If you're considering a career in life insurance, one of the first steps is to obtain a license. The process for getting a license varies depending on the state, but there are some general requirements and steps to follow. This includes meeting basic eligibility requirements such as being at least 18 years old, completing pre-licensing coursework, passing a state licensure exam, and submitting an application. The cost of obtaining a license also differs depending on the state, with fees covering the exam, application, and background checks.

| Characteristics | Values |

|---|---|

| Eligibility Requirements | Be at least 18 years old, be a US citizen or legal alien with work authorization, be a resident of the state, be free of any fraud or felony charges, not owe any federal or state income taxes, be able to pass a background check, not have any past-due child support |

| Pre-licensing Coursework | Complete a pre-licensing course to prepare for the state licensure exam. This can be taken online or in a classroom and covers insurance industry regulations and principles. |

| State Insurance Licensure Exam | Pass the Life, Accident, & Health (LA&H) test. The exam can have 50-200 questions and must be completed in 2-3 hours. The passing score is typically 70% and the test results are valid for two years. |

| Application | Submit your license application to your state's department of insurance regulation. This can be done online and requires a fee. |

| Continuing Education | After obtaining a license, take a minimum of 24 hours of continuing education credits during a two-year term, including three hours of ethics training. |

What You'll Learn

Eligibility requirements

To be eligible for a national life insurance license, you must meet the following requirements:

- Age: You must be at least 18 years old, which is the minimum age to apply for a license in most states.

- Citizenship and Residency: You should be a resident of the state in which you are obtaining your insurance license. If you are not a citizen of the United States, you must provide proof of eligibility to work in the country.

- Criminal Record: You must be free of any fraud or felony charges. Applicants with certain felonies, especially those related to financial services, may be ineligible for a license. Some states also require that applicants do not have past-due child support payments. You must be able to pass a background check.

- Taxes: You should not owe any federal or state income taxes.

- Exams: You must complete the necessary pre-licensing coursework and pass the state insurance licensure exam. The pre-licensing coursework can be completed online or in a classroom and covers topics such as insurance industry regulations and insurance principles. The state licensure exam can be taken online or at a test centre, and you must achieve a passing score, which varies by state but is typically around 70%.

- Application: You will need to submit an application for your insurance license, usually online, along with the required application and processing fees, which vary by state.

Life Insurance and Smoking: Detection Methods and Policies

You may want to see also

Pre-licensing coursework

The pre-licensing coursework can be completed through online courses or in a traditional classroom setup. It is important to choose a reputable course provider that is approved by the relevant state authorities. For example, in California, LyteSpeed Learning is an approved provider of pre-licensing classes, offering comprehensive packages that meet the state's requirements. Their packages include the mandatory 32-hour life insurance pre-licensing course, online exam prep videos, and practice exams.

National Online Insurance School is another example of a certified pre-licensing course provider, offering courses that satisfy the requirements for the state licensing exam. Their courses are fully online and include instructional videos, practice exams, and guidance from state-certified instructors.

The duration of the pre-licensing coursework varies, with some courses offering 20 or 32 hours of instruction. It is important to review the specific requirements of your state, as the mandatory hours may differ. Additionally, some states may offer accelerated programs or allow veterans with specific industry designations to waive the pre-licensing requirement.

The pre-licensing coursework is a vital step in your journey to becoming a licensed life insurance agent or broker. It ensures that you have a strong foundation in the industry's regulations, products, and principles, setting you up for success in the state licensure examinations and your future career.

Life Insurance: Necessary Without Kids?

You may want to see also

State insurance exam

To get a national life insurance license, you must pass a state insurance exam. The exam can be challenging due to the broad range of topics covered, and the content and structure can vary depending on your state. Here is a detailed guide on what to expect and how to prepare for your state insurance exam.

Before registering for the state insurance exam, it is important to meet the basic eligibility requirements, which may vary slightly between states. In most states, you must be at least 18 years old and should not have any fraud or felony charges on your record. A clean background check is also necessary, and some states require that you do not have past-due child support payments. Additionally, you should ensure that you have completed any necessary pre-licensing coursework, which can be done online or in a classroom setting. This coursework will cover essential topics such as insurance industry regulations and principles.

Exam Structure and Content:

The state insurance licensure exam typically consists of multiple-choice questions, with the number of items ranging from 50 to 200, and you will usually have two to three hours to complete the exam. The passing score varies by state but is generally around 70%. The exam covers a wide range of topics, and you can expect questions on life insurance, accident insurance, and health insurance. The Life, Accident, & Health (LA&H) test is specifically required for those seeking a life insurance license.

Exam Registration and Fees:

You can register for the state insurance exam through a testing provider such as Pearson VUE or Prometric. The exam fee typically ranges from $40 to $150, and you will need to present a valid photo ID and your pre-licensing education certificate when taking the exam. In some states, you may also need to submit a Criminal History Record Report along with your application. It is important to note that the exam results are valid for two years, and you must apply for your license within this timeframe.

Preparation and Study Resources:

The state insurance exam can be challenging, so it is essential to allocate sufficient time for preparation. Enrolling in a pre-licensing course will provide you with the necessary knowledge and understanding of the exam content. Additionally, many providers offer study guides, practice tests, and other resources to help you prepare. Due to the comprehensive nature of the exam, it is recommended to dedicate ample time to studying and consider taking a study course to enhance your preparation.

Post-Exam Steps:

Once you have successfully passed the state insurance exam, you can proceed to apply for your life insurance license. You can submit your license application to your state's department of insurance regulation via their website. Along with the application, you will need to pay a licensing fee, which varies by state. The review process may take some time, and the department may contact you to clarify any issues that arise during the background check. You can check the status of your application through the department's website, and once approved, you can obtain a copy of your life insurance license.

Life Insurance Agent: A Fulfilling Career Choice?

You may want to see also

Background checks

Most states require fingerprinting as part of the background check process. This may involve a basic fingerprint scan, which is then used to search state databases for information such as pending litigation or criminal history. Some states may exempt non-resident licensees from this requirement. Additionally, some states require fingerprinting and background checks for the acquisition of each new line of authority. It is important to note that there is a variation in the specific processes and requirements across different states.

In addition to state-level background checks, insurance carriers, agencies, or managing general agent (MGA) organizations typically conduct their own background checks when onboarding new agents. This is done to ensure that only qualified and trustworthy individuals are appointed or affiliated with their organizations. These background checks may include validation of education, experience, criminal history, and financial history.

When it comes to criminal records, most life insurance policies require applicants to wait at least a year after a conviction or until their probation period is over if they have a felony on their record. Misdemeanors or lesser infractions may not significantly affect the premium rate. However, a felony conviction can make it more difficult and expensive to obtain life insurance, especially in the first few years after the conviction. Applicants with criminal records should be honest and disclose their history, as lying on the application may result in rejection and future applications being negatively impacted.

It is important to note that background checks are just one part of the process of obtaining a life insurance license. Other steps may include meeting basic eligibility requirements, completing pre-licensing coursework, passing state licensure examinations, and applying for the license through the appropriate state department.

Life Insurance Rejection: What Are the Legal Risks?

You may want to see also

Application and fees

The application process for a life insurance license will vary depending on the state. However, there are some general steps that you can expect to follow. Once you have passed the state licensing exam and submitted your fingerprints for a background check, you will need to complete an application form for your insurance license. This is usually done online and submitted electronically to the Department of Insurance or its third-party processor.

There are several fees to be aware of when applying for a life insurance license. Firstly, there is the cost of the pre-licensing course, which can vary depending on the number of hours required and the mode of taking the course. Secondly, there is the fee for the licensing exam itself, which can range from $40 to $150. Thirdly, there is the application fee, which can range from $5 to over $200 depending on the state. Finally, there may be additional costs such as a transaction fee, technology fee, processing fee, and the cost of the fingerprint and background check.

In total, you can expect to pay several hundred dollars for the licensing exam and application fees. On top of that, there may be other costs such as pre-licensing courses and background checks. It is also important to consider the future financial commitments associated with holding a life insurance license, such as license renewal fees and continuing education requirements.

- Michigan: $10 application cost

- Massachusetts: $225 application cost

- New York: $40 licensing fee

- Florida: $50 licensing fee

- California: Over $150 application fee

- Texas: $50 application fee

- Illinois: $215 application fee

- Pennsylvania: $55 application fee

- Georgia: $120 licensing fee

- North Carolina: $100 licensing fee

Life Insurance Disqualifiers: Health, Age, and Lifestyle Factors

You may want to see also

Frequently asked questions

The basic requirements are: being at least 18 years old, being a US citizen or legal alien with work authorization, being a resident of the state where you plan to operate, and having no past felony or fraud charges.

The cost varies depending on the state. The licensing exam and application fees can cost several hundred dollars, and there may be additional costs such as pre-licensing education courses and background checks.

The steps are: completing a pre-licensing education course, passing the state insurance license exam, completing a fingerprint and background check, and submitting an insurance license application.

The process can take anywhere from a few weeks to a few months, depending on various factors such as the requirements of the state and the time taken to complete the pre-licensing education.

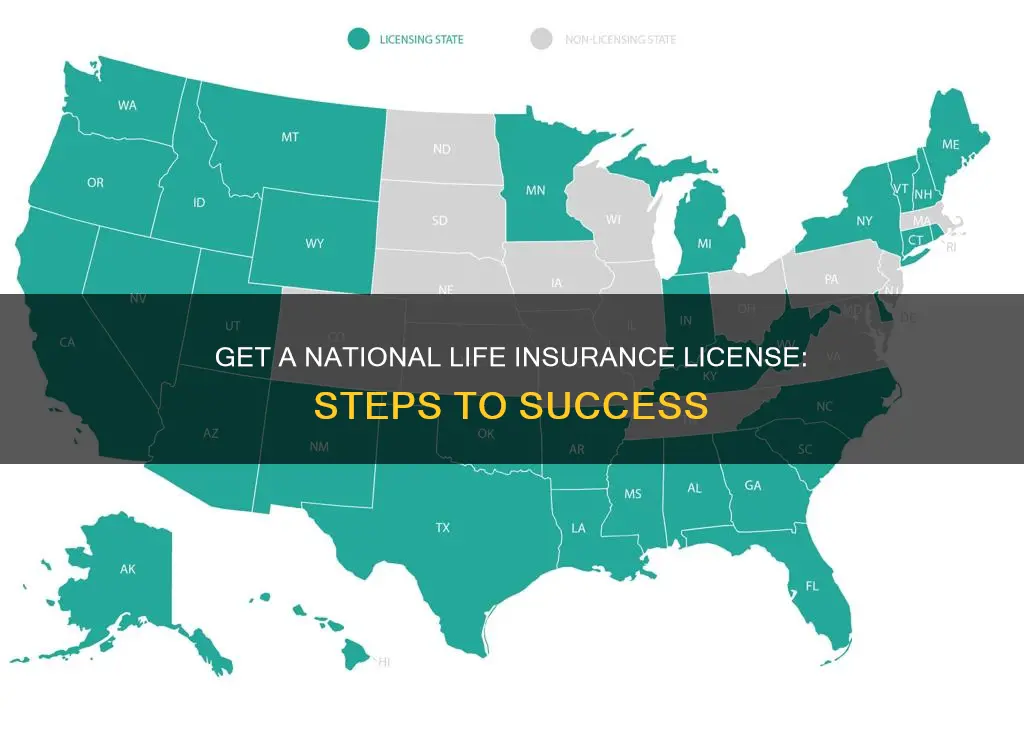

A resident license is the initial license obtained in the state where you plan to operate. After obtaining this, you can apply for a non-resident license in other states without completing additional coursework or testing.