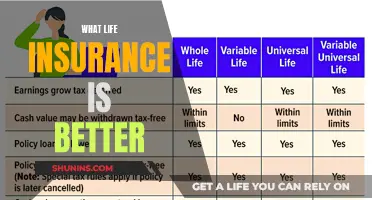

Permanent life insurance is a versatile tool for businesses of all sizes. It can be used to protect a company, family, partners, and key employees from unexpected deaths. It also provides a financial safety net for a business owner's family in the event of their death. Permanent life insurance can also be used to fund a business owner's retirement, providing a stable source of supplemental retirement income unaffected by short-term market volatility.

| Characteristics | Values |

|---|---|

| Protecting family | Replaces income and protects family from debts |

| Protecting company | Pays off business debts, supplements cash flow, covers expenses needed to find a replacement |

| Tax advantages | Provides the same tax advantages as a Roth IRA |

| Funding a buy-sell agreement | Funds a buy-sell agreement, which dictates what happens to each owner's share of the company if they leave the business |

| Protecting partners | Helps fund partnership agreements, equalizes inheritances for adult children |

| Protecting key employees | Provides additional compensation to key employees, covers losses from the death of a key employee |

| Attracting talent | Serves as a valuable benefit to attract top talent |

What You'll Learn

Whole life insurance can protect against financial loss and supplement retirement income

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the policyholder's life, as long as they pay their premiums. It can be an effective tool for business owners to protect their company, family, partners, and employees from financial hardship in the event of their unexpected death.

One key advantage of whole life insurance is its ability to provide a stable source of supplemental retirement income. The cash value of a whole life insurance policy accumulates over time and is guaranteed, regardless of market conditions. This means that business owners can borrow against this cash value to supplement their retirement income without being impacted by short-term market volatility. This can be especially useful during down markets when it is inadvisable to withdraw from equity-based retirement investments. By borrowing from a whole life insurance policy, business owners can leave their investments better positioned to rebound when the market recovers.

Additionally, whole life insurance can also protect against financial loss. In the event of the policyholder's death, the death benefit can provide financial resources for their family, helping to replace lost income and maintain their standard of living. This is particularly important for business owners who may not have access to employee benefits such as a retirement account, group life insurance, or disability insurance.

Furthermore, whole life insurance can be used to fund a buy-sell agreement, a legally binding contract between business co-owners. This agreement stipulates what happens to each owner's share of the company in the event of their death, disability, or departure. The death benefit from the life insurance policy can be used to purchase the deceased owner's share of the business, reducing conflict and allowing the business to continue operating smoothly.

Whole life insurance also offers tax advantages. Distributions from the policy, such as cash dividends and partial/full surrenders, are typically not subject to taxation up to the amount paid into the policy. This feature further enhances the attractiveness of whole life insurance as a retirement income supplement.

In summary, whole life insurance serves as a valuable tool for business owners, providing financial protection for their company and family while also offering a stable source of supplemental retirement income that is insulated from market volatility.

Life Insurance and Doctor Visits: What's the Connection?

You may want to see also

It can be used to fund a buy-sell agreement

Permanent life insurance can be used to fund a buy-sell agreement, which is a legally binding contract between business co-owners. This type of insurance can provide money for a buyout if one of the partners dies or becomes incapacitated. It can also help reduce conflict between all parties involved and allow the business to continue running smoothly.

Here's how it works: The owners or the business purchase policies insuring each partner. If one owner dies, the other owners use the death benefit to buy the deceased owner's share of the business. This creates stability for the company and ensures that the remaining owner(s) are not forced to sell the company or bring in new ownership.

There are two main types of buy-sell agreements: cross-purchase and entity purchase. In a cross-purchase agreement, each owner buys a life insurance policy on the other owners. The death benefit is then paid to the surviving owners, who use it to buy out the deceased owner's interest. In an entity purchase agreement, the business itself buys a life insurance policy on each of the owners. The death benefit is paid to the business, which then uses the money to buy out the deceased owner's interest.

Permanent life insurance is often recommended for funding a buy-sell agreement because it provides lifelong coverage. Term life insurance, on the other hand, only provides coverage for a certain number of years. If the insured person dies after the term period, the beneficiaries receive nothing.

When deciding whether to use permanent or term life insurance to fund a buy-sell agreement, business owners should consider their long-term plans for the company. If they plan to sell the business within a relatively short period, such as 10 years, term life insurance may be sufficient. However, if they plan to be in business for the long haul (20 years or more), permanent life insurance is usually a better option.

Life Insurance Tax: What Pennsylvania Employees Need to Know

You may want to see also

It can help equalise inheritances for adult children

Permanent life insurance can help business owners equalise inheritances for their adult children. This is especially relevant if you have a family-owned business and not all of your children are involved in the company.

For example, if you have two children and only one of them works for the family business, you may want to leave the business to that child. In this case, permanent life insurance can provide a death benefit to the other child, ensuring that your estate is divided equally between them.

Permanent life insurance can also be used to provide a death benefit to family members who are not involved in the company, preventing conflicts that could interrupt the flow of business. This can help to maintain a harmonious relationship between family members and ensure a smooth transition of business ownership.

When considering permanent life insurance to equalise inheritances, it is important to buy enough coverage to fairly compensate the children who are not inheriting the business. Additionally, working with a financial advisor who has experience in this area can help you make the right decisions for your specific situation.

Globe Life Insurance: Waiting Periods and You

You may want to see also

It can be used to pay off business debts

Permanent life insurance can be used to pay off business debts in several ways. Firstly, it can be used to pay off business loans or losses. If a business owner has taken out loans to grow their business, permanent life insurance can help cover those loan payments in the event of their death. This can protect the business from financial strain and ensure its continuity.

Additionally, permanent life insurance can be used to buy back the deceased owner's shares in the business. When a business owner passes away, their shares in the company may need to be purchased by the remaining owners or the company itself. Permanent life insurance provides the necessary funds to facilitate this transaction, allowing for a smooth transition and maintaining the stability of the business.

Permanent life insurance can also provide the financial resources needed to cover the cost of replacing a key employee. The death benefit from the insurance can be used to recruit, hire, and train a replacement, ensuring that the business can continue operating effectively.

Moreover, permanent life insurance can be leveraged to obtain loans or borrow against the accumulated cash value of the policy. This can provide supplemental cash flow for the business, helping it to weather uncertain economic times, pay overhead expenses, or invest in growth opportunities.

By utilizing permanent life insurance to pay off business debts, business owners can protect their company's financial stability, ensure the continuity of operations, and provide the necessary funds for key transitions or investments.

Group Life Insurance: An Optional Program?

You may want to see also

It can be used to protect your family

Permanent life insurance can be used to protect your family in several ways. Firstly, it can replace your income and protect your family from debts in the event of your death. This is especially important for business owners, as you may not have employee benefits like a retirement account, group life insurance, or disability insurance. If your family relies on your income, they will need financial support to care for themselves after you're gone. The death benefit from your life insurance policy can cover your salary and other contributions to the household, such as childcare.

Permanent life insurance can also help with inheritance planning, especially if you own a family business. It can be used to equalize inheritances for your children, ensuring that all heirs receive a fair distribution of your estate, even if not all of them are involved in the business. For example, if you plan to leave the family business to one child, you can use a life insurance policy to provide a death benefit to another child who is not involved in the company. This way, both children receive an equal inheritance.

Additionally, permanent life insurance can help protect your family in the event of unexpected death. If you have used personal assets, such as your home, as collateral for a business loan, life insurance can ensure that your family does not bear the burden of paying off the debt. It can provide the necessary funds to pay off the loan, preventing your family from losing their home.

Permanent life insurance can also be used to fund a buy-sell agreement, which is a legally binding contract between business co-owners. This agreement outlines what happens to each owner's share of the company if they leave the business due to death, disability, or retirement. By including life insurance in the buy-sell agreement, the death benefit can be used to purchase the deceased owner's share of the business, reducing conflict and allowing the business to continue operating smoothly. This protects your family from the complexities of business succession and ensures they receive the financial benefits.

Collateral Assignment: Whole Life Insurance Options

You may want to see also

Frequently asked questions

Permanent life insurance can help business owners in several ways. It can be used to protect the company, family, partners, and key employees from an unexpected death. It can also be used to fund a buy-sell agreement, provide for family succession, and cover key employees.

A whole life insurance policy's cash value can provide a stable source of supplemental retirement income that is unaffected by short-term market volatility. Business owners can borrow against the accumulated cash value of their whole life insurance policy to help their business weather uncertain economic times, pay overhead expenses, or provide supplemental cash flow.

Permanent life insurance provides business owners with additional protection for key executives, access to cash value, and a way to provide executive bonuses. It can also be used to fund a deferred compensation program and protect the company against the loss of a key employee.

When purchasing permanent life insurance as a business owner, it is important to consider your financial goals and objectives, the amount of coverage needed, and the costs and benefits of the policy. It is also important to work with a financial professional who can help you choose the most suitable products for your situation.