Navigating the world of life insurance in Canada can be a daunting task, especially with the myriad of options available. This guide aims to simplify the process by providing a comprehensive overview of where to find and choose the right life insurance policy. Whether you're a resident of Toronto, Montreal, or any other Canadian city, understanding the various providers and their offerings is crucial. From independent insurance brokers to major insurance companies, each has its strengths and specializations. Additionally, exploring online platforms and comparing quotes can help you make an informed decision tailored to your specific needs and budget.

What You'll Learn

- Online Platforms: Compare quotes from multiple providers on websites like InsuranceHotline.com or Insurance.com

- Independent Brokers: Seek advice from licensed brokers who represent various companies, offering personalized recommendations

- Direct from Insurers: Contact major Canadian insurers like Manulife, Sun Life, or TD Insurance for direct quotes and applications

- Financial Advisors: Consult financial advisors who can assess your needs and recommend suitable policies from various providers

- Government Programs: Explore government-backed programs like the Canada Pension Plan Investment Board (CPPIB) for group life insurance options

Online Platforms: Compare quotes from multiple providers on websites like InsuranceHotline.com or Insurance.com

When it comes to finding life insurance in Canada, exploring online platforms can be a convenient and efficient way to compare quotes from various providers. Websites like InsuranceHotline.com and Insurance.com offer comprehensive resources to help you navigate the process. These platforms provide an easy-to-use interface where you can input your specific requirements and receive tailored quotes from multiple insurance companies. By comparing these quotes, you can make an informed decision and find a policy that best suits your needs and budget.

InsuranceHotline.com is a popular online marketplace that connects consumers with insurance providers. It allows you to request quotes from several insurers, including major names in the Canadian market. You can specify the type of life insurance you're interested in, such as term life, permanent life, or critical illness coverage, and the platform will match you with suitable options. This website often provides detailed information about each provider, customer reviews, and ratings, enabling you to assess the reputation and reliability of the insurers before making a choice.

Similarly, Insurance.com is another valuable resource for comparing life insurance policies. This website offers a user-friendly search tool that allows you to input your personal and health-related details, such as age, location, and any pre-existing conditions. By doing so, you can receive customized quotes from a range of insurance companies. Insurance.com often provides comprehensive policy details, including coverage amounts, premium costs, and additional benefits, ensuring that you have all the necessary information to make an informed decision.

Using these online platforms to compare quotes from multiple providers has several advantages. Firstly, it saves you time and effort by consolidating various insurance options in one place. Instead of contacting each insurer individually, you can quickly gather quotes and compare them side by side. Secondly, these platforms often provide unbiased and independent comparisons, allowing you to make an informed choice without any bias from the insurers themselves. Lastly, the convenience of accessing these websites from the comfort of your home or office makes the process accessible and efficient.

When using these online platforms, it's essential to provide accurate and up-to-date information. Ensure that you input your current health status, lifestyle choices, and any relevant details to receive the most precise quotes. Additionally, take the time to read the terms and conditions of each policy to understand the coverage, exclusions, and any additional benefits offered. By being thorough in your research and comparison, you can make a well-informed decision and select a life insurance policy that provides the necessary financial protection for yourself and your loved ones.

Lupus and Life Insurance: What You Need to Know

You may want to see also

Independent Brokers: Seek advice from licensed brokers who represent various companies, offering personalized recommendations

When it comes to finding the right life insurance in Canada, engaging an independent broker can be a strategic move. These brokers are licensed professionals who act as intermediaries between you and various insurance companies. Here's why considering an independent broker is beneficial:

Personalized Service: Independent brokers take the time to understand your unique needs and financial situation. They will assess your age, health, lifestyle, and other factors to provide tailored advice. This personalized approach ensures that you receive recommendations suited to your specific circumstances, helping you make an informed decision.

Market Knowledge: Brokers have extensive knowledge of the Canadian life insurance market. They stay updated on the latest products, rates, and industry trends. This expertise allows them to compare policies from multiple insurers, ensuring you get the best coverage at competitive prices. They can explain the intricacies of different policies, helping you navigate the often complex world of insurance.

Representation of Multiple Companies: One of the key advantages is their ability to represent a wide range of insurance providers. This means they have access to various life insurance options, including term life, permanent life, and critical illness insurance. By working with multiple companies, they can offer a comprehensive selection, allowing you to choose the policy that best fits your requirements.

Objective Advice: As independent professionals, they are not tied to a single insurance company. This independence ensures that their advice is unbiased and in your best interest. They will not push a specific product but instead, provide an honest assessment of what's suitable for you, helping you avoid potential biases that might influence other advisors.

Negotiation Power: Brokers often have strong negotiating skills and can advocate for their clients. They may secure additional benefits, discounts, or better rates on your behalf, ensuring you get the most value for your premium. This can result in significant savings over the life of your policy.

Engaging an independent broker can simplify the process of finding life insurance in Canada. They provide a dedicated, knowledgeable, and unbiased service, ensuring you make a well-informed decision. With their expertise, you can navigate the insurance market with confidence, knowing you have a personalized plan that meets your needs.

Life Insurance Records: Privacy and Confidentiality

You may want to see also

Direct from Insurers: Contact major Canadian insurers like Manulife, Sun Life, or TD Insurance for direct quotes and applications

When considering life insurance in Canada, one of the most straightforward and efficient ways to obtain coverage is by directly contacting major insurance providers. This approach allows you to compare policies, understand the terms, and secure a plan that suits your needs without intermediaries. Here's a guide on how to navigate this process:

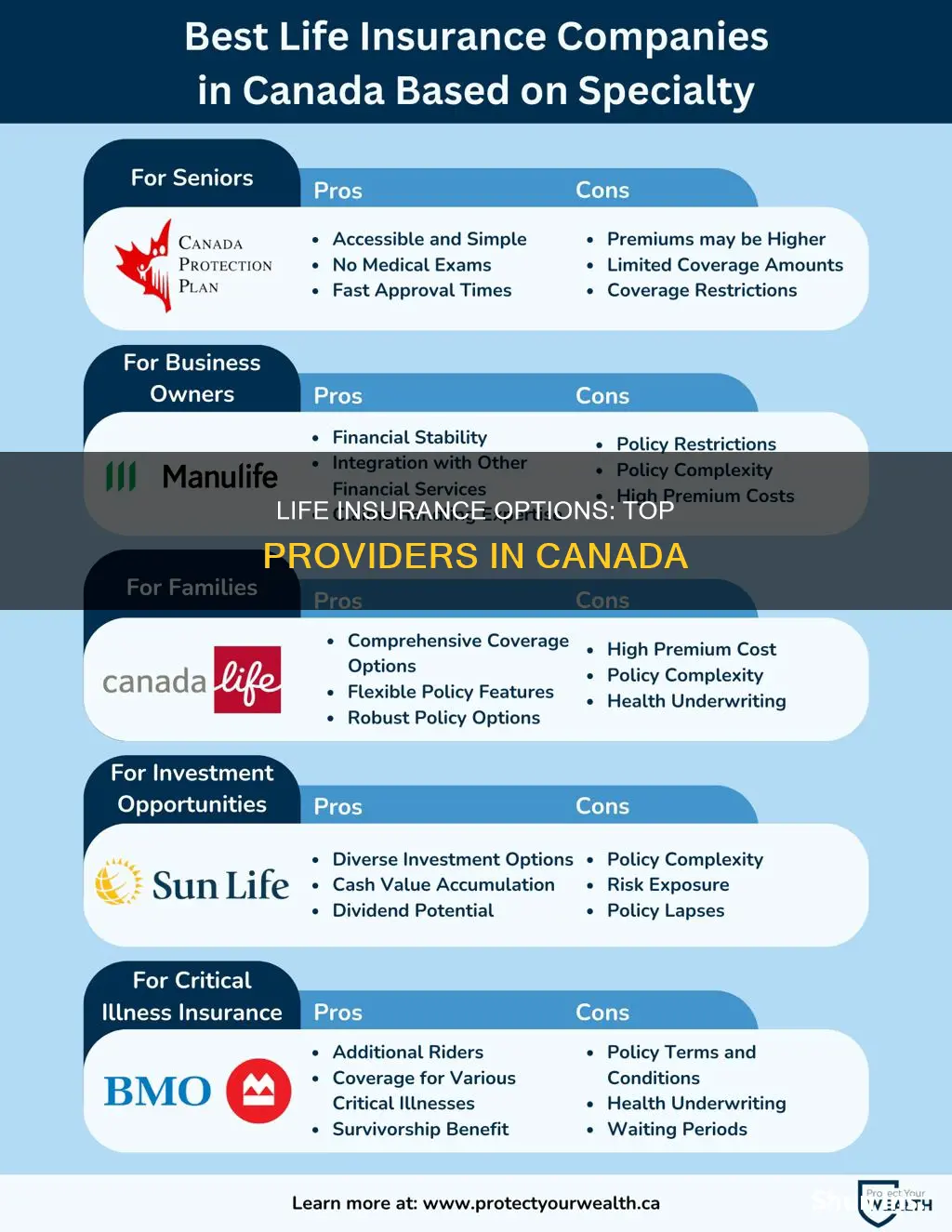

Research and Shortlist Insurers: Begin by researching reputable Canadian insurance companies. Some of the well-known and trusted insurers in the country include Manulife, Sun Life, and TD Insurance. These companies have a strong presence across Canada and offer a range of life insurance products. You can find their websites and contact information easily through a simple online search.

Contact the Insurers Directly: Reach out to these insurers via phone, email, or their online contact forms. When you get in touch, be prepared to provide some basic personal and financial information. The insurers' representatives will guide you through the process and offer quotes based on your specific requirements. They will consider factors such as age, health, lifestyle, and the desired coverage amount to provide tailored recommendations.

Compare Quotes and Policies: Once you receive quotes from multiple insurers, carefully compare the terms and conditions of each policy. Pay attention to the coverage amount, premium costs, policy duration, and any additional benefits or riders offered. Understanding these details will help you make an informed decision. For instance, some insurers might provide critical illness coverage as an add-on, while others may include accidental death benefits.

Application Process: After selecting the insurer and policy that best fits your needs, you can proceed with the application. This typically involves filling out an application form, providing necessary documentation, and potentially undergoing a medical examination, especially for higher coverage amounts. The insurer's representatives will guide you through this process, ensuring you have all the required information and support.

Directly engaging with insurers allows you to build a personal relationship with the company, which can be beneficial for future policy adjustments or claims. Additionally, you can take advantage of any special offers or discounts that might be available for direct applicants. This method ensures a transparent and efficient way to secure life insurance in Canada.

Updating Military Life Insurance: Changing Your Beneficiary Details

You may want to see also

Financial Advisors: Consult financial advisors who can assess your needs and recommend suitable policies from various providers

When it comes to finding the right life insurance in Canada, consulting a financial advisor is an excellent strategy to ensure you make an informed decision. These professionals are equipped with the knowledge and expertise to guide you through the complex world of insurance policies. Here's why seeking their advice is beneficial:

Financial advisors play a crucial role in understanding your unique financial situation and goals. They will assess your current financial health, including your income, assets, and liabilities, to determine the appropriate level of coverage. By evaluating your needs, they can recommend tailored life insurance policies that provide the necessary financial protection for your loved ones. These advisors consider various factors such as your age, health, occupation, and lifestyle to offer personalized advice.

The market offers numerous insurance providers, each with its own set of policies, benefits, and pricing structures. Financial advisors have access to a wide range of providers and can compare different options to find the best fit for your requirements. They can explain the various types of life insurance, such as term life, permanent life, and universal life, and help you understand the pros and cons of each. This comprehensive overview ensures you choose a policy that aligns with your long-term financial objectives.

Moreover, financial advisors can provide valuable insights into the claims process and policy administration. They can assist in filing claims, ensuring a smooth experience during difficult times. Their expertise simplifies the often complex process of making a claim and obtaining the benefits you and your family are entitled to.

Consulting a financial advisor for life insurance in Canada is a proactive step towards securing your family's financial future. These advisors offer a personalized approach, considering your specific circumstances and goals. They provide ongoing support and guidance, ensuring your life insurance policy remains appropriate as your life changes. By leveraging their expertise, you can make confident decisions and obtain the right coverage to protect your loved ones.

Cobra Coverage: Life Insurance Benefits Explained

You may want to see also

Government Programs: Explore government-backed programs like the Canada Pension Plan Investment Board (CPPIB) for group life insurance options

When it comes to life insurance in Canada, exploring government-backed programs can be a valuable option for individuals and groups. One such program is the Canada Pension Plan Investment Board (CPPIB), which offers group life insurance as part of its benefits package. This program is designed to provide financial security to employees and their families, ensuring that their loved ones are protected in the event of the insured's passing.

The CPPIB's group life insurance program is typically offered as a voluntary benefit, allowing employees to opt-in and customize their coverage according to their specific needs. This flexibility is a significant advantage, as it enables individuals to choose the level of protection that aligns with their financial goals and risk tolerance. By offering group life insurance, the CPPIB not only supports its employees but also contributes to the overall financial well-being of their families.

One of the key advantages of this government-backed program is the potential for lower premiums compared to private insurance providers. The CPPIB's bulk purchasing power and risk-sharing model can result in more affordable rates for group members. This cost-effectiveness is particularly beneficial for employees who may have limited budgets for insurance premiums, making it an attractive option for those seeking comprehensive coverage without breaking the bank.

Additionally, the CPPIB's group life insurance program often includes various customizable features. These may include different death benefit options, such as a lump sum payment or regular income payments, to suit the diverse needs of the insured. Some policies might also offer additional benefits like critical illness coverage or disability insurance, providing a more comprehensive safety net for the insured and their dependents.

Exploring government-backed programs like the CPPIB's group life insurance can be a strategic move for individuals and groups seeking reliable and potentially cost-effective life insurance coverage in Canada. It is essential to review the specific terms, conditions, and benefits of such programs to make an informed decision regarding one's insurance needs.

Sun Life Insurance: Cataract Surgery Coverage Explained

You may want to see also

Frequently asked questions

Comparing rates from multiple insurance providers is the best way to find competitive prices. You can start by researching online platforms that aggregate insurance quotes, allowing you to compare offers from various companies. Additionally, consulting with independent insurance brokers can provide personalized recommendations based on your specific needs and financial situation.

Qualification for life insurance typically depends on factors such as age, health, lifestyle, and the amount of coverage you desire. Most insurance companies have minimum age requirements, usually starting from 18 years old. They may also conduct medical exams or ask for health-related information to assess your risk profile. It's advisable to consult with insurance professionals who can guide you through the process and help determine the most suitable coverage options.

Yes, Canada offers several government-backed life insurance programs, such as the Canada Pension Plan (CPP) Death Benefit and the Old Age Security (OAS) Survivors' Pension. These programs provide financial support to the beneficiaries of deceased individuals who were contributing to the CPP or had reached a certain age. It's important to understand the eligibility criteria and benefits associated with these programs to ensure you are aware of your rights and options.