When it comes to car insurance, the cost of a policy varies depending on the state you live in. The national average annual cost for a full-coverage policy is $1,895, but this can be as low as $589 in Maine and as high as $4,003 in Michigan.

Arizona and Texas are no exception to this rule. The typical annual car insurance rate in Texas is $768 more expensive than the average expense in Arizona. However, this cost depends on your coverage level, driving and insurance history, and your chosen auto insurance company.

If you're moving from Arizona to Texas, it's important to consider the financial implications for your car insurance.

| Characteristics | Values | |

|---|---|---|

| Average Annual Premium for Full Coverage | Arizona: $2,547 | Texas: $2,422 |

| Average Annual Premium for Minimum Coverage | Arizona: $621 | Texas: $621 |

| Average Monthly Premium | Arizona: $137 | Texas: N/A |

| Average Monthly Premium for Liability Coverage | Arizona: N/A | Texas: $196 |

| Average Monthly Premium for Full Coverage | Arizona: N/A | Texas: $292 |

What You'll Learn

Minimum liability coverage in Arizona and Texas

Arizona requires drivers to have proof of financial responsibility when operating a motor vehicle on its roadways. Most drivers demonstrate this by buying an auto insurance policy. The state's minimum liability coverage is 25/50/15, which means:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $15,000 for property damage per accident

Arizona is a "pure" comparative fault state, meaning that the responsibility for damages can be shared if both drivers are found to share fault. If one party is found to be 75% at fault, their auto insurance company would pay a proportional amount, while the other party's insurer would be responsible for the remaining 25%.

Arizona's minimum coverage limits are among the lowest in the nation. They were increased in 2020 for the first time since 1972, when the minimum wage was $1.60 per hour. With wage increases come increased costs, including for ambulance transport, emergency room visits, and hospital treatment. A single trip to the emergency room can cost more than $15,000 in today's economy.

As of 2022, Arizona's car insurance minimums are quite low compared to other states. With minimum coverage limits this low, it's highly unlikely that these will adequately cover most costs. Low coverage limits can leave drivers at risk of having to cover the remainder of these costs out of pocket. For example, if a driver causes an accident that results in $35,000 in injuries for the other driver, their liability coverage would only pay $25,000 for that person's injuries, even though their per-accident limit is $50,000.

Arizona's property damage liability limit would also fall short of covering the cost of a high-end or luxury vehicle. A minimum coverage amount of $15,000 doesn't come close to covering the cost of most new vehicles, which average anywhere from $25,000 to $30,000.

Now, let's look at Texas. According to the Texas Department of Insurance, the minimum liability coverage in Texas as of 2024 is 30/60/25, which includes:

- $30,000 for bodily injury liability per person

- $60,000 for total bodily injury liability per accident if two or more people are hurt

- $25,000 for property damage liability per accident

Texas also requires drivers to have personal injury protection (PIP) coverage of at least $2,500 per person, which covers medical expenses for the insured driver and passengers, regardless of who is at fault in an accident.

Texas has higher minimum liability coverage requirements than Arizona, which means that drivers in Texas are generally better protected financially in the event of an accident. The higher limits in Texas reflect the increased costs of medical care and property damage since the minimum coverage limits were set in Arizona in 1972.

However, it's important to note that both states recommend that drivers consider purchasing additional coverage beyond the minimum requirements to ensure they have adequate financial protection in the event of a collision.

Low Mileage, Lower Premiums: How Your Commute Distance Impacts Car Insurance Rates

You may want to see also

Average insurance rates in Arizona and Texas

The average cost of car insurance varies from state to state. This is due to a variety of factors, including the state's minimum-coverage requirements, crime, theft, severe weather, and the number of claims filed.

Arizona

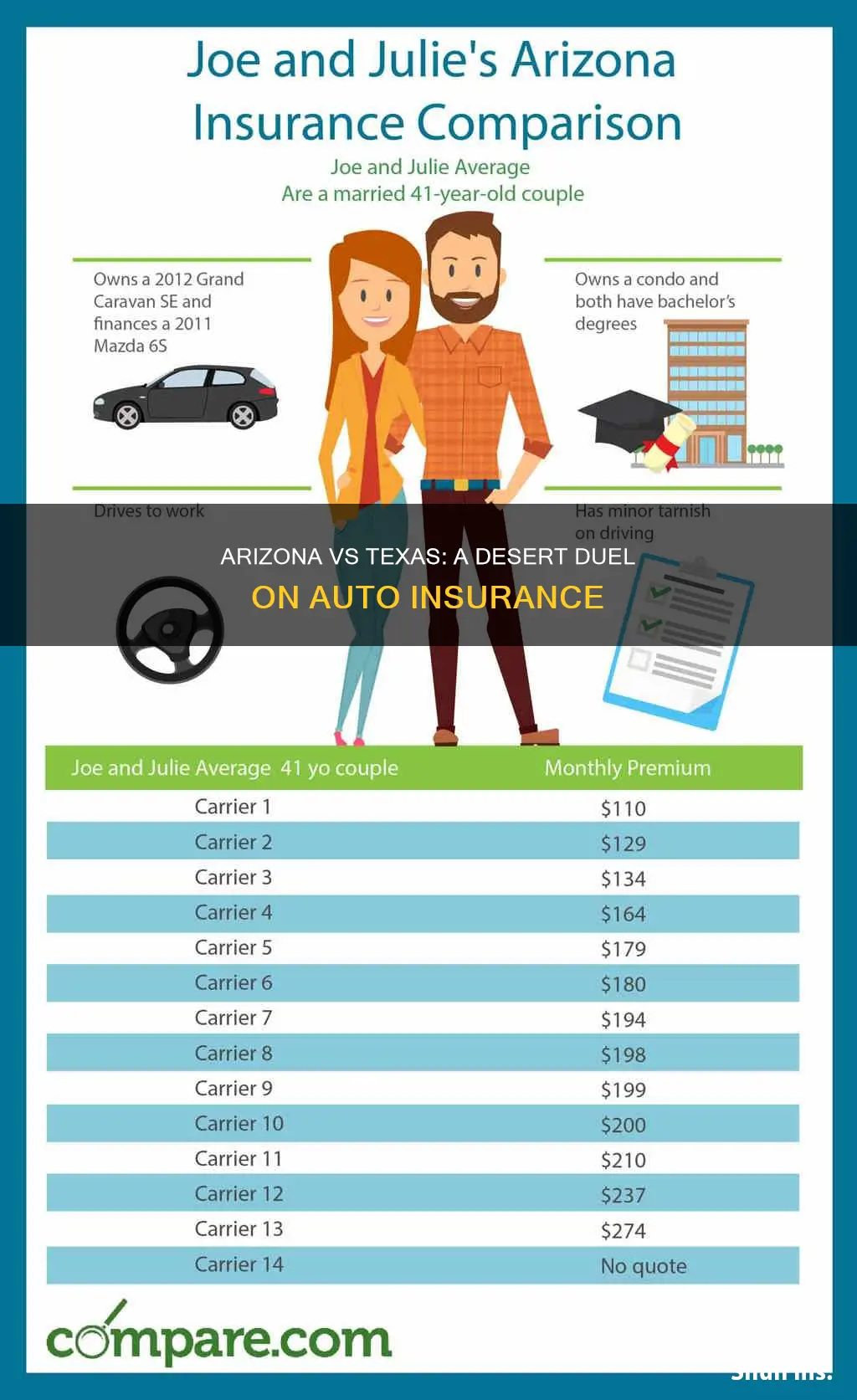

The average cost of auto insurance in Arizona is $137 per month. This is $55 per month with GEICO, the cheapest insurance company overall, according to Compare.com. Arizona's rates are 5% higher than in Utah and the rest of the US, and 22% more expensive than in California and New Mexico.

Texas

Texas has average full coverage auto insurance rates of $2,469 per year, which is 6% more than the national average. Texas has average rankings in cost of living and highway performance, but experiences a high number of vehicle thefts and severe traffic congestion in its metropolitan areas.

Comparison

The typical annual car insurance rate in Texas is $768 more expensive than the average expense in Arizona.

Auto Insurance: Collision Coverage Optional?

You may want to see also

Affordable insurance companies in Arizona and Texas

Arizona

According to MarketWatch, the cheapest car insurance companies in Arizona are Geico, Auto-Owners, Travelers, USAA and Progressive.

The average cost of full-coverage car insurance in Arizona is $2,008 per year, or $167 per month. However, Geico offers the cheapest full-coverage car insurance in the state, at an average cost of $1,173 per year or $98 per month.

For drivers seeking the state minimum coverage, Auto-Owners offers the cheapest rates at an average of $356 per year or $30 per month.

Texas

The Zebra reports that the cheapest car insurance company in Texas is GEICO, with rates of $1,432 annually or $119 per month.

The average cost of car insurance in Texas is $1,584 per year, or $132 per month. This is 4% higher than the national average.

Comparison

The average cost of car insurance in Arizona is slightly higher than in Texas, with Arizona's average annual rate being $2,008 and Texas's being $1,584.

However, it is important to note that car insurance rates can vary depending on factors such as age, driving history, and location. Additionally, different companies may offer different discounts and coverage options, so it is always a good idea to compare quotes from multiple providers to find the best rate.

Splitting Vehicle Insurance for Taxes

You may want to see also

Insurance rates by city in Arizona and Texas

When it comes to insurance rates by city in Arizona, the city in Arizona with the least expensive auto insurance premiums is Lake Havasu City, which has an average annual premium of $1,227. New Kingman-Butler, Sierra Vista, and Flagstaff are also among the cheapest cities for car insurance in Arizona, with average annual premiums ranging from $1,237 to $1,288. On the other hand, Phoenix, the state's largest city, has the most expensive car insurance rates in Arizona, with an average cost of $270 per month.

In Texas, the city with the cheapest car insurance rates is McAllen, with an average annual premium of $1,077. Laredo, Brownsville, and El Paso are also among the most affordable cities for car insurance in Texas, with average annual premiums ranging from $1,120 to $1,161. In contrast, Houston, the largest city in Texas, has relatively expensive car insurance rates, with an average annual premium of $2,233.

AAA Auto Insurance: Affordable or Not?

You may want to see also

Driving laws in Arizona and Texas

Arizona and Texas have a number of driving laws that differ from each other. Here is a comparison of the driving laws in each state:

Arizona

In Arizona, there are several classes of motor vehicle licenses, including Class D, Class M, Class G, and Class A, B, or C commercial licenses. The state has a "Move Over Law," which requires motorists to move to another lane or slow down when approaching emergency vehicles or personnel. Arizona also has a "Stupid Motorist Law," which holds drivers liable for the cost of their rescue if they ignore flood warning signs or barricades.

The state prohibits holding or using a cellphone while driving, except in hands-free mode or for emergencies. Arizona has strict DUI laws, and a driver can be arrested and convicted with any amount of alcohol in their system if it is determined that their ability to operate a vehicle is impaired.

Arizona also has laws regarding smoking in vehicles with minors, with some municipalities imposing fines for this offence.

Texas

Texas has enacted traffic laws to ensure the safety of its driving public. These include laws regarding safety belts, speed limits, and road signs. Texting and cell phone conversations are considered dangerous distractions, and impaired driving can lead to DUI/DWI penalties.

While specific laws regarding these issues were not readily available, Texas, like Arizona, likely has laws governing these areas, and it is important for motorists to familiarize themselves with the driving laws in their state.

Weekend Worries: Auto Insurance Automatic Payments

You may want to see also