Life insurance is an important source of support for couples, as it helps them face the future with more confidence and peace of mind. While nothing can prepare one for the emotional loss of a spouse, life insurance can help assuage financial worries. Couples can choose between separate individual policies or a joint life insurance policy. A single-life insurance policy will cover only one individual, while a joint life insurance policy will cover both spouses. Both options have their pros and cons and should be weighed carefully before making a decision.

| Characteristics | Values |

|---|---|

| Number of people covered | Two |

| Payout structure | First-to-die or second-to-die |

| Cost | Generally, joint policies are cheaper than separate policies |

| Flexibility | Separate policies are more flexible than joint policies |

| Coverage | Coverage may be less for joint policies compared to separate policies |

| Complexity | Joint policies can be complicated to manage if the marriage ends |

| Ease of purchase | Joint policies are rare and not offered by all insurance companies |

What You'll Learn

Joint life insurance: pros and cons

Joint life insurance is a single policy that covers two people for the cost of one premium. It can be a good option for married couples, domestic partners, or business partners. There are two types of joint life insurance: first-to-die and second-to-die (or survivorship) policies. The choice between the two will depend on the couple's specific needs and circumstances. Here are some of the pros and cons of joint life insurance:

Pros:

- Cost-effectiveness: A joint life insurance policy can be more affordable than two separate policies since the insurance company only has to pay out once. This can result in lower premiums for the policyholders.

- Estate planning and wealth preservation: Joint life insurance can be useful for estate planning, especially for couples with a large estate. The death benefits are tax-free for beneficiaries, and can be used to cover funeral costs and other expenses.

- Coverage for both spouses: Joint life insurance can provide coverage for both spouses, even if one spouse is unable to secure their own policy due to poor health or underlying medical conditions.

- Simplicity and convenience: A joint policy simplifies the insurance process by requiring less paperwork, underwriting, and administrative tasks.

Cons:

- Limited flexibility: Joint life insurance policies offer less flexibility than individual policies. Both individuals must meet the coverage requirements, and there may be issues with agreeing on beneficiaries and coverage amounts.

- Tax implications: If beneficiaries are not designated, death benefits become part of the estate and may be subject to estate taxes if they exceed certain thresholds.

- Difficult to split in case of divorce: Joint life insurance policies can become complicated to manage in the event of a divorce, as they cannot be easily divided.

- Higher cost for healthier spouse: In cases where one spouse has significant health issues, the joint policy could result in higher costs for the healthier spouse compared to an individual policy.

Overall, joint life insurance can be a good option for couples or partners looking to streamline their insurance and reduce costs. However, it is important to carefully consider the potential drawbacks and ensure that the policy meets the specific needs and circumstances of both individuals.

Life Insurance Rates: Fluctuating Costs and Uncertain Future

You may want to see also

Separate life insurance policies

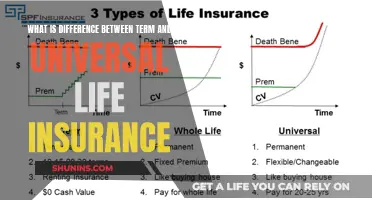

A separate life insurance policy will only cover one spouse and will pay out a death benefit to the surviving partner if the individual passes away while the policy is in force. There are two main types of individual life insurance policies: term and permanent. Term policies cover you for a set period, usually 10 to 30 years, while permanent policies are designed to last your entire life, though some may mature when you reach a certain age, typically between 90 and 121.

A separate life insurance policy is not tied to your marital status, meaning each spouse has their own coverage, unaffected by changes in marital status. This allows for greater flexibility and customization, as each spouse can choose from a variety of options, including term life, whole life, and universal life insurance, tailoring the policy to their individual needs and financial goals.

However, separate policies require managing multiple policies, and since they are not tied together, they are typically more expensive than a joint policy. Individual underwriting might be more stringent and vary per spouse, and there is no potential cost saving from a combined policy.

FHA Mortgage Insurance: A Lifetime Commitment?

You may want to see also

When to get life insurance

When You're Raising Children Together

One of the most common reasons for married couples to get life insurance is to protect their children's future. If something happens to one of the primary providers, the financial impact on the family can be significant. Life insurance provides a safety net, ensuring that the loss of income doesn't disrupt the children's education, daily living expenses, or future opportunities. It helps maintain financial stability during challenging times, allowing the family to focus on healing.

When You Have Shared Debts or Expenses

If you and your spouse have shared debts, such as a mortgage, car payments, student loans, or credit card balances, life insurance can provide peace of mind. It ensures that your spouse won't be left overwhelmed by debt repayments if something happens to you. Additionally, life insurance can help cover living expenses, such as utilities and groceries, which can be a burden for the surviving spouse.

When You Want to Cover Final Expenses

Life insurance can also help alleviate high end-of-life expenses, including funeral costs and medical bills. These expenses can be a significant financial burden for your loved ones, and life insurance provides a way to ease that burden.

When You're Younger and Healthier

The cost of life insurance tends to increase as you get older, and it can be influenced by age-related health concerns. By purchasing life insurance at a younger age, you can secure lower premiums. Starting early allows you to lock in more affordable coverage before age and health risks drive up the cost.

When You're Planning for the Future

Life insurance is also worth considering when you're planning for the future, especially if you're expecting significant life changes. Events such as getting married, having children, purchasing a home, or taking on substantial financial responsibilities like a business loan, are all reasons to re-evaluate your insurance needs. It's a good idea to consult with a financial advisor or insurance professional to assess your specific circumstances and determine the right time to get life insurance.

Life Insurance After Rehab: What You Need to Know

You may want to see also

Best life insurance types for couples

There are several life insurance options available for married couples, and the best choice depends on your unique circumstances and coverage needs. Here are some of the most common types of life insurance policies for couples:

Joint Life Insurance Policies

Also known as dual life insurance, this type of policy covers both spouses. It is a good option for couples looking to lower life insurance costs and protect their assets from taxes after death. There are two types of joint policies:

- First-to-die: The surviving spouse receives the death benefit payout after the first spouse's death.

- Second-to-die or Survivorship: The beneficiaries receive the death benefit once both spouses have passed away. This type of policy is often used by wealthy couples to ensure their heirs have the money to pay estate or inheritance taxes.

Separate Life Insurance Policies

This type of policy covers only one individual and pays out a death benefit to the surviving partner. There are two main types:

- Term life insurance: Coverage for a set period, usually 10 to 30 years.

- Whole life insurance: Lifelong protection with an investment component that can grow over time.

Term Life Insurance

Term life insurance is ideal for couples who want coverage for a specific period, such as 20 years. It is generally more affordable and flexible than permanent life insurance, making it a popular choice for those who want to ensure their loved ones are protected during their most vulnerable years.

Permanent Life Insurance

Permanent life insurance offers lifetime coverage and is a good option for couples who want long-term financial security. It tends to be more expensive than term life insurance but provides the benefit of a cash value component that grows over time. Some policies may mature at a certain age, typically between 90 and 121.

Whole Life Insurance: Taxable or Not?

You may want to see also

How to shop for life insurance

Shopping for life insurance as a married couple can be a daunting task, but it is an important step in ensuring your family's financial security. Here are some detailed instructions on how to shop for life insurance:

Determine Your Needs:

Before purchasing life insurance, it is crucial to assess your financial situation and identify your specific needs. Consider factors such as your age, income, mortgage, debts, and anticipated expenses. Ask yourselves questions like: Are you raising children together? Do you have shared debts or financial obligations? Do you want coverage for a specific period or lifelong protection? These questions will help you decide on the type and amount of coverage required.

Understand the Types of Life Insurance:

There are two main types of life insurance policies: term life insurance and permanent life insurance. Term life insurance provides coverage for a specified period, usually 10 to 40 years, and is more affordable. On the other hand, permanent life insurance offers lifelong coverage and includes a cash value component that can grow over time. Permanent life insurance is more expensive but provides long-term financial security.

Compare Quotes from Reputable Companies:

Research and compare quotes from multiple reputable insurance companies. Factors such as your age, gender, health, and lifestyle will impact the cost and availability of coverage. Consider using an independent broker, as they can help you compare policies from different insurers simultaneously.

Apply and Wait for Approval:

Once you've determined the type of policy and coverage amount that suits your needs, submit your application to the chosen insurer. The approval process can take up to four to six weeks, but it may be faster if you're eligible for no-exam life insurance.

Sign the Policy and Make the First Payment:

After receiving approval, carefully review the final policy offer. Once you're satisfied, sign the policy documents and make the initial premium payment to activate your coverage.

Seek Expert Advice:

Consulting a licensed insurance agent or financial professional can be immensely beneficial. They can guide you through the complex world of life insurance, help you navigate the various options, and ensure you make an informed decision that best suits your unique circumstances.

Remember, the goal of life insurance is to provide financial protection for your spouse and family in the event of your untimely death. By following these steps and considering your specific needs, you can make a well-informed decision when shopping for life insurance.

Life Insurance: Should Employers Offer It?

You may want to see also

Frequently asked questions

Joint life insurance covers two people, usually spouses, with a single benefit payout. Separate life insurance policies cover only one individual and pay out a death benefit to the surviving partner.

Joint life insurance can help lower overall life insurance costs and simplify management with one policy. It can also be useful for estate planning and minimising taxes.

Joint life insurance offers less flexibility and can be complicated to manage if the marriage ends. Coverage may also be lower compared to individual policies for the same premium.

Separate life insurance policies allow for greater flexibility and can be tailored to meet individual needs and financial goals. Each spouse has their own coverage, which is unaffected by changes in marital status.

Separate policies require managing multiple policies and can be more expensive than a joint policy.