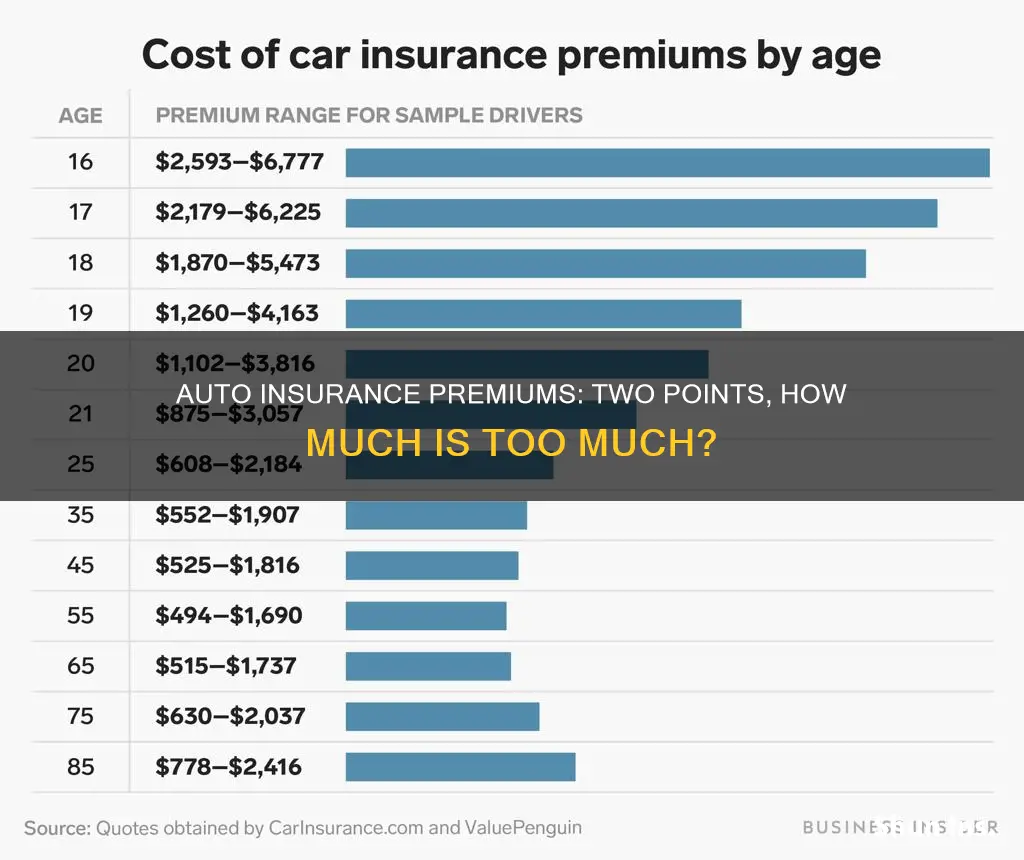

Drivers with points on their license due to traffic violations will typically face higher car insurance premiums. The increase in insurance costs depends on several factors, including the insurance company, state, type of violation, and the driver's history. Generally, insurance rates can go up by anywhere between 10% and 180% for two points on a driver's license.

| Characteristics | Values |

|---|---|

| Average increase in insurance rates | 20% to 180% |

| Average cost of auto insurance with one point on license | $306 per month |

| States without a license point system | Alaska, Iowa, Michigan, Montana, New Hampshire, North Dakota, Oregon, Pennsylvania, Wisconsin, and the District of Columbia |

What You'll Learn

How much do points impact insurance rates?

Having points on your driver's license will almost always result in an increase in your auto insurance rates. The extent of the increase depends on several factors, including the insurance company, the state, the type of violation, and the severity of the incident.

Points on your driver's license can lead to a significant increase in your auto insurance rates, typically ranging from 20% to 100%. The exact increase will depend on various factors.

- Insurance Carrier: Different insurance companies have their own point systems and methods for determining rate adjustments.

- Type of Violation: More severe violations, such as reckless driving or DUIs, will generally result in higher increases in insurance rates compared to minor traffic violations.

- State Regulations: The impact of points on insurance rates varies by state. Some states, like North Carolina, have a set rate increase for specific violations, while others allow insurers to determine the increase.

- Number of Points: The more points you accumulate, the higher the impact on your insurance rates.

Examples of Point Impact on Insurance Rates

To illustrate the impact of points on insurance rates, let's look at a few examples:

- In California, disobeying a traffic control signal (one point) may increase rates by 20.2%, while speeding (one point) may result in a 25.6% increase.

- In Florida, a driver with two points for reckless driving saw their insurance costs increase by 44.5%.

- In New York, accumulating 11 points in an 18-month period may result in license suspension and significant insurance rate increases. For example, speeding 11-15 mph over the limit (three points) can lead to higher rates.

- In Ohio, accumulating more than 12 points in two years can result in license suspension. Each violation, such as speeding or failure to stop at a red light, will impact your insurance rates.

Mitigating the Impact of Points

While points will likely increase your insurance rates, there are strategies to minimize the impact:

- Defensive Driving Courses: Many states offer the option to reduce points and insurance rates by completing an approved driving course.

- Maintain a Clean Record: Avoid further traffic violations, as points typically decrease or disappear from your record after a certain period (usually three to five years).

- Shop for Insurance: Compare rates from different insurers, as some specialize in covering high-risk drivers or offer more forgiving rates.

Auto Insurance in Michigan: How Much?

You may want to see also

How long do points stay on your record?

The length of time that points stay on your driving record varies depending on the state and the type of violation. In California, single-point offences remain on your record for 39 months, while more serious violations such as DUIs and reckless driving stay on your record for 13 years. In Michigan, points remain on your record for two years from the date of conviction. In Nevada, points for minor traffic violations are only kept for one year, while in Utah, points for individual convictions are removed from your record three years after the violation.

The length of time that points stay on your record can have significant consequences, including increased insurance premiums and suspension or revocation of your driver's license. For example, in California, if you accumulate four points within 12 months, six points within 24 months, or eight points within 36 months, your license can be suspended or revoked. Additionally, points on your record can affect your employment prospects, as some jobs require a clean driving record.

It's important to note that the impact of points on your insurance rates also depends on the type of violation and the insurance company. For example, in California, disobeying a traffic control signal resulted in a 20.2% increase in insurance rates, while speeding resulted in a 25.6% increase, despite both violations being worth one point.

Does GEICO Auto Insurance Cover U-Haul Rentals?

You may want to see also

How to reduce points on your license

Having points on your license can lead to a significant increase in your insurance rates, so it's understandable that you'd want to reduce them. Here are some ways to do that:

Take a Defensive Driving Course

Many states offer the option to reduce points on your driving record by completing a state-approved defensive driving course. This can help lower your points and may also qualify you for additional discounts from your insurance provider. These courses can usually be completed online, at your own pace, and are designed to be fun, easy, and stress-free.

Maintain a Clean Driving Record

Going forward, the best way to reduce points is to avoid traffic violations and accidents. In many states, points decrease or disappear from your driving record after a certain period, typically between two and five years. So, if you can maintain a clean record during this time, your points will naturally reduce.

Shop Around for Insurance

If your current insurer significantly increases your rates due to points, consider shopping around. Some insurance providers, such as State Farm, USAA, and Liberty Mutual, offer more competitive rates for drivers with several points on their license.

Check Your State-Specific Laws

Each state has different laws and regulations regarding the assessment and reduction of points. For example, in Alaska, you can have two negative points removed by completing an approved defensive driving course. In Georgia, you can request that the Department of Driver Services reduce up to seven points once every five years by completing an approved driver improvement course. On the other hand, some states like Arizona, Arkansas, and California do not currently have point reduction programs.

Fight Your Ticket

If you haven't been convicted yet, you may be able to fight your ticket in court and get the charges dropped, preventing any points from being added to your record. Even if you aren't successful in getting the charges dropped completely, you may be able to defend yourself in a way that results in a reduction of points.

Remember, the best strategy is to keep your driving record clean and always make your car insurance payments on time.

Auto Insurance: Age-Based Discounts

You may want to see also

How to find cheap insurance with points on your license

Having points on your license can make it harder to find cheap insurance, as it indicates to insurance companies that you are a high-risk driver. However, there are several strategies you can use to mitigate the impact of points on your insurance rates and find more affordable coverage.

Firstly, it's important to understand how points affect your insurance rates. Insurance companies don't solely base your rates on the number of points you have; they also consider the types of violations that led to those points. More serious violations, such as reckless driving or DUIs, will result in higher insurance premiums than minor traffic infractions. Additionally, different states have different point systems, with some states not using points at all. The number of points required for license suspension also varies by state.

To find cheap insurance with points on your license, consider the following strategies:

- Shop around for insurance: Compare quotes from multiple insurance providers, as rates can vary significantly between companies. Some insurers may offer more competitive rates for drivers with points on their licenses.

- Take a defensive driving course: Completing an approved defensive driving course can help reduce points on your license and may also qualify you for discounts on your insurance.

- Maintain a clean driving record: Avoid future traffic violations and accidents, as points typically disappear from your record after a certain period (usually three to five years).

- Consider switching insurance companies: Different insurance providers treat driving violations differently. By switching to a company that specializes in covering high-risk drivers or offers more forgiving rates, you may be able to find cheaper coverage.

- Bundle your insurance policies: If you're a homeowner, consider bundling your car and home insurance policies. This can often lead to lower rates, even with points on your license.

- Improve your driving habits: Avoid getting additional points by practising safe and defensive driving habits. This will help reduce your risk profile over time, leading to lower insurance rates.

- Let a more experienced motorist borrow your car: If you're a young driver, allowing a more experienced motorist with a clean driving record to borrow your car can help reduce your insurance costs.

- Downgrade to a car in a lower insurance group: Cars with bigger engines often fall into higher insurance groups. By opting for a vehicle with a smaller engine, you may be able to benefit from cheaper insurance rates.

- Opt for a black box insurance policy: Telematics insurance can help offset the risk associated with having points on your license by providing your insurer with detailed information about your driving habits.

- Take an advanced driving test: Completing an advanced driving course can help reduce your insurance premiums by demonstrating to insurers that you have the skills to handle challenging driving situations.

Remember, the impact of points on your insurance rates may vary depending on your location and the specific violations. It's always a good idea to compare quotes from multiple providers and explore different options to find the most affordable coverage for your situation.

Allstate Auto Insurance: What's the Real Cost?

You may want to see also

How to avoid points on your license

Having points on your license can lead to a significant increase in auto insurance rates, so it's understandable that drivers want to avoid this. Here are some ways to do so:

Plead Exceptional Circumstances

In certain cases, you may have been speeding due to exceptional circumstances, such as rushing your pregnant wife to the hospital. In such situations, you can argue that there were mitigating factors that influenced your actions.

Take a Defensive Driving Course

In some states, completing a defensive driving or driver improvement course can help prevent points from being added to your license. For example, in Michigan, eligible drivers can take a Basic Driver Improvement Course (BDIC) to avoid points and prevent notification of the ticket from being sent to their insurance company. However, the course typically lasts at least four hours and comes with a fee.

Fight the Ticket in Court

If you believe you have been wrongly accused of a traffic violation, you can choose to contest the ticket in court. If you are successful and the charges are dropped, you will avoid any points on your record. Even if you are not completely cleared, you may be able to reduce the number of points.

Be Mindful of State-Specific Rules

The impact of points on insurance rates and license suspension varies by state. For example, in California, points from major violations can remain on your license for up to 10 years, while in Nevada, points from minor traffic violations are removed after one year. Understanding the specific rules and point systems in your state can help you make more informed decisions.

Maintain a Clean Driving Record

One of the best ways to avoid points is to practice safe driving and maintain a clean driving record. Avoid traffic violations and accidents, obey traffic laws, and be mindful of speed limits. This will help keep your insurance rates low and reduce the risk of license suspension.

Event Insurance: Progressive Auto's Extra Coverage

You may want to see also

Frequently asked questions

Auto insurance rates can go up anywhere from 20% to 100% with 2 points, depending on the insurance company, state, and violation.

Some common violations that result in 2 points include driving in the dark without headlights and performing an illegal U-turn.

Points can remain on your driving record for varying durations, depending on the state. For instance, in California, points for major violations can stay on your license for up to 10 years, while in Nevada, points for minor traffic violations are only kept for a year.

You can reduce points on your driving record by completing a defensive driving or driver safety course. These courses can help lower your points and may also qualify you for discounts from your insurance provider.