrease, the need for life insurance as a primary income replacement may diminish

When it comes to life insurance, the need for coverage can evolve over time, especially for those who are widowed. One crucial aspect to consider is the role of income replacement, which can significantly impact the decision to maintain or discontinue life insurance. If an individual's income sources become more diverse or experience a decline, the rationale behind relying heavily on life insurance as a primary income replacement may no longer hold.

Diversifying income streams can be a strategic move for many. For instance, a person might have a primary job, a side business, investments, or rental properties that provide additional revenue. In such cases, the overall financial stability and security are enhanced, reducing the immediate need for life insurance to cover a sudden loss of income. With multiple sources of income, the impact of a single breadwinner's passing is mitigated, and the financial impact on the surviving spouse or family is less severe.

On the other hand, a decrease in income sources can also prompt a reevaluation of life insurance needs. This could be due to various factors such as retirement, health issues, or the loss of a job. As income decreases, the primary purpose of life insurance, which is often to replace lost income, becomes less relevant. For example, if a stay-at-home parent's role is no longer necessary due to the family's financial situation, the need for life insurance to cover their contribution might diminish.

Assessing the current financial situation and future plans is essential. If an individual's income is sufficient to meet their expenses and obligations without relying heavily on life insurance, then maintaining the policy might not be cost-effective. However, it's important to note that life insurance can still serve other purposes, such as covering final expenses, providing liquidity for estate planning, or ensuring financial security for dependent children.

In summary, the decision to stop carrying life insurance as a widow should consider the evolving nature of income replacement. Diversifying income sources can reduce the immediate need for life insurance, while a decrease in income may prompt a reevaluation of coverage. Regularly reviewing and adjusting insurance policies to align with life's changing circumstances is essential to ensure that the chosen coverage remains appropriate and beneficial.

Whole Life Insurance: Better Investment Option than Bonds?

You may want to see also

Family Structure: Changes in family dynamics, such as children moving out or the death of a spouse, can impact insurance needs

Changes in family dynamics can significantly influence an individual's insurance needs, especially when it comes to life insurance. One of the most common life events that trigger a reevaluation of insurance coverage is the transition of children leaving home. As children grow and establish their own lives, the financial responsibilities of the parents shift. This shift often leads to a reevaluation of insurance policies to ensure that the remaining family members are adequately protected. For instance, if a child moves out and starts earning an income, the need for a substantial life insurance policy on the parent's life may diminish. This is because the child's income can now contribute to the family's financial stability, reducing the reliance on the parent's life insurance benefits.

The death of a spouse is another critical life event that can impact insurance needs. When a spouse passes away, the surviving partner may need to adjust their insurance coverage to account for the loss of income and the potential changes in their family structure. For example, if the deceased spouse was the primary breadwinner, the surviving partner might require a larger life insurance policy to cover the financial gap left by their partner's death. Additionally, the surviving spouse may also need to consider their own life insurance to ensure that their financial obligations and future needs are met.

As family dynamics evolve, it is essential to periodically review and adjust insurance policies accordingly. When children move out, the insurance needs may change due to reduced financial dependence and potential changes in the family's overall financial situation. Similarly, the death of a spouse can lead to a complete reevaluation of insurance coverage, including life insurance, to ensure that the surviving partner's financial well-being is protected.

In both scenarios, it is crucial to consult with insurance professionals who can provide guidance tailored to the specific family circumstances. They can help determine the appropriate level of coverage, ensuring that the insurance policy aligns with the changing family dynamics. Regularly reviewing and updating insurance plans can provide peace of mind, knowing that the coverage is optimized for the current family structure and financial obligations.

By staying proactive and adapting insurance policies to reflect the evolving family structure, individuals can ensure that their loved ones are protected during significant life transitions. This approach allows for a more personalized and effective insurance strategy, providing financial security for the entire family throughout various life stages.

Understanding IRIX: The Key to Accurate Life Insurance Underwriting

You may want to see also

Wealth Accumulation: Building a substantial personal and family wealth may reduce the reliance on life insurance for financial security

Building substantial personal and family wealth is a strategic approach to reducing the long-term need for life insurance, which can provide financial security for your loved ones in the event of your passing. As you accumulate wealth, you create a safety net that can eventually replace the role of life insurance. Here's how wealth accumulation can help you make that transition:

- Diversifying Income Streams: Wealth accumulation often involves diversifying your income sources. This could mean having multiple streams of revenue, such as investments, rental properties, business ventures, or a well-diversified portfolio. By having multiple sources of income, you can ensure a steady cash flow that can support your family's financial needs without relying solely on life insurance. For instance, if you own rental properties, the rental income can provide a consistent financial cushion, reducing the urgency to rely on life insurance proceeds.

- Growing Assets: As your wealth grows, you build a substantial asset base. These assets can include real estate, stocks, bonds, mutual funds, or other investments. The value of these assets can appreciate over time, providing a significant financial cushion. For example, if you own a valuable piece of property or have a well-diversified stock portfolio, the potential for growth and liquidity can make these assets a reliable source of financial support for your family, reducing the need for life insurance.

- Creating a Legacy: Wealth accumulation allows you to create a lasting legacy for your family. This could involve funding your children's education, establishing trust funds, or supporting charitable causes. By ensuring your family's long-term financial goals are met, you can reduce the emotional and financial burden that life insurance might otherwise carry. For instance, if you've set up a trust fund for your children's future, the assets within the trust can provide financial security, making life insurance less critical.

- Long-Term Financial Planning: Building wealth encourages long-term financial planning, which often includes setting up various financial instruments and strategies. This could include retirement plans, tax-efficient savings accounts, or insurance policies tailored to your specific needs. As your financial plan matures, you may find that the coverage provided by these specialized policies is sufficient, reducing the need for standard life insurance.

- Reducing Risk Exposure: Wealth accumulation can help mitigate the risks associated with life insurance. Life insurance is typically used to cover expenses and provide financial support during the insured's lifetime. With a substantial personal and family wealth, you can reduce the likelihood of facing significant financial hardships that might otherwise require life insurance. For example, if you have a robust financial cushion, you may be less likely to need life insurance to cover everyday living expenses.

In summary, wealth accumulation is a powerful tool to reduce the reliance on life insurance. By diversifying income, growing assets, creating a legacy, and implementing long-term financial planning, you can ensure that your family's financial security is met through other means. This approach not only provides financial peace of mind but also allows you to make more informed decisions about the type and extent of life insurance coverage you may still require.

ACA and Pre-Existing Conditions: Life Insurance Impact

You may want to see also

Frequently asked questions

The decision to discontinue life insurance as a widow depends on several factors. Firstly, assess your current financial situation and needs. If you no longer require the financial support that life insurance provides, such as for dependent children or a mortgage, then it might be a good time to review your policy. Additionally, consider the terms of your policy, as some insurers offer a reduced premium or a policy lapse option after a certain period, allowing you to adjust the coverage according to your evolving circumstances.

There isn't a universal timeframe that applies to everyone. It's essential to evaluate your personal situation. If you've reached a point where the primary beneficiaries no longer rely on the insurance proceeds, and your financial obligations have decreased, you may consider adjusting or terminating the policy. However, consulting with a financial advisor or insurance specialist can provide tailored guidance based on your unique circumstances.

Continuing life insurance as a widow can offer several benefits. It provides financial security and peace of mind, ensuring that your beneficiaries receive the intended financial support. Over time, you may also be able to build cash value within the policy, which can be borrowed against or withdrawn. This can be particularly useful if you need immediate funds for unexpected expenses or if you want to build a financial cushion for future goals. Regularly reviewing and adjusting the policy with the help of a professional can ensure it remains aligned with your evolving needs.