Retirement marks a significant life transition, and ensuring financial security becomes a top priority. When it comes to life insurance, retirees often seek options that provide peace of mind without adding unnecessary complexity. The best life insurance options for retirees typically include term life insurance, which offers coverage for a specific period, and whole life insurance, which provides lifelong coverage with an accumulation of cash value. These policies can help cover final expenses, provide financial support to loved ones, and even serve as a source of emergency funds. Understanding the different types of life insurance and their benefits is crucial for retirees to make informed decisions and ensure their financial well-being during this new chapter of life.

What You'll Learn

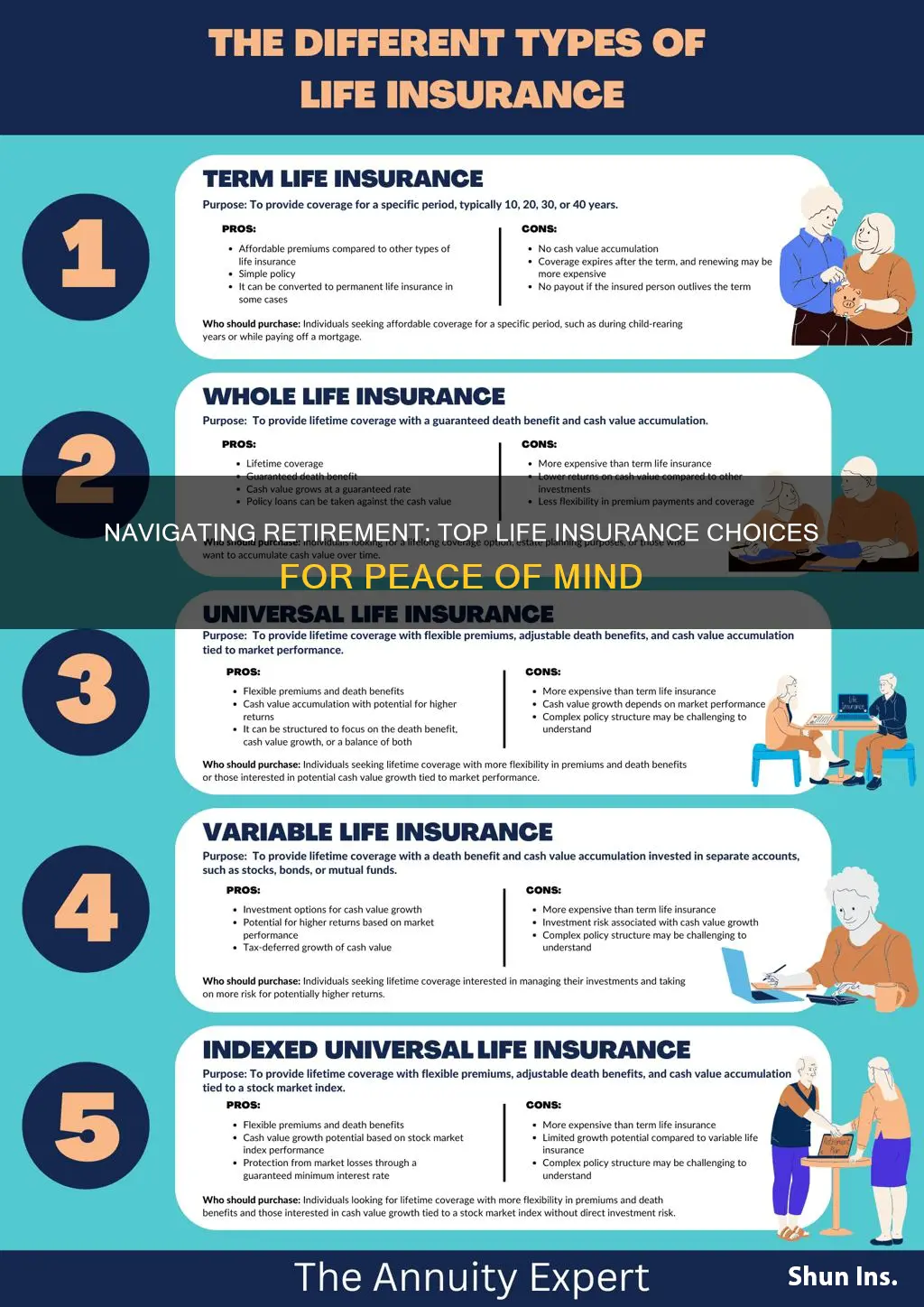

- Term Life Insurance: Temporary coverage, affordable, and ideal for retirement planning

- Whole Life Insurance: Permanent coverage, builds cash value, suitable for long-term financial security

- Universal Life Insurance: Flexible premiums, adjustable coverage, and potential investment options for retirees

- Final Expense Insurance: Covers funeral and burial costs, providing peace of mind for retirees

- Long-Term Care Insurance: Covers assisted living and nursing home care, essential for retirement planning

Term Life Insurance: Temporary coverage, affordable, and ideal for retirement planning

Term life insurance is a popular and practical choice for individuals approaching retirement, offering a range of benefits that make it an ideal tool for retirement planning. This type of insurance provides temporary coverage, typically for a set period, such as 10, 20, or 30 years, and is designed to protect your loved ones during this specific time frame. As you enter retirement, your financial responsibilities may shift, and term life insurance can be a strategic decision to ensure your family's financial security.

One of the key advantages of term life insurance is its affordability. During retirement, you might have a reduced income or be relying on a fixed pension, making it crucial to choose an insurance plan that fits your budget. Term policies often offer lower premiums compared to permanent life insurance, allowing you to secure a higher level of coverage without straining your retirement funds. This affordability factor is particularly beneficial for retirees who want to allocate their resources efficiently while still providing for their family's future.

The temporary nature of term life insurance is a significant advantage for retirement planning. As you age, your health and financial situation may change, and term policies allow you to adapt your coverage accordingly. For instance, you can choose a term length that aligns with your retirement goals, ensuring that your family is protected until your desired retirement age or until your children finish their education, whichever comes first. This flexibility empowers you to make informed decisions based on your evolving circumstances.

When considering term life insurance for retirement, it's essential to evaluate your specific needs. Retirees often have different priorities than younger individuals, such as focusing on long-term care, healthcare expenses, or leaving an inheritance. Term life insurance can be tailored to address these concerns. For example, you might opt for a longer term length to cover potential healthcare costs or choose a higher death benefit to ensure your family's financial stability.

In summary, term life insurance is a valuable consideration for retirees seeking to protect their loved ones during a critical period. Its temporary nature, affordability, and flexibility make it an excellent tool for retirement planning. By carefully assessing your retirement goals and financial situation, you can determine the most suitable term life insurance policy, providing peace of mind and financial security for your golden years.

How to Modify an Irrevocable Life Insurance Trust

You may want to see also

Whole Life Insurance: Permanent coverage, builds cash value, suitable for long-term financial security

When considering life insurance options for retirement, whole life insurance stands out as a reliable and comprehensive choice. This type of policy offers permanent coverage, ensuring that your loved ones are protected even after you're gone. One of the key advantages of whole life insurance is its ability to build cash value over time. As premiums are paid, a portion of the money goes into a savings component, allowing the policy to accumulate a significant cash value. This feature becomes especially valuable in retirement, as it provides a source of funds that can be borrowed against or withdrawn, offering financial flexibility.

In retirement, individuals often face changing financial needs and goals. Whole life insurance provides a stable and predictable financial structure. The guaranteed death benefit ensures that your beneficiaries receive a fixed amount upon your passing, providing financial security for your family. Additionally, the cash value built up within the policy can be utilized for various purposes. You can borrow against it to access funds for any retirement-related expenses or even consider taking regular withdrawals to supplement your retirement income. This flexibility is a significant advantage, allowing you to make the most of your insurance policy during your golden years.

The long-term financial security provided by whole life insurance is particularly appealing. As you age, the risk of health issues and mortality increases, and traditional term life insurance may not offer the same level of coverage. Whole life insurance, with its permanent nature, remains a consistent part of your financial plan, providing peace of mind. Moreover, the cash value growth can be a valuable asset, allowing you to build a substantial fund that can be passed on to beneficiaries or used for personal financial goals.

When evaluating retirement life insurance options, it's essential to consider your specific needs and financial objectives. Whole life insurance offers a unique combination of permanent coverage, cash value accumulation, and long-term financial security. It provides a sense of stability and control over your financial future, ensuring that your loved ones are protected and that you have the means to achieve your retirement aspirations. Consulting with a financial advisor can help you determine if whole life insurance is the right choice, allowing you to make informed decisions about your retirement planning.

Uncover the Benefits: Understanding Sun Life Disability Insurance

You may want to see also

Universal Life Insurance: Flexible premiums, adjustable coverage, and potential investment options for retirees

Universal life insurance is a versatile and adaptable financial product that can be particularly beneficial for retirees seeking to manage their insurance needs effectively. This type of policy offers a unique combination of features that provide retirees with a sense of security and flexibility. One of the key advantages is the ability to customize the insurance plan according to individual needs.

Retirees often have different priorities and financial goals, and universal life insurance allows them to tailor the policy accordingly. The premiums can be adjusted over time, providing flexibility in budgeting. For instance, during the initial years of retirement, when income might be higher, individuals can opt for higher premiums to build up a substantial cash value in the policy. As retirement progresses and income sources change, the premiums can be reduced, ensuring that the insurance remains affordable. This adjustability is a significant advantage over traditional life insurance, where premiums are typically fixed for the policy's duration.

The adjustable nature of universal life insurance also extends to the coverage amount. Retirees can increase or decrease the death benefit as their financial circumstances change. For example, if a retiree's estate grows significantly, they might want to increase the coverage to ensure their beneficiaries receive an adequate payout. Conversely, if their financial situation becomes more modest, reducing the coverage can lower the overall cost of the insurance. This level of control empowers retirees to make informed decisions based on their evolving financial landscape.

Furthermore, universal life insurance often includes investment options, which can be a valuable feature for retirees. The policy's cash value can be invested in various investment accounts, offering the potential for growth and accumulation of wealth. Retirees can choose from a range of investment options, such as stocks, bonds, or mutual funds, to align with their risk tolerance and financial objectives. This investment aspect allows the policy to grow over time, providing a financial safety net and potentially increasing the overall value of the insurance contract.

In summary, universal life insurance offers retirees a flexible and customizable approach to life insurance. With adjustable premiums and coverage, it caters to changing financial circumstances. Additionally, the potential investment options within the policy can help grow the cash value, providing a financial cushion for retirees. Considering these features, universal life insurance can be an excellent choice for retirees who value adaptability and the opportunity to make their insurance policy work in harmony with their overall financial strategy.

Life Insurance Agents: Fiduciary Duty or Not?

You may want to see also

Final Expense Insurance: Covers funeral and burial costs, providing peace of mind for retirees

As you approach retirement, it's essential to consider your long-term financial well-being, especially when it comes to managing expenses and ensuring your loved ones are taken care of. One often overlooked aspect of retirement planning is final expenses, which can include funeral and burial costs, and this is where final expense insurance comes into play. This type of insurance is specifically designed to provide financial coverage for these end-of-life expenses, offering retirees and their families a sense of security and peace of mind.

Final expense insurance is a tailored policy that caters to the unique needs of retirees. It is a straightforward and affordable way to ensure that your loved ones won't have to bear the financial burden of arranging your final arrangements. When you retire, you might want to consider this insurance as a safety net, knowing that your family can focus on honoring your memory rather than dealing with financial stress. The policy typically covers the costs associated with funeral services, including transportation, embalming, casket, and burial or cremation. It can also include other expenses like funeral home fees, grave marker costs, and even legal and administrative fees.

The beauty of final expense insurance is its simplicity and predictability. Unlike other life insurance policies, it doesn't require a medical examination or extensive health history. Instead, it is based on your age and overall health, making it accessible to a wide range of retirees. This type of insurance is particularly beneficial for those who may have pre-existing health conditions or are considered high-risk by traditional insurance providers. By opting for final expense insurance, retirees can ensure that their final wishes are respected and that their families are financially protected during an already emotionally challenging time.

When choosing a final expense insurance policy, it's crucial to compare different providers and policies. Look for companies that offer competitive rates, flexible payment options, and a range of coverage levels to suit your needs. Additionally, consider the reputation and financial stability of the insurance company to ensure you're making a sound investment. Many retirees find that this type of insurance provides a sense of financial security, allowing them to relax and enjoy their retirement years without the worry of unexpected expenses.

In summary, final expense insurance is a valuable consideration for retirees, offering a practical solution to cover funeral and burial costs. It provides a sense of reassurance, knowing that your final wishes will be honored and your family's financial burden will be minimized. With various policy options available, retirees can find a suitable plan that fits their budget and ensures a peaceful transition during their later years.

Unlocking Estate Conversion: A Guide to Life Insurance Benefits

You may want to see also

Long-Term Care Insurance: Covers assisted living and nursing home care, essential for retirement planning

Long-term care insurance is a critical component of retirement planning, especially for those who want to ensure they can maintain their desired standard of living as they age. This type of insurance is designed to cover the costs associated with long-term care services, which can become increasingly necessary as individuals grow older and may require assistance with daily activities or medical care. The primary benefit of long-term care insurance is that it provides financial protection against the high costs of long-term care, which can be a significant burden on retirement savings.

Retirement planning often involves a comprehensive approach to financial security, and long-term care insurance is an essential part of that strategy. As people age, they may face the need for various levels of care, from assisted living facilities to skilled nursing homes. These care options can be expensive, and without proper insurance coverage, retirees might find themselves depleting their savings or relying on family members for support. Long-term care insurance offers a solution by providing a defined benefit or an indemnity policy, ensuring that policyholders receive the necessary care without financial hardship.

When considering long-term care insurance, it's important to understand the different coverage options available. A defined benefit policy guarantees a specific amount of coverage for long-term care services, ensuring that policyholders receive the agreed-upon benefits. On the other hand, an indemnity policy provides coverage based on the actual costs incurred, allowing policyholders to choose the care they receive. Both types of policies can offer valuable protection, and the choice depends on individual preferences and financial goals.

The importance of long-term care insurance becomes evident when considering the potential financial impact of long-term care needs. Nursing home care, for instance, can cost thousands of dollars per month, and even assisted living facilities can be expensive. Without insurance, these costs can quickly deplete retirement savings, leaving individuals and their families financially strained. By investing in long-term care insurance, retirees can ensure that they have the necessary financial resources to maintain their desired lifestyle and avoid the financial burden associated with long-term care.

In summary, long-term care insurance is a vital consideration for retirement planning, offering financial protection against the high costs of long-term care services. It provides peace of mind, allowing retirees to age in place or choose the care they receive without worrying about the financial implications. With various coverage options available, individuals can tailor their insurance plans to suit their specific needs, ensuring a more secure and comfortable retirement.

Unraveling Trustage Life Insurance: A Comprehensive Guide to Understanding Your Coverage

You may want to see also

Frequently asked questions

It's a good practice to review your life insurance coverage periodically, especially during significant life events like retirement. As your financial situation and needs change, you may want to adjust your policy to ensure it still provides adequate protection for your beneficiaries. Consider reviewing it annually or whenever you experience major life changes, such as a significant health issue or a change in your financial status.

Retirees often have different insurance needs compared to those who are still working. Here are some options:

- Term Life Insurance: This provides coverage for a specific period, offering a cost-effective solution for retirees who want temporary protection.

- Whole Life Insurance: A permanent policy that builds cash value over time, providing lifelong coverage and a guaranteed death benefit.

- Universal Life Insurance: Offers flexibility in premium payments and death benefits, allowing policyholders to customize their coverage.

Retirement can significantly change your insurance requirements. With reduced income and potential changes in health, you might want to reconsider the following:

- Coverage Amount: You may no longer need a substantial death benefit to support a working spouse, so adjusting the policy to match your current financial situation is advisable.

- Policy Type: Consider converting a term life policy to a permanent one to ensure long-term coverage without the need for frequent renewals.

Yes, retirees can still obtain life insurance, but the process might be different. Insurance companies often consider age and health when assessing eligibility and determining premiums. Retirees may find it more challenging to qualify for the same rates as younger individuals. It's essential to disclose your retirement status and any relevant health information accurately during the application process.

Converting a term life insurance policy to a permanent one (like whole life or universal life) during retirement can offer several advantages:

- Long-term Coverage: Permanent policies provide lifelong protection, ensuring your beneficiaries are covered even in your later years.

- Cash Value Accumulation: These policies build cash value, which can be borrowed against or withdrawn, providing financial flexibility during retirement.

- Fixed Premiums: Once the conversion is made, premiums remain consistent, protecting you from potential rate increases in the future.