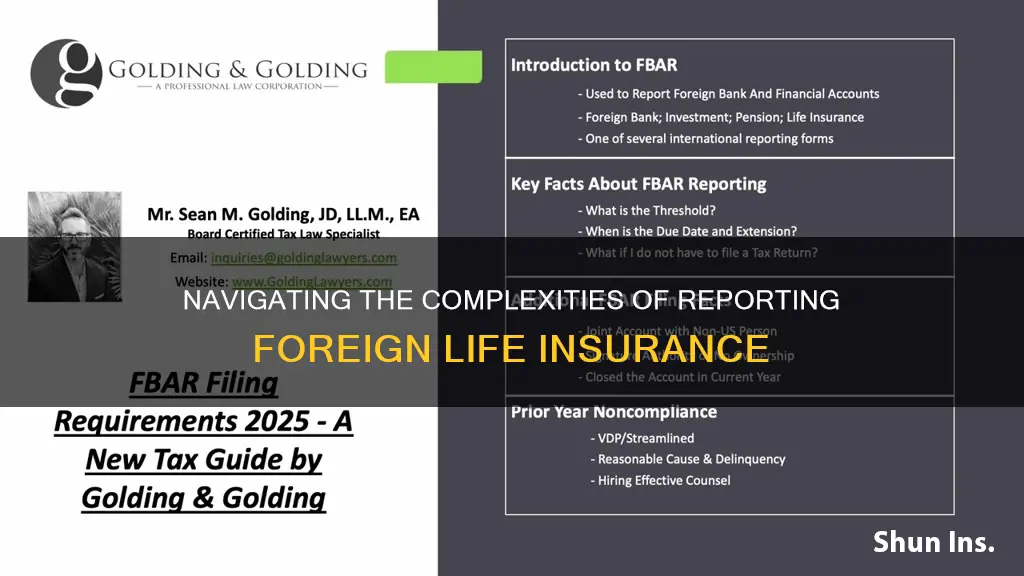

When you report foreign life insurance, it's important to understand the tax implications and reporting requirements. Foreign life insurance policies can provide valuable coverage, but they may also have tax consequences that need to be considered. Reporting these policies accurately and on time is essential to avoid penalties and ensure compliance with tax laws. This guide will provide an overview of the key considerations and steps involved in reporting foreign life insurance, helping you navigate the process with confidence.

What You'll Learn

- Tax Implications: Understand how foreign insurance impacts your tax obligations

- Regulatory Compliance: Ensure adherence to local regulations when reporting foreign policies

- Currency Exchange: Consider currency fluctuations when valuing foreign insurance benefits

- Policy Translation: Accurate translation of policy terms is essential for reporting

- Local Insurance Laws: Familiarize yourself with the legal framework for foreign insurance in your jurisdiction

Tax Implications: Understand how foreign insurance impacts your tax obligations

When dealing with foreign life insurance, understanding the tax implications is crucial to ensure compliance with tax laws and to avoid any potential penalties. Reporting foreign insurance can have significant tax consequences, especially for individuals with international connections or those who have purchased insurance policies from foreign insurers. Here's a breakdown of the key considerations:

Tax Treatment of Foreign Insurance Proceeds: In many countries, the tax treatment of foreign insurance proceeds can vary. Typically, if you receive a death benefit or a payout from a foreign life insurance policy, it may be subject to taxation in your home country. The tax authorities often require you to report these benefits and may consider them as foreign-source income. It is essential to understand the tax laws in your country to determine the applicable tax rates and deductions. For instance, some countries offer tax exemptions or reduced rates for foreign insurance proceeds, especially if the policy was purchased before emigration or if the policy is held for a specific period.

Expatriation and Foreign Insurance: Expatriation, the act of leaving one's country of residence, can have tax implications for foreign insurance policies. If you become a non-resident or expatriate, you may need to report and declare any foreign insurance benefits received. Tax laws often require individuals to disclose foreign assets and income, including insurance policies, to the tax authorities. This reporting ensures transparency and helps in assessing the correct tax liability. It is advisable to consult a tax professional to navigate the complexities of reporting foreign insurance, especially when expatriation is involved.

Tax Treaties and Double Taxation: Tax treaties between countries can provide relief from double taxation, ensuring that foreign insurance benefits are not taxed twice. These treaties often outline specific rules for the taxation of insurance proceeds, dividends, and other forms of income. When reporting foreign insurance, it is beneficial to review the tax treaty between your home country and the country where the insurance policy is held. This can help in understanding the tax obligations and potentially reducing the tax impact.

Record-Keeping and Documentation: Proper record-keeping is essential when dealing with foreign insurance. Maintain detailed documentation of the insurance policy, including the terms, conditions, and any changes made over time. Keep records of premium payments, policy values, and any relevant communications with the foreign insurer. This documentation will be crucial when filing tax returns and may be required by tax authorities for verification purposes.

Consultation with Tax Professionals: Given the complexity of tax laws and their variations across jurisdictions, consulting a tax advisor or accountant who specializes in international tax is highly recommended. They can provide tailored advice based on your specific circumstances, ensuring that you comply with tax regulations and optimize your tax position regarding foreign life insurance.

IUL Life Insurance: How Does it Work?

You may want to see also

Regulatory Compliance: Ensure adherence to local regulations when reporting foreign policies

When dealing with foreign life insurance policies, regulatory compliance is of utmost importance to ensure that all reporting requirements are met. Each country has its own set of regulations and guidelines for insurance companies operating within its borders, and these rules can vary significantly. Therefore, it is essential to understand and adhere to the specific local regulations when reporting foreign life insurance policies.

The process of reporting foreign insurance policies often involves a series of steps and documentation. Firstly, insurance companies must identify the relevant regulatory bodies in the country where the policy was issued. These bodies are responsible for overseeing and regulating the insurance industry, and they will have specific guidelines for reporting foreign policies. It is crucial to contact these regulatory authorities and obtain the necessary information regarding the reporting process, including any required forms, fees, and deadlines.

Once the regulatory requirements are identified, insurance companies should ensure that they have the appropriate documentation in place. This may include policy details, beneficiary information, and any other relevant data that the local regulations mandate. The documentation should be accurate, up-to-date, and easily accessible to the regulatory authorities upon request. Proper record-keeping is essential to demonstrate compliance and facilitate any audits or inspections.

Adhering to local regulations also involves staying informed about any changes or updates to the reporting requirements. Insurance companies should establish a process to monitor and receive notifications about any modifications to the regulatory framework. This could include subscribing to official government or regulatory body newsletters, attending industry events, or utilizing online resources that provide updates on insurance regulations. By staying proactive, companies can ensure that they are always in compliance with the latest reporting standards.

In summary, regulatory compliance is a critical aspect of reporting foreign life insurance policies. It requires a thorough understanding of local regulations, accurate documentation, and a commitment to staying informed about any changes. By following these guidelines, insurance companies can ensure that they meet their legal obligations and maintain a positive relationship with the regulatory authorities in the respective countries.

HDFC Life Insurance: Client ID Meaning and Importance

You may want to see also

Currency Exchange: Consider currency fluctuations when valuing foreign insurance benefits

When dealing with foreign life insurance, one crucial aspect to consider is the impact of currency exchange rates on the value of your insurance benefits. Currency fluctuations can significantly affect the purchasing power of your insurance payout, especially if you are receiving benefits in a different currency from the one you initially paid for the policy. This is an important factor to keep in mind, as it can potentially reduce the real value of your insurance settlement.

The exchange rate between your home currency and the currency of the foreign insurance provider can either increase or decrease the amount you receive. For instance, if you live in a country with a strong currency and the insurance policy is in a weaker currency, a favorable exchange rate could result in a higher payout. Conversely, if the insurance benefits are paid out in a currency with a declining value compared to your home currency, the actual amount you receive may be lower than expected.

To navigate this, it's essential to monitor currency exchange rates regularly. Financial advisors or insurance brokers can provide valuable guidance on this front. They can help you understand the potential impact of currency movements on your insurance benefits and offer strategies to mitigate any adverse effects. Additionally, some insurance companies may offer policies with built-in currency protection, ensuring that the value of your benefits remains stable despite exchange rate fluctuations.

Another approach is to consider converting the insurance payout into your home currency at the time of receipt. This way, you can lock in the exchange rate and avoid potential losses due to currency depreciation. However, it's important to be aware of any associated fees or taxes that may apply to currency conversions.

In summary, currency exchange rates play a vital role in the valuation of foreign insurance benefits. Being proactive in monitoring these rates and understanding their potential impact can help you make informed decisions regarding your insurance policy and ensure that you receive the most out of your foreign life insurance coverage.

Life Insurance Proceeds: Criminal Restitution Entanglement

You may want to see also

Policy Translation: Accurate translation of policy terms is essential for reporting

When dealing with foreign life insurance policies, accurate translation of policy terms is a critical aspect that cannot be overlooked. Reporting on these policies requires a meticulous approach to ensure that all relevant information is conveyed correctly. The process of translating insurance documents is not merely a linguistic exercise; it involves a deep understanding of the legal and financial implications of the policy.

In the context of international insurance, the terms and conditions of a policy can vary significantly across different countries. For instance, a term like 'disability' might be translated as 'invalidity' in some jurisdictions, carrying a different legal meaning. Similarly, the concept of 'life insurance' itself can have nuances that require precise translation to avoid misunderstandings. The process of policy translation is, therefore, a complex task that demands the expertise of professionals who are familiar with both the source and target languages and the legal frameworks governing insurance.

The accuracy of translation is paramount because it directly impacts the clarity and comprehensibility of the policy for the reporting entity. Misinterpretation of policy terms can lead to incorrect reporting, which may result in financial losses or legal complications. For instance, if a clause in the policy is translated inaccurately, it could be missed or misunderstood during the reporting process, potentially leading to non-compliance with regulatory requirements.

To ensure the highest level of accuracy, insurance companies and reporting entities should engage professional translation services. These services should employ translators who are not only fluent in the languages involved but also possess a strong understanding of insurance terminology and the legal systems of the countries represented. Additionally, the use of specialized software and tools can aid in the consistent and accurate translation of insurance documents.

In summary, the translation of foreign life insurance policies is a critical step in the reporting process. It requires a meticulous approach, a deep understanding of legal and financial implications, and the use of professional translation services to ensure accuracy. By paying close attention to policy translation, insurance companies and reporting entities can maintain compliance, avoid legal pitfalls, and provide a clear and reliable representation of the policy to stakeholders.

Pension and Life Insurance: Are They Linked?

You may want to see also

Local Insurance Laws: Familiarize yourself with the legal framework for foreign insurance in your jurisdiction

When dealing with foreign life insurance, it's crucial to understand the local insurance laws and regulations in your jurisdiction. Each country has its own set of rules and requirements that govern the operation and regulation of insurance companies, especially those offering products from other countries. Familiarizing yourself with these local laws is essential to ensure compliance and avoid any legal issues.

The first step is to identify the relevant insurance regulatory body in your country. This body is responsible for overseeing and regulating the insurance industry, including foreign insurance providers. They will have information on the legal framework, licensing requirements, and any specific guidelines for foreign insurance companies operating within your jurisdiction. Researching their website, publications, and guidelines can provide valuable insights into the local insurance landscape.

Local insurance laws often dictate the conditions under which foreign insurance companies can offer their products. This may include restrictions on the types of insurance policies they can provide, the territories they can operate in, and the requirements for establishing a local presence. For instance, a foreign insurance company might need to set up a branch office or appoint a local agent to comply with the regulations. Understanding these requirements is essential to ensure your foreign insurance provider meets the legal standards.

Additionally, local laws may impose obligations on foreign insurance companies to provide specific information to the regulatory body and policyholders. This could include regular reporting, financial disclosures, and customer data protection measures. Staying informed about these reporting requirements is vital to maintain compliance and avoid any penalties or legal consequences.

It is also advisable to consult with legal professionals who specialize in insurance law. They can provide tailored advice based on your jurisdiction's specific regulations. These experts can guide you through the legal process, ensuring that your foreign life insurance is reported and handled according to the local laws, thus protecting both your interests and the interests of the insurance company.

How to Press Pause on Your Life Insurance

You may want to see also

Frequently asked questions

Yes, you generally need to report foreign life insurance policies on your tax return. This includes any life insurance policies issued or maintained by a foreign insurer, even if you are not a U.S. citizen or resident.

You typically report foreign life insurance on Form 8938, "Statement of Foreign Bank and Financial Accounts." This form is used to report foreign financial assets, including life insurance policies, that exceed certain threshold values. You may also need to provide additional information on your U.S. tax return, such as the policy's cash value or death benefit.

Yes, there are some exceptions. If the foreign life insurance policy has a death benefit of $100,000 or less, and you are not a U.S. citizen or resident, you may be exempt from reporting it. Additionally, policies with minimal cash value or those held for a short period might also fall under specific reporting requirements.

You need to report each foreign life insurance policy separately. This includes providing details about the policy, such as the insurer's name, policy number, and the policy's value. You should also report any changes in the policy's value or ownership during the tax year.

The deadline for filing Form 8938 is generally April 15th of the following year. However, if you are required to file an extension, you should submit Form 8868, "Foreign Assets and Foreign Accounts," along with your tax return to request additional time. It's important to stay on top of these deadlines to avoid penalties.