Life insurance is often seen as a crucial financial tool for protecting loved ones and ensuring financial security in the event of one's passing. However, it is important to recognize that life insurance can also be viewed as a less-than-ideal investment opportunity. While it provides a safety net for beneficiaries, the primary purpose of life insurance is to cover the financial risks associated with death, not to generate significant returns. In this context, some argue that investing in life insurance might not be the best use of one's financial resources, especially when compared to other investment options that offer higher potential returns over time.

What You'll Learn

- High Costs: Premiums can be expensive, outweighing potential benefits

- Limited Returns: Life insurance doesn't offer significant financial growth

- Tax Implications: Premiums may be taxable, reducing overall value

- Complexity: Understanding policies can be challenging for non-experts

- Long-Term Commitment: Term lengths may not align with individual needs

High Costs: Premiums can be expensive, outweighing potential benefits

Life insurance is often marketed as a safety net for loved ones, but it can also be a costly financial decision. One of the primary reasons why life insurance might not be a wise investment is the expense of premiums. These premiums can be significantly high, especially for those with pre-existing health conditions or older individuals. The cost of a life insurance policy is determined by various factors, including age, health status, lifestyle choices, and the amount of coverage desired. While younger and healthier individuals may secure lower premiums, the older you get, the more expensive the policy becomes. This is because insurance companies assess the risk associated with insuring an individual, and as people age, the likelihood of developing health issues increases, thus raising the premium rates.

For instance, a 30-year-old in excellent health might pay a relatively modest annual premium for a substantial life insurance policy. However, a 60-year-old with a history of heart disease or diabetes could face a significantly higher premium for the same coverage. In some cases, the premiums for older individuals can be prohibitively expensive, making it financially challenging to maintain the policy over time. This is especially true if the individual's income is limited or if they have other financial commitments.

Moreover, the cost of life insurance can be further exacerbated by the various fees and charges associated with the policy. These may include administration fees, policy maintenance fees, and even surrender charges if the policyholder decides to terminate the contract early. Such additional costs can add up over time, reducing the overall value of the policy and potentially making it a less attractive financial option.

In some cases, the premiums for life insurance can be so high that they outweigh the potential financial benefits. For example, if an individual's annual premium is $5,000 and the policy provides a death benefit of $100,000, the premium-to-benefit ratio is 5%. While this might seem reasonable, it's important to consider that other investment options, such as term life insurance or whole life insurance with a savings component, could offer better returns. These alternatives may provide more substantial financial security without the same level of premium expense.

In conclusion, the high costs associated with life insurance premiums can make it a less appealing investment, especially for those on a tight budget or with limited financial resources. It is essential to carefully consider the potential benefits against the financial burden before committing to a life insurance policy. Exploring alternative financial strategies and understanding the various factors that influence premium rates can help individuals make more informed decisions regarding their insurance and investment needs.

Life Insurance and Drug Overdoses: What's the Verdict?

You may want to see also

Limited Returns: Life insurance doesn't offer significant financial growth

Life insurance is often marketed as a financial safety net, providing peace of mind and financial security for loved ones in the event of an untimely death. However, when considering it as an investment, it's important to recognize that it has limited potential for financial growth. Unlike other investment vehicles, life insurance is primarily designed to pay out a death benefit upon the insured individual's passing, rather than accumulating value over time. This fundamental difference in purpose means that the returns on life insurance are not comparable to those of stocks, bonds, or mutual funds, which are typically aimed at generating capital appreciation and income.

The primary function of life insurance is to provide a financial cushion for beneficiaries, ensuring they have the means to cover expenses, such as mortgage payments, education costs, or daily living expenses, after the insured person's death. While this is a valuable service, it does not equate to an investment that grows in value. The death benefit is typically a fixed amount, and any additional features, such as investment components in some policies, are designed to enhance the policy's value but are still subject to market fluctuations and may not guarantee growth.

In the context of investment, the term 'return' often refers to the growth in value of an asset or the income generated from it. Life insurance, however, is structured to provide a return in the form of a lump-sum payment, which may or may not be sufficient to meet the financial needs of the beneficiaries. This limited return is a result of the insurance company's primary obligation to honor the policy's terms upon the insured's death, rather than to generate investment returns.

Furthermore, the investment aspect of some life insurance policies, often referred to as 'investment-linked' or 'investment-based' life insurance, does not guarantee growth. These policies may offer additional features like cash value accumulation, which can be borrowed against or withdrawn, but they are still subject to market volatility. The potential for financial gain is limited by the insurance company's management of the investment portfolio and the overall market conditions, which are beyond the control of the policyholder.

In summary, life insurance is not a vehicle for significant financial growth. Its primary purpose is to provide a safety net for beneficiaries, and any investment-related features are secondary considerations. While it can be a valuable part of a comprehensive financial plan, it should not be relied upon as a primary means of wealth accumulation or as a substitute for other investment opportunities that offer the potential for higher returns. Understanding the limited returns of life insurance is crucial for making informed financial decisions.

Unlocking 1035 Exchanges: Life Insurance Products for Your Money

You may want to see also

Tax Implications: Premiums may be taxable, reducing overall value

When considering life insurance as an investment, it's crucial to understand the potential tax implications that can impact its overall value. One significant aspect to consider is the taxation of premiums. Life insurance premiums, which are the regular payments made by the policyholder to the insurance company, may be subject to taxation. This means that the amount you pay in premiums could be considered taxable income, reducing the net value of your investment.

In many jurisdictions, the tax treatment of life insurance premiums varies. Some countries may allow for tax deductions, where a portion of the premium payments can be claimed as expenses, thus reducing the taxable income. For example, if you are in a country that offers tax deductions for life insurance premiums, you can deduct a certain percentage of the annual premium payments from your taxable income, effectively lowering your tax liability. However, it's important to note that this tax benefit is often limited to a specific amount or percentage, and the remaining premium may still be subject to taxation.

The taxability of premiums can have a direct impact on your investment returns. When you invest in life insurance, you typically pay a lump sum or regular installments over a certain period. If these premiums are taxable, a larger portion of your investment may be consumed by taxes, leaving a smaller net value. This can be particularly significant for long-term investments, where the cumulative effect of taxable premiums can substantially reduce the overall return on your investment.

To minimize the tax impact, it is advisable to consult with a tax professional or financial advisor who can provide guidance tailored to your specific circumstances. They can help you understand the tax laws in your region and explore strategies to optimize your life insurance investment. Additionally, considering the tax implications early in the decision-making process can help you make more informed choices and potentially save on taxes in the long run.

In summary, the tax implications of life insurance premiums should not be overlooked. The potential taxation of these premiums can reduce the overall value of your investment, making it less attractive compared to other investment options. Being aware of these tax considerations and seeking professional advice can help you navigate the complexities and make the best financial decisions regarding life insurance.

First Citizens Bank: Life Insurance Offerings and Benefits

You may want to see also

Complexity: Understanding policies can be challenging for non-experts

Life insurance policies can be intricate and complex, often requiring a deep understanding of financial and legal concepts, which can be a significant challenge for individuals who are not well-versed in these areas. The language used in insurance policies is often technical and filled with jargon, making it difficult for the average person to comprehend the terms and conditions. For instance, terms like 'rider', 'exclusion clause', and 'benefit period' might sound familiar but have specific meanings that are not immediately obvious to the layperson. This complexity can lead to confusion and potential misunderstandings when it comes to making important decisions regarding one's financial well-being.

The process of understanding a life insurance policy involves deciphering various clauses and provisions, which can be a daunting task. These policies often contain numerous pages of fine print, detailing the coverage, exclusions, and various scenarios under which the insurance company may adjust the policy. For example, understanding the difference between term life insurance and permanent life insurance, and the implications of each, is crucial. Term life insurance provides coverage for a specified period, while permanent life insurance offers lifelong coverage, but with additional features like cash value accumulation. The complexity lies in knowing when and why to choose one over the other, and the long-term financial implications of each choice.

Non-experts might struggle with the idea of long-term commitments and the potential for policy changes over time. Life insurance policies often have provisions that allow the insurance company to adjust premiums or coverage amounts, especially in the case of term life insurance. This flexibility can be a double-edged sword, as it provides adaptability but also introduces uncertainty for the policyholder. Understanding how and when these adjustments occur, and the potential impact on the policy's value and the insured individual's financial plan, is essential but often overlooked.

Moreover, the concept of 'lapse' in life insurance policies is another aspect that can be confusing. If a policyholder fails to make the required premium payments, the policy may lapse, resulting in the loss of coverage. This is a critical point that non-experts might not fully grasp, as it directly impacts their financial security. Understanding the conditions under which a policy can lapse and the steps to prevent it is vital for maintaining the intended level of protection.

In summary, the complexity of life insurance policies can be a significant barrier for non-experts, making it challenging to make informed decisions. The technical language, intricate details, and long-term implications require careful consideration and a comprehensive understanding of financial planning. While life insurance can provide valuable protection, it is essential to approach it with caution and seek professional guidance to ensure that the chosen policy aligns with one's financial goals and needs.

Life Insurance Basics: MetLife's Essential Guide

You may want to see also

Long-Term Commitment: Term lengths may not align with individual needs

Life insurance is often marketed as a long-term financial commitment, but the reality is that term lengths may not always align with an individual's needs, which can lead to potential drawbacks. One of the primary concerns is that life insurance policies typically have fixed terms, such as 10, 20, or 30 years. During this period, the policyholder pays premiums to the insurance company, and in return, the insurer promises to pay a death benefit to the designated beneficiaries if the insured individual passes away within the specified term. However, the issue arises when the policyholder's needs change over time.

For instance, a young adult purchasing life insurance might be doing so to secure their family's financial future in the event of their untimely death. However, as they age, their financial obligations may evolve. They might pay off their mortgage, their children may leave home, or they could even become financially independent. In such cases, the long-term commitment of a life insurance policy may no longer be necessary or beneficial. The individual might find themselves continuing to pay premiums for a policy that no longer serves a critical purpose in their life.

The problem is exacerbated by the fact that many people outlive their initial expectations. For example, a 30-year term policy might seem sufficient for a young family, but if the insured individual lives beyond the term, they may have to decide whether to continue the policy, which could become increasingly expensive, or allow the coverage to lapse, leaving their beneficiaries without the intended financial support. This situation highlights the challenge of aligning the term length with the actual lifespan and changing circumstances of the policyholder.

To address this issue, some insurance companies offer convertible term life insurance policies. These policies allow the insured individual to convert their term life insurance into a permanent life insurance policy (such as whole life or universal life) after the initial term expires. This flexibility can be advantageous, as it provides a way to ensure long-term coverage without the risk of outliving the policy. However, it also means that the insured must carefully consider their future needs and potentially face higher costs if they decide to convert.

In summary, the long-term commitment inherent in life insurance policies can be a double-edged sword. While it provides financial security during specific periods, it may not always align with an individual's evolving needs and circumstances. Policyholders should carefully evaluate their financial goals, life stage, and expected lifespan to determine the most suitable insurance coverage, ensuring that their long-term commitment to insurance is both necessary and beneficial.

Life Insurance and THC: Can It Cause Denial?

You may want to see also

Frequently asked questions

No, life insurance is not a suitable investment for everyone. It is primarily a financial protection tool designed to provide financial security to the beneficiaries in the event of the insured's death. While it can be a valuable asset for some, it may not be the best investment for those seeking high returns or those with limited financial resources.

Life insurance is generally not considered a risky investment in the traditional sense, as it is a long-term financial commitment. However, there are some risks associated with it. For instance, the investment component of certain life insurance policies may be subject to market volatility, and the performance of the policy can vary over time. It's important to understand the specific features and risks of the policy you are considering.

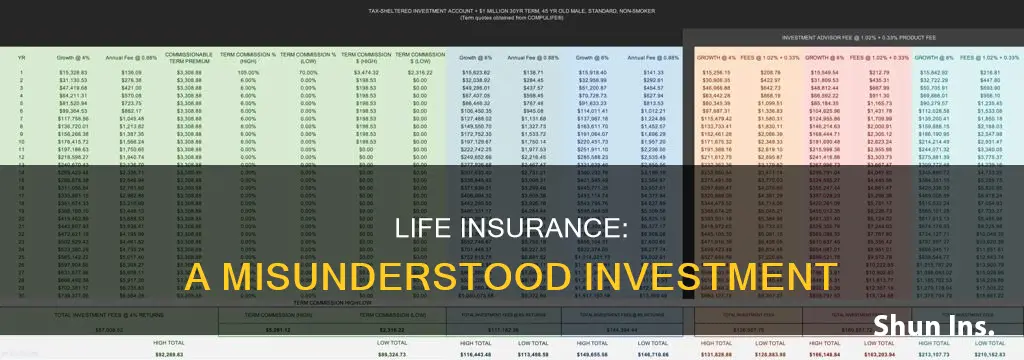

One of the main drawbacks is that life insurance policies often have high fees and commissions, which can eat into the overall returns. Additionally, the investment portion of these policies may have lower guaranteed returns compared to other investment vehicles. The complexity of understanding and managing the policy can also be a challenge for some investors.

Yes, there are several alternative investment options that individuals can consider. These include stocks, bonds, mutual funds, real estate, and retirement plans like 401(k)s or IRAs. Each of these alternatives has its own set of advantages and risks, and it's essential to evaluate your financial goals, risk tolerance, and time horizon before making an investment decision.

To make an informed decision, it's crucial to understand your personal financial situation, goals, and the specific features of the life insurance policy you are considering. Seek professional advice from a financial advisor who can provide tailored guidance based on your needs. Additionally, compare different policies, review the fine print, and consider the long-term implications of the investment to ensure it aligns with your financial objectives.