The residual market is a segment of the auto insurance market that serves as a last resort for high-risk drivers who are unable to obtain coverage from standard insurers. These drivers may have a history of driving offences, accidents, or claims, or they may fall into certain high-risk categories based on factors such as age, gender, or vehicle type. In some cases, individuals with convictions or a poor credit rating may also need to seek insurance from the residual market. This market is often referred to as shared or involuntary because state regulators assign insurers to these drivers, rather than insurers choosing to insure them voluntarily. While residual market insurance is more expensive, it ensures that all drivers who are legally allowed to drive and own a car can obtain the necessary coverage.

| Characteristics | Values |

|---|---|

| Purpose | To provide insurance to high-risk drivers who have been rejected by voluntary market insurers |

| Type of Insurance | Most often workers' compensation, personal automobile liability, and property insurance |

| Market Mechanism | Spreads the risk of insuring high-risk drivers among licensed insurers within the state |

| Market Structure | Non-voluntary or shared market; state insurance regulators assign drivers to insurers |

| Insurer Obligation | Based on market share; larger insurers are obligated to accept more high-risk motorists |

| Driver Factors | Driving history, tickets, accidents, claims, convictions, age, gender, vehicle type |

| Examples | Speeding tickets, unsafe driving record, DUI/DWAI, age, gender |

What You'll Learn

High-risk drivers

Residual market auto insurance programs exist to insure high-risk drivers who are denied coverage by regular insurers. These programs are sometimes known as "shared" or "involuntary" auto insurance programs because major auto insurance companies must be involved and must take on a certain percentage of these risks. They do not have a choice in the matter and cannot opt out of these programs.

In the United States, state governments force auto insurers to accept high-risk drivers. This is because all drivers are required to maintain auto insurance, even if they are considered unsafe or high-risk. While the specific requirements vary by state, insurers are generally required to allocate a small percentage of their auto insurance business to high-risk clients, typically around 1%.

While residual market insurance provides a safety net for high-risk drivers, it comes at a cost. High-risk drivers will typically pay higher rates for their auto insurance compared to other drivers. Additionally, it may be challenging to find insurers who participate in residual market programs, as they do not actively advertise these programs. However, resources and specialists are available to help high-risk drivers navigate the process of obtaining residual market insurance.

Full Coverage Auto Insurance: Understanding the Standard Package

You may want to see also

Insurance companies involved

The residual market is a segment of the auto insurance market that serves as a last resort for drivers who are considered high-risk and are unable to obtain coverage from insurers in the voluntary market. This market operates by distributing the risk of insuring these drivers across licensed insurers within a given state, based on their market share. As a result, larger insurance companies that write a significant portion of policies in a state will be required to accept more high-risk motorists than smaller companies.

In the United States, there are various programs and insurance companies that provide residual market auto insurance. The specific providers can vary by state, but here are some of the insurance companies involved:

- Fair Access to Insurance Requirements (FAIR) Plans: FAIR Plans are designed to provide property insurance, including both homeowners and renters insurance. They are established to ensure continued insurance coverage in urban and coastal areas. FAIR Plans are available in multiple states, although the specific offerings may differ slightly between states.

- Beach and Windstorm Plans: These plans primarily focus on wind-only risks in designated coastal areas. They are typically offered in conjunction with FAIR Plans to provide comprehensive coverage for individuals residing in these regions.

- Florida Citizens Property Insurance Corp. (CPIC): This is a state-run insurance company in Florida that offers a hybrid plan combining FAIR and Beach Plans. It provides property insurance throughout the state of Florida, covering risks such as windstorms, vandalism, and fire.

- Louisiana Citizens Property Insurance Corp. (Louisiana Citizens): Similar to CPIC, Louisiana Citizens is a state-run insurance company in Louisiana that offers a hybrid plan for property insurance. It provides coverage for a range of exposures, including windstorm risk, vandalism, and fire.

It is important to note that the involvement of specific insurance companies in the residual market can change over time, and there may be additional providers in different states. The information provided here offers a general overview of some of the key players in the residual market for auto insurance.

Restarting Auto Insurance: Coverage After a Lapse

You may want to see also

How to shop for residual market insurance

Residual market insurance is a type of auto insurance for high-risk drivers who have been denied coverage by insurers in the regular market. This type of insurance is typically more expensive and serves as a last resort for drivers who are considered high-risk due to factors such as their driving history, age, gender, credit rating, vehicle type, and neighbourhood.

- Contact a local insurance agent you trust: If you have a local insurance agent or an insurer you already have a relationship with, contact them first. They may not be able to provide you with a quote directly, but they can direct you to a "partner" or "subsidiary" company that specialises in high-risk insurance. This is especially helpful if you had a policy bundle with your previous insurer, as you may still be able to maintain your multi-line policy discounts.

- Search online: If your trusted insurance agent cannot help you, you can search for residual market insurance online. Use specific search phrases such as "cheap auto insurance for high-risk drivers in [your state]," "involuntary auto insurance policies in [state]," or "residual market auto insurance in [city]." Your search results will include insurers actively seeking high-risk clients.

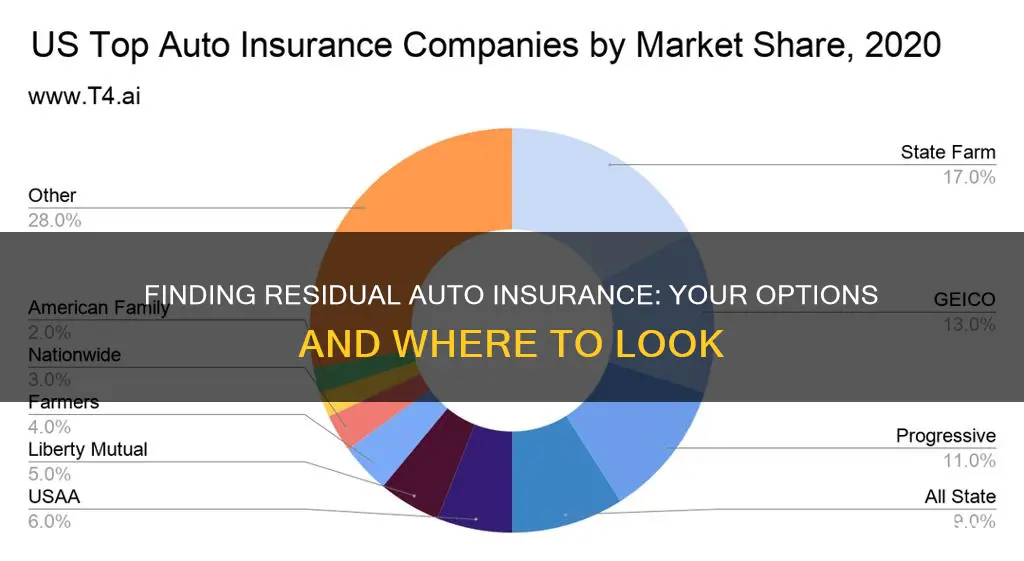

- Contact popular auto insurance companies directly: While smaller companies may not be required to participate in the residual insurance market, the most prominent auto insurance companies in your state are likely to be involved in these programs. Contact them directly, explain your situation, and request a quote. You may need to speak to several agents before finding the right policy, so don't give up.

- Consider alternatives: If possible, you may want to avoid residual market insurance due to its high cost. To do this, you can take steps to improve your risk rating, such as taking defensive driving courses, maintaining a good insurance history, improving your credit rating, and choosing a vehicle that is not considered high-risk.

Remember that residual market insurance is a last resort, and it is always better to maintain a good driving record and insurance history to avoid being classified as a high-risk driver.

Auto Insurance in California: What's Happening and Why

You may want to see also

Improving risk rating

Residual market auto insurance is a type of insurance for high-risk drivers who have been rejected by voluntary market insurers. These drivers are considered high-risk due to factors such as their driving history, including tickets, accidents, and claims, as well as criminal convictions such as DUIs.

Risk rating is a crucial aspect of the auto insurance industry, as it helps determine the likelihood of a driver filing a claim. Improving risk rating can lead to more accurate pricing and coverage decisions, benefiting both the insurer and the insured. Here are some ways to improve risk rating:

- Utilize advanced technologies: Embrace new technologies such as telematics, machine learning, and data analytics. Telematics devices can be installed in vehicles to track driving behaviour, including speed, acceleration, and braking patterns. This provides a more accurate assessment of an individual's driving habits and risk profile. Machine learning algorithms can analyse vast amounts of data to identify patterns and predict claim probabilities more effectively.

- Expand data sources: Go beyond traditional data sources such as driving records and credit scores. Incorporate additional data points like telematics data, vehicle specifications, and even health records (with the driver's consent). A more comprehensive dataset will lead to more accurate risk assessments.

- Implement regular reviews: Conduct periodic reviews of risk rating models and update them as necessary. This ensures that the models remain relevant and effective in the face of changing market conditions and driving trends. Stay informed about new developments in the industry, such as advancements in vehicle safety features or changes in driving regulations.

- Enhance customer engagement: Encourage drivers to provide feedback and share their experiences. This can be done through surveys, feedback forms, or even mobile apps. By understanding drivers' behaviours, preferences, and concerns, insurers can refine their risk assessments and develop more tailored coverage options.

- Collaborate with industry partners: Share insights and best practices with other industry participants, such as insurance brokers, vehicle manufacturers, and road safety organisations. By collaborating, insurers can collectively improve risk rating models and develop more effective risk mitigation strategies.

- Focus on driver education: Promote safe driving practices and provide educational resources to drivers. This can include offering defensive driving courses, safe driving tips, and incentives for maintaining a clean driving record. Educated and informed drivers are more likely to make better decisions on the road, reducing their risk profile.

- Customise coverage plans: Avoid a one-size-fits-all approach to auto insurance. Instead, offer customised coverage plans that take into account individual drivers' needs, preferences, and risk profiles. This can lead to more accurate risk assessments and pricing, as well as improved customer satisfaction.

By implementing these strategies, insurers can improve their risk rating processes, leading to more precise assessments of driver risk. This, in turn, can result in more equitable pricing, better coverage options, and a safer driving environment for all.

Auto Insurance: When Coverage Becomes Excessive

You may want to see also

Examples of high-risk drivers

Residual market auto insurance is a type of insurance for drivers who are considered high-risk and have been denied coverage by insurers. Here are some examples of high-risk drivers:

History of Driving Tickets, Accidents, and Claims

High-risk drivers often have a history of driving violations, such as speeding tickets, accidents, and insurance claims. A high number of driving infractions can indicate to insurers that a driver is more likely to be involved in an accident or make a claim in the future.

Convictions for Driving Under the Influence (DUI)

Individuals with multiple convictions for driving under the influence of alcohol or drugs may struggle to find an insurer willing to cover them. DUI convictions are considered a serious offence and indicate a higher risk of dangerous driving behaviour.

Inexperienced or Young Drivers

Inexperience behind the wheel can also lead to higher insurance premiums or a need for residual market insurance. Young and inexperienced drivers are more likely to be involved in accidents due to their lack of experience and maturity.

Poor Credit History

In some cases, a person's credit history can impact their insurance premiums or eligibility. Insurers may view individuals with a poor credit history as higher-risk, as they may be more likely to miss payments or default on their insurance policies.

High-Performance Vehicle Owners

Owning a high-performance vehicle, such as a sports car, can also result in higher insurance costs or the need for residual market insurance. These vehicles are often more expensive to repair or replace, and their high-performance capabilities may encourage riskier driving behaviours.

Texas Auto Insurance: Is Collision Coverage Mandatory?

You may want to see also

Frequently asked questions

Residual market auto insurance is a type of insurance for drivers who are considered high-risk and have been denied coverage by insurers. It is also known as the non-voluntary or shared market.

A high-risk driver is someone with a history of driving tickets, accidents, claims, or convictions for driving offenses such as driving under the influence.

The risk of insuring high-risk drivers is spread among the licensed insurers within a state. State insurance regulators assign drivers to insurers, and companies with a larger market share are obligated to accept more high-risk motorists.

If you have been deemed a high-risk driver and are unable to obtain insurance through regular channels, then you likely need residual market auto insurance. You may also find yourself in this situation if you are having difficulty buying an affordable policy.

You can start by contacting a local insurance agent you trust and asking about residual market insurance policies. They may be able to direct you to a partner or subsidiary that deals with these risks. You can also search online for insurers actively seeking this type of business by using specific search phrases such as "residual market auto insurance in [city]."