An auto insurance policy number is a unique identifier that links you directly to your insurance coverage. This number is crucial for managing claims and billing and can be found in several places, including your insurance ID card, billing statements, and the policy declaration page. Knowing where to find your auto insurance policy number is essential for various scenarios, such as accidents, traffic stops, and policy changes. This number allows insurance companies to identify your specific policy and provide the necessary coverage and assistance.

| Characteristics | Values |

|---|---|

| How long is a car insurance policy number? | Typically between 8 and 13 digits long. |

| Where can I find my car insurance policy number? | On your insurance card, bill, the declarations page, your online account with the carrier, the carrier's mobile app, your insurance policy packet, and your billing statements. |

| When do I need my car insurance policy number? | After a car accident, during a traffic stop, when contacting your insurance company, when renewing your license plate, when registering your car, when test-driving a new car, and when buying a new car. |

| What to do if I lost my car insurance policy number? | Contact your insurance provider immediately. They can verify your identity and provide you with the number. |

What You'll Learn

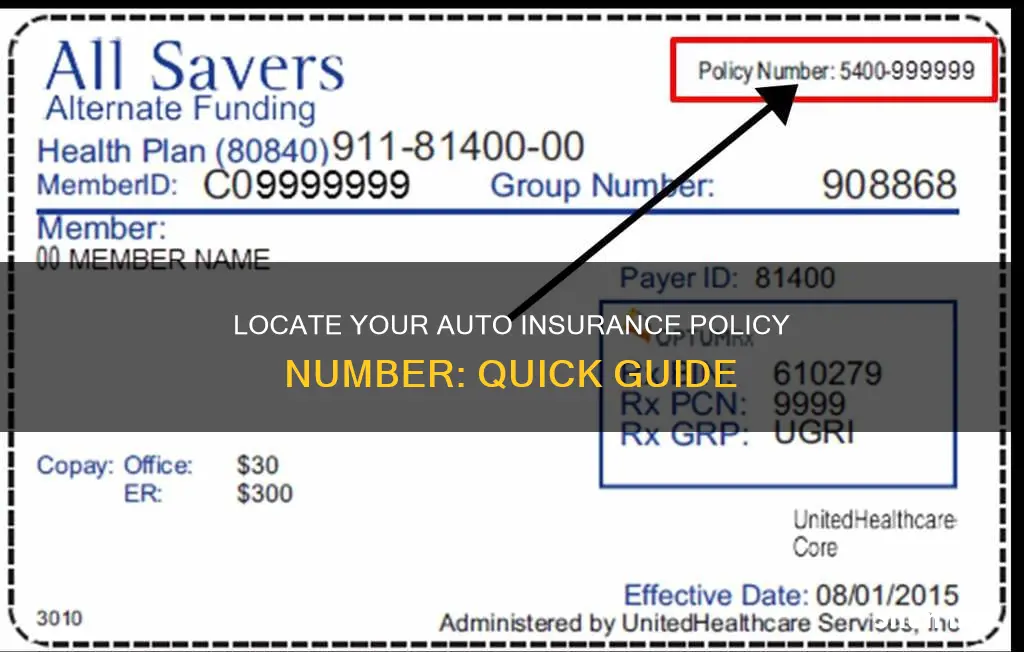

On your insurance card

Your auto insurance policy number can be found on your insurance card, which is typically mailed to you shortly after you purchase a policy. You can also access it online right away through your insurer's website or mobile app.

The insurance card contains vital information, including the name and contact information of the policyholder or covered individuals, the types of coverage included in the policy, the policy term dates, and vehicle information such as the make, model, and Vehicle Identification Number (VIN).

It's important to keep a physical copy of your insurance card in your vehicle, as it serves as proof of insurance, which is legally required in most states. Additionally, having a physical copy ensures that you have access to your policy number even if your phone battery dies or you are in an area with limited cell service.

Your insurance card may also come in handy when you need to provide your policy number to others, such as during a car accident or when test-driving or purchasing a new car. It's recommended to keep at least one hard copy in your glove box and consider storing a digital copy on your phone as well.

The policy number on your insurance card is typically located near the top and is easily identifiable. It is a unique identifier, usually a combination of numbers, that specifically ties you and your coverage to the insurance company. This number remains the same as long as you stay with the same insurance provider.

Utah's Digital Auto Insurance Cards: Are They Legal?

You may want to see also

On your billing statement

Your auto insurance policy number is an important piece of information that you should keep easily accessible. It is a unique identifier that connects you directly to your insurance coverage and is crucial for managing claims and billing. While you may not need to know your policy number at all times, there are several instances when you will need to retrieve it. Here are some tips on finding your auto insurance policy number on your billing statement:

Your auto insurance policy number can typically be found on your billing statement, which is sent to you by your insurance provider. Keep in mind that if you have a payment plan, the account number on your billing statement may not be the same as your policy number. This is because some insurance companies set up separate payment accounts for different payment plans. Therefore, carefully review your billing statement to locate your policy number. It is usually listed at the top of the page.

It is a good practice to keep old billing statements, not just for your financial records but also because they contain your policy number. While there is no definite rule on how long you should keep insurance-related records, it is generally recommended to retain copies of your billing statements for at least a few months. Additionally, if you receive invoices or mailers from your insurance company, your policy number will likely be displayed prominently at the top.

If you prefer paperless billing, you can opt to receive your billing statements and invoices via email. In this case, your policy number will be included in the digital copies of these documents. You can also access your policy number by logging into your online account with your insurance company or through their mobile app, if available.

Remember that your auto insurance policy number is different from your account number or VIN (Vehicle Identification Number). The policy number specifically pertains to your insurance coverage, while the account number may refer to your overall account with the insurance company, which can include multiple policies.

In conclusion, your billing statement is one of the most convenient places to find your auto insurance policy number. By keeping old statements and accessing digital copies, you can easily retrieve your policy number whenever needed.

Arizona vs Texas: A Desert Duel on Auto Insurance

You may want to see also

On your policy declaration page

Your auto insurance policy number can be found on your policy declaration page. This page is part of the policy paperwork, which is the most detailed information you'll receive from your insurance provider. The policy declaration page includes information such as your personal details, vehicle identification number, rate and deductible information, coverage benefits, and insurance duration.

The policy declaration page is typically included in your insurance policy packet, which contains all the relevant information about your insurance coverage. This packet is usually provided to you when you first purchase or renew your insurance policy. It's a good idea to keep this packet in a safe and easily accessible place, as it contains important information that you may need to refer to in the future.

If you have multiple insurance policies with different providers, each policy will have its own declaration page with a unique policy number. This number is used to identify your specific policy and coverage. It's important to keep track of these numbers, especially if you need to file a claim or make changes to your insurance coverage.

In addition to the policy declaration page, there are a few other places you can find your auto insurance policy number. These include your insurance card, your online account with the insurance carrier, their mobile app, and your premium or billing statements. However, the policy declaration page is a comprehensive source of information about your policy, including the policy number.

Remember that your auto insurance policy number is different from your vehicle identification number (VIN). The VIN is a unique combination of numbers and letters that specifically identifies your vehicle, while the policy number identifies your insurance coverage. Keeping both of these numbers handy is important, especially if you need to provide proof of insurance or file a claim.

Bundling Auto and Home Insurance: Risks and Hidden Costs

You may want to see also

On your insurance policy documents

Your auto insurance policy number is a unique identifier that links you and your insurance coverage directly to the insurance company. It is essential for managing claims and billing. You can find your auto insurance policy number in several locations within your insurance policy documents.

The first place to look is the declarations page of your insurance policy documentation. This is usually the first page of the document, and the policy number is typically located at the top right. The declarations page acts as a summary of your insurance policy, detailing the specifics of your coverage, including comprehensive auto insurance coverage, monthly and annual rates, deductibles, and other relevant information.

Your auto insurance ID card will also display your policy number. Every insurance company designs its ID cards differently, but they all include certain standard elements, such as the name and contact information of the policyholder, coverage types, policy term dates, vehicle information, and of course, the policy number. Your insurance card should be mailed to you shortly after purchasing the policy, and you can also access it online or through your insurer's mobile app.

In addition, your policy number will appear on any billing statements or invoices you receive from your insurance company. These documents will usually have the policy number displayed prominently at the top.

Finally, your insurance policy packet will contain your policy number. This is the detailed documentation you receive from your insurance provider, outlining your personal details, vehicle identification number, rate and deductible information, coverage benefits, insurance duration, and more. Your policy number will typically be on the declaration page of this packet, labelled as either the 'Policy Number' or 'Account Number', as some providers use these terms interchangeably.

Auto Theft Insurance: What's Covered and What's Not

You may want to see also

In correspondence from your insurance company

Your auto insurance policy number is a unique identifier that links you and your insurance coverage directly to the insurance company. It is vital for managing claims and billing. This number can be found in several locations, including:

- In correspondence from your insurance company: Whenever you receive an invoice or mailer from your insurance company, your policy number will be prominently displayed at the top.

- On your insurance ID card: Every insurance company designs its auto insurance ID cards differently, but certain elements are standard across all insurers. These include your name and contact information, coverage types, policy term dates, and the policy number. Your insurance policy card should be mailed to you shortly after you purchase a policy, although you can also access it online.

- On your declarations page: The declarations page is the first page in your auto insurance policy documentation, and you will likely find the policy number at the very top on the right side. You can think of this page as a summary of your insurance policy, and you can refer back to it for your policy number and information on deductibles and coverage.

- On billing statements: Your policy number will be included on billing statements and premium invoices.

- Online: Every insurance company provides online access to detailed information about your auto policy number. Familiarizing yourself with your insurer's website will allow you to easily access your coverage details and policy number. Many companies also offer a mobile app that allows you to print or save a digital copy of your car insurance ID card and policy number.

It is important to know where to find your auto insurance policy number for emergencies, traffic stops, or accidents. If you lose your insurance policy number, contact your insurance provider immediately. They can verify your identity and provide you with the correct policy number.

Auto Insurance: What's Recommended?

You may want to see also

Frequently asked questions

Your auto insurance policy number can be found on your insurance ID card, the declarations page, your insurance policy documents, or any correspondence from your insurance company, such as billing statements or invoices.

If you are unable to locate your auto insurance policy number, you can contact your insurance company's customer support team. They will ask for some personal information to verify your identity and help you find your policy number. You may also request a copy of your policy documents for future reference.

Your auto insurance policy number is important as it allows insurance companies to identify and access specific details about your policy. It is required when filing claims, making changes to your policy, contacting your insurance provider, or providing proof of insurance during traffic stops or accidents.

An auto insurance policy number is a unique identifier assigned to a policyholder by their insurance company. It is used to access and manage your policy details, verify coverage, and streamline interactions with insurers.