If you're looking to cancel your auto insurance policy with Grange, there are a few steps you should follow to ensure you don't encounter any issues. Firstly, it's important to understand that you can cancel your policy at any time and for any reason, even if it has only been a few days since the policy started. You'll need to contact your insurer or agent to find out the best way to cancel your policy, as some companies allow cancellation over the phone or online, while others may require written notification or a signed document. It's also a good idea to have another policy in place before cancelling your existing coverage to avoid any lapses in insurance, which could result in fines and penalties.

What You'll Learn

Cancelling over the phone or online

Cancelling your auto insurance policy over the phone or online is a straightforward process. Here are the steps you need to take:

Firstly, ensure that you have another policy in place to avoid any lapse in coverage, as this could result in fines and penalties. Nearly all states require drivers to have liability coverage, so it is essential to maintain continuous coverage.

Next, contact your insurer or agent by phone or online. Grange Insurance, for example, provides a phone number and website for customers to connect with their team. Ask them to cancel your policy and find out if there are any specific requirements, such as a signed cancellation form or a 30-day notice period. Some insurers may also charge a cancellation fee, so it's worth inquiring about this.

When you cancel, you may be entitled to a refund for the unused portion of your policy, provided you paid in advance. However, this depends on your state and the timing of your cancellation, so be sure to clarify this with your insurer.

To summarise, the key steps are:

- Ensure you have alternative coverage in place to avoid a lapse.

- Contact your insurer or agent by phone or online to request cancellation.

- Inquire about any specific requirements, fees, and potential refunds.

- Follow through with any necessary steps to finalise the cancellation.

Join Travelers Auto Insurance: Steps to Success

You may want to see also

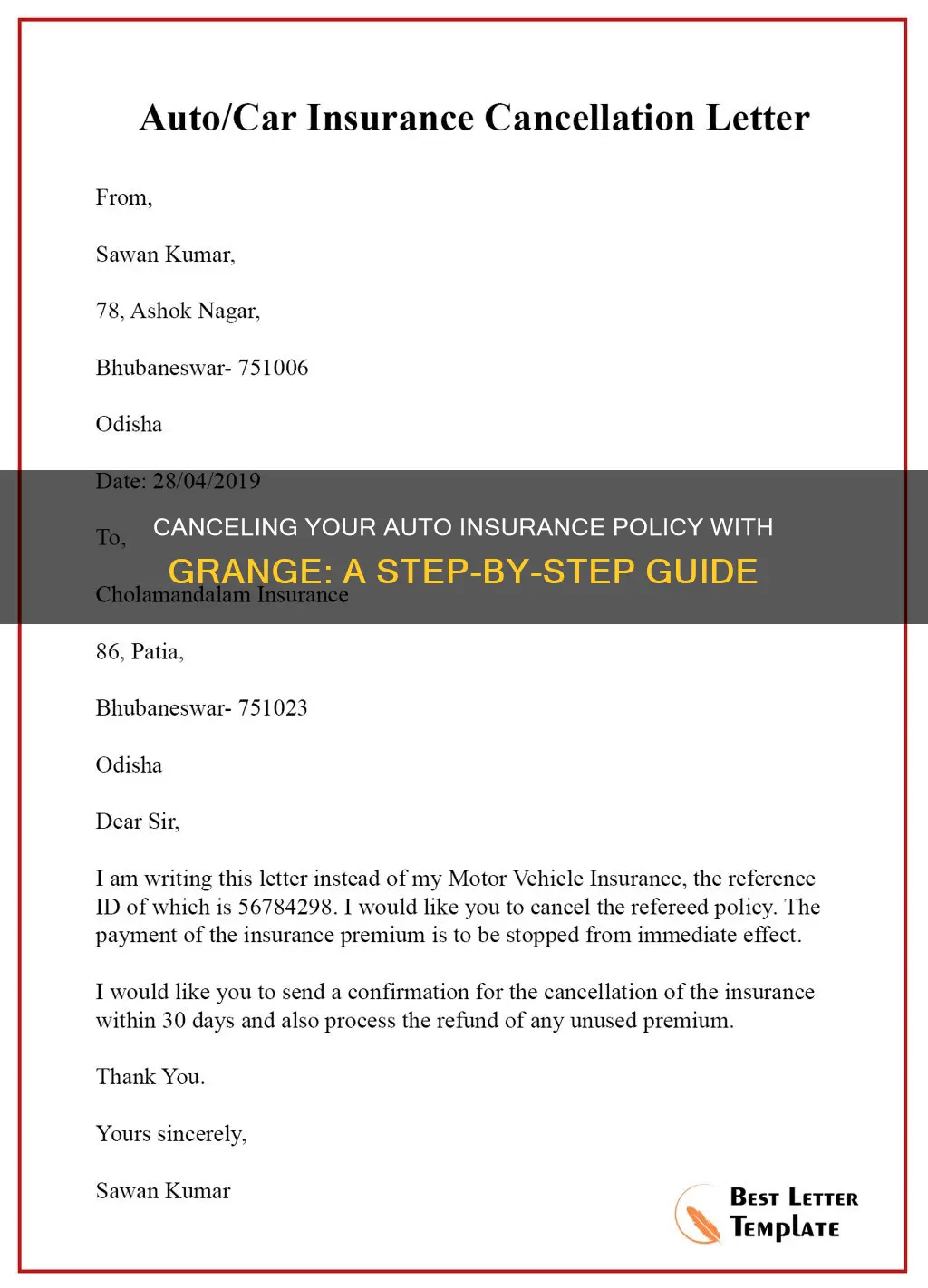

Signing a cancellation form

Your cancellation letter should include your full name, address, auto policy number, and the date of the requested cancellation. It is also important to include the reason for your cancellation. Some insurance companies may require a cancellation form or letter, while others may accept a phone call or in-person request.

[Date]

To Whom It May Concern,

I am writing to request the cancellation of my auto insurance policy, [policy number], effective [date of cancellation]. Please find attached the necessary documentation to support this request.

My reason for cancellation is [state your reason here]. Please stop all automatic payments or debits from my account as of the date of cancellation.

I also request written confirmation of the cancellation and the timely refund of any unused premiums. You can send both to me at the following address:

[Your name]

[Your address]

[City, State, ZIP]

If you require any further information or have any questions, please do not hesitate to contact me at [phone number] or [email address].

Sincerely,

[Your signature]

[Your full name]

Tips for signing and sending your cancellation letter:

- Verify the mailing address: Before sending off your cancellation request, double-check that you have the correct mailing address for your insurance company. Sending it to the wrong address could delay the cancellation process.

- Be polite: While it may be inconvenient, it is important to remain courteous and professional in your cancellation letter to ensure a smooth process.

- Keep a copy for your records: Always keep a copy of the signed cancellation letter for your reference in case you need it later.

- Ask for confirmation: Requesting confirmation of your cancellation will provide proof of your request and the effective date of cancellation.

- Confirm the preferred delivery method: Your insurance company may require you to send the letter by certified mail, or they may accept an email. Finding this out beforehand could save you money on postage.

Remember to review your policy to understand any cancellation fees, refund policies, or notice requirements. By following these steps, you can effectively sign and submit a cancellation form to terminate your auto insurance policy.

The Battle of the Insurance Giants: AARP vs. AAA—Who Offers the Best Auto Insurance Deal?

You may want to see also

Getting a refund for the unused portion of the policy

If you've paid your premium in advance and cancel your Grange auto insurance policy before the end of the term, you may be eligible for a refund for the unused portion of the policy. The amount of the refund will depend on how much of the premium you paid in advance, how much time is left on your policy, and the company's rules about refunds.

Some insurers may require you to pay a cancellation fee, which could offset your refund amount. Cancellation fees can be a flat fee or a short-rate fee, where the insurer charges the policyholder a percentage of the unused premium, typically 10%.

To get a refund for the unused portion of your Grange auto insurance policy, you should contact your insurer or agent to find out the best way to cancel your policy. Some insurance companies permit you to cancel over the phone or online, while others may require written notification or a signed document. When you connect with your insurer, you can ask about the possibility of a refund and any applicable cancellation fees.

It's important to note that nearly all states require drivers to have liability coverage. Therefore, you should ensure you have coverage with another company before cancelling your existing policy to avoid a lapse in coverage, which could result in higher rates in the future.

The Ticket Trap: Navigating Auto Insurance Hikes

You may want to see also

Avoiding a lapse in coverage

- Purchase new coverage before cancelling your old policy: Before you take any steps to cancel your current car insurance, make sure you have a new policy in place with a different insurer. This ensures there is no gap in coverage, which can result in penalties and higher rates.

- Align the start date of your new policy with the cancellation date of the old policy: By coordinating the dates, you can avoid any lapse in coverage. This is especially important if your state requires you to surrender your license plates before cancelling your existing policy. Having even a few days of overlapping insurance can help you avoid state fines.

- Inform your current insurer: Contact your insurance company via email, postal mail, or phone to initiate the cancellation process. Ask about any cancellation fees, refunds for unused premiums, and other requirements, such as providing advanced notice.

- Sign a cancellation letter, if necessary: Some insurers may require a signed cancellation letter, which includes details about your policy and the remaining time on it.

- Request a policy cancellation notice: You may receive this automatically, but if not, be sure to request written confirmation of the cancellation.

- Be mindful of state regulations: Each state has its own regulations regarding car insurance. Understand the requirements and potential penalties in your state, such as fines, license suspension, and increased rates, to make informed decisions.

- Maintain continuous coverage: Even if you're not driving for a period, consider maintaining the minimum amount of car insurance required in your state. Gaps in coverage can lead to higher rates and difficulties in purchasing a new policy in the future.

- Consider suspending your policy instead of cancelling: If you're recuperating from surgery, going on an extended vacation, or temporarily not driving, explore the option of suspending your policy with your insurer. This can help you avoid the negative consequences associated with a full cancellation.

- Review your options with an insurance agent: Before making any final decisions, discuss your situation with a licensed insurance agent. They can guide you on how to avoid legal and financial risks associated with cancelling your policy.

By following these steps and staying informed about your insurance options, you can effectively avoid a lapse in coverage when switching car insurance policies.

Auto Insurance Deductibles: What's the Average?

You may want to see also

Cancelling due to being covered under someone else's policy

If you are covered under someone else's auto insurance policy, you may wish to cancel your own policy. This is most likely to be the case if you get married, but could also be appropriate for adult children moving back home.

Before you cancel your auto insurance policy, ensure that you are added to the other person's policy. Adding a driver to an existing policy might increase the premium, but there may also be discounts available to help mitigate the increase.

Also, keep in mind that insurance follows the vehicle, not the person. So, if you drop coverage on your car by cancelling your policy, you will need to add that vehicle to the other person's policy to ensure financial coverage.

To cancel your auto insurance policy, contact your insurer or agent to find the best way to do so. Some insurance companies permit you to cancel right over the phone or online. Other insurers may require written notification or a signed document.

Auto Insurance: Understanding Your Monthly Costs

You may want to see also

Frequently asked questions

You can cancel your auto insurance policy by calling your insurer or agent. Some insurers may require you to sign a cancellation form.

No, policyholders can cancel their auto insurance policy at any time, for any reason.

Yes, insurers will generally refund you for the unused portion of your policy, assuming you paid in advance.

Depending on your state and when you cancel, your insurer may charge a cancellation fee.

Yes, since nearly all states require drivers to have liability coverage, you must have an auto policy in effect with another insurer when cancelling your current policy.