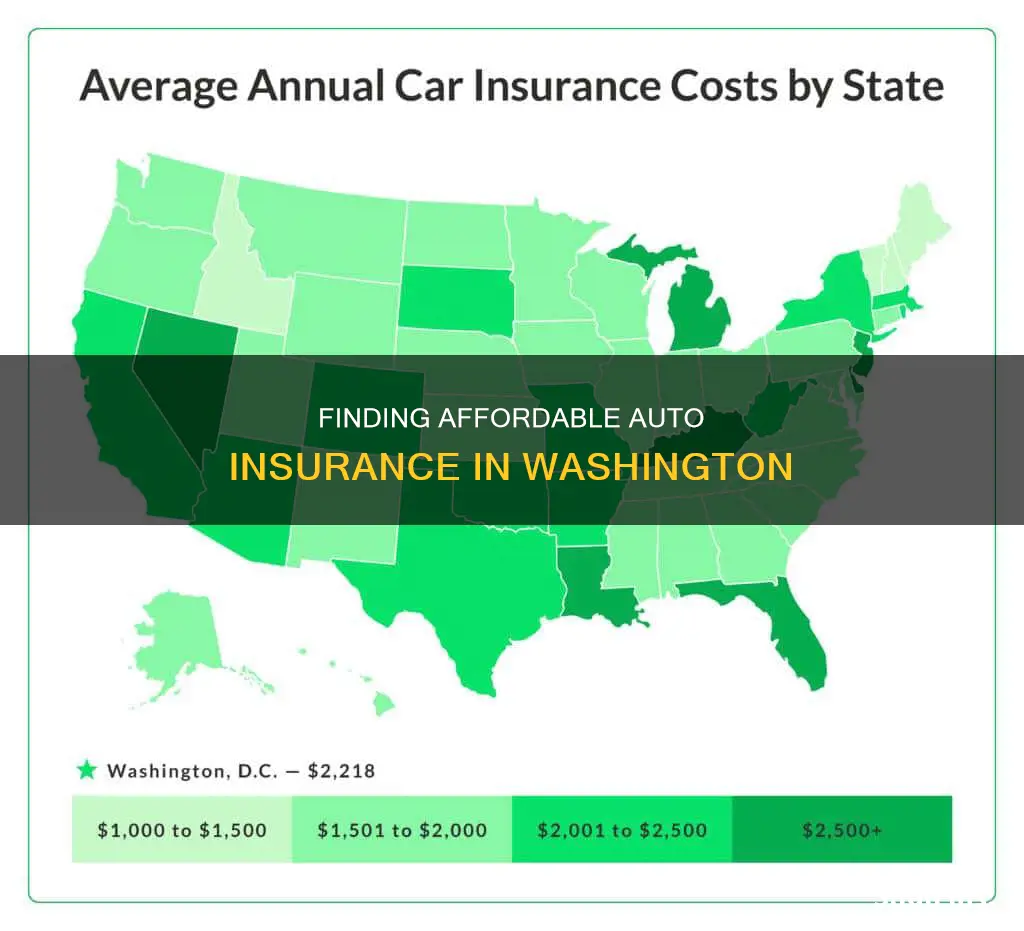

Finding cheap auto insurance in Washington can be challenging, but it's not impossible. The best way to find cheap car insurance is to compare rates from multiple insurers.

According to a 2024 study, USAA offers the cheapest car insurance rates in Washington at $889 per year. PEMCO Mutual is the second most affordable company at $896 annually. The average annual car insurance premium in Washington is $1,285.

The cost of car insurance in Washington varies based on your location. For example, the average cost of full coverage car insurance in Seattle is $1,561 per year, while residents of Spokane Valley can expect the lowest annual rates in the state, with an average of $1,209.

When looking for cheap car insurance in Washington, it's important to consider factors such as your age, driving history, and credit score. Young drivers and those with poor credit scores typically pay higher rates. Comparing quotes from multiple companies and taking advantage of discounts can help you find the best rate.

| Characteristics | Values |

|---|---|

| Cheapest full coverage car insurance in Washington | CIG ($874 per year) |

| Cheapest full coverage car insurance in Washington for 20-year-olds | Capital Insurance ($182 per month) |

| Cheapest full coverage car insurance in Washington for 30-year-olds | Capital Insurance ($99 per month) |

| Cheapest full coverage car insurance in Washington for 40-year-olds | Capital Insurance ($92 per month) |

| Cheapest full coverage car insurance in Washington for 50-year-olds | Capital Insurance ($89 per month) |

| Cheapest full coverage car insurance in Washington for 60-year-olds | Capital Insurance ($86 per month) |

| Cheapest full coverage car insurance in Washington for 70-year-olds | Capital Insurance ($92 per month) |

| Cheapest minimum coverage car insurance in Washington | Pemco ($123 per year) |

| Cheapest minimum coverage car insurance in Washington for 20-year-olds | State Farm ($64 per month) |

| Cheapest minimum coverage car insurance in Washington for 30-year-olds | State Farm ($32 per month) |

| Cheapest minimum coverage car insurance in Washington for 40-year-olds | State Farm ($31 per month) |

| Cheapest minimum coverage car insurance in Washington for 50-year-olds | State Farm ($30 per month) |

| Cheapest minimum coverage car insurance in Washington for 60-year-olds | State Farm ($28 per month) |

| Cheapest minimum coverage car insurance in Washington for 70-year-olds | State Farm ($31 per month) |

What You'll Learn

Cheap car insurance for young drivers in Washington

Young drivers in Washington can find cheap car insurance rates by shopping around and comparing quotes from multiple insurers. Here are some of the cheapest car insurance options for young drivers in Washington:

PEMCO Mutual

PEMCO Mutual offers the cheapest car insurance rates for young drivers in Washington. According to a study, the average annual cost for a 17-year-old male driver is $2,796, while it is $2,657 for a female driver. These rates are much lower than the statewide average rates for teen drivers. PEMCO Mutual also has the lowest average rates for 25-year-old drivers.

USAA

USAA provides exclusive insurance coverage for military personnel and their families. It offers the cheapest average car insurance rates in Washington, with an average annual premium of $889.

State Farm

State Farm offers the cheapest minimum coverage car insurance in Washington, with an average monthly rate of $33. It also has competitive rates for young drivers with a speeding ticket or an accident on their record.

Grange Insurance Association

Grange Insurance Association provides the cheapest minimum coverage car insurance rates for young drivers in Washington, especially those with poor credit or a speeding ticket/accident on their record.

GEICO

GEICO has the cheapest car insurance for drivers in Washington with a DUI conviction. A full coverage policy from GEICO costs an average of $157 per month, which is 34% cheaper than the average cost of car insurance in the state.

Print Your Progressive Auto Insurance Card: A Step-by-Step Guide

You may want to see also

Cheap car insurance for drivers with poor credit

Grange Insurance Association

Grange Insurance Association offers the cheapest car insurance for drivers with poor credit in Washington. The average rate for minimum coverage is $41 per month.

State Farm

State Farm is the cheapest company in Washington state for minimum coverage car insurance. A State Farm policy costs an average of $33 per month, which is 38% cheaper than the overall state average.

Pemco

Pemco offers young drivers in Washington the most affordable quotes, with an average rate of $75 per month for minimum coverage insurance.

Geico

Geico has the cheapest car insurance for drivers in Washington with a DUI (driving under the influence) conviction. A full coverage policy from Geico costs $157 per month, which is 34% cheaper than the average cost of car insurance in Washington state.

Gap Insurance: New PPI Scandal?

You may want to see also

Cheap car insurance for drivers with a speeding ticket

If you have a speeding ticket on your record, you may be worried about the cost of your car insurance. Here is some information about cheap car insurance for drivers with a speeding ticket in Washington.

According to US News, USAA and PEMCO Mutual offer the cheapest car insurance rates for drivers with a speeding ticket in Washington. USAA provides insurance at $1,044 per year on average, while PEMCO Mutual is only slightly more expensive at $1,088 per year. These rates are much cheaper than the state average of $1,604 per year.

NerdWallet also reports that PEMCO Mutual is the cheapest option for drivers with a speeding ticket, with an average rate of $1,088 per year.

The cost of your car insurance will depend on several factors, including your age, gender, location, and type of car. It is always a good idea to shop around and compare quotes from multiple insurance companies to find the best rate for your needs.

Lowering Auto Insurance Post-DUI: What You Need to Know

You may want to see also

Cheap car insurance for drivers with an at-fault accident

Washington is an at-fault state, meaning that the driver who causes an accident is responsible for any property damage or injury resulting from the accident. This means that insurance rates can increase after an accident.

PEMCO Mutual has the most affordable sample rate for drivers with an at-fault accident, at $1,173 annually. This is significantly lower than the state average of $1,861 per year.

State Farm also offers affordable rates for drivers with an at-fault accident, with an average rate of $1,020 per year.

It is important to note that car insurance rates are highly individualized, and your policy price will depend on various factors such as age, location, type of car, and driving history. Shopping around and comparing rates from multiple insurers is the best way to find the cheapest car insurance.

Auto Insurance 101: Is 130 a Good Rate?

You may want to see also

Cheap car insurance for drivers with a DUI

If you have a DUI on your driving record, you will likely be considered a high-risk driver by insurance companies, and your insurance rates will increase. In Washington, car insurance rates after a DUI average $1,928 per year. State Farm, with a sample premium of $1,321 per year, has the cheapest rates on average.

- PEMCO Mutual Company

- American Family Company

- Grange Insurance Association

Does Your Auto Policy Include Gap Insurance?

You may want to see also

Frequently asked questions

State Farm offers the cheapest car insurance quotes in Washington state. A minimum coverage policy from State Farm costs $33 per month, and full coverage costs $87 per month.

On average, minimum coverage car insurance in Washington costs $54 per month, or $651 per year. A full coverage policy costs an average of $128 per month, or $1,534 per year.

Car insurance in Seattle costs an average of $156 per month. That's 22% more expensive than the average in Washington state.

Washington requires drivers to have bodily injury limits of $25,000 per person and $50,000 per accident, along with $10,000 in property damage liability insurance, to drive legally.

No, Washington is an at-fault auto insurance state, meaning that whoever causes an accident is liable for covering all damages.