When you get denied life insurance, it can be a frustrating and disheartening experience, especially if you've been told that you're a low-risk candidate. However, it's important to remember that there are several reasons why an insurance company might deny your application, and it's not always a reflection of your personal circumstances. Understanding the reasons for the denial and knowing your options can help you navigate the process more effectively and potentially find alternative coverage that suits your needs.

What You'll Learn

- Financial Impact: Understand the financial consequences of being denied life insurance

- Appeal Process: Learn the steps to appeal a life insurance denial

- Health Factors: Explore how health issues affect life insurance eligibility

- Coverage Alternatives: Discover alternative coverage options for those denied

- Improving Chances: Tips to increase the likelihood of life insurance approval

Financial Impact: Understand the financial consequences of being denied life insurance

When an individual is denied life insurance, it can have significant financial implications that extend far beyond the initial shock of the rejection. The primary financial impact is the loss of a crucial safety net that many families rely on to secure their financial future. Life insurance provides a financial cushion in the event of the insured's death, ensuring that loved ones are taken care of and that financial obligations are met. Without this coverage, the financial burden of funeral expenses, outstanding debts, mortgage payments, and the overall cost of living can fall solely on the surviving family members.

The financial consequences can be particularly severe for those with young children or elderly parents who depend on the insured's income. The denial of life insurance may force these individuals to make difficult choices, such as reducing their standard of living, taking on additional debt, or even going without necessary expenses to cover the basic needs of their family. This can lead to long-term financial strain and a reduced quality of life.

Moreover, the denial could have a ripple effect on an individual's financial goals and plans. For instance, if someone was counting on life insurance to fund their child's education or to build a retirement nest egg, the absence of this financial tool can disrupt these plans. It may require a complete reevaluation of financial strategies, potentially leading to higher costs or reduced savings to achieve the same goals.

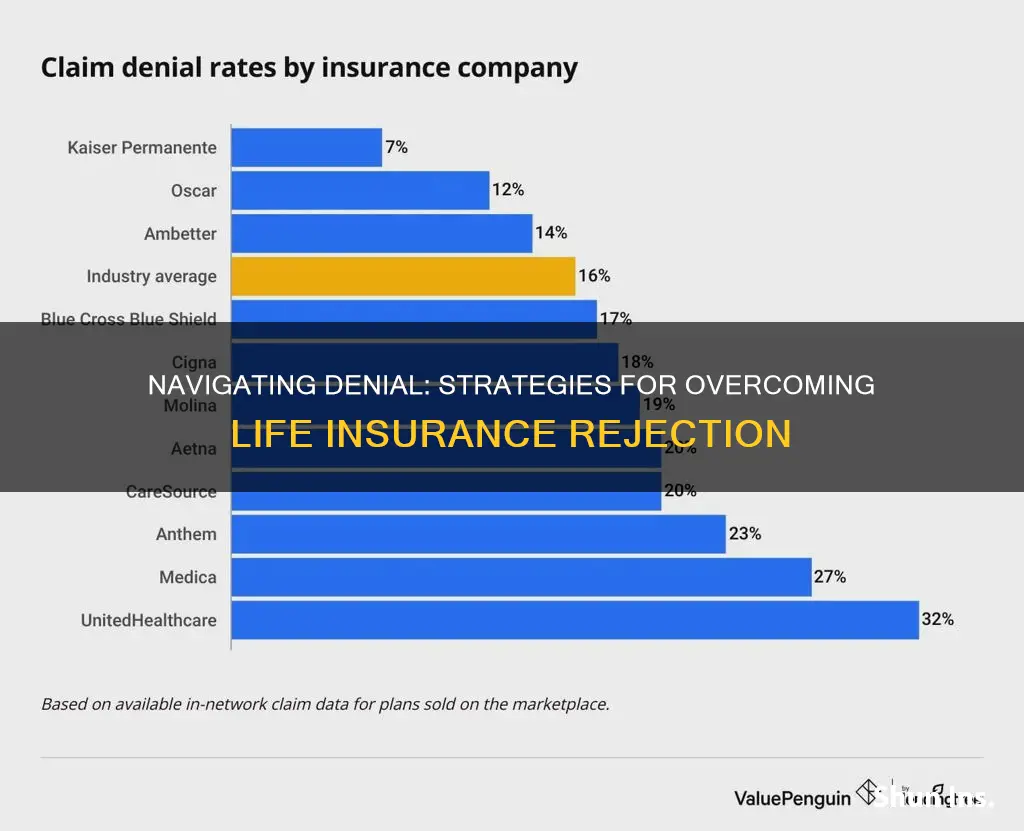

In some cases, being denied life insurance might prompt individuals to seek alternative financial products, such as term life insurance or whole life insurance from other providers. However, this process can be challenging and may result in higher premiums or even further rejections, especially if the initial denial was due to pre-existing health conditions or lifestyle factors. The financial burden of securing alternative coverage can be substantial, and the process can be emotionally and financially draining.

Understanding the financial impact of being denied life insurance is crucial for making informed decisions. It highlights the importance of maintaining a healthy lifestyle, regularly reviewing and updating insurance policies, and seeking professional advice to navigate the complexities of the insurance market. By being proactive, individuals can increase their chances of obtaining suitable coverage and ensure their financial security for the long term.

Life Insurance at 80: How Much Cover is Enough?

You may want to see also

Appeal Process: Learn the steps to appeal a life insurance denial

When you receive a denial for life insurance, it can be a challenging and frustrating experience. However, it's important to remember that you have the right to appeal the decision and potentially secure the coverage you need. Understanding the appeal process is crucial to navigating this situation effectively. Here's a step-by-step guide to help you through the process:

- Review the Denial Letter: Start by carefully reading the denial letter you received. Pay close attention to the reasons provided for the rejection. Insurance companies typically cite specific factors, such as pre-existing medical conditions, lifestyle choices, or occupation, that contributed to their decision. Understanding these factors will help you tailor your appeal.

- Gather Supporting Evidence: Prepare a comprehensive package of supporting documents to strengthen your case. This may include medical records, lab results, doctor's notes, or any other evidence that contradicts or clarifies the insurer's concerns. For example, if your denial was based on a health condition, provide recent medical assessments that demonstrate improved health or effective management of the issue.

- Contact the Insurance Company: Reach out to your insurance provider and request an appeal form or guidelines. Inquire about their specific requirements and deadlines for submitting an appeal. It's essential to act promptly, as there may be time limits for challenging the decision. During this conversation, ask for the name of the person or department you should correspond with to ensure your appeal is directed to the appropriate team.

- Write a Persuasive Appeal Letter: Craft a well-structured and compelling letter explaining why you believe the initial decision was incorrect. Highlight any new or changed circumstances that may now support your eligibility for coverage. Provide a detailed account of your current health, lifestyle, or any other factors that were not considered in the initial assessment. Ensure your letter is concise, professional, and free of emotional language.

- Include Supporting Documents: Attach all the relevant medical records, test results, or any other evidence to your appeal letter. Ensure that the documents are legible and clearly marked with your personal information for easy identification. This additional information will assist the insurer in re-evaluating your case.

- Follow-up and Stay Informed: After submitting your appeal, maintain regular contact with the insurance company to ensure your case is being processed. Inquire about the status of your appeal and be prepared to provide additional information if requested. Stay informed about the latest developments and be proactive in keeping the insurer updated on any changes in your health or circumstances.

Remember, the appeal process allows you to provide new insights and evidence that may change the insurer's perspective. By following these steps, you can effectively challenge a life insurance denial and potentially secure the coverage you deserve. It is a right that you should be aware of and utilize to your advantage.

Getting a Non-Resident Life Insurance License: A Step-by-Step Guide

You may want to see also

Health Factors: Explore how health issues affect life insurance eligibility

Health factors play a crucial role in determining life insurance eligibility, and understanding these factors is essential for anyone seeking coverage. Life insurance companies assess the risk associated with insuring an individual, and several health-related aspects can significantly impact the decision-making process. Here's an in-depth look at how health issues can affect your chances of getting approved for life insurance:

Chronic Conditions and Pre-Existing Diseases: One of the primary considerations is the presence of chronic illnesses or pre-existing health conditions. Conditions like diabetes, heart disease, cancer, or kidney disease can raise concerns for insurers. These illnesses often require ongoing medical management and may lead to increased healthcare costs. Insurers might request detailed medical records to assess the severity and control of these conditions. For instance, well-managed diabetes with stable blood sugar levels may result in more favorable terms, while uncontrolled diabetes could lead to higher premiums or even denial.

Lifestyle Choices: Lifestyle factors, such as smoking, excessive alcohol consumption, and drug use, significantly influence life insurance eligibility. Smoking, in particular, is a major risk factor for various health issues, including lung cancer, heart disease, and respiratory problems. Insurers often view smokers as high-risk candidates due to the increased likelihood of health complications. Similarly, excessive alcohol consumption or drug abuse can lead to liver damage, cardiovascular issues, and other health risks, making it challenging to obtain favorable insurance terms.

Age and Gender: Age and gender are demographic factors that insurers consider when evaluating health risks. Generally, older individuals may face higher insurance premiums or even denial due to the increased likelihood of health issues. As people age, the risk of developing chronic diseases tends to rise. Additionally, certain health conditions are more prevalent in specific genders. For example, breast cancer is more common in women, while prostate cancer is more frequently diagnosed in men. Insurers might use these statistics to adjust premiums or eligibility criteria.

Mental Health and Psychological Disorders: Mental health is another critical aspect. Severe mental health disorders, such as schizophrenia, bipolar disorder, or severe depression, can impact an individual's ability to manage daily life and may raise concerns for insurers. Insurers might require comprehensive psychological assessments and treatment plans to gauge the individual's stability and functioning. In some cases, managing mental health effectively can improve eligibility, but severe or untreated conditions may result in denial or limited coverage.

Obesity and Weight-Related Issues: Obesity is a growing health concern and can significantly affect life insurance eligibility. Excessive body weight is associated with various health risks, including type 2 diabetes, high blood pressure, and cardiovascular disease. Insurers may use body mass index (BMI) calculations to assess the risk. Individuals with severe obesity may face higher premiums or even denial, especially if they have related health complications.

Understanding these health factors is vital for individuals seeking life insurance. It empowers them to make informed decisions about their lifestyle choices, manage existing health conditions, and potentially improve their chances of obtaining favorable insurance coverage. Being proactive in addressing health concerns can lead to better insurance outcomes and financial security for the future.

Exploring Life Insurance: Uncertainty About My Father's Policy

You may want to see also

Coverage Alternatives: Discover alternative coverage options for those denied

When an individual is denied life insurance, it can be a challenging and frustrating experience, but it's important to remember that there are alternative coverage options available. Here are some strategies to explore:

Review and Understand the Denial: Start by carefully reviewing the denial letter or communication from the insurance company. Understand the reasons for the rejection. Common reasons include pre-existing health conditions, lifestyle factors, or a lack of medical history. Identifying these factors will help you navigate the next steps more effectively.

Consider Term Life Insurance: One of the most common alternatives is term life insurance. This type of policy provides coverage for a specific period, such as 10, 20, or 30 years. It is generally more affordable and offers a straightforward solution for those who need coverage for a defined period, such as until a child's education is funded or a mortgage is paid off.

Explore Universal Life Insurance: Universal life insurance offers permanent coverage and provides flexibility in premium payments. It allows policyholders to build cash value over time, which can be borrowed against or withdrawn. This option is suitable for those seeking long-term financial security and the ability to customize their policy according to their changing needs.

Group Life Insurance: Many employers offer group life insurance as a benefit to their employees. This type of coverage is often more affordable and accessible, especially for those who may not qualify for individual policies. Group life insurance typically provides a set amount of coverage, and the premium is usually deducted from the employee's paycheck.

Review Your Health and Lifestyle: If you were denied due to health issues, consider making positive lifestyle changes to improve your overall health. Maintaining a healthy weight, exercising regularly, quitting smoking, and managing any existing medical conditions can significantly impact your insurability. Over time, these improvements may lead to better coverage options and potentially lower premiums.

Consult a Broker or Financial Advisor: Insurance brokers and financial advisors can provide valuable guidance in finding alternative coverage options. They have access to various insurance providers and can help you compare policies, understand the terms, and make informed decisions. They can also assist in filling out applications and navigating the claims process if needed.

Remember, being denied life insurance doesn't mean you are without options. Exploring these alternative coverage choices can provide the financial security and peace of mind that individuals and families often require. It is essential to stay informed, seek professional advice when needed, and take proactive steps to secure the right insurance coverage for your circumstances.

Becoming an Independent Life Insurance Broker in California

You may want to see also

Improving Chances: Tips to increase the likelihood of life insurance approval

Getting denied life insurance can be a frustrating and concerning experience, especially when you need coverage for your loved ones. However, there are several strategies you can employ to improve your chances of approval and secure the insurance you need. Here are some valuable tips to guide you through the process:

- Understand the Reasons for Rejection: When you receive a rejection, it's crucial to understand the reasons behind it. Insurance companies assess various factors to determine eligibility. Common reasons for denial include pre-existing medical conditions, lifestyle choices (such as smoking or excessive alcohol consumption), age, and occupation. By identifying the specific reasons, you can take targeted actions to address them. For instance, if your health is a concern, you might consider making lifestyle changes or seeking medical advice to improve your overall well-being.

- Improve Your Health and Lifestyle: Insurance providers often look for evidence of good health and a healthy lifestyle. Here's how you can enhance your chances:

- Medical Check-ups: Schedule regular health check-ups to monitor your overall health. Address any existing medical conditions and follow the recommended treatment plans.

- Healthy Habits: Adopt a healthy lifestyle by maintaining a balanced diet, exercising regularly, and managing stress. These habits can significantly impact your overall health and insurance eligibility.

- Quit Smoking and Reduce Alcohol Intake: Insurance companies often view smokers and heavy drinkers as high-risk candidates. Quitting smoking and moderating alcohol consumption can substantially improve your chances of approval.

- Shop Around and Compare Policies: Different insurance companies have varying criteria for approval and may offer different coverage options. It's essential to explore multiple providers to find the best fit for your situation. Compare policies, premiums, and coverage terms to identify the most suitable plan. Additionally, consider seeking advice from independent financial advisors who can provide unbiased recommendations based on your specific needs.

- Consider Term Life Insurance: Term life insurance is a popular and often more affordable option that can provide coverage for a specific period. It is typically more accessible to obtain, especially for those with pre-existing conditions or high-risk lifestyles. By choosing a term policy, you can focus on improving your health and lifestyle during the coverage period, potentially leading to better long-term insurance prospects.

- Provide Accurate and Complete Information: When applying for life insurance, ensure that you provide accurate and detailed information. Inaccuracies or omissions can lead to further complications and potential denial. Be transparent about your medical history, lifestyle choices, and any other relevant factors. Insurance companies often require thorough medical exams, so be prepared for that process and provide all necessary documentation.

- Seek Professional Guidance: Consider consulting a financial advisor or insurance specialist who can offer personalized advice. They can help you navigate the application process, understand your options, and increase your chances of approval. These professionals can also assist in finding the right insurance provider and policy that aligns with your specific circumstances.

Remember, getting denied life insurance is not a permanent setback. By taking proactive steps to improve your health, lifestyle, and understanding of the insurance process, you can significantly enhance your chances of approval. Stay informed, be persistent, and don't hesitate to seek professional guidance when needed.

Life Insurance vs. Pension: Understanding the Key Differences

You may want to see also

Frequently asked questions

If your life insurance application is denied, it's important to understand the reasons behind the decision. Common factors that may contribute to a rejection include pre-existing medical conditions, lifestyle choices (such as smoking or excessive alcohol consumption), or a history of certain health issues. Review the denial letter carefully to identify the specific reasons and take the necessary steps to address them. You can consider improving your health, quitting smoking, or seeking medical advice to manage any existing conditions before reapplying.

Yes, you have the right to appeal a life insurance denial. Contact the insurance company and request an appeal process. Gather any additional medical records, test results, or evidence that may support your case. Provide this information to the insurance company, and they will re-evaluate your application. It's essential to act promptly, as there may be time limits for appealing a decision.

Improving your health and lifestyle can significantly enhance your chances of getting approved for life insurance. Here are some steps you can take:

- Maintain a healthy diet and exercise regularly to improve overall fitness.

- Quit smoking and reduce alcohol consumption.

- Manage any existing medical conditions by following your doctor's recommendations and taking prescribed medications.

- Consider taking a medical exam to provide updated health information.

- Shop around and compare different insurance providers, as some may offer more favorable terms for individuals with specific health profiles.

If you can't get approved for life insurance, there are alternative options to consider:

- Term Life Insurance: This is a more affordable and straightforward policy that provides coverage for a specific period. It can be a good temporary solution while you work on improving your health.

- Universal Life Insurance: This type of policy offers flexibility and potential for long-term savings. It may be more suitable for individuals with a higher risk profile.

- Group Life Insurance: Check with your employer or professional associations if they offer group life insurance plans, which often have more relaxed underwriting criteria.

- Review and Compare Quotes: Get quotes from multiple insurance providers to find the best rates and coverage options available to you.