Term life insurance is a type of life insurance that provides coverage for a specific period, or term, typically ranging from 10 to 30 years. The monetary value of this insurance is determined by the insurance company's assessment of the individual's risk profile, including factors such as age, health, lifestyle, and occupation. The index used to calculate this value is a standardized measure that helps insurers assess the likelihood of an insured individual's death during the term of the policy. This index takes into account various statistical data and risk factors to provide a comprehensive evaluation, ensuring that the insurance company can accurately price the policy and manage the associated risks. Understanding this concept is essential for individuals seeking to protect their loved ones and make informed decisions about their life insurance coverage.

What You'll Learn

- Definition: Term life insurance is a monetary value index based on the insured's age, health, and term length

- Cost: Premiums are calculated using the index, reflecting the insured's risk profile

- Benefits: Payouts are determined by the index, providing financial security for beneficiaries

- Term Length: The index influences the duration of coverage, impacting overall cost

- Comparison: Indexing allows for comparisons between different term life insurance policies

Definition: Term life insurance is a monetary value index based on the insured's age, health, and term length

Term life insurance is a financial product that provides coverage for a specific period, known as the "term." It is a form of protection that ensures financial security for the insured's beneficiaries in the event of the insured's death during the term. This type of insurance is often more affordable than permanent life insurance because it does not accumulate cash value over time and is designed to cover a defined period of risk. The primary factor in determining the cost and eligibility for term life insurance is the insured's age, health, and the length of the coverage period.

The "monetary value index" in the context of term life insurance refers to the assessment and calculation of the insurance premium based on various factors. These factors include the insured's age, which is a critical determinant as younger individuals generally have a lower risk profile and can secure coverage at more competitive rates. Additionally, the insured's health is a significant consideration; a person with a healthy lifestyle and no pre-existing medical conditions may qualify for lower premiums. The term length, or the duration of the insurance coverage, also plays a crucial role in pricing. Longer terms typically result in higher premiums due to the extended period of risk.

When applying for term life insurance, insurance companies use complex algorithms and statistical models to evaluate the insured's profile and determine the appropriate premium. This process takes into account the insured's age, health status, and the desired coverage amount. The monetary value index is essentially a standardized method of assessing the risk associated with insuring an individual, allowing insurers to offer personalized quotes based on the specific circumstances of each applicant.

The beauty of term life insurance lies in its simplicity and cost-effectiveness. It provides a straightforward way to secure financial protection for a defined period, making it an attractive option for individuals seeking affordable life insurance coverage. By considering the insured's age, health, and term length, insurers can offer competitive rates, ensuring that the policyholder receives the necessary coverage without incurring excessive costs.

In summary, term life insurance is a monetary value index that evaluates and determines the cost of insurance coverage based on the insured's age, health, and the desired term length. This approach allows for personalized and affordable insurance solutions, providing individuals with a means to protect their loved ones without breaking the bank. Understanding this definition is essential for anyone considering term life insurance, as it highlights the key factors that influence the overall cost and accessibility of this valuable financial product.

Term Life Insurance: Understanding Average Coverage

You may want to see also

Cost: Premiums are calculated using the index, reflecting the insured's risk profile

Term life insurance with a monetary value index is a unique and innovative approach to life insurance, offering a dynamic and flexible way to protect your loved ones. This type of policy is designed to adapt to the changing circumstances of the insured individual, ensuring that the coverage remains relevant and valuable over time. The key concept here is the use of an index to calculate premiums, which is a departure from traditional fixed-rate policies.

The monetary value index is a powerful tool that takes into account various factors to determine the insured's risk profile. It considers a wide range of personal and health-related data, such as age, gender, medical history, lifestyle choices, and even genetic predispositions. By analyzing this comprehensive set of information, the index provides a detailed assessment of the individual's health and lifestyle risks. This allows for a more accurate and personalized premium calculation.

Premiums, a critical aspect of term life insurance, are determined using this index, ensuring that the cost reflects the insured's current risk status. The index-based approach means that as the insured's health and lifestyle factors change over time, the premiums will adjust accordingly. For instance, if an individual improves their health through lifestyle changes, the premiums may decrease, providing a more cost-effective policy. Conversely, if health indicators deteriorate, the premiums will increase, ensuring that the coverage remains adequate.

This dynamic pricing structure offers several advantages. Firstly, it provides a more accurate reflection of the insured's risk profile, allowing for fair and tailored pricing. Secondly, it encourages policyholders to take proactive steps towards a healthier lifestyle, as improvements can lead to reduced costs. Additionally, the flexibility of index-based premiums means that individuals can make necessary adjustments to their coverage as their circumstances evolve, ensuring they always have the right level of protection.

In summary, the term life insurance monetary value index is a sophisticated mechanism that revolutionizes the way premiums are calculated. By incorporating an individual's risk profile into the pricing structure, this approach offers a more personalized and adaptable insurance solution. It empowers policyholders to manage their insurance costs effectively while ensuring that their loved ones remain protected. This innovative method of pricing is a significant advantage for those seeking a dynamic and responsive life insurance policy.

Life Insurance: A Business Owner's Supplemental Income Strategy

You may want to see also

Benefits: Payouts are determined by the index, providing financial security for beneficiaries

Term life insurance with a monetary value index is a financial product that offers a unique and valuable feature: its payouts are directly linked to a specific index, ensuring a reliable and predictable financial safety net for the policy's beneficiaries. This index-based approach provides a sense of security and peace of mind, especially in uncertain economic times.

The primary benefit of this type of insurance is the guaranteed payout structure. When you purchase a term life insurance policy with a monetary value index, the insurance company promises to pay out a predetermined amount to your designated beneficiaries if you pass away during the specified term. This payout is directly tied to the performance of the index, which could be an economic indicator or a financial benchmark. For example, the index might represent the stock market's performance, a specific commodity's price, or a particular interest rate.

The beauty of this system is that it provides financial security and stability. The beneficiaries can rely on receiving the agreed-upon amount, which can be a substantial financial cushion during challenging times. This is particularly important for families or individuals who depend on a steady income to cover essential expenses, such as mortgage payments, living costs, or education fees. By ensuring a consistent payout, the insurance policy becomes a vital tool for maintaining financial stability and preventing the potential financial strain that could arise from the loss of a primary income earner.

Furthermore, the index-based payout structure offers a level of predictability that is often lacking in other forms of insurance. Policyholders can have a clear understanding of the potential financial benefit they are securing for their loved ones. This transparency allows individuals to make informed decisions about their insurance needs and plan accordingly, ensuring that their beneficiaries are protected against unforeseen circumstances.

In summary, term life insurance with a monetary value index provides a powerful benefit by offering guaranteed payouts that are directly linked to a specific index. This feature ensures financial security and peace of mind for beneficiaries, allowing them to rely on a consistent financial safety net during challenging times. It is a valuable tool for anyone seeking to protect their loved ones and maintain financial stability in the face of uncertainty.

Large Life Insurance Check: Depositing and Managing Your Payout

You may want to see also

Term Length: The index influences the duration of coverage, impacting overall cost

The term life insurance monetary value index is a fascinating concept that directly impacts the cost and duration of your insurance policy. This index is a measure of the current value of a term life insurance policy, taking into account various factors such as interest rates, investment performance, and the policyholder's age and health. It is a crucial tool for insurance providers to assess the financial worth of a policy and determine the appropriate premium rate.

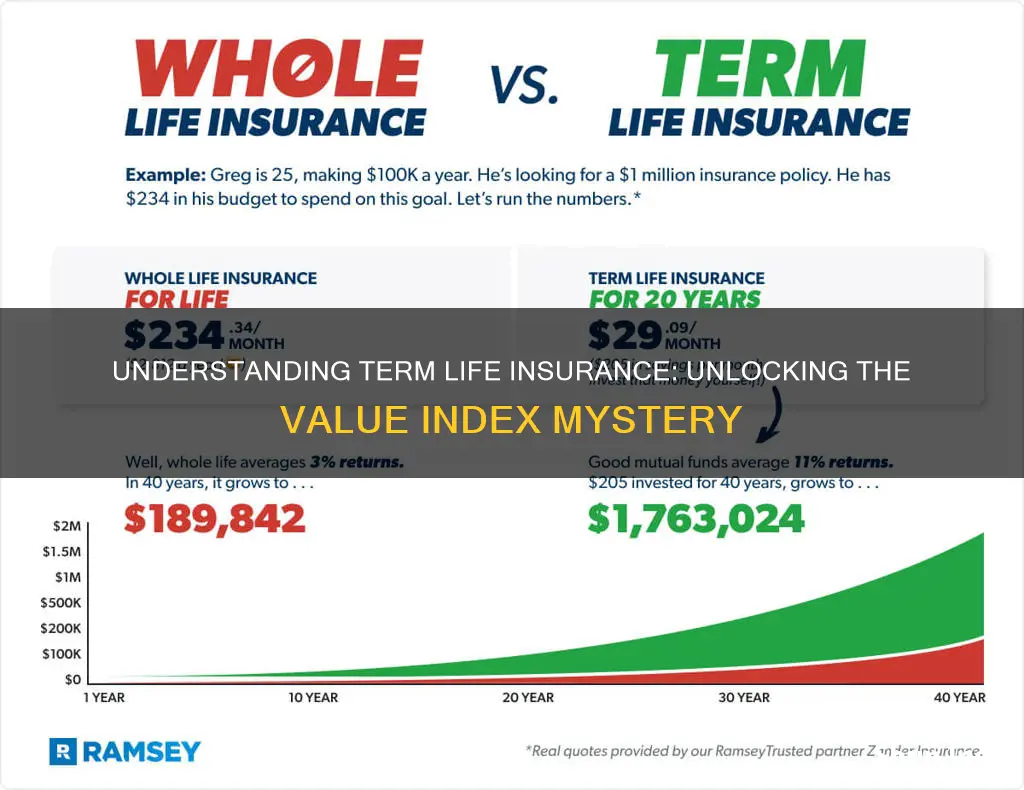

When it comes to term life insurance, the term length is a critical aspect. It refers to the period during which the insurance coverage is in effect. The monetary value index influences this duration, as it provides a reference point for the insurance company to calculate the policy's worth over time. Longer term lengths typically result in higher overall costs because the insurance company assumes a higher risk for an extended period. For instance, a 30-year term policy will generally be more expensive than a 10-year term policy, as the former covers a more extended period, and the risk of the insured individual's death during that time is higher.

The index plays a pivotal role in determining the cost of term life insurance. It is used to calculate the present value of future cash flows, which includes the premiums paid and the death benefit. By considering the time value of money, the index ensures that the policy's value is accurately assessed. As interest rates fluctuate, the index adjusts, impacting the overall cost. For example, if interest rates are low, the present value of future cash flows is lower, leading to a reduced premium. Conversely, during periods of high interest rates, the index may increase, resulting in higher insurance costs.

Understanding the term length and its relationship with the monetary value index is essential for policyholders. It empowers individuals to make informed decisions when choosing a term life insurance policy. Longer term lengths provide more extended coverage, ensuring financial protection for a more extended period. However, it is crucial to consider one's financial goals and future plans. For instance, if you plan to retire or have specific financial milestones in the near future, a longer term length might be beneficial. On the other hand, if you have a shorter-term financial goal, such as saving for a child's education, a shorter term length could be more suitable, keeping overall costs lower.

In summary, the term life insurance monetary value index significantly influences the term length of a policy, which, in turn, affects the overall cost. This index is a critical component in the pricing and valuation of term life insurance, ensuring that the insurance company can offer competitive rates while managing risk effectively. By understanding this relationship, individuals can make well-informed choices when selecting a term life insurance policy that aligns with their financial needs and objectives.

Rheumatoid Arthritis: Life Insurance Rates and Their Impact

You may want to see also

Comparison: Indexing allows for comparisons between different term life insurance policies

Indexing is a powerful tool that enables consumers to compare the value and performance of different term life insurance policies. When it comes to term life insurance, the concept of indexing allows for a fair and transparent assessment of various products in the market. This is particularly important as term life insurance policies can vary significantly in terms of coverage, premiums, and benefits. By using indexing, individuals can make informed decisions and choose the policy that best suits their needs and financial goals.

The process of indexing involves creating a standardized scale or benchmark to measure and compare the monetary value of different insurance policies. This index acts as a common reference point, ensuring that all policies are evaluated on the same criteria. For instance, an index might consider factors such as the death benefit amount, the duration of the policy term, the insurer's financial strength, and any additional riders or benefits included. Each policy is then assigned a value or rating based on these factors, allowing for easy comparison.

One of the key advantages of indexing is that it provides a comprehensive overview of the market. It enables consumers to see how various insurers stack up against each other in terms of policy offerings. For example, an indexed comparison might reveal that Policy X from Insurer A offers a higher death benefit for a similar premium compared to Policy Y from Insurer B. This information empowers individuals to make apples-to-apples comparisons and select the policy that aligns with their desired level of coverage and budget.

Moreover, indexing facilitates a more nuanced understanding of the value proposition of each policy. It goes beyond simple price comparisons and delves into the underlying features and benefits. For instance, an indexed analysis might highlight that Policy Z from Insurer C provides an additional critical illness benefit, which could be valuable for certain individuals. By presenting this information in a structured manner, indexing ensures that consumers can make well-informed decisions, considering both the monetary value and the additional perks offered by different insurers.

In summary, indexing plays a vital role in comparing term life insurance policies by providing a standardized framework for evaluation. It empowers consumers to make informed choices by presenting a clear picture of the market and the unique features of each policy. Through indexing, individuals can ensure they receive the best value for their money and select a term life insurance policy that meets their specific requirements. This process ultimately contributes to a more transparent and competitive insurance market.

Group Variable Universal Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

The monetary value index (MVI) is a concept used in the context of term life insurance to determine the financial worth of a policy. It is a way to measure the potential financial impact of a life insurance policy over time, considering factors like interest rates, investment performance, and policyholder behavior. MVI helps assess the policy's value, especially in the context of long-term financial planning and retirement strategies.

Calculating the MVI involves several steps and assumptions. It typically starts with determining the policy's death benefit and then adjusting it for factors such as interest rates, investment returns, and policyholder actions. The formula considers the present value of future benefits, taking into account the time value of money. This calculation provides an estimate of the policy's worth, which can be useful for understanding the potential financial gains or losses associated with the insurance policy.

Understanding the MVI can be beneficial for policyholders as it provides insights into the potential value of their insurance policy. If the MVI indicates a positive value, it suggests that the policy's financial impact could be significant over time. This information can help individuals make informed decisions about their insurance coverage, especially when considering policy upgrades, conversions, or surrender options. Additionally, it allows policyholders to assess the potential returns on their insurance investment, which can be valuable for long-term financial planning.