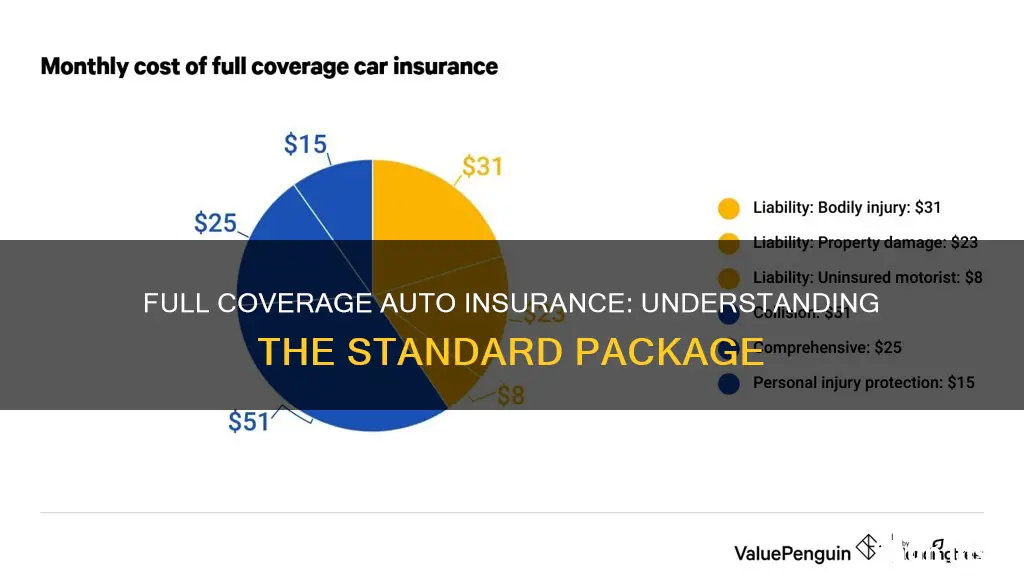

Standard full-coverage auto insurance is a combination of comprehensive, collision, and liability coverage. It provides coverage for most scenarios, including damage to your car from the weather, an at-fault accident, hitting an animal, or vandalism. While there is no standard definition of full coverage, it typically includes protection against physical damage, such as collision coverage and comprehensive coverage, in addition to the required liability coverage.

| Characteristics | Values |

|---|---|

| Liability Coverage | Covers damages/injuries to another vehicle or person |

| Collision Coverage | Pays to repair your car after any kind of accident |

| Comprehensive Coverage | Pays to repair your vehicle from incidents other than collisions |

| Uninsured Motorist Coverage | Pays for injuries and/or damage to your vehicle if an uninsured motorist hits you |

| Underinsured Motorist Coverage | Pays for costs when another driver’s insurance is insufficient |

| Medical Payments Coverage | Covers medical bills for you and your passengers |

| Personal Injury Protection (PIP) | Pays for your injuries, regardless of who was at fault |

| Roadside Assistance Coverage | Provides services like towing, lockout assistance, and fuel delivery |

| Rental Car Reimbursement Coverage | Reimburses you for the cost of a rental car while your vehicle is being repaired |

What You'll Learn

Liability insurance

Liability coverage is split into two components:

- Bodily injury liability: This covers the cost of injuries to others in an accident caused by the policyholder, up to the policy's limits.

- Property damage liability: This covers damage to other vehicles or property in an accident caused by the policyholder, up to a certain limit.

Each state has different minimum requirements for liability coverage. For example, in Pennsylvania, the minimum required coverage is $15,000 in bodily injury liability per person and $30,000 in bodily injury liability per accident, plus $5,000 in property damage liability per accident.

Infiniti Lease: Gap Insurance Included?

You may want to see also

Comprehensive coverage

The cost of comprehensive coverage varies depending on factors such as the age and value of your vehicle, as well as your chosen deductible. Generally, comprehensive coverage is less expensive than collision coverage, as the average comprehensive claim is smaller. You can save money on comprehensive coverage by choosing a lower deductible.

While comprehensive coverage is not mandatory, it is often required by lenders or leasing companies. It is also worth considering if you want to protect your vehicle from unforeseen events and avoid unexpected repair bills. However, if your vehicle is older or has a low value, comprehensive coverage may not be worth the additional cost.

Who's the Real Owner? Understanding Lien Holders and Auto Insurance Policies

You may want to see also

Collision coverage

The cost of collision coverage can vary depending on the value of your vehicle and the deductible you choose. The deductible is the amount you have to pay out of pocket before the insurance company covers the rest. Deductibles can range from $500 to $5000, and choosing a higher deductible can lower your monthly insurance payments.

When deciding whether to add collision coverage to your policy, consider the value of your vehicle and your ability to pay for repairs or a replacement vehicle out of pocket. Collision coverage may be especially useful if your vehicle is new or expensive, as it can help cover the cost of expensive repairs or replacements.

It's important to note that collision coverage does not apply to accidents involving animals or damage caused by events outside your control, such as a tree falling on your vehicle. These types of incidents are typically covered under comprehensive coverage, which is another optional add-on to full-coverage auto insurance.

Auto Insurance Premiums: Two Points, How Much is Too Much?

You may want to see also

Uninsured motorist coverage

In addition to uninsured motorist coverage, underinsured motorist coverage is also important. This type of coverage protects individuals if they are hit by a driver who does not have enough insurance to pay for the damages or injuries caused. Underinsured motorist coverage also has two components: underinsured motorist bodily injury (UIMBI) and underinsured motorist property damage (UIMPD). UIMBI covers medical bills for both the policyholder and their passengers, while UIMPD covers damage to the policyholder's vehicle.

While not all states mandate uninsured and underinsured motorist coverage, it is highly recommended for all drivers. In some states, such as Illinois, both types of coverage are required. In other states, like Massachusetts and South Carolina, only uninsured motorist coverage is mandatory. It is important for individuals to understand the requirements and options in their state to ensure they have the necessary protection.

The cost of uninsured motorist coverage can vary depending on factors such as the state, the insurance company, and the chosen insurance limits. Individuals can typically choose their insurance limits, and it is recommended to match the liability coverage limits for the bodily injury portion. For UMPD, individuals can select a limit that closely mirrors the value of their vehicle.

Choosing the Right Auto Insurance Deductible for Your Needs

You may want to see also

Personal injury protection

In the US, 12 states require drivers to carry personal injury protection, while in the remaining 38 states, it is optional. In states with no-fault insurance laws, every driver must file a claim with their own insurance company after an accident, regardless of who caused it. This means that all drivers need to buy personal injury protection coverage as part of their auto policies.

The cost of PIP insurance varies depending on location, the amount of coverage desired, and driving history. In Texas, for example, insurance companies are required to offer every driver at least $2,500 of PIP insurance, with the option to increase coverage to $5,000 or $10,000. The average cost of PIP insurance is $15 per month.

While PIP provides coverage for medical expenses, it does not cover everything. For instance, it will not cover the other driver's injuries in a collision or any injuries sustained while committing a crime. To ensure full coverage, it is recommended to also consider policies such as bodily injury liability insurance and property damage liability insurance.

Auto Insurance: Uber Data

You may want to see also

Frequently asked questions

Full-coverage auto insurance typically includes liability, comprehensive, and collision insurance, covering you in most scenarios.

Full-coverage insurance can apply in most situations, such as damage to your car from a storm, an at-fault accident, hitting an animal, or vandalism. It also covers injuries or damage you cause to others.

The cost varies depending on factors such as age, location, driving record, and insurance score. The national average for a 35-year-old good driver with good credit is $1,766 per year or about $147 per month.

Full-coverage auto insurance is typically required if you have an auto loan or lease. It is also recommended if you have a new or expensive car, commute in heavy traffic, or live in an area with extreme weather or high theft rates.

To save on full-coverage auto insurance, you can shop around for quotes from multiple companies, look for discounts, increase your deductible, and maintain a clean driving record.