Navigating the complexities of life insurance can be daunting, but understanding where to access your policy is a crucial step in ensuring your financial security. Whether you're a policyholder or a beneficiary, knowing how to access your life insurance is essential. This guide will provide a comprehensive overview of the various methods and platforms you can use to access your life insurance, including online portals, customer service hotlines, and mobile apps, ensuring you can easily manage and review your policy whenever needed.

What You'll Learn

- Online Portal: Check your policy online, often accessible through the insurer's website

- App: Many insurers offer a mobile app for quick access

- Customer Service: Contact their support team for guidance and assistance

- Policy Documents: Review your policy documents for detailed information

- Agent/Broker: Consult your insurance agent or broker for personalized advice

Online Portal: Check your policy online, often accessible through the insurer's website

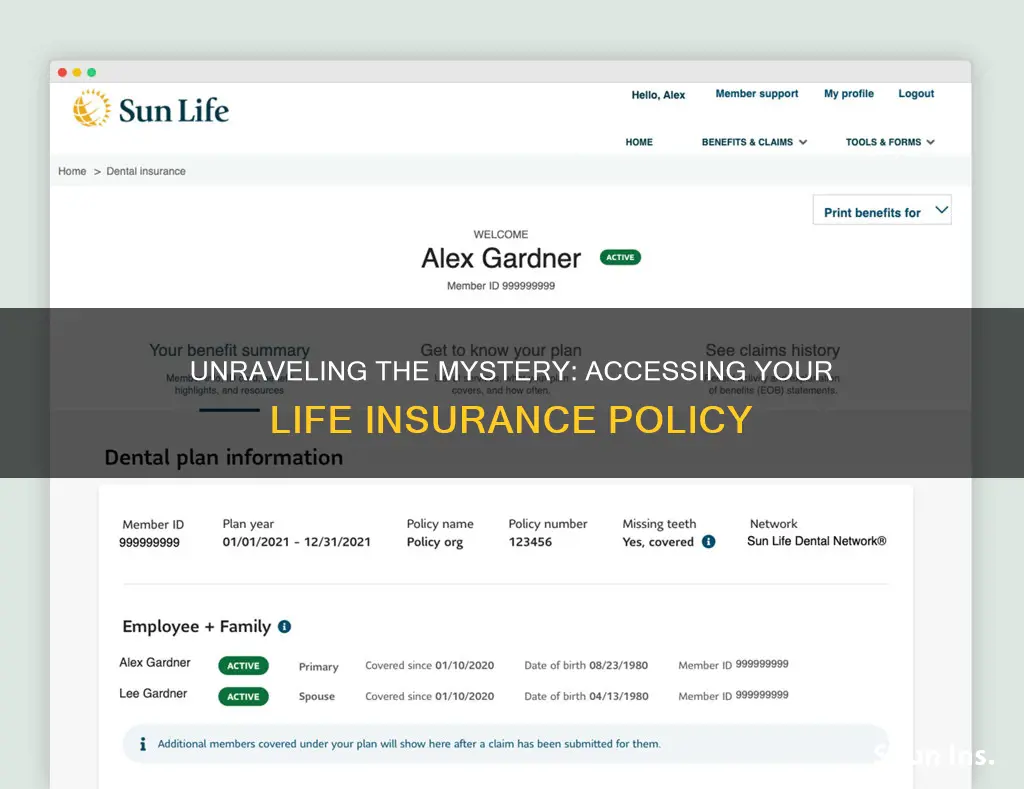

When it comes to accessing your life insurance policy, many insurance providers offer an online portal as a convenient and efficient way to manage your coverage. This digital platform is often accessible through the insurer's website, providing policyholders with a secure and user-friendly interface to view and manage their life insurance details. Here's a step-by-step guide on how to utilize this online portal:

Accessing the Online Portal:

Start by visiting the official website of your insurance company. Look for a dedicated section or a prominent link labeled "Customer Login," "My Account," or "Online Services." Entering your personal login credentials, such as your policy number and a unique password, will grant you access to your personalized online portal. If you're new to the portal, you might need to register and create an account, which typically involves providing some basic personal information.

Navigating the Online Policy Dashboard:

Once logged in, you'll likely be directed to a dashboard or summary page that provides an overview of your life insurance policy. This page will display essential details such as the policy type, coverage amount, beneficiaries, and any additional benefits or riders included. Take time to familiarize yourself with the layout and navigation options provided.

Viewing Policy Details:

The online portal allows you to access comprehensive information about your policy. You can view the policy's terms and conditions, including coverage limits, exclusions, and any specific provisions. It also provides details about your beneficiaries, allowing you to confirm their names, contact information, and their relationship to you. Additionally, you can often find a summary of any recent changes or updates made to your policy.

Making Changes or Updates:

Many insurance providers empower policyholders to make changes or updates directly through the online portal. This might include updating your personal contact information, changing beneficiaries, or adjusting coverage amounts. However, it's crucial to review any proposed changes carefully before submitting them to ensure accuracy and compliance with the insurer's policies. Some changes may require additional documentation or verification, which the portal might guide you through.

Staying Informed and Secure:

Regularly checking your policy online ensures that you stay informed about your life insurance coverage. You can quickly identify any discrepancies or changes that might require your attention. Additionally, the online portal often incorporates security measures, such as two-factor authentication, to protect your personal information. It is essential to keep your login credentials secure and to regularly update your password to maintain the security of your account.

Term Insurance vs Life Insurance: What's the Difference?

You may want to see also

App: Many insurers offer a mobile app for quick access

In today's digital age, accessing your life insurance information has become more convenient than ever, thanks to the numerous mobile apps offered by insurance companies. These apps provide a user-friendly interface, allowing policyholders to quickly and easily manage their life insurance policies from the comfort of their smartphones or tablets. With just a few taps, you can gain instant access to essential details, ensuring you stay informed and in control of your financial security.

Many insurance providers recognize the importance of digital accessibility and have developed dedicated mobile applications to cater to their customers' needs. These apps typically offer a range of features, including policy overview, premium payments, claim processing, and customer support. By downloading your insurer's official app, you can streamline your interactions and gain a comprehensive view of your life insurance coverage.

The app experience is designed to be intuitive and efficient. Upon launching, users can navigate through various sections, each providing specific information. The policy overview section displays key details such as the policy number, coverage amount, beneficiary information, and policy term. Additionally, it may include a summary of any recent changes or updates to your policy, ensuring you stay informed about any modifications made by the insurer.

For premium payments, the app often integrates a secure payment gateway, allowing policyholders to make payments conveniently. Users can set up recurring payments, view payment history, and even receive reminders for upcoming due dates. This feature ensures that you never miss a payment and helps maintain the continuity of your life insurance coverage.

Furthermore, the app can be a valuable tool for processing claims. In the event of a covered loss, policyholders can initiate the claims process directly through the app. It provides a step-by-step guide, ensuring users understand the required documentation and procedures. This streamlined approach can significantly reduce the time and effort typically associated with filing a claim, offering a more efficient and user-friendly experience.

In summary, the availability of mobile apps from insurance companies has revolutionized how individuals access and manage their life insurance policies. These apps provide quick access to essential information, efficient premium payments, and a simplified claims process. By leveraging technology, insurers empower their customers to take control of their financial well-being, ensuring they stay protected and informed at all times.

Life Insurance for Employees: What's the Deal?

You may want to see also

Customer Service: Contact their support team for guidance and assistance

If you're unsure about where to access your life insurance policy, the first step is to reach out to the customer service team of your insurance provider. They are there to assist you and ensure you have the necessary information and access to your policy. Here's a breakdown of how to proceed:

Contact Information: Begin by locating the contact details of your insurance company. This can usually be found on your policy documents, on the back of your ID card, or on the company's website. Look for a dedicated customer service or support section, where you'll find phone numbers, email addresses, or live chat options.

Phone Support: Picking up the phone is often the fastest way to get immediate assistance. When calling, have your policy number ready, as this will help the representative quickly identify your account. Be prepared to explain your situation, and the support team will guide you through the process of accessing your policy. They might ask for verification details to ensure your security.

Email or Online Support: If you prefer written communication or want to submit your request at your convenience, email support is an option. Craft a clear and concise email stating your inquiry about accessing the policy. Include any relevant details, such as your name, policy number, and the specific information you're seeking. The support team will respond with the required guidance and may even provide online resources or portals to help you manage your policy.

Live Chat or Online Portal: Many insurance companies now offer live chat support, providing real-time assistance. This can be particularly useful if you have immediate questions or need quick access to your policy details. Additionally, some insurers provide online portals or customer dashboards where you can log in and view your policy information, make changes, and even manage your payments.

Remember, the customer service team is there to help and ensure a smooth experience. They can provide guidance on the specific steps required to access your life insurance, whether it's through online resources, downloading documents, or updating your personal details. Don't hesitate to reach out and clarify any concerns you may have about your policy.

Canceling Life Insurance: What You Need to Know

You may want to see also

Policy Documents: Review your policy documents for detailed information

When it comes to accessing your life insurance, the first step is to review your policy documents. These documents are a comprehensive guide to your insurance coverage and are essential for understanding the terms and conditions of your policy. They provide detailed information about the coverage you have, the beneficiaries, the policy's value, and the various options available to you.

Policy documents typically include a range of important details. Firstly, they outline the specific type of life insurance you hold, such as term life, whole life, or universal life. Each type has its own unique features and benefits, and understanding these differences is crucial. The documents will also specify the coverage amount, which is the financial benefit that will be paid out upon your passing. This amount is a key factor in ensuring your loved ones are financially protected.

In addition to the coverage details, policy documents provide information about the policy's duration. This includes the start and end dates of the coverage, as well as any renewal options. Understanding the policy's term is essential to know how long the coverage will last and whether it can be extended or renewed. The documents may also include a summary of the policy's costs, such as premiums and any associated fees.

Another critical aspect covered in policy documents is the beneficiary information. Here, you can specify who will receive the death benefit upon your passing. This is an important step to ensure that your insurance proceeds go to the intended recipients. You can also update this information at any time if your wishes or circumstances change.

Reviewing your policy documents regularly is a proactive approach to managing your life insurance. It allows you to stay informed about your coverage, ensuring that you are aware of any changes or updates. By doing so, you can make informed decisions about your insurance needs and take advantage of any policy options that may benefit you. Remember, these documents are a valuable resource, providing the necessary details to make the most of your life insurance policy.

Life Insurance and Child Support: New York's Complex Reality

You may want to see also

Agent/Broker: Consult your insurance agent or broker for personalized advice

Consulting your insurance agent or broker is an essential step to ensure you have easy access to your life insurance policy and to receive tailored guidance. These professionals are your go-to resource for understanding and managing your insurance coverage. Here's why reaching out to them is beneficial:

Personalized Assistance: Insurance agents and brokers have in-depth knowledge of various insurance products, including life insurance. They can provide personalized advice based on your unique circumstances. When you contact them, they will assess your current situation, consider your financial goals, and offer recommendations to ensure your life insurance policy aligns with your needs. This tailored approach is crucial as it helps you make informed decisions and ensures you have the right coverage.

Policy Access and Management: Your insurance agent or broker can guide you on how to access your policy documents, which may include the insurance contract, beneficiary information, and other relevant details. They can also assist in updating your policy, such as changing beneficiaries, increasing coverage, or adjusting policy terms to reflect life changes. Regular communication with your agent ensures you stay informed about your policy's status and can make necessary adjustments over time.

Claims and Payout Process: In the unfortunate event of a claim, your insurance agent or broker can provide valuable support. They will help you understand the claims process, ensure all necessary documentation is in order, and assist in initiating the payout process. This guidance can be particularly important during challenging times, ensuring a smooth and efficient claims experience.

Regular Reviews: Insurance needs can change over time due to various life events. Your agent or broker can schedule regular reviews to assess your policy's performance and make adjustments as required. This proactive approach ensures your life insurance remains relevant and adequate, providing peace of mind as your life circumstances evolve.

By consulting your insurance agent or broker, you gain a dedicated partner who understands your insurance needs and can provide ongoing support. They are equipped to answer your questions, address concerns, and offer solutions tailored to your specific situation. This personalized service is invaluable in helping you navigate the complexities of life insurance and ensuring you have the right coverage in place.

H&R Block: Life Insurance for Employees?

You may want to see also

Frequently asked questions

To access your life insurance policy, you can typically contact your insurance provider directly. They will guide you through the process, which may involve providing personal details, policy numbers, and any necessary documentation. You can usually reach out via phone, email, or through their online portal.

If you've misplaced your policy documents, don't worry. You can still access your life insurance by contacting your insurance company. They can provide you with a copy of your policy or help you locate the necessary information. It's a good idea to keep your policy details secure and easily accessible.

Yes, many insurance companies offer online services that allow policyholders to manage their policies. You can log in to your account on their website or mobile app to view policy details, make changes, and access important information. Online access provides convenience and allows you to stay updated on your coverage.

In the event of a claim, you should promptly notify your insurance provider. They will guide you through the claims process, which may involve providing supporting documents and evidence. Your insurance company will assess the claim and, if approved, provide the necessary benefits according to your policy terms.