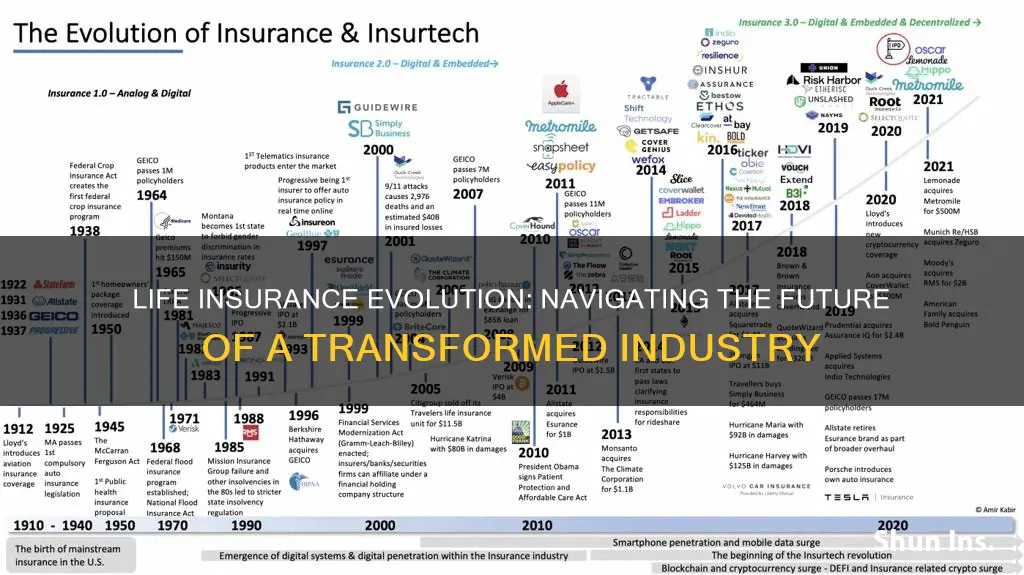

The life insurance industry has undergone significant transformations in recent years, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. As the industry continues to navigate these shifts, it is crucial to explore innovative strategies and solutions that can shape its future trajectory. This paragraph will delve into the potential avenues the life insurance industry can pursue, focusing on enhancing customer experiences, leveraging technology, and adapting to the evolving needs of a dynamic market. By embracing these opportunities, the industry can not only survive but thrive in the face of ongoing challenges and opportunities.

What You'll Learn

- Regulatory Reform: Streamlining rules to encourage innovation and protect consumers

- Digital Transformation: Embracing technology for improved customer experience and efficiency

- Sustainability Focus: Integrating environmental, social, and governance (ESG) practices into business models

- Data Privacy: Enhancing security measures to protect sensitive customer information

- Ethical Marketing: Promoting transparency and responsible advertising to build trust

Regulatory Reform: Streamlining rules to encourage innovation and protect consumers

The life insurance industry, like many others, is ripe for regulatory reform to foster innovation while ensuring consumer protection. One key area is streamlining rules to encourage competition and product development. Excessive regulation can stifle innovation, making it crucial to strike a balance between consumer protection and industry growth.

Streamlining regulations can involve simplifying and consolidating existing rules, reducing unnecessary complexity. This simplification should focus on areas where innovation is hindered without compromising consumer safeguards. For instance, updating and modernizing regulations to accommodate new technologies and business models can be beneficial. For example, allowing for the development of digital-first insurance products and services, which can offer more personalized and accessible options to consumers, especially those who prefer online interactions.

Additionally, creating a more conducive environment for innovation through regulatory sandboxes can be a game-changer. These sandboxes allow insurers to test new ideas and technologies in a controlled, regulated setting, providing a safe space for experimentation. By doing so, insurers can bring innovative products to market faster, benefiting consumers with improved options and potentially lower costs.

To protect consumers, any regulatory reforms should emphasize transparency and fair practices. This includes ensuring clear and concise communication of policy details, avoiding complex jargon that might mislead or confuse customers. Furthermore, implementing robust complaint mechanisms and regular audits can help maintain high standards and quickly address any issues.

In summary, regulatory reform aimed at streamlining rules can significantly impact the life insurance industry's future. By encouraging innovation, fostering competition, and prioritizing consumer protection, the industry can evolve to better meet the needs of a changing market while maintaining the trust of its customers. This approach ensures that the industry remains dynamic, efficient, and responsive to the demands of a modern, tech-savvy consumer base.

Accidental Life Insurance: What Counts as an 'Accident'?

You may want to see also

Digital Transformation: Embracing technology for improved customer experience and efficiency

The life insurance industry is at a pivotal point, where embracing digital transformation is not just an option but a necessity to stay competitive and meet evolving customer expectations. The traditional methods of selling and servicing insurance policies are no longer sufficient in a rapidly changing market. By adopting new technologies, insurers can enhance the customer experience, improve operational efficiency, and drive innovation.

One of the key areas of focus for digital transformation is the development of user-friendly online platforms and mobile applications. Customers now demand seamless, digital interactions, and life insurance companies must provide accessible and intuitive interfaces. This includes streamlining the policy purchase process, making it quick and efficient, and offering personalized recommendations based on customer data. For instance, implementing AI-powered chatbots can provide 24/7 customer support, answering queries and guiding users through policy options, thus improving customer satisfaction and reducing the burden on human customer service teams.

Data analytics and machine learning are powerful tools that can revolutionize the industry. By analyzing large datasets, insurers can identify trends, predict customer behavior, and make informed decisions. This technology can be used to personalize policies, offer tailored financial advice, and detect potential fraud. For example, predictive analytics can help in identifying high-risk areas for certain demographics, allowing insurers to offer more targeted and competitive products. Additionally, machine learning algorithms can automate routine tasks, such as policy administration and claims processing, leading to significant cost savings and faster turnaround times.

Embracing digital transformation also involves leveraging the power of social media and online communities. Life insurance companies can build and engage with their customer base through social media platforms, providing valuable content and addressing customer concerns. This strategy not only improves brand visibility but also fosters a sense of community, encouraging customer loyalty. Furthermore, insurers can utilize social media analytics to understand customer preferences and pain points, enabling them to develop more effective marketing strategies and improve the overall customer journey.

In addition to enhancing the customer experience, digital transformation can significantly improve operational efficiency. Automating back-office processes, such as document management and underwriting, can reduce manual errors and free up resources for more strategic initiatives. Cloud-based solutions can also provide a scalable and secure infrastructure, allowing insurers to manage data and operations more effectively. By integrating these technologies, life insurance companies can streamline their processes, reduce time-to-market for new products, and ultimately provide better value to their customers.

In conclusion, the life insurance industry has the opportunity to revolutionize its operations and customer interactions through digital transformation. By adopting advanced technologies, insurers can create a more personalized, efficient, and engaging experience for their clients. From online platforms to data analytics and social media engagement, the industry can leverage these tools to stay ahead of the curve, meet customer demands, and drive sustainable growth in a rapidly evolving market. This strategic shift will not only benefit the insurers but also provide customers with the modern, convenient services they expect.

Uncover the Secrets: Essential Questions to Ask Your Life Insurance Agent

You may want to see also

Sustainability Focus: Integrating environmental, social, and governance (ESG) practices into business models

The life insurance industry is at a pivotal point where embracing sustainability and integrating environmental, social, and governance (ESG) practices can significantly impact its future trajectory. As consumers and investors increasingly prioritize sustainability, insurance companies have a unique opportunity to differentiate themselves and meet the evolving expectations of their customers. By adopting a sustainability-focused approach, life insurance providers can not only enhance their brand image but also drive long-term growth and resilience.

Integrating ESG factors into business models involves a comprehensive strategy that goes beyond traditional risk management. Firstly, insurers should conduct a thorough assessment of their current practices and identify areas where they can improve their environmental impact. This may include evaluating the carbon footprint of their operations, implementing energy-efficient measures, and exploring sustainable investment options. For instance, companies can invest in renewable energy projects or green bonds, which support environmentally friendly initiatives while generating competitive returns. By actively reducing their environmental impact, insurance firms can attract environmentally conscious clients and investors.

Social considerations are another crucial aspect of ESG. Life insurance providers should focus on enhancing their social responsibility by promoting diversity, equity, and inclusion within their organizations and the communities they serve. This can be achieved through initiatives such as diverse hiring practices, employee resource groups, and community engagement programs. For example, insurers could partner with local organizations to provide financial literacy workshops, empowering individuals to make informed decisions about their insurance needs. By addressing social issues, insurance companies can build stronger relationships with their customers and create a positive social impact.

Governance plays a vital role in ensuring the long-term success of ESG integration. Insurance firms should establish robust governance frameworks that align with sustainable business practices. This includes implementing transparent reporting mechanisms, setting clear ESG goals, and regularly monitoring and evaluating progress. By providing stakeholders with accessible and detailed ESG reports, companies can demonstrate their commitment to sustainability and build trust. Moreover, insurers should engage in dialogue with regulators and industry peers to shape policies and standards that promote sustainable practices across the sector.

In summary, the life insurance industry has the potential to revolutionize itself by embracing sustainability and integrating ESG practices. By actively addressing environmental, social, and governance factors, insurers can attract a new generation of customers and investors who prioritize sustainability. This shift will not only contribute to a more sustainable future but also position insurance companies as industry leaders, fostering long-term success and resilience in a rapidly changing business landscape. It is a strategic move that aligns with the growing global emphasis on environmental responsibility and social impact.

Life Insurance on Strangers: Is it Possible?

You may want to see also

Data Privacy: Enhancing security measures to protect sensitive customer information

The life insurance industry, like many others, is increasingly reliant on data-driven insights and digital platforms to operate efficiently and offer personalized services. However, this reliance on data also exposes the industry to significant risks, particularly in the realm of data privacy. As the volume and sensitivity of customer data continue to grow, it becomes imperative for life insurance companies to enhance their security measures to protect this valuable asset.

One of the primary steps towards enhancing data privacy is to implement robust encryption protocols. Encryption ensures that even if data is intercepted, it remains unreadable without the appropriate decryption keys. Life insurance companies should employ strong encryption algorithms for both data at rest and in transit. For instance, using SSL/TLS for secure data transmission over networks and advanced encryption standards for storing sensitive customer information in databases can significantly reduce the risk of unauthorized access.

Another critical aspect is the implementation of multi-factor authentication (MFA) for all user accounts, especially those with access to customer data. MFA adds an extra layer of security by requiring users to provide multiple forms of identification before gaining access. This could include something the user knows (a password), something the user has (a physical token or mobile device), and something the user is (biometric data like fingerprints or facial recognition). By adopting MFA, life insurance companies can ensure that even if a user's credentials are compromised, unauthorized access to customer data is highly unlikely.

Regular security audits and penetration testing are essential to identify and address vulnerabilities in the system. These tests should be conducted periodically to ensure that any new security measures are effective and that existing ones remain robust. Additionally, life insurance companies should invest in employee training programs to raise awareness about data privacy best practices. Educating employees about potential security threats, such as phishing attacks and social engineering, can significantly reduce the risk of human error leading to data breaches.

Furthermore, compliance with international data privacy standards and regulations is vital. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States provide guidelines for handling customer data securely. Life insurance companies should ensure they meet these standards to avoid legal consequences and maintain customer trust. This includes obtaining explicit consent for data collection, providing transparent privacy policies, and offering customers the right to access, rectify, or delete their personal information.

In conclusion, enhancing data privacy in the life insurance industry requires a multi-faceted approach. By implementing strong encryption, multi-factor authentication, regular security audits, and adhering to international data privacy standards, life insurance companies can significantly improve their security posture. These measures not only protect sensitive customer information but also help maintain the industry's reputation and foster trust among policyholders. As the digital landscape continues to evolve, staying proactive in data security will be crucial for the long-term success and sustainability of the life insurance sector.

Understanding Tricare's Term-to-90 Life Insurance Policy

You may want to see also

Ethical Marketing: Promoting transparency and responsible advertising to build trust

In today's world, where consumers are increasingly conscious of the impact of their choices, the life insurance industry has an opportunity to lead the way in ethical marketing practices. One of the most powerful tools at its disposal is promoting transparency and responsible advertising to build trust with customers. This approach not only benefits the industry but also empowers individuals to make informed decisions about their financial security.

Transparency is the cornerstone of ethical marketing. Life insurance companies should provide clear and concise information about their products, policies, and fees. This includes detailed explanations of coverage, exclusions, and potential risks. By offering comprehensive disclosures, insurers can ensure that policyholders fully understand the terms and conditions of their insurance, fostering a sense of trust and confidence. For instance, instead of using complex jargon, companies can provide simple, easy-to-understand language to explain policy benefits, making it accessible to a wider audience.

Responsible advertising plays a crucial role in this context. Marketers should avoid making exaggerated claims or using misleading tactics to attract customers. Instead, they should focus on highlighting the genuine advantages and unique selling points of their products. For example, instead of promoting a policy as the "best" or "most comprehensive," insurers can emphasize how it provides tailored coverage to meet specific needs. This honest approach will attract customers who value authenticity and build a loyal customer base.

Furthermore, life insurance providers can encourage transparency by providing accessible resources for customers. This could include online tools that allow individuals to compare policies, calculators to estimate premiums, and educational materials to enhance financial literacy. By offering these resources, companies empower customers to make well-informed decisions, ultimately leading to higher satisfaction and trust.

In summary, the life insurance industry can significantly benefit from embracing ethical marketing practices. By promoting transparency and responsible advertising, companies can build a strong foundation of trust with their customers. This approach not only ensures that policyholders are well-informed but also positions the industry as a leader in ethical standards, attracting customers who value honesty and integrity. As consumers become more discerning, this ethical approach will be a key differentiator in a highly competitive market.

CSRS Life Insurance: Protecting Your Future

You may want to see also

Frequently asked questions

The life insurance industry can focus on innovation and technology integration to enhance customer experience and product offerings. Developing digital platforms and online tools can improve accessibility and provide personalized advice. Additionally, expanding the range of insurance products to cater to diverse needs, such as offering more flexible payment options and customizable coverage, can attract a wider customer base.

To meet evolving customer demands, the industry should emphasize transparency and education. Providing clear and concise information about policies, benefits, and potential risks can build trust. Moreover, adapting to an aging population and changing family structures by offering tailored solutions for different life stages, such as term life insurance for young families or long-term care insurance for the elderly, will be crucial.

Sustainability in the life insurance sector can be achieved through strategic partnerships and diversification. Collaborating with financial advisors, healthcare providers, and technology startups can open new avenues for business. Additionally, the industry can explore new markets and demographics, such as catering to the needs of the gig economy or offering insurance products tailored to specific cultural or ethnic communities. Continuous innovation, regulatory compliance, and a customer-centric approach will be key to long-term success.